The facts have become too dire to ignore any longer.

By Chad Mulligan

Source: Hipcrime Vocab

I’d like to pose a question I’ve been dancing around for the last couple of posts: Is the United States a failed society?

That may seem overly dramatic, but please hear me out.

Recently, it has once again come to the attention of the news media that Americans are an order of magnitude more likely to die at every age than citizens of other advanced, wealthy, industrialized nations.

This was most recently expounded by a Financial Times correspondent named John Burn-Murdoch. The article itself is paywalled, but this Twitter thread contains all the relevant information:

https://threadreaderapp.com/thread/1641799698058035200.html

It makes for sobering reading. A lot of times the discussion just focuses on total life expectancy, that is, the number on the death certificate. That’s fallen too, but not as dramatically. But life expectancy differs at various ages. Yet, what the numbers invariably show is that, at every single age Americans are more likely to die than their counterparts in other wealthy industrialized nations.

For example, one in 25 five-year-olds in the United States will not live to see their fortieth birthday. That means a lot of parents are going to have to bury their children. But at every age, whether you’re twenty-five or fifty, your chances of dying are much higher in the United States than anywhere else. By age 29, the average American is four times more likely to die than a 29 year-old in another country. I’ve heard plenty of stories from people in their twenties and thirties talking about their high-school years like military veterans recounting their service during wartime (“fifteen in my class didn’t make it out.”). And those are just ordinary citizens!

In other words, growing up in the United States is extraordinarily deadly.

In fact, the social outcomes for the average American are worse than the most socially deprived areas of the United Kingdom like Blackpool—an area synonymous with industrial decline. At every single point along the income distribution, Americans are more likely to be hurt, injured, or killed than their peers in other wealthy, developed nations.

Furthermore, these trends are exclusively confined to the United States. Even Cuba, a relatively poor country under continuous sanctions by the United States since the nineteen-sixties, now has better health outcomes (e.g. life expectancy, infant mortality, chronic diseases). So, too, does China, which has overtaken the U.S. in a number of health metrics despite being the largest country in terms of total population.

The Atlantic’s Derek Thompson has called the United States “The Rich World’s Death Trap.” He interviews John Burn-Murdock here:

The bottom line is this: in many ways, your life chances are much, much lower in the United States than in any other wealthy, industrialized nation in the world. This is simply undeniable.

Which leads me to pose the question I asked above.

Peer Countries

Because this is such a fraught topic, it’s worthwhile to get some things out of the way. Certainly your life chances in the United States are better than many other parts of the world at the moment.

Some places are run by military dictatorships like North Korea or Myanmar. Some places are in outright civil war like Syria, Libya or Sudan. Some areas are in an active shooting war like Ukraine and Russia. Some countries have huge areas of absolute deprivation like sub-Saharan Africa, India, the Philippines or Afghanistan. Some countries have lost control over parts of their territory to drug gangs like Mexico, El Salvador, Peru and Ecuador. You’re certainly better off here than in many of those other countries.

So let’s just acknowledge that right off the bat. Of course, this raises questions about just how supposedly wonderful the current state of our world actually is, but that’s a topic for another time.

But I think it’s absolutely invalid to invoke those countries as a justification for the abysmal statistics listed above. Here’s why: the United States is at the absolute apex of the global economy, and has been since World War Two. We issue the world’s reserve currency. We have more billionaires than anywhere else. We are home to the largest and most powerful corporations in the world. No country in the world is more wealthy or powerful than the United States at the present moment.

This is the concept of peer nations. Those are the ones we should be judging ourselves against. You can use a number of indicators for this. The United States is a member of both the OECD and the G-7. In fact, it is the key member of these organizations. It is at peacetime. It is an electoral democracy. It has the world’s largest GDP. It is surrounded by the world’s two largest oceans and has benign neighbors to the north and the south. It has not had a war on its home soil since the 1860s.

Simply put, the United States has more resources at its disposal and more wherewithal to tackle social problems than anywhere else in the world.

So, unlike many other countries around the world, the United States has no excuse whatsoever for the sorry state of its citizenry, and comparing the United States to non-peer countries is no more than pathetic excuse-making in the face of damning evidence that the U.S. government simply chooses to ignore burgeoning social problems and leaves the majority of its citizens to fend for themselves.

