By Robert J. Burrowes

Tax havens are locations around the world where wealthy individuals, criminals and terrorists, as well as governments and government agencies (such as the CIA), banks, corporations, hedge funds, international organizations (such as the Vatican) and crime syndicates (such as the Mafia), can stash their money so that they can avoid regulation and oversight and, very often, evade tax. According to Nicholas Shaxson: ‘Tax havens are now at the heart of the global economy.’

Which is why, as he explains it: ‘The term “tax haven” is a bit of a misnomer, because such places aren’t just about tax. What they sell is escape: from the laws, rules and taxes of jurisdictions elsewhere, usually with secrecy as their prime offering.’ See ‘The tax haven in the heart of Britain’. A tax haven (or ‘secrecy jurisdiction’) then is a ‘place that seeks to attract business by offering politically stable facilities to help people or entities get around the rules, laws and regulations of jurisdictions elsewhere’. See Treasure Islands: Tax Havens and the Men Who Stole the World.

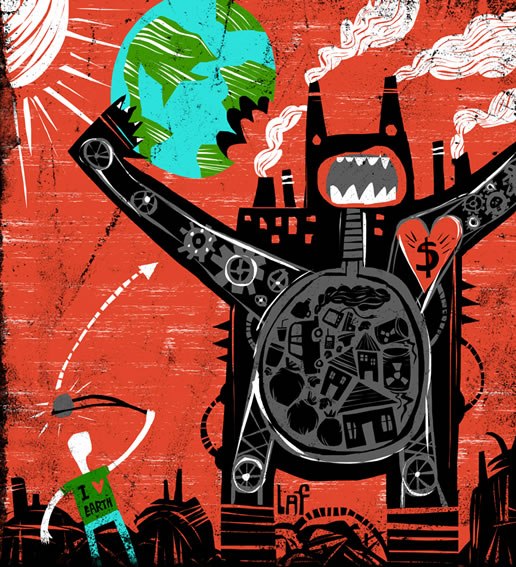

Tax havens are a vitally important part of the global infrastructure of corruption and criminality – see ‘Giant Leak of Offshore Financial Records Exposes Global Array of Crime and Corruption’ – that enables privileged individuals and their organizations to legally and illegally steal money from the rest of us, particularly those in developing countries, and to have the services of a vast network of accountants, bankers, lawyers and politicians (often from captured legislatures) to help them do it, and to ensure that they get away with it.

How many tax havens are there? Where are they? How much money do they have? Who uses them? Why? How do they work? Why does all this matter to us? And what can we do about them?

Tax Havens: how many and where are they?

In his book Treasure Islands: Tax Havens and the Men Who Stole the World, author and financial journalist Nicholas Shaxson identified about sixty ‘secrecy jurisdictions’ or ‘offshore groups’ around the world which he divided into four categories, as follows.

The most important category, by far, is those tax havens that form the spider’s network of havens centred on the City of London. It has three main layers: there are two inner rings – Britain’s Crown Dependencies of Jersey, Guernsey (which includes the sub-havens of Sark, Alderney and Brecqhou) and the Isle of Man, and its overseas territories such as the Cayman Islands, Bermuda, the British Virgin Islands and Gibralter – which are substantially controlled by Britain. The third layer is an outer ring with a more diverse array of havens, like Hong Kong, Singapore, the Bahamas, Dubai and Ireland, which are outside Britain’s direct control but have strong historical and current links to that country and the City of London (which I will discuss below). This network controls almost one half of all international bank assets.

The second category of tax havens is those in Europe notably including Switzerland, Luxembourg – see ‘Explore the Documents: Luxembourg Leaks Database’ – the Netherlands, Belgium and Austria, as well as microstates such as Liechtenstein and Monaco. While ‘Geneva bankers had sheltered the secret money of European elites since at least the eighteenth century’, the European havens ‘got going’ during World War I as governments raised taxes sharply to pay for the war.

The third category of tax havens is that focused on the United States. It has three tiers as well. At the federal level, the US government offers a range of tax exemptions, secrecy provisions and laws designed to attract foreign money. This means, for example, that US banks can legally accept proceeds from a range of crimes as long as the crimes are committed overseas. The second tier involves individual US states such as Florida (where Central/South American elites do their banking and the countries adversely impacted are prevented by US secrecy provisions from accessing relevant data, and where much Mob and drugs money is hidden too), Delaware, Nevada and Wyoming, where even terrorist money is protected by secrecy provisions. The third tier of the US network is the overseas satellites such as the American Virgin Islands, the Marshall Islands, Liberia and Panama, with the latter, according to Jeffrey Robinson, being ‘one of the filthiest money laundering sinks in the world’. See The Sink: Terror, Crime and Dirty Money in the Offshore World.

