By Chloe Ann King

Source: The Hampton Institute

For most of my working life I have been stuck in the hospitality industry which is lowly paid, painfully precarious and poorly regulated. In New Zealand, where I live, hospitality employers mostly treat you as nothing more than an easily replaceable unit to turn-over-profit. I have spent over a decade in this industry and as such I have become acutely aware of the fact that no matter how many shifts I work or how many poorly paid jobs I undertake; I will never have enough money to meet rising living costs.

Sometimes, my life is a bit depressing. You know what I mean? I get up, I go and work one of my multiple jobs and I come home. Each week I check my bank balance and I feel pretty put-out about how low my pay is as compared to how hard I worked for it.

Obviously, working hard at minimum wage jobs is never going to land me economic security. No matter how hard I have worked in the hospo industry I have never ever received a pay-rise, not once. The lie of “hard work” serves to convince us that if we fail to achieve happy, healthy and joy filled lives which are economically secure thanks to well paid jobs, it is because we failed to work hard enough for it. Constantly we are told that external factors do not affect us. This type of pervasive ‘positive’ rhetoric isendlessly used by many self-help Gurus such as Tony Robbins, one of America’s most well-known motivational speakers.

The lie of “hard work” is pitched to us – those from the working and lower classes, by not only self-help gurus and spiritualists but politicians and well intentioned high school teachers and even our parents, as being one of the best paths to prosperity. This myth is perpetuated and disseminated by the mainstream media as motivational newsworthy ‘human interest’ stories. However, there is very little which is human about these types of stories. The core of these news pieces has nothing to do with humanity or being human and everything to do with selfishness and individualism and play on insecurities and our need to compare our lives to others who we think or we are passive aggressively told, have it better than us.

A few months ago the NZ Herald (New Zealand’s most read newspaper which controls the national narrative) ran yet another one of these “motivational” articles on a young landlord named Gary Lin. Who has managed to buy up a staggering eleven properties citing “hard work” as a reason for his success. He told the NZ Herald,

“Work hard, work smart, save hard, and invest smart. Wealth creation is not rocket science – perseverance and hard work can get you there.”

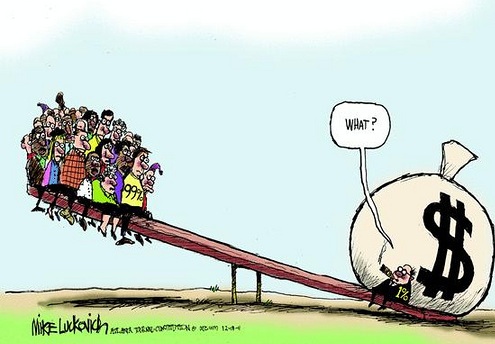

As if wealth creation is something we should as young people, be aspiring to. In times of great wealth inequality, we should be demanding wealth dispersal not setting out to create and covet wealth for ourselves. Gary, unlike most of us, was given a hefty “leg up” or what we poor folk call a “handout” by his father in the sum of $200,000 as a wedding gift which allowed him to buy his first home which cost him $175,000. I guess for some people money really does grow on trees.

I hate to break it to you Gaz – can I call you Gaz? But “hard work” had nothing to do with your successes in life.

Gaz got lucky. He won the genetic lottery and was born into wealth – he did not earn the money that helped him buy his first home. It was given to him. Instead of using his unearned wealth to help others he made the choice to punch-down and profit off the growing number of people stuck in the rental trap by hoarding properties. Gaz has engaged in predatory behavior by renting his properties out at market rental rates. In an unregulated rental market the odds are never in favor of tenants. As George Monbiot wrote for the Guardian, “Rent is another term for unearned income.”

People like Gaz rarely acknowledge their economic success is at the expense of those from the lower and working classes. To recognize this Gaz, might have to feel a little bit bad about how he came into his millionaire property portfolio. He might have some kind of world shattering epiphany that he is not as smart as he believes and his successes are owed more to an ability to stomach the ruthless actions and attitudes needed to ‘make it’ in a society that is quickly turning into a dystopian one. Which makes The Hunger Games, look like child’s play. Sociopathy and luck had more to do with Gaz’s successes in life than actual “hard work”, talent and intelligence.

