By John Liberty

Source: The Mind Unleashed

“I don’t have to tell you things are bad. Everybody knows things are bad. It’s a depression. Everybody’s out of work or scared of losing their job. The dollar buys a nickel’s worth, banks are going bust, shopkeepers keep a gun under the counter. Punks are running wild in the street and there’s nobody anywhere who seems to know what to do, and there’s no end to it.” — Howard Beale

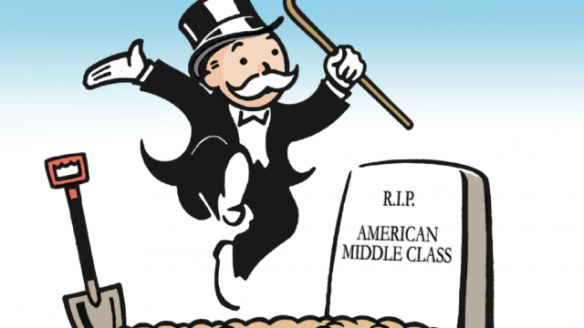

Howard Beale, the main character in the 1976 film Network, became a part of cinematic history when he uttered the line “I’m mad as hell and I’m not gonna take it anymore.” That one line expressed a growing rage among America’s shrinking middle class at a time when Americans were reeling from years of war, political scandals and economic downturn.

In the four decades that have followed, little has improved for the average American. We’re still ‘mad as hell’ and the middle class is being eroded right in front of our eyes. When adjusted for inflation, many Americans are working longer hours and earning less than they did in 1976. So, how have we gone from vibrant middle class to the working poor in a matter of decades?

Median Incomes Are Stagnant

Despite increases in the national income over the past fifty years, middle class families have experienced little income growth over the past few decades. According to U.S. Census data, middle class incomes have grown by only 28 percent from 1979 – 2014. Meanwhile, a report from the Congressional Budget Office (CBO) shows that the top 20 percent of earners has seen their incomes rise by 95 percent over that same period of time.

Contributing to the stagnation of wages is a notable decrease in the workforce participation rate. According to the Brookings institute, “One reason for these declines in employment and labor force participation is that work is less rewarding. Wages for those at the bottom and middle of the skill and wage distribution have declined or stagnated.” Historical data from the Bureau of Labor Statistics backs up these findings, showing a steady decrease in workforce participation over the last two decades.

The Erosion of the Minimum Wage & America’s Purchasing Power

Anyone who has read a comment thread on the internet about minimum wage laws knows the debate is currently one of the most highly contentious political topics in America. In the halls of Congress, the debate has turned into a nearly decade long impasse. As a result, workers at the low end of the wage scale have watched the purchasing power of their wages decrease from $7.25 in 2009, to $6.19 in 2018 due to inflation. In 2018, you need to perform 47 hours of minimum wage work to achieve the same amount of purchasing power as 40 hours of work in 2009.

The inflation-adjusted minimum wage value has been in steady decline since 1968, when the $1.60 minimum wage was equal to $11.39 (in 2018 dollars). Since then, lawmakers have reduced minimum wage increases relative to the rate of inflation. As Christopher Ingraham reports:

“Recent research shows that the reason politicians — Democrats and Republicans alike — are dragging their feet on popular policies such as the minimum wage is that they pay a lot more attention to the needs and desires of deep-pocketed business groups than they do to regular voters. Those groups tend to oppose minimum wage increases for the simple reason that they eat into their profit margins.”

To be clear, the erosion of the purchasing power of everyday Americans is hardly a new phenomenon. According to data from the U.S. Bureau of Labor Statistics, the purchasing power of the U.S. Dollar has plummeted by over 95 percent since 1913, the year the Federal Reserve was created. The Bureau’s Consumer Price Index indicates that prices in 2018 are 2,436.33% higher than prices in 1913 and that the dollar has experienced an average inflation rate of 3.13% per year during this period.

The Rich Get Richer

While the outlook may be grim for low-wage workers, this is fantastic news for large corporations. Data from the U.S. Bureau of Economics shows that corporate profits are approaching all-time highs. But it’s not just workers who are feeling the effect of growing income inequality. The contrast is also being felt on Main Street. An analysis of the S & P 500 and the Russell 1,000 & 2,000 indexes by Bloomberg revealed a growing gap between America’s largest employers and smaller businesses.

A report from the Institute for Policy Studies entitled Billionaire Bonanza: The Forbes 400 and the Rest of Us echoed these findings when it revealed that America’s 20 wealthiest people — a group that could fit comfortably in one single Gulfstream G650 luxury jet – now own more wealth than the bottom half of the American population combined.

Although the Trump administration continues to tout stock market and labor force increases as signs of economic prosperity, numbers show that the wealthiest 10 percent of Americans own 84 percent of all stock. A study conducted by the Economic Policy Institute found that wage growth remains too weak to consider the economy at full employment and that stagnant wage growth has contributed to the growing level of income inequality in America. The study noted that while wages have recovered from the 2008 recession, the gap between those at the top and those at the middle and bottom has continued to increase since 2000. As the study’s author, Elise Gould writes:

“We’re looking at nominal wage growth that is still slower than you would expect in a full employment economy, slower than you would expect if you thought there were any sort of inflation pressures from wage growth.”

The Decimation of the American Dream

Comedian George Carlin once said, “The reason they call it the American Dream is because you have to be asleep to believe it.” For millions of middle class Americans Carlin’s statement has proven eerily accurate. Stagnant wages and decreased purchasing power has put the prospects for middle class children in a tailspin as upward mobility trends have reportedly fallen by over 40 percent since 1950.

A poll conducted by the Pew Research Institute corroborates this claim. According to Pew, only 37 percent of Americans believe that today’s children will grow up to be better off financially than their parents. That means more Americans think that today’s children will be financially worse off than their parents than those who believe they will be better off.

The sentiments expressed by millions of middle class Americans appear to be wholly justified due to the fact that middle class families are becoming more fragile and dependent on two incomes. A report from the Council of Economic Advisors found the majority of the income gains made by the middle class from 1979 to 2013 were a result of increased participation in the workplace by women. The report also noted the fragility of two income families amidst a decline in marriage and a drastic rise in single parent homes in recent years.

As a result of the slow growth in wages, over half of Americans now receive more in Government transfer payments (Medicare, Medicaid, food stamps, Social Security) than they pay in federal taxes. An analysis of all 50 states also found that in 42 states the cost of living is higher than the median income.

The rising cost of healthcare is also putting the pinch on the wallets of many Americans. As Jeffrey Pfeffer noted in his book Dying for a Paycheck, healthcare spending—per capita—has increased 29 fold over the past 40 years, outpacing the growth of the American economy.

While many Americans continue to look to the government to fix problems like wage stagnation, income inequality and rising healthcare costs, the sad truth is that we live in a time when 1 in 3 households has trouble paying energy bills and 40 percent of Americans face poverty in retirement at the exact same time the Federal Government has admitted that they lost $21 trillion. Not only did they lose $21 trillion (yes that’s TRILLION with a T), but the Department of Defense indicated in a press conference that they “never expected to pass” the audit to locate the missing taxpayer money.

John Emerich Edward Dalberg Acton famously proclaimed in 1887:

“Power tends to corrupt, and absolute power corrupts absolutely. Great men are almost always bad men.”

Perhaps it’s time for the millions of Americans who are quietly ‘mad as hell’ to start expressing their rage at the corrupt institutions of power that are decimating their livelihoods rather than expecting those very same institutions to fix the problems they created.