As Shaxson notes: ‘offshore finance has quietly been at the heart of Neoconservative schemes to project US power around the globe for years. Few people have noticed.’

The fourth category of tax havens identified by Shaxson includes those that do not fit in the categories above, such as Somalia and Uganda.

The (incomplete) list of tax havens on the website ‘Tax Havens of the World’ will give you some idea of where these secrecy jurisdictions are located but there are important omissions in this list, notably including the City of London Corporation.

For a brief look at 15 tax havens (again, notably excluding some of the most important) and some of the corporations that use them, see ‘What Are the World’s Best Tax Havens?’

And for a highly instructive and utterly sobering video documentary on British Tax Havens, see ‘The Spider’s Web: Britain’s Second Empire’. This documentary will inform you, among many more important things, that the building housing Her Majesty’s Revenue and Customs, the UK tax office, is owned by an offshore company in Bermuda!

To summarize the central aspect of the development of tax havens following World War II: ‘The British Establishment – an old boys network of privileged elites – had carved out a lucrative vehicle for themselves in the offshore world after the demise of Empire. They transformed themselves from administrators of Empire to financial handlers for the global elite and multinational corporations.’ See ‘The Spider’s Web: Britain’s Second Empire’.

Before concluding this section, it is worth emphasizing that, as Shaxson explains it, ‘the offshore world is not a bunch of independent states exercising their sovereign rights to set their laws and tax systems as they see fit. It is a set of networks of influence controlled by the world’s major powers, notably Britain and the United States. Each network is deeply interconnected with the others.’ He goes on: ‘The world’s most important tax havens are not exotic palm-fringed islands, as many people suppose, but some of the world’s most powerful countries.’ Shaxson quotes Marshall Langer, a prominent supporter of secrecy jurisdictions: ‘It does not surprise anyone when I tell them that the most important tax haven in the world is an island. They are surprised, however, when I tell them that … the island is Manhattan. Moreover, the second most-important tax haven … is located on an island. It is called the City of London.’

The City of London Corporation

What is the City of London Corporation, also known as the ‘Square Mile’? It is ‘a 1.22-square-mile slab of prime central London real estate that stretches from the Thames at Victoria Embankment, clockwise up through Fleet Street, the Barbican Centre, then to Liverpool Street in the north-east, then back down to the Thames just west of the Tower of London.’ See Treasure Islands: Tax Havens and the Men Who Stole the World.

According to Shaxson, the City of London Corporation, the ‘modern period’ of which dates from 1067 (yes, that is not a typing error), is ‘the local-government authority for the 1.2-square-mile slab of prime real estate in central London that is the City of London. The corporation is an ancient, semi-alien entity lodged inside the British nation state; a “prehistoric monster which had mysteriously survived into the modern world”, as a 19th-century would-be City reformer put it.’

Importantly, Shaxson explains, ‘the role of the City of London Corporation as a municipal authority is its least important attribute. This is a hugely resourced international offshore lobbying group pushing for international financial deregulation, tax-cutting and tax havenry around the world.’ Moreover, it is ‘the hub of a global network of tax havens sucking up offshore trillions from around the world and sending it, or the business of handling it, to London’. Notably, so powerful is the City of London that no sovereign or government of Britain in a thousand years has had the courage to seriously take it on and attempt to subject it to British government control. See ‘The tax haven in the heart of Britain’.

How much money is in Tax Havens?

So how much of the world’s wealth is stashed in tax havens around the globe? According to the Tax Justice Network in its 2012 report written by James S. Henry ‘The Price of Offshore Revisited: New Estimates for “Missing” Global Private Wealth, Income, Inequality, and Lost Taxes’: ‘A significant fraction of global private financial wealth – by our estimates, at least $21 to $32 trillion as of 2010 – has been invested virtually tax-free through the world’s still-expanding black hole of more than 80 “offshore” secrecy jurisdictions. We believe this range to be conservative…’ He goes on to emphasize that ‘this is just financial wealth. A big share of the real estate, yachts, racehorses, gold bricks – and many other things that count as non-financial wealth – are also owned via offshore structures where it is impossible to identify the owners’.

Henry also notes that given that Credit Suisse estimated global wealth in 2011 at $231 trillion, the amount of money in secrecy jurisdictions is conservatively estimated at 10% of global wealth.