What Else Is New?

Reading these facts, I’m wondering why any of this this is news to people. As far back as 2013 I noted the following:

Americans die younger and experience more injury and illness than people in other rich nations, despite spending almost twice as much per person on health care.

That was the startling conclusion of a major report released earlier this year by the U.S. National Research Council and the Institute of Medicine. It received widespread attention. The New York Times concluded: “It is now shockingly clear that poor health is a much broader and deeper problem than past studies have suggested.”

Also from 2013: The Surprising Reason Americans Are Far Less Healthy Than Others in Developed Nations (Alternet)

It received widespread attention all right, and then was promptly forgotten. But even earlier, in 2012, there was this report from The Lancet:

American teenagers have the highest rates of drug and alcohol abuse in the developed world. And they are far more likely to be killed by violence than peers in Europe. This lost generation, whose unemployment rate is 20 percent, leads the modern world in some of the most dangerous and irresponsible behaviors, according to a new study released by the Lancet medical journal.

U.S. teens worst in western world for binge-drinking, drugs and violent deaths (Daily Mail)

In 2019, husband-and-wife economists Angus Deaton and Anne Case coined the term “deaths of despair,” and noted that these were exclusively confined to the United States. In 2020, they published a book chronicling their grim studies with that same title. It, too, received a brief burst of attention in the media and then promptly disappeared down the memory hole just like everything else.

So this is old news. As Burn-Murdock’s article notes, the divergence between the U.S. and its peers has been continuously growing since around 1990, and has been getting even more acute in recent years.

The above podcast touts how “rich” we are compared with other nations using metrics like dollar income. But what does a high salary even mean when you are less likely to survive than other places? What are you supposed to do with that money, anyway—fill your oversized house with crap? As the saying goes, “you can’t take it with you.” This also belies the insanely high cost of everything in America, especially housing, which leads to 70 percent of Americans feeling financially stressed according to CNBC, despite how “rich” we supposedly are. According to Brookings, 44 percent of Americans earn low wages in this allegedly “rich” country.

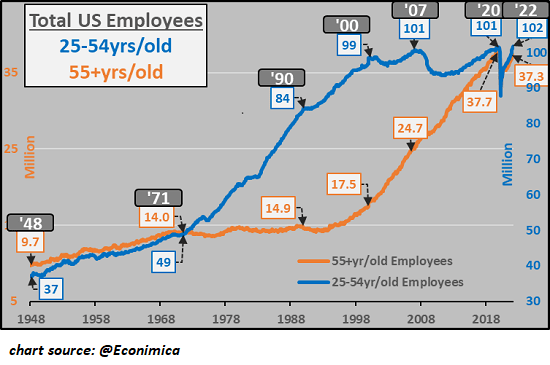

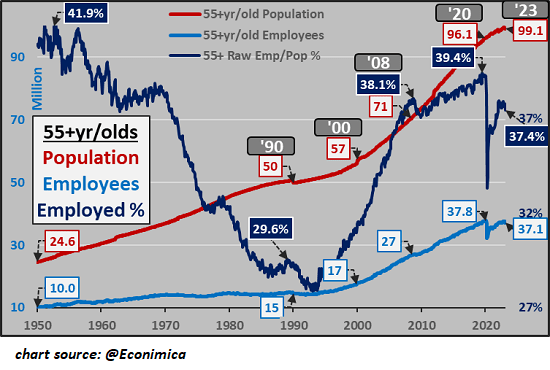

And, as economist Dean Baker has noted, people in many other countries choose to take their additional “income” as leisure time, which may be another reason why they are so much healthier than we are. Americans work longer hours than anyone else, and at unusual times. The United States has a lousy work culture, with much less vacation or family leave time than other countries. Americans also take less vacation, work longer days, and retire later. Citizens of other countries also don’t have to pay for as many things out of their own pocket—from transportation, to retirement, to health care—due to a misguided fear of “socialism,” making income comparisons misleading. What sense does it make to earn a lot of money if you are lonely and isolated and have no time off to enjoy it? And much of that extra income is dedicated to cushioning ourselves from the fallout of a society decaying around us and positional goods to compete with everyone else.