Lawyer and anti-poverty activist David Tong, responded to Gaz’s flawed belief that anyone can own property if they just “work hard” enough, with these words:

“Motivational read from the NZ Herald: You too can be a rich property investor. If dad gives you a $200,000 gift”

“Hard work” and motivation don’t mean shit in a broken economy that was built on the blood, backs and bones of the working class and the most marginalized and vulnerable. Increasingly, accessing upward mobility – which buying property can help you obtain as well as a better quality of life, is becoming an impossible task because of low wages, insecure work and a flooded job market. People are just struggling to get off minimum wage let alone save for a house.

***

The New Zealand Council of Trade Unions states that “At least 30% of New Zealand’s workers – over 635,000 people – are in insecure work. We believe it may well cover 50% of the workforce.” No matter how hard you work it is impossible to get ahead when your employer only offers you inconsistent hours and denies your basic right to a guarantee of minimum hours.

Casual contracts are used widely within the hospitality and service industries and state that your employer owes you “no minimum of hours.” But the expectation is that you will cover and come in when needed and if you refuse you are often faced with penalties. Such as having your shifts cut the next week. Having the stability of a salary as opposed to waged work is a far off dream for so many of us. You can’t budget let alone save money for a house when you never know what your pay-check is going to be from one week to the next.

Economic insecurity because of cut shifts and insecure hours has been a major feature of my working life. For example, last year just before Christmas I had my shifts cut in half. I went from working between four and five shifts a week down to only two. I was given six days’ notice and when I pointed out how hard this would hit me economically to a Duty manager I was told, “I should go and find a second job” and reminded that “I was only on a casual contract so there was not much I could do about it.”

For the last few months I had been back-breakingly flexible for this employer. I had come in whenever I was needed and covered shifts at short notice. I had worked hard to make every customer’s experience an enjoyable one, all this for minimum wage. I spent most of December desperately scrounging around for a second job, as did two other workers who had suffered the same fate.

I popped into the same work soon after my shifts had been cut to collect my tips and one of the regulars who had been drinking, accosted me verbally and demanded to know why I was in such vocal support of the recent rolling strikes of Bunnings Warehouse workers. These workers had been subject to Zero Hour contracts, eternal bullying and harassment from managers and no guarantee of shifts or rosters. He said “why don’t these Bunnings workers just go out and get a better job”. This statement coming from a white male Baby Boomer who enjoyed free tertiary education and did not start his working life off in debt. All is crimson and gold in middle class Whiteywood, I guess.

“Why don’t you just go and get a better job?” This singular narrative epitomizes the ignorant attitudes of people like Gaz and the regular from my work whose name is ironically Gary, as well. It also puts the sole responsibility of finding well paid and meaningful work onto the worker, while absolving a government’s responsibility to push for job creation which serves their citizenry and the environment and to raise the minimum wage to a living wage, in New Zealand.

If over 30% of the workforce is stuck in precarious work and large sectors of the workforce earn below Aotearoa’s living wage of $19.25 an hour, finding “better work” is statistically impossible for a vast majority of us. There are thousands of hospitality businesses in Auckland, New Zealand, and only a handful pay a living wage and nearly none offer a guarantee of hours. As such telling people to “get a better job” is like telling them to buy a lotto ticket and live in hope they take out the jackpot.

***

No matter what the Gaz’s, Gary’s and the self-help superstars such as Tony Robbins of this world have to say on the myth of “hard work” and perseverance paying off one day, the reality is our ability to access upward mobility; buy a house; obtain a decent standard of living is tied to what type of work you can access. External factors not only deeply impact people’s lives they oppress those who do not benefit from certain types of privilege. Not all roads lead to Rome. More often than not for us poor folk they lead to roadblocks and hurdles that increase based on the colour of your skin, the class you were born into and/or your gender, how bodily abled you are and your sexuality or a combination of all of these.