But other figures do indeed suggest this estimate is low. Shaxson cites compelling evidence that ‘More than half of world trade passes, at least on paper, through tax havens. Over half of all banking assets and a third of foreign direct investment by multinational corporations, are routed offshore.’ Moreover, as long ago as 2008, the US Government Accountability Office reported that 83 of the 100 biggest corporations in the USA had subsidiaries in tax havens and the following year, using a broader definition, the Tax Justice Network discovered that ninety-nine of Europe’s hundred largest companies used offshore subsidiaries. And in each country, ‘the largest user by far was a bank’. See Treasure Islands: Tax Havens and the Men Who Stole the World.

In any case, the most recent estimate by the Tax Justice Network indicates ‘tax losses to profit shifting by multinational companies (a)pplying a methodology developed by researchers at the International Monetary Fund to an improved dataset… of around $500 billion a year’. See ‘New estimates reveal the extent of tax avoidance by multinationals’.

To reiterate then, on the understanding that these estimates are probably quite low, by 2010, between $US21 and $US32 trillion had been taken out of circulation so that it was beyond the laws, financial regulations and taxes that the rest of us cannot escape. But that figure has been added to by half a trillion dollars each year since, by moving more money into tax havens. And don’t forget: this figure does not include non-financial wealth. How many gold bricks, yachts, artworks and racehorses do you own and have stashed away somewhere free of scrutiny?

Who uses Tax Havens? And why?

As I mentioned above, tax havens are used by wealthy individuals (including businesspeople, sports and pop stars), criminals and terrorists, as well as governments (and their agencies), banks, corporations (such as Amazon and Google), international organizations and crime syndicates (such as the Medellin Cartel). While motives vary, in essence the lack of regulation and oversight, as well as tax evasion, are the reasons that individuals and organizations use them.

An individual might want to hide stolen wealth, to evade tax or cheat a divorced spouse out of their share of the family fortune. A bank, corporation, crime syndicate, international or terrorist organization might want to evade scrutiny of the source of their money and/or evade tax on windfall or even ongoing profits (legal and/or otherwise). A government might want to hide the ‘dirty money’ it uses to finance ‘black ops’ (that is, illegal and secret military violence such as that carried out by the CIA). But there are myriad explanations.

In John Christensen’s analysis of over 100 offshore clients of accounting firm Deloitte Touche he studied in Jersey, he found that the clients were engaging in insider trading, market rigging, failure to disclose conflicts of interest, weapons trading, illicit political donations, contract kickbacks, bribery, fraudulent invoicing, trade mispricing and tax evasion. See ‘The Spider’s Web: Britain’s Second Empire’.

Most people have heard of the money stashed away by corrupt dictators like Suharto in Indonesia, Ferdinand Marcos in the Philippines and Mobuto Sese Seko of Zaire (now Democratic Republic of the Congo) each of whom stole from the people of their country. However, they could only do this with the help of western enablers and ongoing elite resistance to developing country attempts to create a more transparent and fairer process for collecting tax on cross-border financial flows. As a result, Alex Cobham of the Tax Justice Network observes, worldwide, developing nations lose in excess of $1trillion per year in ‘capital flight’ and tax evasion to wealthy countries. See ‘The Spider’s Web: Britain’s Second Empire’.

But these more public examples, while terrible, tend to obscure two important facts. The amount stolen from sub-Saharan Africans, for example, between 1970 and 2008 was at least five times the total amount of their foreign debt during that period – see ‘The Spider’s Web: Britain’s Second Empire’ – and, by highlighting these examples, attention is drawn away from even worse and ongoing examples of such criminality by those corrupt/criminal individuals and organizations (including banks, accountancy and legal firms, corporations, international organizations, crime syndicates and governments) committed to using outright theft, fraud, money laundering and other devices to steal wealth from ordinary people all over the world.

So, for example, if one follows the money trails of various lucrative financial operations, some technically legal but immoral and others simply illegal, apart from the world’s major corporations, one quickly comes across the names of the major (and well known) banks and financial institutions (such as the Bank of England, Barclays, Goldman Sachs, JPMorgan Chase…), the ‘big four’ accountancy firms (Deloitte, Ernst & Young (EY), KPMG and PricewaterhouseCoopers), and elite lawyers (such as those in London’s ‘Magic Circle’, like Clifford Chance, Mourant du Feu & Jeune, and Slaughter and May). See, for example, Treasure Islands: Tax Havens and the Men Who Stole the World, ‘New estimates reveal the extent of tax avoidance by multinationals’ and ‘Looting with Putin’.