My question is this: if the United States is not a failed society, then by what criteria should we judge success? Are context-free income statistics, GDP, and the number of billionaires really the appropriate measure for a good society rather than the well-being of the average citizen? People like to tout America’s so-called “innovation,” but one area we don’t seem to be innovating very much in is keeping our citizens healthy and alive.

The symptoms versus the disease

The reasons given for the above statistics are the usual ones: gun violence, drug overdoses, suicides, car crashes, metabolic diseases, and lack of access to basic and preventative health care compared to other nations.

But I want to distinguish the symptoms from the disease.

In medicine, doctors are taught to separate the symptoms from the disease. If a patient is suffering from a fever, jaundice, and swelling, for example; the fever, jaundice, and swelling aren’t what is making them ill. Instead, these are all symptoms caused by the disease which the patient is afflicted with, and it is the doctor’s job to determine what the disease is from the symptoms and try to cure it.

If that is the case, then what is the disease we are suffering from in this instance? In my opinion, it is this: American society is fundamentally rotten to the core.

We have effectively restructured our entire society as a lottery. Under this system, you’re entitled to precisely nothing except what you can claw free from the impersonal market casino rigged in favor the House. American society been transformed into a brutal winner-take-all tournament in the name of “meritocracy,” and most Americans seem to be okay with that.

At every point on their hierarchy, from the highest perch to the lowest, everyone is desperately trying to maintain their current position, hyperattuned to status, fearful of falling into the abyss, clawing each other’s eyes out to hold onto their small piece of the pie in a crabs-in-a-bucket scenario. “There is no such thing as society” has been elevated from a political statement to a a central guiding tenet where it’s every man for himself and the devil take the hindmost.

While other nations at least try to look after the welfare of all of their citizens, in America if you are not rich, successful or an entrepreneur, then your life is worth nothing. If you aren’t good enough, or don’t measure up, then you deserve to suffer. We actively hate the poor and think they should die. We talk about them like animals. Average is over. The rich get richer. Winners take all.

Cutthroat capitalism is the order of the day. Your only task when you get up every morning is to get as much of the other guy’s money as possible into your own bank account by any means necessary for the next twenty-four hours and do it all over again the next day. There is no higher purpose. “Freedom” is defined as the ability for the rich to do whatever they like to the rest of us without consequence or sanction. It’s a world of predator and prey where you can either be one or the other—there is no other option.

Unlike in other countries, in the United States the government does not exist to help its citizens; rather, its primary role is to funnel money to a series of well-connected insiders feeding at various troughs. The rest of us are on our own. No one is on your side.

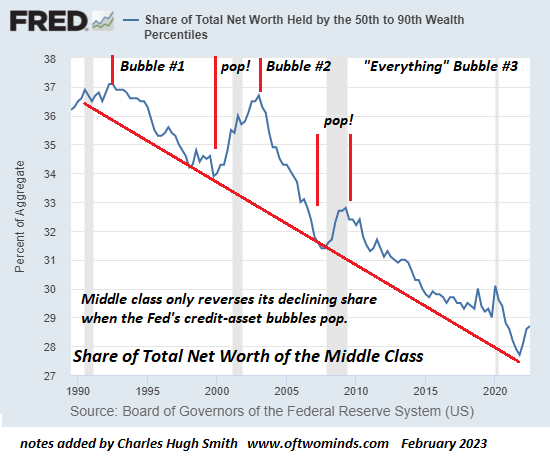

In every country, you need to educate your citizenry and keep them safe and healthy. That is the most basic task of any government, anywhere. In the United States, these tasks are delegated to predatory institutions designed to extract as much money as possible so that sticky-fingered middlemen can siphon off as vast amounts to feather their nests. A small sliver of executives in finance, education and health care get obscenely rich while the rest of the population struggles and is mired in debt, assuming they can even access those services at all. As a result, Americans pay wildly inflated prices for just about everything, from health care, to education, to energy, to entertainment and telecommunications. And the system cannot be changed because those insiders and middlemen fund the political campaigns and spend billions on highly effective propaganda. The rich people at the apex cynically strip-mine society for their benefit, while there are fewer paths than ever to a middle class lifestyle for the average person.

