Amazon CEO and richest-man-in-the-world Jeff Bezos wants you to work as much as he does—for one millionth of the pay

By Branko Marcetic

Source: In These Times

“Is Jeff Bezos a horrible boss and is that good?” That was the question posed by Forbes magazine in 2013, a sentiment that helps explain why Amazon’s founder and CEO is detested by the Left for his oligarchic ambitions, while simultaneously admired by America’s capitalist class for his business success. Ironically, Bezos is also loathed by former President Donald Trump, while celebrated by many liberals for so-called resistance.

But with Bezos and his $115 billion fortune laying claim to the title of richest man on Earth, and with Amazon playing an increasingly influential role in public life, it is worth asking: What does Jeff Bezos stand for?

A gifted child born to a teen mom, Bezos grew up not knowing his biological father, who was once one of the top-rated unicyclists in Albuquerque, N.M. Instead, Bezos was raised by the man his mother soon married: Miguel Bezos, who had fled Cuba and the Communist revolution, which had shuttered the elite private Jesuit school he attended, as well as his family’s lumberyard.

Journalists have speculated whether Bezos’ near-pathological competitiveness is a product of his early abandonment, similar to that of fellow tech overlord Steve Jobs. No doubt equally formative was Bezos’ adoptive father, who told Brad Stone, author of The Everything Store: Jeff Bezos and the Age of Amazon, that their home life was “permeated” by complaints about totalitarian governments of both the Right and the Left.

Bezos envisioned the concept of an “everything store” while working for a Wall Street hedge fund in the 1990s. He opened Amazon in 1994 as an online bookshop, a pragmatic starting point. Bezos gave the company his own $10,000 cash injection, took out interest-free loans, and received $245,000 from his parents and family trust.

Many of Amazon’s controversial labor practices can be traced to these early years as a plucky start-up. Amazon’s small team ran on tireless ambition to live up to the company’s customer-focused promise — key to its eventual market domination. Stone reports that, to meet Bezos’ “get big fast” directive, employees devoted themselves completely, working long, unusual, frenzied hours. One early warehouse worker who biked to work simply forgot about his improperly parked car, eventually discovering it had been ticketed, towed and sold at auction.

Such a relentless pace is one thing for a small group of true believers but is quite another when applied to low-wage workers just making ends meet. By 2011, Amazon’s workplace culture became known through a series of headline-grabbing reports that have come to define its public image: badly paid, ceaselessly surveilled, overworked workers, struggling to maintain a breakneck pace.

Bezos created a culture in which everyone from the lowest peon to the highest-ranking executive is expected to match his own devotion, an approach that resulted in spectacular levels of staff turnover by the early 2000s. A declared enemy of “social cohesion,” Bezos pushed his underlings to reject compromise and instead fiercely debate and criticize colleagues when they disagreed. One former employee described it as “purposeful Darwinism.” Known for withering put-downs — “Are you lazy or just incompetent?” “Did I take my stupid pills today?”—Bezos also isn’t above pulling out his phone or, in some cases, simply leaving the room when an employee fails to impress.

The flipside of Bezos’ intellect is a cold, clinical approach to human relations. Bezos described himself as a “professional dater” during his Wall Street days, trying to improve what he called his “women flow” — a riff on the Wall Street term “deal flow.”

“He was not warm,” one person who knew Bezos during his Wall Street days told the East Bay Express in 2014. “It was like he could be a Martian for all I knew.”

Bezos’ pitiless leadership style bled out beyond the Amazon boardroom as he used the company’s growing market share to bully book publishers into his terms. The company launched the “Gazelle Project”—as in, go after publishers “the way a cheetah would pursue a sickly gazelle” — allowing Amazon to undercut its competition at the cost of little to no profit for smaller publishers.

As Amazon inched closer to Bezos’ original vision, it began lobbying efforts in 2000 and became more transparently political by 2011, spending millions to defeat an internet sales tax and playing hardball with state governments, threatening to shutter Amazon facilities if its wishes went unfulfilled. In 2013, Amazon began lobbying Congress to cut corporate taxes.

The same year, Bezos bought the Washington Post, invested in Business Insider and donated to the publisher of the libertarian magazine Reason. Though Bezos argues his purchase of the Post was motivated by “a love affair [with] the printed word” and a desire to support American democracy, others suspect Bezos’ interest in media is related to bad press following a scathing Lehman Brothers report in 2000, which sent Amazon’s stock price tumbling.

Leading up to the Post purchase, Bezos was increasingly displaying what early Amazon investor Nick Hanauer called his “libertarian politics.” In addition to spending $100,000 in 2010 on a campaign to defeat a proposed Washington state tax on high-income earners, Bezos put hundreds of thousands of dollars toward boosting charter schools and other neoliberal education reforms.

Bezos’ political involvement reached a new apogee in 2019 during the re-election bid of Seattle’s socialist city councilwoman, Kshama Sawant, who called Bezos “our enemy” and tried to pass a head tax to fund housing for those displaced by Amazon’s Seattle footprint. Amazon spent $1.5 million against Sawant and other progressive candidates, a record at the local level, with more than a dozen of the company’s executives contributing to Sawant’s opponent. (Sawant won re-election anyway.)

As for Bezos’ endgame? A Trekkie since childhood, he has long dreamed of funding space exploration, a mission pursued by other superrich moguls (such as Elon Musk) in the face of the climate emergency. Opening the doors of his secretive Blue Origin aerospace company to journalists for the first time in 2016, Bezos told the New York Times he envisioned a future of “millions of people living and working in space,” exploiting the natural resources of surrounding planets and rezoning Earth “as light industrial and residential.”

Ironically, as Bezos pours the wealth he wrung out of exhausted, low-wage Amazon workers into space exploration, Amazon is busy hastening the very planetary collapse Bezos claims he’s trying to prevent — by silencing workers who speak out against Amazon’s assistance to oil and gas companies.

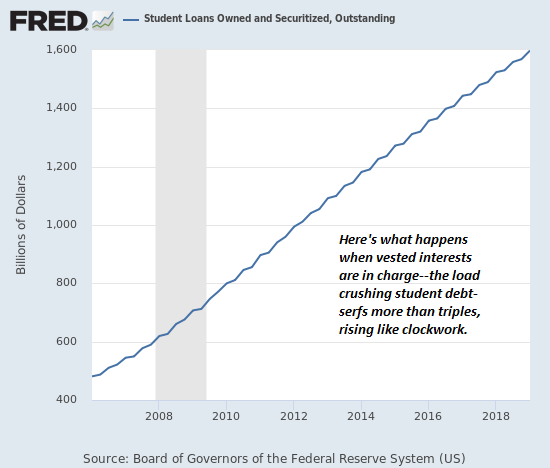

Let’s imagine, however, that Bezos, who accumulates $9 million an hour, lived in a world with Bernie Sanders’ 8% wealth tax (just on fortunes over $10 billion). A single year would see $9 billion flow from Bezos’ treasure trove into government coffers, more than enough to cover the 10-year cost of Elizabeth Warren’s universal child care plan ($1.7 billion) and maintain safe drinking water under Sanders’ plan ($6 billion).

Bezos’ career is a testament to the cruel autocracy and senseless misallocation of resources that our neoliberal capitalist system enables. But his opulence also reveals that the wealth exists to build a fairer and more equitable society — if redistributed. Bezos may loathe social cohesion, but in a world organized around democracy rather than the whims of space-billionaires, it’s something we may well be able to achieve.