Apparently, like major corporations and crime syndicates, few banks, accountancy firms and lawyers have ethics policies that require them to follow the law and to exercise ‘due diligence’ (check out a client before signing a contract) so that they can steer clear of handling illegal and immoral profits, especially if they are monstrous.

In fact, according to a US Senate report, ‘virtually every major bank in the world – especially the biggest in North America and Europe – holds accounts for offshore banks and/or banks in suspect jurisdictions’. See The Sink: Terror, Crime and Dirty Money in the Offshore World.

As Eva Joly MEP, vice-chair of the Panama Papers Committee of the European Parliament, succinctly puts it: ‘Ordinary people are paying taxes. Rich people are not.’ See ‘The Spider’s Web: Britain’s Second Empire’.

The Vatican

But perhaps the example which best illustrates the moral depravity of those who use tax havens is the Vatican. In his carefully researched book Operation Gladio: The Unholy Alliance between the Vatican, the CIA and the Mafia author Paul L. Williams recounts the efforts of the CIA, former Nazis, the Sicilian/American Mafia, the Vatican and even Freemasonry to resist an anticipated postwar invasion of western Europe by those ‘Godless communists’ in the Soviet Union by establishing ‘stay-behind units’ (clandestine military and paramilitary units) throughout the countries of Europe (Belgium, Denmark, Italy, Netherlands, Norway, Portugal…) led by former Nazis and composed of ‘die-hard fascist fanatics’.

This alliance to fight the Cold War against the former Soviet Union and the rising tide of progressive governments in Europe and the rest of the world, particularly as the US war on Vietnam gathered pace, led, as Williams chillingly puts it, to ‘the toppling of governments, wholesale slaughter and financial devastation’ around the world. It was also, of course, the forerunner to its equivalent – Operation Condor – to resist, and destroy if possible, the spread of progressive movements, ranging from communism to liberation theology, throughout Central/South America.

While the Vatican played a number of unsavory roles in this alliance, including its facilitation of massive numbers of heroin addictions, its use of counterfeit securities, participation in false flag attacks that killed thousands and strings of gangland slayings, support of military juntas (that massacred tens of thousands) and the ‘purging’ of progressive priests (including Archbishop Óscar Romero of San Salvador and two Jesuit priests denounced by Fr. Jorge Mario Bergoglio, now Pope Francis, in Argentina: see ‘Who is Pope Francis? Jorge Mario Bergoglio and Argentina’s “Dirty War”’) while causing the financial destitution of thousands of families, one of its key ongoing functions, designed to maximize the Vatican’s power while highlighting its moral and spiritual bankruptcy, was to act as ‘God’s banker’ for many of these operations. See Operation Gladio: The Unholy Alliance between the Vatican, the CIA and the Mafia.

It did this, for example, by accepting Mafia/Medellin Cartel-collected drugs money (for a 15-20% cut) into the Vatican Bank (technically: Istituto per le Opere di Religione or Institute for the Works of Religion) and then laundering it through its shell companies – such as Cisalpine Overseas Bank, Astolfine SA, United Trading Corporation, Erin SA, Bellatrix SA, Belrose SA, Starfield SA and Nordeurop Establishment – in tax havens in the Bahamas, Liechtenstein, Luxembourg, Panama and Switzerland.

With the CIA providing services, such as the transport of Mafia/Medellin cocaine to drug dealers in the US, its share of the drug profits (cycled through its own CIA-controlled banks including Continental Illinois, Castle Bank & Trust, and Bank of Credit and Commerce International but eventually involving many of the most prestigious banks in the US, as the money was passed to the Vatican Bank) were used to finance key aspects of Operations Gladio and Condor with weapons also supplied by the CIA from NATO arsenals. But there was plenty of Vatican money in these Operations too.

As an aside, so devastating was the fallout from the ongoing exposure of the many aspects of Vatican corruption that, by the beginning of the twenty-first century, Roman Catholic membership was falling by 400,000 per year in the USA alone but the trend was even stronger in Europe with ‘magnificent churches and cathedrals’ becoming museums visited solely by tourists, parishes being boarded up, seminaries and convents closed, and parochial schools consolidated. And this was before the ‘plague of pedophilia’ had fully hit further decimating the Church’s tattered reputation. To this day, the Vatican Bank remains ‘one of the world’s leading laundries for dirty money’. See Operation Gladio: The Unholy Alliance between the Vatican, the CIA and the Mafia.

How do Tax Havens work?