People’s situations are complicated and difficult and cannot be curtailed into passive aggressive motivational “one liners” that nearly always punch-down and not up. Our working class struggles cannot be solved by a set of self-help rules or keys or steps which are meant to guide anyone to economic stability and lead you to the life of your dreams and a perfect job. In the book, The New Soft War on Women, the chapter entitled ‘Doing Well May Not Work Out So Well’, Caryl Rivers and Rosaling C. Barnett, write,

“We like to believe that the workplace is fair and that if we do a good job, we will be rewarded. After all, that’s the American way. But this belief is less true for women than it is for men. Indeed, too often women’s performance which is stellar gets fewer rewards than men do – even men who are less than outstanding.”

During a major speech at Wellesley College, presidential candidate Hillary Clinton, talked about the role women can play in politics and public life, she said,

“We know we’ve got to keep pushing at that glass ceiling. We have to try and break it… Obviously. I hope to live long enough to see a woman elected president of the United States.”

Encouraging women to break the glass ceiling is all well and good but what if moving off minimum wage and accessing a living wage, is no easy feat? In America alone, 6 out of every 10 women are stuck on minimum wage.

The Glass Ceiling is so high up most of us can barely even see it. Researchers at the non-profit group Catalyst point out, “[…] when you start from behind, it’s hard enough to keep pace, never mind catch up-regardless of what tactics you use.” Both Rivers and Barnett went on to write,

“Doing all the right things to get ahead-using those strategies regularly suggested in self-help books, coaching sessions and the popular press-pays off much better for men than it does for women.”

As women, we do not struggle to “get ahead” because of personal failings but this struggle is born from structural sexism which creates gendered inequality.

Telling white women and women of colour to be more ambitious and just “work harder” if they want to smash the Glass Ceiling and obtain a decent standard of living is almost laughable. Considering many women, in particular, indigenous women and women of colour, are still struggling to make it out of the basement. Still, self-help gurus such as Tony Robbins preach to millions that none of what I am writing about actually matters: race, gender… whatever you were born as, and into, does not have to hold you back. You just have to believe in yourself and follow the Tony Robbin’s step-by-step guide to snagging a life beyond anything you could ever dream of. Which he has called: ’12 Keys to an Extraordinary Life’. You couldn’t make this shit up. He said at a recent event:

“I don’t care if you are young or old, I don’t care what your colour is, what your gender is, what country you come from, if you understand the science of building wealth you can have an abundance of it. If you violate those rules [of the 12 keys to an Extraordinary Life] either because you’re ignorant to them or you don’t apply then, you are going to have financial stress”

Tony, who sounds uncomfortably like Gaz in his belief anyone can become a millionaire, may as well have just said “we are all one”! “Everyone can make it no matter what grinding and economically depressive situations you come from”! And be done with it.

Financial stress is not brought about because you have unknowingly violated one or more of the ’12 Keys to an Extraordinary Life’ which Tony has made tens of millions off. Violating female stereotypes of passivity have a lot more to do with our failure or success in the workplace than how hard we do, or do not, hustle for top positions and top earning brackets. Rivers and Barnett write, “Competent women violate the traditional female stereotype of passivity. And that violation can trigger a reaction of fear and loathing [in the workplace].”

Financial stress is brought about because of injustices such as the pay-gap and the coloured pay-gap. Something Tony, has clearly gone out of his way to ignore. Self-help gurus and people like Gaz and Gary tend to, “displace questions of social justice and frame their rhetoric by the individualist and corporatist values of a consumer society,” as both Jeremy Carrette and Richard King wrote in the book, Selling Spirituality: the silent take over of religion.

Both Rivers and Barnett point out in relation to the American pay gap,

“Hispanic/Latino women have the lowest median earnings, earning just 55 percent of the median weekly earnings of white men; black women have, median weekly earnings of 64 percent of those of white men.”

The pay gap for America’s first nation indigenous women also sits at 55 cents in the dollar compared to white men, as non-profit AAUW reports. Indigenous women are faced with earning nearly half of what white men do in America.

