By HipCrime Vocab

There’s apparently a row over whether billionaires should exist. That is, whether or not billionaires should be a thing in our society.

What a stupid question. Of course billionaires shouldn’t exist! But the reason has nothing to do with Socialism.

Rather, under a properly-functioning free-market capitalist system, billionaires shouldn’t exist. And that would have also been the opinion of the “Classical Liberals” so favored by the Right these days: Adam Smith, David Ricardo. Thomas Malthus, John Stuart Mill, and so on.

Billionaires are a sign of market failure.

Let me say that again: billionaires are a form of market failure! You cannot simultaneously be both pro-Market and pro-billionaire.

I’m amazed at how few people get this!

In a truly competitive market, excess profits would be competed away. Someone would come along and undercut outsize profits. That’s exactly how the Classical Liberals assumed free markets would work. In this, they saw markets as instruments of greater equality, not inequality, and certainly not as a way to construct a new and improved aristocracy even more powerful than the old one.

The Classical Liberals wrote in opposition to the main power centers of their day: aristocratic government and chartered monopolies like the East India Company. They didn’t see the purpose of their writings as defending privilege and power. One can dispute the end results, but that was not their goal. Quite the contrary. The idea that a single, solitary individuals would possess more wealth than the kings and pharaohs of old under a functioning free market system would have been unthinkable to them.

In their time, much of the national wealth was monopolized by a landed aristocracy who gained their wealth through disproportionate ownership of the country’s productive land. The other major source of wealth came from large joint-stock companies that were granted royal monopolies due to their political connections. Yet another source of unearned wealth came from the holders of bonds (gilts)—essentially loaning money to the state and getting the government’s tax revenues funneled to them via interest payments.

Classical English Liberals felt that competitive markets would do away with a good portion of the unearned and unproductive wealth common in Great Britain at the time. They believed that “free and open” markets would channel wealth and activity to more productive ends. That is, they would break up large pools of wealth and unproductive money. The kind of obscene fortunes that they saw in their day would no longer be possible thanks to competition, they assumed, and that British society would become more equal than it was under landed aristocracy, not less. We can dispute their logic (and I have issues with it), but I think we can safely say that this is what they believed, rightly or wrongly.

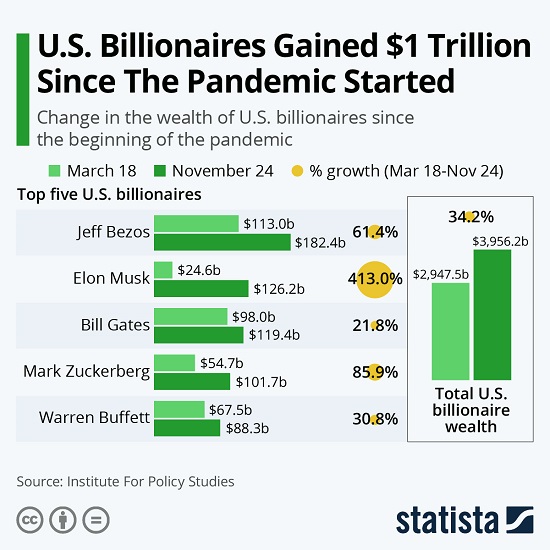

An inherent part of their conception of free markets is the possibility of failure. Unproductive or inefficient businesses would be competed away, they assumed, and the fortunes earned through such activities would disappear. But that is not the case today. Billionaires have so much money they can literally never lose it! That’s not capitalism, that’s aristocracy. I read recently that someone like Bill Gates literally cannot give away money to his pet causes fast enough to reduce his fortune even if he tried. In fact, he’s grown wealthier even while giving away billions.

The important point about [Adam] Smith’s system, on the other hand, is that it precluded steep inequalities not out of a normative concern with equality but by virtue of the design that aimed to maximize wealth. Once we put the building blocks of his system together, concentration of wealth simply cannot emerge.

In Smith, profits should be low and labor wages high, legislation in favor of the worker is “always just and equitable,” land should be distributed widely and evenly, inheritance laws should partition fortunes, taxation can be high if it is equitable, and the science of the legislator is necessary to thwart rentiers and manipulators.

Political theorists and economists have highlighted some of these points, but the counterfactual “what would the distribution of wealth be if all the building blocks were ever in place?” has not been posed. Doing so encourages us to question why steep inequality is accepted as a fact, instead of a pathology that the market economy was not supposed to generate in the first place.

Contrary to popular and academic belief, Adam Smith did not accept inequality as a necessary trade-off for a more prosperous economy (LSE Blogs)

Yet today the people who call themselves the heirs to “Classical English Liberals” emphatically defend the existence of billionaires and extreme inequality at every turn. Such people are not pro-market or pro-capitalism as they like to portray themselves; they are simply pro-wealth, or—to use a less complementary term—bootlickers. They are not defending capitalism or Markets; what they really are defending is oligarchy, power, privilege, and hierarchy. As Corey Robin opined, “The priority of conservative political argument has been the maintenance of private regimes of power,” with all the soaring rhetoric about markets and freedom being just a smokescreen and a cover for defending hierarchies and power imbalances. Their defense of billionaires is proof positive of this. This is true of presidential candidates as well.