Each tax haven offers its own unique combination of services. After all, it is a tough market competing for the world’s wealth and so each jurisdiction has developed its own set of services designed to maximize its attractiveness to potential clients. In essence, this means that there is some ongoing ‘competition’ to reduce regulatory and oversight requirements so that each tax haven can attract clientele. This has become so extreme that basic requirements of banking for those who do it legally, such as proof of identity, are not required in the offshore world. In fact, even your true name can be withheld if you wish. It is easier to avoid any risk of embarrassment from exposure this way.

As a result, virtually any jurisdiction will open an account (or as many accounts as you want) in whatever names you specify. Then, usually employing a variety of devices, ranging from secret bank accounts, nominee directors (usually locals who play no part in the organization bar give it their name) and structures such as shell companies (that exist on paper and perhaps a wall plaque somewhere, but nothing else) and trusts (which, unlike the legitimate version, appear to separate responsibility and control from the benefits of ownership but actually do not), to processes such as transfer pricing (a technique by which companies ‘shift paper profits into low-tax countries and costs into high-tax countries’ to minimize – or eliminate – tax payments) and often employing a convoluted process that rapidly shifts monies through several jurisdictions so that it becomes ‘untraceable’ (because authorities must get permission to access each jurisdiction in turn in any effort to trace the money), profits are effectively hidden and any accountability to authorities of any kind utterly eliminated. See Treasure Islands: Tax Havens and the Men Who Stole the World.

For one simple example of such a strategy, employing a technique known as the ‘double Irish, Dutch sandwich’ (which is legal), see ‘Google shifted $23bn to tax haven Bermuda in 2017, filing shows’. But you can read other examples here: ‘The tech giants will never pay their fair share of taxes – unless we make them’ and ‘7 Corporate Giants Accused of Evading Billions in Taxes’.

Why does the existence of Tax Havens matter to us?

Well, the simple answer to this question is that just a fraction of the money hidden in tax havens would feed, clothe, house and provide clean water, medical care and educational opportunities to everyone on Earth. It would eliminate the 100,000 deaths by starvation-related diseases each day. It would eliminate poverty and homelessness. And, as one byproduct of having these material needs met, it would facilitate the emergence of an informed, engaged and empowered human population to tackle the vast range of environmental, climate and military threats that currently threaten biosphere collapse and imminent human extinction. See ‘Human Extinction by 2026? A Last Ditch Strategy to Fight for Human Survival’.

As Professor Prem Sikka puts it more simply: Because of the penetration by financial services executives of the British state, including the Treasury ‘It deprives people of opportunities to have healthcare, education, security, justice and, ultimately, a fulfilling life.’ See ‘The Spider’s Web: Britain’s Second Empire’.

Fundamentally, then, tax havens and their secrecy are at the heart of those elite institutions and processes that functionally undermine democracy and give extraordinary power to certain anonymous individuals and their entities without accountability. See ‘The Spider’s Web: Britain’s Second Empire’.

Of course, the elites that control the tax haven networks are not about to let this change. Tax havens are simply too important as part of the global infrastructure for maintaining elite profit, power and privilege and for resisting grassroots efforts to bring peace, justice and ecological sanity to our world. And that is why they are protected by government legislation and legal systems, with an ‘army’ of accountants, auditors, bankers, businesspeople, lawyers and politicians ensuring that they remain protected.

So don’t forget: laws are designed to control and punish you, no matter how trivial your infringement: a parking fine, a littering offence, a petty theft. But if you have enough money, the law simply does not exist. And you can evade taxes legally and in the full knowledge that your vast profits (even from immorally-acquired wealth such as sex trafficking, gun-running, endangered species trafficking, conflict diamonds and drug trafficking) are ‘lawful’ and will escape regulation and oversight of any kind. See ‘The Rule of Law: Unjust and Violent’.

Let me give a personal example. I have been a war tax resister since 1983: I have a conscientious objection to paying taxes to the Australian government to deploy military forces in other countries to kill people in my name. So, instead of paying taxes to kill, for many years I donated the equivalent amount to organizations engaged in peace, development, environment and human rights work, and to ‘pay the rent’ for my use of indigenous land. As some of many outcomes to this conscientious and highly public resistance (garnering national media attention at times), in 1991 I was bankrupted, in 1992 I was convicted of contempt of court (for my conscientious refusal to cooperate with the bankruptcy trustee) and in 1993 my passport was seized. In 1999, I was advised that I will be ‘bankrupt forever’ because of my ongoing conscientious refusal to finance the killing.

