By Rajan Menon

Source: Unz Review

So effectively has the Beltway establishment captured the concept of national security that, for most of us, it automatically conjures up images of terrorist groups, cyber warriors, or “rogue states.” To ward off such foes, the United States maintains a historically unprecedented constellation of military bases abroad and, since 9/11, has waged wars in Afghanistan, Iraq, Syria, Libya, and elsewhere that have gobbled up nearly $4.8 trillion. The 2018 Pentagon budget already totals $647 billion — four times what China, second in global military spending, shells out and more than the next 12 countries combined, seven of them American allies. For good measure, Donald Trump has added an additional $200 billion to projected defense expenditures through 2019.

Yet to hear the hawks tell it, the United States has never been less secure. So much for bang for the buck.

For millions of Americans, however, the greatest threat to their day-to-day security isn’t terrorism or North Korea, Iran, Russia, or China. It’s internal — and economic. That’s particularly true for the 12.7% of Americans (43.1 million of them) classified as poor by the government’s criteria: an income below $12,140 for a one-person household, $16,460 for a family of two, and so on… until you get to the princely sum of $42,380 for a family of eight.

Savings aren’t much help either: a third of Americans have no savings at all and another third have less than $1,000 in the bank. Little wonder that families struggling to cover the cost of food alone increased from 11% (36 million) in 2007 to 14% (48 million) in 2014.

The Working Poor

Unemployment can certainly contribute to being poor, but millions of Americans endure poverty when they have full-time jobs or even hold down more than one job. The latest figures from the Bureau of Labor Statistics show that there are 8.6 million“working poor,” defined by the government as people who live below the poverty line despite being employed at least 27 weeks a year. Their economic insecurity doesn’t register in our society, partly because working and being poor don’t seem to go together in the minds of many Americans — and unemployment has fallen reasonably steadily. After approaching 10% in 2009, it’s now at only 4%.

Help from the government? Bill Clinton’s 1996 welfare “reform” program , concocted in partnership with congressional Republicans, imposed time limits on government assistance, while tightening eligibility criteria for it. So, as Kathryn Edin and Luke Shaefer show in their disturbing book, $2.00 a Day: Living on Almost Nothing in America, many who desperately need help don’t even bother to apply. And things will only get worse in the age of Trump. His 2019 budget includes deep cuts in a raftof anti-poverty programs.

Anyone seeking a visceral sense of the hardships such Americans endure should read Barbara Ehrenreich’s 2001 book Nickel and Dimed: On (Not) Getting By in America. It’s a gripping account of what she learned when, posing as a “homemaker” with no special skills, she worked for two years in various low-wage jobs, relying solely on her earnings to support herself. The book brims with stories about people who had jobs but, out of necessity, slept in rent-by-the-week fleabag motels, flophouses, or even in their cars, subsisting on vending machine snacks for lunch, hot dogs and instant noodles for dinner , and forgoing basic dental care or health checkups. Those who managed to get permanent housing would choose poor, low-rent neighborhoods close to work because they often couldn’t afford a car. To maintain even such a barebones lifestyle, many worked more than one job.

Though politicians prattle on about how times have changed for the better, Ehrenreich’s book still provides a remarkably accurate picture of America’s working poor. Over the past decade the proportion of people who exhausted their monthly paychecks just to pay for life’s essentials actually increased from 31% to 38%. In 2013, 71% of the families that had children and used food pantries run by Feeding America, the largest private organization helping the hungry, included at least one person who had worked during the previous year. And in America’s big cities, chiefly because of a widening gap between rent and wages, thousands of working poor remain homeless, sleeping in shelters, on the streets, or in their vehicles, sometimes along with their families. In New York City, no outlier when it comes to homelessness among the working poor, in a third of the families with children that use homeless shelters at least one adult held a job.

The Wages of Poverty

The working poor cluster in certain occupations. They are salespeople in retail stores, servers or preparers of fast food, custodial staff, hotel workers, and caregivers for children or the elderly. Many make less than $10 an hour and lack any leverage, union or otherwise, to press for raises. In fact, the percentage of unionized workers in such jobs remains in the single digits — and in retail and food preparation, it’s under 4.5%. That’s hardly surprising, given that private sector union membership has fallen by 50% since 1983 to only 6.7% of the workforce.