“Everything for myself and my immediate offspring; nothing for other people,” is the pervasive ethos: “I dont want pay for someone else’s (health care, education, fill-in-the blank).” But once that attitude becomes endemic, you no longer have anything even resembling a society anymore; you have only collection of individuals fending for themselves. As the title of a post from a few years back put it, “I don’t know how to explain to you that you should care about other people.”

It is a nation of sociopaths where fellow citizens are seen as either enemies or competitors. The simple warmth of human kindness has been abolished. Americans walk around in a constant state of fear and high alertness like the prey animals they have become. Or else they have the thousand-yard-stare grazing in the aisles at Walmart. I’ve mentioned before how many Americans seem to be crazed and deranged, or zonked out on drugs, and don’t know how to behave around other people or show basic decency. People seem more and more desperate. I personally have witnessed many more acts of erratic behavior and dangerous driving lately, and have heard similar stories from other people. American society seems to be under more pressure than ever before, and people are cracking up left and right. It feels like a lot of people—even the supposedly “successful” ones—have basically checked out and are simply going through the motions.

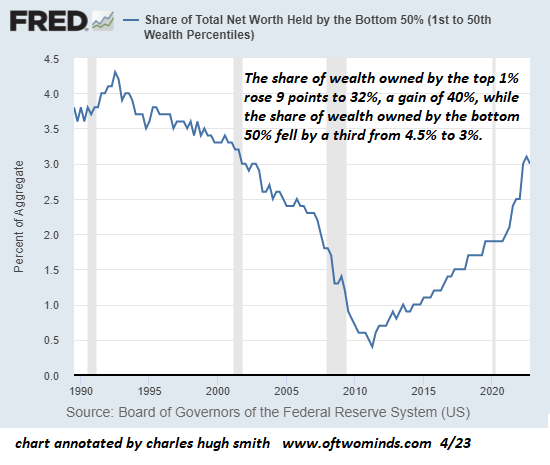

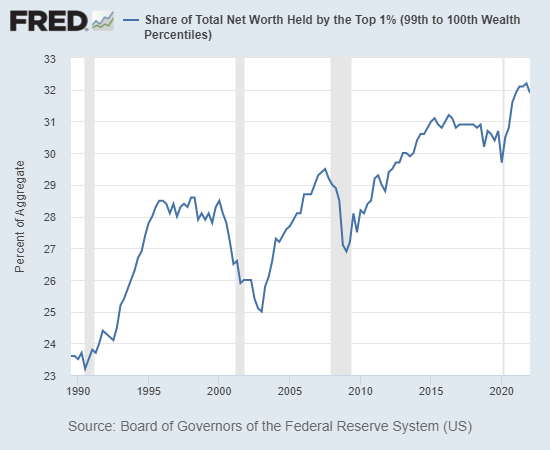

The United States is a plantation society to the core. At a basic, fundamental level, American society is not set up not to deliver a good quality of life to it citizens, but rather for a small segment of hard, hard men to get unfathomably rich beyond the dreams of avarice, with the rest of us no more than insects to be stepped on in pursuit of that goal. And if some people happen to enjoy good lives anyway under that system, well, it’s more of an unintentional side-effect than a deliberate outcome. Perhaps you’re one of those hard men (or women), or hope to be. Good for you, I guess.

So I think that’s the fundamental reason for all of the above. That’s the disease, and everything else is merely a symptom—our refusal to properly fund universal health care; our built environment designed exclusively around cars and lack of public transportation; our fat and sugar-laden diets; our overcrowded prisons; our opioid-addicted homeless; our frayed social safety nets; our violent, trigger-happy cops; our extortionate education costs; our predatory financial institutions; our refusal to build affordable housing; and our propensity to shoot one another. American society is rotten to the core.

For example, even though our weekly mass shootings make international headlines, they don’t really have that much of an impact on life expectancy when you compare them against the size of the world’s third most populous nation, despite troubling statistics like these:

Last year (2022), two people died from gun violence in the United States every hour. In 2023, there have been at least 160 mass shootings across the US so far this year. There are 120 guns for every 100 Americans. No other nation has more civilian guns than people. About 44% of US adults live in a household with a gun, and about one-third personally own one.