In the same period, since 1983, trillions and trillions of dollars of tax have been illegally and secretly evaded as wealthy individuals and corporations, criminals and crime syndicates, international organizations and governments channel their incomes and profits through tax havens. Laws and legal systems throughout the world make this possible and, provided it is done correctly, it is quite straightforward to avoid any penalties for secretly evading payment of taxes or hiding money acquired through criminal activity. But the point, as you can see, is that tax evasion by wealthy individuals and corporations meant that many of these individuals and corporations didn’t pay taxes to kill people either. They just didn’t pay taxes at all.

Of course, their motive was personal gain, their way was legal, they incurred no penalty and, of course, they didn’t pay an equivalent amount to support peace and justice causes. More fundamentally, however, the trillions of dollars they took from the global economy were made by killing and exploiting people and the planet in a significant variety of other ways, ranging from sex trafficking, gun-running, conflict diamonds and trafficking in drugs and endangered species, to simply starving people to death at the rate of 100,000 people each day by managing the global economy, using tax havens as a primary tool, to extract maximum profit.

Richard Brooks documents how this legal exploitation occurs in another way in his book The Great Tax Robbery: How Britain Became a Tax Haven for Fat Cats and Big Business. The vast tax evasion by elites in Britain, including by diverting funds through tax havens, attracts just five prosecutions each year per £1 billion of evasion of direct taxes. In contrast, benefits fraud by those on unemployment and disability pensions attract 9,000 prosecutions each year per £1 billion of fraud. ‘So theft by the poor warrants the full force of the law’. But not theft by elites who write the law and largely control the political and legal processes in relation to it.

Hence, under the guise of ‘relationship taxing’ (that is, building a relationship between tax authorities and corporate executives and ‘tailoring’ tax payments to corporate wishes to the extent the law allows), corporations have long known that ‘If you don’t like the law… we’ll see what we can do’.

As is obvious from this example, attempts at government reform, including to defeat tax havens, in the direction of making elites financially and legally accountable, both nationally and internationally, for the responsibilities which the rest of us cannot escape, are invariably for show and, in any case, achieve zero of substance. For example, the attempt to ‘approve’ a blacklist of tax havens at the G20 gathering in 2009 was resisted by the Chinese premier on behalf of Chinese elites who, like other national elites keen to have political control but ‘judicial separation’ from their offshore centres, opposed the listing of notorious havens Hong Kong and Macau: see Treasure Islands: Tax Havens and the Men Who Stole the World. The global elite is clearly in control with national governments and international organizations powerlessly doing as instructed. So complete is this control, in fact, that Brooks notes that, in Britain, ‘Anti-tax avoidance laws had to be relaxed to accommodate companies’ tax avoidance schemes.’

Brooks concludes that ‘British taxation policy really had been so comprehensively captured by the world’s biggest corporations that screw-the-poor policies… could be written into the statute books at their whim, without a pang of conscience being felt anywhere in Whitehall.’ Clearly, however, his comment can be applied to virtually any government in the world.

So does it matter to you that these tax havens exist and do what they do?

What can be done about Tax Havens?

Authors such as Nicholas Shaxson and Richard Brooks suggest a raft of measures to correct the large number of ‘faults’ that facilitate the secrecy, protection from regulation and tax evasion that individuals, corporations, organizations, criminals and terrorists utilize in tax havens.

For Shaxson, these include financial reforms such as ‘blacklisting’ of tax havens so that their rogue state status is public knowledge; greater transparency, for example, through government sharing of information about the local income and assets of each other’s citizens and by requiring multinational corporate activities in each country to be made visible (rather than hidden behind ‘international’ figures); promoting the needs of developing countries which need their tax bases protected far more than they need aid or debt relief; confronting the British ‘spider’s web’ of tax havens by abolishing the City of London Corporation and submerging it into a unified and fully democratic London; taxing an entire multinational ‘group’ as a single unit and then allocating the appropriate amounts of its income out to the different jurisdictions in which it was earned and allow it to be taxed as each jurisdiction decides; onshore tax reform such as a land value tax (because land cannot be moved offshore and so tax on it must be paid locally), and by a direct distribution of mineral wealth in any country to each of its inhabitants (who can then be taxed); tackling the ‘enablers’ – the accountants, lawyers, individual bankers, businesspeople – and not just the clients, so that they go to jail; rethinking the meaning of ‘corporate responsibility’ (because corporations are given a wealth of capital in public infrastructure, an educated and healthy workforce… with which to work) so that corporations are transparent about their affairs and pay tax as part of their corporate responsibility; re-evaluating the meaning of corruption – insiders abusing the common good in secrecy and getting away with it and so worsening inequality and entrenching vested interests and unaccountable power – so that we see, more clearly, all of the actors and their activities; and changing the culture that fawns over people who abuse the system for personal gain. See Treasure Islands: Tax Havens and the Men Who Stole the World.

