By Michael Snyder

Source: Economic Collapse Blog

Those that have been hoping for some sort of a “V-shaped recovery” have had their hopes completely dashed. U.S. workers continue to lose jobs at a staggering rate, and economic activity continues to remain at deeply suppressed levels all over the nation. Of course this wasn’t supposed to happen now that states have been “reopening” their economies. We were told that things would soon be getting back to normal and that the economic numbers would rebound dramatically. But that is not happening. In fact, the number of Americans that filed new claims for unemployment benefits last week was much higher than expected…

Weekly jobless claims stayed above 1 million for the 13th consecutive week as the coronavirus pandemic continued to hammer the U.S. economy.

First-time claims totaled 1.5 million last week, higher than the 1.3 million that economists surveyed by Dow Jones had been expecting. The government report’s total was 58,000 lower than the previous week’s 1.566 million, which was revised up by 24,000.

To put this in perspective, let me once again remind my readers that prior to this year the all-time record for a single week was just 695,000. So even though more than 44 million Americans had already filed initial claims for unemployment benefits before this latest report, there were still enough new people losing jobs to more than double that old record from 1982.

That is just astounding. We were told that the economy would be regaining huge amounts of jobs by now, but instead job losses remain at a catastrophic level that is unlike anything that we have ever seen before in all of U.S. history.

With the addition of this latest number, a grand total of nearly 46 million Americans have now filed initial claims for unemployment benefits since the COVID-19 pandemic began.

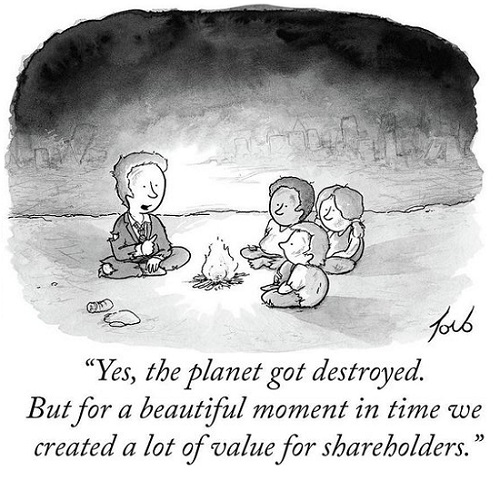

If you can read that statement and still believe that the U.S. economy is not imploding, I would like to know what you are smoking, because it must be pretty powerful.

Some of the things that we are seeing happen around the country right now are absolutely nuts. For example, earlier this week in Kentucky it was being reported that people were waiting in line for up to 8 hours to talk with a state official face to face about their unprocessed unemployment claims…

This wasn’t supposed to happen.

By now, the U.S. economy was supposed to be roaring back to life and we were supposed to be entering a new golden age of American prosperity.

Unfortunately, the truth is that more bad economic news is hitting us on a continual basis, and that isn’t going to change any time soon.

Over the past few days, we have learned that Hilton is laying off 22 percent of its corporate staff, and AT&T has announced that it will be eliminating 3,400 jobs and closing 250 stores…

The wireless carrier AT&T is cutting 3,400 jobs and shutting down 250 stores over the next few weeks, according to a statement from the Communications Workers of America, a union representing AT&T workers.

The AT&T Mobility and Cricket Wireless retail closures will affect 1,300 jobs, while the other layoffs are said to be affecting technical and clerical workers.

Needless to say, all of these job losses are having a tremendous ripple effect throughout the economy.

Without paychecks coming in, a lot of Americans are having a really tough time paying their bills, and the Wall Street Journal is reporting that payments have already been skipped on more than 100 million loans…

Americans have skipped payments on more than 100 million student loans, auto loans and other forms of debt since the coronavirus hit the U.S., the latest sign of the toll the pandemic is taking on people’s finances.

The number of accounts that enrolled in deferment, forbearance or some other type of relief since March 1 and remain in such a state rose to 106 million at the end of May, triple the number at the end of April, according to credit-reporting firm TransUnion.

Wow.

To me, that is an almost unimaginable number, and it has become clear that a tremendous amount of pain is ahead for the financial institutions that are holding these loans.

A lot of people out there are going to keep hoping that there will be some sort of an economic rebound, but the cold, hard reality of the matter is that fear of COVID-19 is going to keep a large segment of the population from resuming normal economic activities for the foreseeable future. And it certainly doesn’t help that the number of confirmed cases in the U.S. has been steadily rising over the past couple of weeks and that the mainstream media has been endlessly warning that a “second wave” is coming.

If you doubt what I am saying, just look at what is happening to the restaurant industry. We had started to see a small bit of improvement in the numbers, but now fear of a “second wave” has caused restaurant traffic to start cratering again…

After three months of slow but consistent improvement in restaurant dining data in the US and across the globe, in its latest update on “the state of the restaurant industry”, OpenTable today reported the biggest drop in seated restaurant diners (from online, phone and walk-in reservations) since the depth of the global shutdown in March.

As shown in the OpenTable graphic below, on Sunday, June 14, restaurant traffic suddenly tumbled, sliding from a -66.5% y/y decline as of June 13 to -78.8% globally.

This was mostly due to a sharp drop in US restaurant diners, which plunged by 13% – from -65% to -78% – the biggest one day drop since the start of the shutdown in the US, and the second biggest one day drop on record.

Business travel is another area where we are seeing signs of big trouble ahead. The following comes from Yves Smith…

Business travel is not coming back any time soon. People are getting accustomed to Zoom. And word may also get out that domestic flying is much worse than it used to be, which will be a deterrent to those who might be so bold as to want to get on a plane. That is a fundamental blow to airlines, airport vendors, hotels, restaurants, and convention centers. Hotel occupancy in April was 24.5% which if anything seems high based on my personal datapoints. The pricings I see say that hotel operators are not expecting much if any improvement through the summer.

Like many of you, I wish that economic conditions would go back to the way they used to be, but that simply is not going to happen.

Yes, we will see economic numbers go up and down over the coming months, but a return to “the good times” is not in the cards.

And what hardly anyone realizes is that this is just the beginning of our problems, and I am working on a new project right now which will explain why this is true in great detail.

So stay tuned, because things are about to get really, really “interesting”.