Low-wage employers like it that way and — Walmart being the poster child for this — work diligently to make it ever harder for employees to join unions. As a result, they rarely find themselves under any real pressure to increase wages, which, adjusted for inflation, have stood still or even decreased since the late 1970s. When employment is “at-will,” workers may be fired or the terms of their work amended on the whim of a company and without the slightest explanation. Walmart announced this year that it would hike its hourly wage to $11 and that’s welcome news. But this had nothing to do with collective bargaining; it was a response to the drop in the unemployment rate, cash flows from the Trump tax cut for corporations (which saved Walmart as much as $2 billion), an increase in minimum wages in a number of states, and pay increases by an arch competitor, Target. It was also accompanied by the shutdown of 63 of Walmart’s Sam’s Club stores, which meant layoffs for 10,000 workers. In short, the balance of power almost always favors the employer, seldom the employee.

As a result, though the United States has a per-capita income of $59,500 and is among the wealthiest countries in the world, 12.7% of Americans (that’s 43.1 million people), officially are impoverished. And that’s generally considered a significant undercount. The Census Bureau establishes the poverty rate by figuring out an annual no-frills family food budget, multiplying it by three, adjusting it for household size, and pegging it to the Consumer Price Index. That, many economists believe, is a woefully inadequate way of estimating poverty. Food prices haven’t risen dramatically over the past 20 years, but the cost of other necessities like medical care (especially if you lack insurance) and housing have: 10.5% and 11.8% respectively between 2013 and 2017 compared to an only 5.5% increase for food.

Include housing and medical expenses in the equation and you get the Supplementary Poverty Measure (SPM), published by the Census Bureau since 2011. It reveals that a larger number of Americans are poor: 14% or 45 million in 2016.

Dismal Data

For a fuller picture of American (in)security, however, it’s necessary to delve deeper into the relevant data, starting with hourly wages, which are the way more than 58%of adult workers are paid. The good news: only 1.8 million, or 2.3% of them, subsist at or below minimum wage. The not-so-good news: one-third of all workers earn less than $12 an hour and 42% earn less than $15. That’s $24,960 and $31,200 a year. Imagine raising a family on such incomes, figuring in the cost of food, rent, childcare, car payments (since a car is often a necessity simply to get to a job in a country with inadequate public transportation), and medical costs.

The problem facing the working poor isn’t just low wages, but the widening gap between wages and rising prices. The government has increased the hourly federal minimum wage more than 20 times since it was set at 25 cents under the 1938 Fair Labor Standards Act. Between 2007 and 2009 it rose to $7.25, but over the past decade that sum lost nearly 10% of its purchasing power to inflation, which means that, in 2018, someone would have to work 41 additional days to make the equivalent of the 2009 minimum wage.

Workers in the lowest 20% have lost the most ground, their inflation-adjusted wages falling by nearly 1% between 1979 and 2016, compared to a 24.7% increase for the top 20%. This can’t be explained by lackluster productivity since, between 1985 and 2015, it outstripped pay raises, often substantially, in every economic sector except mining.

Yes, states can mandate higher minimum wages and 29 have, but 21 have not, leaving many low-wage workers struggling to cover the costs of two essentials in particular: health care and housing.

Even when it comes to jobs that offer health insurance, employers have been shifting ever more of its cost onto their workers through higher deductibles and out-of-pocket expenses, as well as by requiring them to cover more of the premiums. The percentage of workers who paid at least 10% of their earnings to cover such costs — not counting premiums — doubled between 2003 and 2014.

This helps explain why, according to the Bureau of Labor Statistics, only 11% of workers in the bottom 10% of wage earners even enrolled in workplace healthcare plans in 2016 (compared to 72% in the top 10%). As a restaurant server who makes $2.13 an hour before tips — and whose husband earns $9 an hour at Walmart — put it, after paying the rent, “it’s either put food in the house or buy insurance.”

The Affordable Care Act, or ACA (aka Obamacare), provided subsidies to help people with low incomes cover the cost of insurance premiums, but workers with employer-supplied healthcare, no matter how low their wages, weren’t covered by it. Now, of course, President Trump, congressional Republicans, and a Supreme Court in which right-wing justices are going to be even more influential will be intent on poleaxing the ACA.

It’s housing, though, that takes the biggest bite out of the paychecks of low-wage workers. The majority of them are renters. Ownership remains for many a pipe dream. According to a Harvard study, between 2001 and 2016, renters who made $30,000-$50,000 a year and paid more than a third of their earnings to landlords (the threshold for qualifying as “rent burdened”) increased from 37% to 50%. For those making only $15,000, that figure rose to 83%.

In other words, in an ever more unequal America, the number of low-income workers struggling to pay their rent has surged. As the Harvard analysis shows, this is, in part, because the number of affluent renters (with incomes of $100,000 or more) has leapt and, in city after city, they’re driving the demand for, and building of, new rental units. As a result, the high-end share of new rental construction soared from a third to nearly two-thirds of all units between 2001 and 2016. Not surprisingly, new low-income rental units dropped from two-fifths to one-fifth of the total and, as the pressure on renters rose, so did rents for even those modest dwellings. On top of that, in places like New York City, where demand from the wealthy shapes the housing market, landlords have found ways — some within the law, others not — to get rid of low-income tenants.

