The Inequality Gap on a Planet Growing More Extreme

By Nomi Prins

Source: TomDispatch.com

As we head into 2019, leaving the chaos of this year behind, a major question remains unanswered when it comes to the state of Main Street, not just here but across the planet. If the global economy really is booming, as many politicians claim, why are leaders and their parties around the world continuing to get booted out of office in such a sweeping fashion?

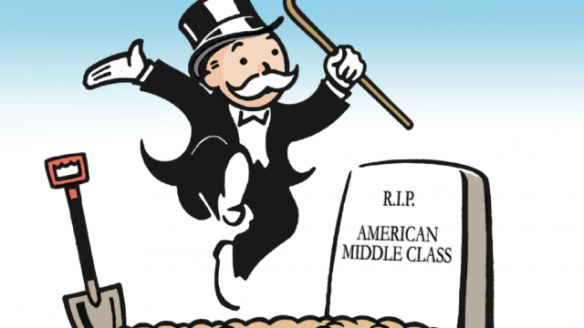

One obvious answer: the post-Great Recession economic “recovery” was largely reserved for the few who could participate in the rising financial markets of those years, not the majority who continued to work longer hours, sometimes at multiple jobs, to stay afloat. In other words, the good times have left out so many people, like those struggling to keep even a few hundred dollars in their bank accounts to cover an emergency or the 80% of American workers who live paycheck to paycheck.

In today’s global economy, financial security is increasingly the property of the 1%. No surprise, then, that, as a sense of economic instability continued to grow over the past decade, angst turned to anger, a transition that — from the U.S. to the Philippines, Hungary to Brazil, Poland to Mexico — has provoked a plethora of voter upheavals. In the process, a 1930s-style brew of rising nationalism and blaming the “other” — whether that other was an immigrant, a religious group, a country, or the rest of the world — emerged.

This phenomenon offered a series of Trumpian figures, including of course The Donald himself, an opening to ride a wave of “populism” to the heights of the political system. That the backgrounds and records of none of them — whether you’re talking about Donald Trump, Viktor Orbán, Rodrigo Duterte, or Jair Bolsonaro (among others) — reflected the daily concerns of the “common people,” as the classic definition of populism might have it, hardly mattered. Even a billionaire could, it turned out, exploit economic insecurity effectively and use it to rise to ultimate power.

Ironically, as that American master at evoking the fears of apprentices everywhere showed, to assume the highest office in the land was only to begin a process of creating yet more fear and insecurity. Trump’s trade wars, for instance, have typically infused the world with increased anxiety and distrust toward the U.S., even as they thwarted the ability of domestic business leaders and ordinary people to plan for the future. Meanwhile, just under the surface of the reputed good times, the damage to that future only intensified. In other words, the groundwork has already been laid for what could be a frightening transformation, both domestically and globally.

That Old Financial Crisis

To understand how we got here, let’s take a step back. Only a decade ago, the world experienced a genuine global financial crisis, a meltdown of the first order. Economic growth ended; shrinking economies threatened to collapse; countless jobs were cut; homes were foreclosed upon and lives wrecked. For regular people, access to credit suddenly disappeared. No wonder fears rose. No wonder for so many a brighter tomorrow ceased to exist.

The details of just why the Great Recession happened have since been glossed over by time and partisan spin. This September, when the 10th anniversary of the collapse of the global financial services firm Lehman Brothers came around, major business news channels considered whether the world might be at risk of another such crisis. However, coverage of such fears, like so many other topics, was quickly tossed aside in favor of paying yet more attention to Donald Trump’s latest tweets, complaints, insults, and lies. Why? Because such a crisis was so 2008 in a year in which, it was claimed, we were enjoying a first class economic high and edging toward the longest bull-market in Wall Street history. When it came to “boom versus gloom,” boom won hands down.

None of that changed one thing, though: most people still feel left behind both in the U.S. and globally. Thanks to the massive accumulation of wealth by a 1% skilled at gaming the system, the roots of a crisis that didn’t end with the end of the Great Recession have spread across the planet, while the dividing line between the “have-nots” and the “have-a-lots” only sharpened and widened.