And some progress appears to be occurring along lines he suggests. For example, a version of automatic information exchange (AIE), by which governments make sure that essential information is made available to other jurisdictions as a matter of routine, has been discussed by the OECD and, while full of loopholes – see ‘Loophole USA: the vortex-shaped hole in global financial transparency’ – some commitments have been made. For the list of commitments as at November 2018, see ‘AEOI commitments’.

However, the USA has not made this commitment and while Switzerland, for example, finds this objectionable – see ‘The U.S. hasn’t signed the AEoI Agreement: Reciprocity demanded’ – the reality is that it makes little difference. For example, ICO Services, which specializes in the formation of offshore companies and offshore banking, will assist you to get around the AEoI requirement. Their website advertises that ‘asset holders need to start looking for alternative jurisdictions for protecting their assets. There are some reputable jurisdictions that are still outside the AEoI – e.g. Cyprus – but U.S. states of Delaware and some others shouldn’t be dismissed.’

But if you want a more established name to help you take advantage of a tax haven in the USA, you really can’t go past Rothschild & Co. So, to check out what they are offering: ‘Here Is Rothschild’s Primer How To Launder Money In U.S. Real Estate And Avoid “Blacklists”’.

Moreover, the AEoI agreement ‘outlaws’ bank secrecy but not trust secrecy (which dates from the Crusades) on which the British model is based – ‘The Trust lies at the core of the British secrecy model’ – so it does not address the cornerstone of British tax haven secrecy and explains why the British were happy to see the Cayman Islands commit to the AEoI. In short: the British government would be happy to kill off bank secrecy so that they can capture a larger market share (based on Trust secrecy). See ‘The Spider’s Web: Britain’s Second Empire’.

Separately from this initiative, in 2018 the UK parliament enacted a new law requiring its overseas territories – including notorious tax havens like Bermuda, the Cayman Islands and the British Virgin Islands – to start disclosing the owners of corporations they register by 2020. In theory: ‘This could shut down a huge amount of offshore tax evasion and other financial crimes because individuals from anywhere in the world, including the United States, have long been able to set up secret corporations in these tax havens to stash their money.’ See ‘New UK Law May Shut Down the Biggest Tax Havens – Aside from the U.S.’

However, while the report pointed out that the new law obviously does not impact the USA (or, of course, Switzerland or …) and the easy rerouting options available if these havens are effectively (or even actually) shut down, it failed to mention that this initiative does not in any way address the City of London Corporation so the impact of this initiative must be very limited unless it is followed by some pretty drastic initiatives in Westminster, Washington, Bern and elsewhere.

In summary, while one cannot disagree with any of Shaxson’s fine suggestions or be displeased that public pressure has led to some effort being made by the OECD and the UK parliament to address elements of the tax haven scourge, the reality is that the extent of the changes necessary are not going to happen without enormous grassroots pressure, strategically applied, and they are very unlikely to happen as reforms of the existing capitalist system. This is simply because the global elite is solidly in control of the institutions and processes of global capitalism, including its compliant governments and international organizations, and will readily stymie any attempt at serious reform of tax havenry particularly given the number of major reforms needed and the number of nations in which these reforms must be enacted. To state two obvious examples: The City of London Corporation has not existed for 1,000 years because it has no defense. And the changes noted above have only made the US more attractive as a secrecy jurisdiction.

Meanwhile, with the aim of promoting ‘financial innovation’, Switzerland has recently made things easier for smaller financial technology companies thus making tax havenry more attractive to those who might not have otherwise considered it. See ‘Swiss watchdog to propose looser anti-money laundering rules for fintechs’.

So, given that most tax havens are protected by host government legislation and there is no international mechanism to control them, the tax haven industry generally is not under threat of being held to account in any significant way.

And, despite the more elaborate explanation offered above, there is a simple reason for this. Unofficially, of course, illegal money, laundered through tax havens, has become an essential and sometimes stabilizing element of the global financial system. See ‘Drug money saved banks in global crisis, claims UN advisor’.

So what can we do that will make a difference?

Given the deeply entrenched and long-standing nature of this problem, clearly it needs to be addressed at various levels.