Public housing and housing vouchers are supposed to make housing affordable to low-income households, but the supply of public housing hasn’t remotely matched demand. Consequently, waiting lists are long and people in need languish for years before getting a shot — if they ever do. Only a quarter of those who qualify for such assistance receive it. As for those vouchers, getting them is hard to begin with because of the massive mismatch between available funding for the program and the demand for the help it provides. And then come the other challenges: finding landlords willing to accept vouchers or rentals that are reasonably close to work and not in neighborhoods euphemistically labelled “distressed.”

The bottom line: more than 75% of “at-risk” renters (those for whom the cost of rent exceeds 30% or more of their earnings) do not receive assistance from the government. The real “risk” for them is becoming homeless, which means relying on shelters or family and friends willing to take them in.

President Trump’s proposed budget cuts will make life even harder for low-income workers seeking affordable housing. His 2019 budget proposal slashes $6.8 billion(14.2%) from the resources of the Department of Housing and Urban Development’s (HUD) by, among other things, scrapping housing vouchers and assistance to low-income families struggling to pay heating bills. The president also seeks to slash funds for the upkeep of public housing by nearly 50%. In addition, the deficits that his rich-come-first tax “reform” bill is virtually guaranteed to produce will undoubtedly set the stage for yet more cuts in the future. In other words, in what’s becoming the United States of Inequality, the very phrases “low-income workers” and “affordable housing” have ceased to go together.

None of this seems to have troubled HUD Secretary Ben Carson who happily ordered a $31,000 dining room set for his office suite at the taxpayers’ expense, even as he visited new public housing units to make sure that they weren’t too comfortable (lest the poor settle in for long stays). Carson has declared that it’s time to stop believing the problems of this society can be fixed merely by having the government throw extra money at them — unless, apparently, the dining room accoutrements of superbureaucrats aren’t up to snuff.

Money Talks

The levels of poverty and economic inequality that prevail in America are not intrinsic to either capitalism or globalization. Most other wealthy market economies in the 36-nation Organization for Economic Cooperation and Development (OECD) have done far better than the United States in reducing them without sacrificing innovation or creating government-run economies.

Take the poverty gap, which the OECD defines as the difference between a country’s official poverty line and the average income of those who fall below it. The United States has the second largest poverty gap among wealthy countries; only Italy does worse.

Child poverty? In the World Economic Forum’s ranking of 41 countries — from best to worst — the U.S. placed 35th. Child poverty has declined in the United States since 2010, but a Columbia University report estimates that 19% of American kids (13.7 million) nevertheless lived in families with incomes below the official poverty line in 2016. If you add in the number of kids in low-income households, that number increases to 41%.

As for infant mortality, according to the government’s own Centers for Disease Control, the U.S., with 6.1 deaths per 1,000 live births, has the absolute worst record among wealthy countries. (Finland and Japan do best with 2.3.)

And when it comes to the distribution of wealth, among the OECD countries only Turkey, Chile, and Mexico do worse than the U.S.

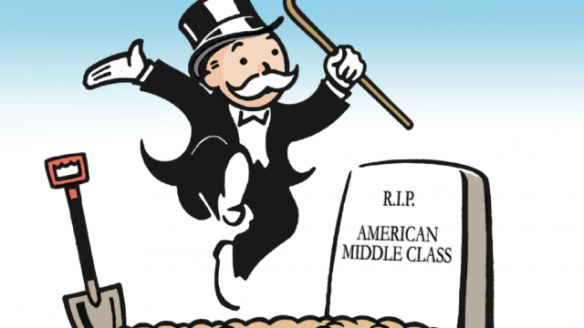

It’s time to rethink the American national security state with its annual trillion-dollar budget. For tens of millions of Americans, the source of deep workaday insecurity isn’t the standard roster of foreign enemies, but an ever-more entrenched system of inequality, still growing, that stacks the political deck against the least well-off Americans. They lack the bucks to hire big-time lobbyists. They can’t write lavish checks to candidates running for public office or fund PACs. They have no way of manipulating the myriad influence-generating networks that the elite uses to shape taxation and spending policies. They are up against a system in which money truly does talk — and that’s the voice they don’t have. Welcome to the United States of Inequality.

Rajan Menon, a TomDispatch regular, is the Anne and Bernard Spitzer Professor of International Relations at the Powell School, City College of New York, and Senior Research Fellow at Columbia University’s Saltzman Institute of War and Peace Studies. He is the author, most recently, of The Conceit of Humanitarian Intervention