Similarly, in Aotearoa indigenous Maori and Pasifika women, face significant coloured/indigenous pay-gaps compared to white men and women. TheDominion Post, reported last year, “Maori and Pasifika women are more likely to be in the lowest paying jobs, which increases the poverty in their lives and communities.” The Human Rights Commission has been tracking unfairness and inequality at work and cites that Pasifika women on average earn $57,668 while white men earn $66,900. What this data shows us is that, “Men are paid more than women overall and within ethnic groups. The effects increase when combining several factors as is the case between New Zealand European men and Pacific women. These patterns have persisted over time.”

These “patterns” of women of colour and Indigenous women being paid significantly less than white men and women, to do the same damn jobs have “persisted” all over the world from America to Aotearoa. Injustice and oppression is locally and globally connected.

A more accurate description of what the aspirational metaphor of the Glass Ceiling is made out of is to say it is made from lead. So many women are much more likely to fall off what Rivers and Barnett have labelled the “glass cliff” than triumphantly smash the glass ceiling into a million little pieces. Following Tony Robbin’s guide to obtaining some magical, fairy-tale life, or any other pseudo bullshit glittery guides to financial freedom, aren’t going to be very effective for women born into a system which was built to silence and eradicate them.

The only thing I am aspiring to “smash” is white imperial patriarchal systems that at best disempower women and at worst, brutally and often violently oppress them.

***

As workers we are criticized for our behavior whether we are told we need to be “more ambitious” or we “just need to work harder” in response to our perceived failure to land a great job with good pay and consistent hours. I am so tired of listening to people who endlessly tell me to go and get a “better job” or a “real job” (what does that even mean?!). And I have lost count of the times I have been told by people who hold anti-protester positions to “go and get a job” while I am on the picket line or the protest ground. As if the low waged work I do counts for absolutely nothing. As if service industry work is some kind of phantom job.

This is for anyone who has ever told a service worker to go and get a “job” or a “real job”: why don’t you make your own double shot soy latte, flip your own burgers and pour your own damn beer and make your own designer espresso martini, which costs more than I make in an hour.

When as a worker, I refuse to put up with horrible workplace conditions and hit the picket line or call the Union as a form of resistance I have been called a “trouble maker”, “dirty hippy” and an “inconvenience”. I am proud to be all of those things. I am glad I stood up and was brave and risked job loss (sometimes I have lost my job for speaking out) and arrest in an attempt to better my workplace conditions. The only people who are “dirty” are those who seize on disaster capitalism and economically benefit from the oppression of others… I am looking at you Tony Robbin’s and Gaz.

We need more workers collectively rising up and following the lead of Health Care workers, Bunning Warehouse and Supermarket workers and more recently Bus drivers. Who have all relentlessly hit union backed picket lines to demand ‘fair pay for fair work’ and better work conditions, in New Zealand. And less people thinking magically one day their lives will get better if they just play by the rules and perform their duties at work without complaint. This is nothing but blind faith. It is like believing in god: no matter how long you patiently wait he is not going to come and save you.

People from the working classes and those who have been in the wake of the 2008 financial crash, disenfranchised from the middle and upper-classes can save each other. But we need to refuse to allow those who hold power to continue to pit us against one another in some kind of Capitalist Death Match. Where the only prize you get is some demeaning job where the wages are so low you have to pick between buying food or paying the electricity bill. Starving or freezing does not sound like much of a “win” to me. It sounds like bullshit.

The more people who push against injustice in staggering numbers the harder it is for the media to ignore us and distort our messages of resistance.

Many people’s grinding situations have nothing to do with individual ‘bad choices’ or laziness or you know, violating the ’12 Steps to an Extraordinary Life’. No matter how many times we hear rotten rhetoric like this we must refuse – absolutely – to accept these types of pervasive and dominant narratives. At their core these narratives use shame and ruggedly focus on the individual as a method to pacify and silence. We must disrupt language that is designed to disempower and divide workers while seeming to empower. We need to seek out ways to elevate the voices of our most vulnerable and the messages of people of conscience who can envision a better world and whose political imaginations outstretch the dominant reality.

Lastly, we need to fight and stand with other workers against employers who exploit their employees and view them as nothing more than units to turn-over capital. Jeremy Carrette and Richard King, went on to write in their before mentioned book:

“We are never obliged to accept the dominant version of reality (however conceived throughout history) without question.”