How US gun culture stacks up with the world (CNN)

How many US mass shootings have there been in 2023? (BBC)

But that’s not the question we should be asking. The question we should be asking is this: what does this level of gun massacres and homicidal mania say about the nature of American society itself?

What does it say about American society that so many people have to turn to alcohol, opioids and other addictive drugs just to cope?

What does it say about America that it produces so many mentally-ill and broken people?

What does it say that Americans are so much fatter and sicker than people in other countries?

What does it say that we lock up more of our citizens than anywhere else in the world?

What does it say that our Surgeon General has described an epidemic of loneliness and isolation?

Americans are prickly and thin-skinned. They can’t bear any criticism of their nation, and will absolutely lose their minds at even the implication that they do not live in the best country on earth, despite mountains of evidence to the contrary (unless you are very wealthy). They will rationalize away all of the statistics listed above. Or else they will resort to immigrants as a way to shore up their fragile egos: “Everyone wants to move here!!!” Interestingly, according to the podcast above (-14:39), U.S. immigrants seem to live about as long as anyone else in the world. Perhaps it’s because immigrant communities tend to look after each other and manage to keep the toxic, every-man-for-himself individualism of mainstream American culture at arm’s length. Too bad for the rest of us, though.

In the end, the facts speak for themselves: By the standards that actually matter for the average individual, compared to peer nations, the United States is an objective failure.

Why is it like this? Some pessimists say that it’s been like this from day one and there’s nothing we can do about it. Perhaps they’re right. But the facts tell a different story. According to the data, it’s really only since 1990 that this yawning chasm in social outcomes has opened up in between the United States and the rest of the world. During the New Deal era, for instance, these gaps didn’t exist or actually favored Americans. The United States was able to accomplish big things like building the Hoover Dam and putting a man on the moon, and people didn’t hate and fear their own government. The U.S. was perceived very differently abroad.

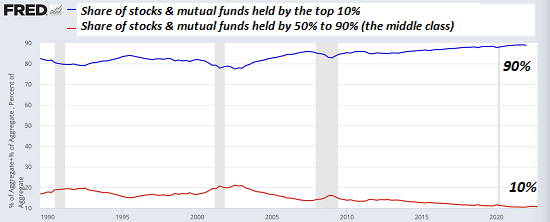

Here’s what I think happened. Starting in the 1970s a small group of sociopathic men at the top of the hierarchy acquired the means and the tools to reshape the United States in their own image. They founded think-tanks. They funded economics departments and political campaigns. They bought up the media. They started television networks to promote their agenda. They packed the courts. They used the latest cutting-edge psychological research and techniques that had been developed in the service of advertising to remold the society like putty in their hands. Throughout the decade of the 1980s under Reagan, their plans ultimately came to fruition, and the transformation was compete by 1990 which is why the changes became apparent after then. Ever since, we’ve been living in the society that they have created. I’m skeptical that Americans were always inherently more sociopathic and antisocial than people everywhere else—I think to a large extent we’ve been made to be this way.

So we’re all living in the end result of that. And now that it has been accomplished, we see the ugly results everywhere around us, including increasing political radicalization and strife as the failure of this vision of society is becoming increasingly apparent but we seem to be incapable of envisioning an alternative or are too fearful of change. Instead, we seem to be doubling down. I fear it’s already too late to turn things around, and this is just the way American society will be forever now and things will just continue to get worse and worse for the vast majority of us. We will remain the (not so) rich world’s death trap, permanently.

I’ll conclude with this passage which I read years ago:

If I could paint the country in one broad stroke, I would say it’s a place where one concept of freedom – used to lobby for private interests and free markets – is at odds with another kind: the ability to lead a life you enjoy. Fewer and fewer seem privileged with this second kind. Not Trayvon Martin, who was a victim of a certain kind of racism which had, as its root, private property anxiety. Not the natural gas employee who has consigned himself to a life of doing something that he feels ought not to be done. Even I – who have managed to escape from time to time – always find, upon return, a cordial invitation to fall in line.

What I learned about freedom from hitchhiking around America (The Guardian)

As the above statistics show, not only are many of us not living lives we enjoy, but increasingly more and more of us aren’t living at all.