Fundamentally, we can nurture our children so that we do not destroy their conscience. See ‘My Promise to Children’. Remember all of those corrupt/criminal accountants, bankers, businesspeople, priests and popes, lawyers and politicians that kept creeping up in the discussion above? The people who maintain the entire infrastructure that allows tax havens to exist and those who manage and profit from it too?

Do they care about you? Do they care about the people in Africa, Asia and Central/South America who starve as a result of the types of policies that allow tax havens to exist and function? Do they care about those driven into poverty and homelessness in modern industrial economies because vast sums are drained out of them and hidden in secrecy jurisdictions? Do they care about the people killed by the military and other violence from which they profit and then hide the proceeds to evade tax? Do they care about the Earth? Fundamentally, do they care about themselves?

Of course not! But this is only because they are extraordinarily psychologically damaged individuals. See ‘The Global Elite is Insane Revisited’ with a more complete explanation in ‘Why Violence?’ and ‘Fearless Psychology and Fearful Psychology: Principles and Practice’.

If we inflict enormous violence on a child throughout their childhood to compel their obedience, how can we expect them to grow up to lead a life of integrity based on their conscience, courage, compassion, empathy and love? Those who use tax havens are truly ‘poor little rich boys’ (and girls). See ‘Love Denied: The Psychology of Materialism, Violence and War’ and ‘Why Set Up a Shell Company in Panama? The Psychology Driving Illicit Financial Flows’.

Beyond tackling the problem at its source however, we can also tackle manifestations of the problem but not by lobbying elites – and their political agents: there are no votes in it, in any case – to control this depravity for which they are well rewarded.

For a start we can boycott all of the major private banks in favor of those smaller or member-owned banks that have a serious commitment to peace, justice and ecological sustainability, or we can seek out equivalent institutions like credit unions. We can also create public banks based on ethical principles. See ‘What are Public Banks and How Do They Operate? An Introduction’.

We can boycott large corporations – like Amazon, Apple, Gap, Google, Ikea, Microsoft and Starbucks – that use tax havens. None of these corporations is a monopoly: there are alternatives which can be investigated and employed, assuming we can’t go without some version of the product or service they offer. Whenever you can, find a locally-owned outlet that offers a local product or service.

We can boycott the Catholic Church. God does not ask that you morally or financially support a corrupt organization that doesn’t understand or represent morality and spirituality. Remember, it was Jesus who threw the moneychangers out of the temple.

If our conscience speaks loudly enough, we can decline employment by any organization that is unethical, such as those that use tax havens.

We can refuse to gamble, refuse to buy the services of a sex worker (who might even be illegally trafficked into the work), refuse to buy the products of endangered species – see, for example, ‘Killing Elephants “for Pet Food” Condemned’ – and refuse to use illicit drugs. These products and services are virtually always offered by industries controlled by criminal organizations so by buying them you are only harming yourself and/or other people or species about whom you could choose to exercise a duty of care while also not contributing to the diversion of financial resources into tax havens.

We can encourage unions, with members who work for organizations using tax havens, to take a stand on the issue.

We can support existing organizations that work on the problem, preferably those that offer grassroots alternatives. The Tax Justice Network, an ‘activist think tank’, and its sister organization, the Global Alliance for Tax Justice, campaign for systemic change.

If we are genuinely ambitious, we can develop comprehensive nonviolent strategies to compel particular individuals and organizations to desist from using tax havens or even compel countries to close down tax havens. See Nonviolent Campaign Strategy. This can easily be part of a larger strategy to transform the global economy into one that satisfies human and ecological needs, particularly given the imminence of biosphere collapse, as noted above. See ‘The Flame Tree Project to Save Life on Earth’.

If violence and exploitation in all of their guises concern you, consider signing the online pledge of ‘The People’s Charter to Create a Nonviolent World’.

So here is a final question for you to consider: What might the world look like if all those trillions of dollars were being shared and spent where they are most needed?

Biodata: Robert J. Burrowes has a lifetime commitment to understanding and ending human violence. He has done extensive research since 1966 in an effort to understand why human beings are violent and has been a nonviolent activist since 1981. He is the author of ‘Why Violence?’ His email address is flametree@riseup.net and his website is here.

Robert J. Burrowes

P.O. Box 68

Daylesford, Victoria 3460

Australia

Email: flametree@riseup.net

Websites:

Nonviolence Charter

Flame Tree Project to Save Life on Earth

‘Why Violence?’

Feelings First

Nonviolent Campaign Strategy

Nonviolent Defense/Liberation Strategy

Anita: Songs of Nonviolence

Robert Burrowes

Global Nonviolence Network