Though the media hasn’t been paying much attention to the resulting inequality, the statistics (when you see them) on that ever-widening wealth gap are mind-boggling. According to Inequality.org, for instance, those with at least $30 million in wealth globally had the fastest growth rate of any group between 2016 and 2017. The size of that club rose by 25.5% during those years, to 174,800 members. Or if you really want to grasp what’s been happening, consider that, between 2009 and 2017, the number of billionaires whose combined wealth was greater than that of the world’s poorest 50% fell from 380 to just eight. And by the way, despite claims by the president that every other country is screwing America, the U.S. leads the pack when it comes to the growth of inequality. As Inequality.org notes, it has “much greater shares of national wealth and income going to the richest 1% than any other country.”

That, in part, is due to an institution many in the U.S. normally pay little attention to: the U.S. central bank, the Federal Reserve. It helped spark that increase in wealth disparity domestically and globally by adopting a post-crisis monetary policy in which electronically fabricated money (via a program called quantitative easing, or QE) was offered to banks and corporations at significantly cheaper rates than to ordinary Americans.

Pumped into financial markets, that money sent stock prices soaring, which naturally ballooned the wealth of the small percentage of the population that actually owned stocks. According to economist Stephen Roach, considering the Fed’s Survey of Consumer Finances, “It is hardly a stretch to conclude that QE exacerbated America’s already severe income disparities.”

Wall Street, Central Banks, and Everyday People

What has since taken place around the world seems right out of the 1930s. At that time, as the world was emerging from the Great Depression, a sense of broad economic security was slow to return. Instead, fascism and other forms of nationalism only gained steam as people turned on the usual cast of politicians, on other countries, and on each other. (If that sounds faintly Trumpian to you, it should.)

In our post-2008 era, people have witnessed trillions of dollars flowing into bank bailouts and other financial subsidies, not just from governments but from the world’s major central banks. Theoretically, private banks, as a result, would have more money and pay less interest to get it. They would then lend that money to Main Street. Businesses, big and small, would tap into those funds and, in turn, produce real economic growth through expansion, hiring sprees, and wage increases. People would then have more dollars in their pockets and, feeling more financially secure, would spend that money driving the economy to new heights — and all, of course, would then be well.

That fairy tale was pitched around the globe. In fact, cheap money also pushed debt to epic levels, while the share prices of banks rose, as did those of all sorts of other firms, to record-shattering heights.

Even in the U.S., however, where a magnificent recovery was supposed to have been in place for years, actual economic growth simply didn’t materialize at the levels promised. At 2% per year, the average growth of the American gross domestic product over the past decade, for instance, has been half the average of 4% before the 2008 crisis. Similar numbers were repeated throughout the developed world and most emerging markets. In the meantime, total global debt hit $247 trillion in the first quarter of 2018. As the Institute of International Finance found, countries were, on average, borrowing about three dollars for every dollar of goods or services created.

Global Consequences

What the Fed (along with central banks from Europe to Japan) ignited, in fact, was a disproportionate rise in the stock and bond markets with the money they created. That capital sought higher and faster returns than could be achieved in crucial infrastructure or social strengthening projects like building roads, high-speed railways, hospitals, or schools.

What followed was anything but fair. As former Federal Reserve Chair Janet Yellen noted four years ago, “It is no secret that the past few decades of widening inequality can be summed up as significant income and wealth gains for those at the very top and stagnant living standards for the majority.” And, of course, continuing to pour money into the highest levels of the private banking system was anything but a formula for walking that back.

Instead, as more citizens fell behind, a sense of disenfranchisement and bitterness with existing governments only grew. In the U.S., that meant Donald Trump. In the United Kingdom, similar discontent was reflected in the June 2016 Brexit vote to leave the European Union (EU), which those who felt economically squeezed to death clearly meant as a slap at both the establishment domestically and EU leaders abroad.

Since then, multiple governments in the European Union, too, have shifted toward the populist right. In Germany, recent elections swung both right and left just six years after, in July 2012, European Central Bank (ECB) head Mario Draghi exuded optimism over the ability of such banks to protect the financial system, the Euro, and generally hold things together.

Like the Fed in the U.S., the ECB went on to manufacture money, adding another $3 trillion to its books that would be deployed to buy bonds from favored countries and companies. That artificial stimulus, too, only increased inequality within and between countries in Europe. Meanwhile, Brexit negotiations remain ruinously divisive, threatening to rip Great Britain apart.

Nor was such a story the captive of the North Atlantic. In Brazil, where left-wing president Dilma Rouseff was ousted from power in 2016, her successor Michel Temer oversaw plummeting economic growth and escalating unemployment. That, in turn, led to the election of that country’s own Donald Trump, nationalistic far-right candidate Jair Bolsonaro who won a striking 55.2% of the vote against a backdrop of popular discontent. In true Trumpian style, he is disposed against both the very idea of climate change and multilateral trade agreements.

In Mexico, dissatisfied voters similarly rejected the political known, but by swinging left for the first time in 70 years. New president Andrés Manuel López Obrador, popularly known by his initials AMLO, promised to put the needs of ordinary Mexicans first. However, he has the U.S. — and the whims of Donald Trump and his “great wall” — to contend with, which could hamper those efforts.

As AMLO took office on December 1st, the G20 summit of world leaders was unfolding in Argentina. There, amid a glittering backdrop of power and influence, the trade war between the U.S. and the world’s rising superpower, China, came even more clearly into focus. While its president, Xi Jinping, having fully consolidated power amid a wave of Chinese nationalism, could become his country’s longest serving leader, he faces an international landscape that would have amazed and befuddled Mao Zedong.

Though Trump declared his meeting with Xi a success because the two sides agreed on a 90-day tariff truce, his prompt appointment of an anti-Chinese hardliner, Robert Lighthizer, to head negotiations, a tweet in which he referred to himself in superhero fashion as a “Tariff Man,” and news that the U.S. had requested that Canada arrest and extradite an executive of a key Chinese tech company, caused the Dow to take its fourth largest plunge in history and then fluctuate wildly as economic fears of a future “Great Something” rose. More uncertainty and distrust were the true product of that meeting.

In fact, we are now in a world whose key leaders, especially the president of the United States, remain willfully oblivious to its long-term problems, putting policies like deregulation, fake nationalist solutions, and profits for the already grotesquely wealthy ahead of the future lives of the mass of citizens. Consider the yellow-vest protests that have broken out in France, where protestors identifying with left and right political parties are calling for the resignation of neoliberal French President Emmanuel Macron. Many of them, from financially starved provincial towns, are angry that their purchasing power has dropped so low they can barely make ends meet.

Ultimately, what transcends geography and geopolitics is an underlying level of economic discontent sparked by twenty-first-century economics and a resulting Grand Canyon-sized global inequality gap that is still widening. Whether the protests go left or right, what continues to lie at the heart of the matter is the way failed policies and stop-gap measures put in place around the world are no longer working, not when it comes to the non-1% anyway. People from Washington to Paris, London to Beijing, increasingly grasp that their economic circumstances are not getting better and are not likely to in any presently imaginable future, given those now in power.

A Dangerous Recipe

The financial crisis of 2008 initially fostered a policy of bailing out banks with cheap money that went not into Main Street economies but into markets enriching the few. As a result, large numbers of people increasingly felt that they were being left behind and so turned against their leaders and sometimes each other as well.

This situation was then exploited by a set of self-appointed politicians of the people, including a billionaire TV personality who capitalized on an increasingly widespread fear of a future at risk. Their promises of economic prosperity were wrapped in populist platitudes, normally (but not always) of a right-wing sort. Lost in this shift away from previously dominant political parties and the systems that went with them was a true form of populism, which would genuinely put the needs of the majority of people over the elite few, build real things including infrastructure, foster organic wealth distribution, and stabilize economies above financial markets.

In the meantime, what we have is, of course, a recipe for an increasingly unstable and vicious world.