The existence of obscene fortunes and extreme inequality are not a sign of capitalism’s success; they are a sign of capitalism’s failure.

This is pointed out by Chris Dillow:

“I don’t think anyone in this country should be a billionaire” said Labour’s Lloyd Russell-Moyle yesterday, at which the BBC’s Emma Barnett took umbrage. The exchange is curious, because from one perspective it should be conservative supporters of a free market who don’t want there to be billionaires.

I say so because in a healthy market economy there should be almost no extremely wealthy people simply because profits should be bid away by competition. In the textbook case of perfect competition there are no super-normal profits, and in the more realistic case of Schumpeterian creative destruction, high profits should be competed away quickly.

From this perspective, every billionaire is a market failure – a sign that competition has failed. The Duke of Westminster is rich because there’s a monopoly of prime land in central London. Would Ineos’ Jim Ratcliffe be so rich if pollution were properly priced, or if his firm faced more competition?

The Right’s Mega-Rich Problem (Stumbling and Mumbling)

How is this rectified? How do they square their supposed love of fair competition and free and open markets with the presence of outsize fortunes?

They don’t.

And the sad thing is how many people buy into their nonsense. Everyone seems to think that a defense of billionaires is a defense of capitalism.

It’s not. It’s the opposite.

What is a billionaire?

Billionaires are only made possible through monopolies and tollbooths. Period. And such monopolies are more possible than ever before thanks to technology.

This is argued by Matt Stoller, an expert on monopolies, in a post entitled, What Is A Billionaire?:

Most people think a billionaire is someone with a lot of money, a sort of Scrooge McDuck who goes swimming in a pool of gold coins. And why wouldn’t we? The name billionaire has the word billion contained within it, so clearly it means having a net worth of at least ten figures. And in a sense, that is technically true. But if you look at the top ranks of the Bloomberg billionaire index, you’ll notice that nearly all of the leaders are people who own a corporation with substantial amounts of market power in one or more markets.

Billionaires use market power to extract revenue the way that a tollbooth operator does. If you want to drive on a road, you have to pay for the privilege. It costs the tollbooth operator nothing, he/she just has a strategic chokepoint for extraction. Billionaire Warren Buffett, for instance, has such a ‘tollbooth’ strategy for investing, though he uses the term ‘moat’ because it sounds charming and quirky rather than rapacious.

Put another way, the Bloomberg billionaire index isn’t a list of the most important Scrooge McDuck’s, it’s a list of the biggest tollbooth operators in the world.

What he’s saying is that one becomes a billionaire only by short-circuiting the competitive market economy. Then their profits cannot be competed away. Only by gaming the system can one “earn” over a billion dollars. No one person is that valuable.

Stoller goes on to elucidate the operational tactics used by both Bill Gates and by his predecessor John D. Rockefeller, and finds that even though the industries are radically different, the techniques of short-circuiting and circumventing market competition are the same. Whether it’s horizontal and vertical integration, or using market influence to price out rivals, or exclusive contracts, the techniques are the same regardless of industry or time period:

In 1976 and 1980, Congress allowed the copyrighting of software. IBM had been under aggressive antitrust investigation and litigation since 1967, so when it built a personal computer, it outsourced the operating system – MS-DOS – to Gates’s company and allowed Gates to license it to other equipment makers. (Gates’s upbringing didn’t hurt; the CEO of IBM at the the time knew his mother.) Such a relationship with a vendor was a shocking change for IBM, which had traditionally made everything in-house or tightly controlled its suppliers. But IBM treated Microsoft differently, transferring large amounts of programming knowledge to the small corporation. IBM also did this with the microprocessor company Intel, which IBM protected from Japanese competition.

And yet, in 1982, the Department of Justice dropped the antitrust suit against IBM, signaling a new pro-concentration framework. Bill Baxter, Reagan’s antitrust chief, did not want to bring monopolization suits, and did not. The new fast-growing technology space of personal computers would be a monopolized industry. But it would not be monopolized by IBM, which had kept control of the computing industry since the 1950s, because IBM’s corporate structure was now skittish about the raw use of power. And it would not be monopolized by AT&T, which was kept out of the computing industry by a 1956 consent decree that lasted until 1984. Gates, in many ways, had a greenfield, an environment friendly to monopoly but one in which all the old monopolists had been cleared out by antitrust actions.

In the case of Amazon, even though it theoretically has competition, through vertical and horizontal integration it can effectively control online e-commerce to a large degree. The result is a fortune greater than that of entire nation-states controlled by a single individual. One hardly imagines that Adam Smith would approve.

I read an interesting concept, and I forget where it came from. It was that networks are natural monopolies. This explains things like Facebook, Apple, Amazon, etc. It’s entirely possible that the online world, due to features inherent in the technology, simply cannot be regulated by normal competition the way the market for goods and services can. Yet all our theories pretend that it can. It’s delusional.

Under these scenarios,’ profits’ are really a form of tribute (or perhaps plunder). In fact, we really shouldn’t even use the word ‘profits’ to describe them (just like we shouldn’t use ‘trade’ to describe global wage arbitrage).

And there are many more examples of competition being limited by deliberate legal policy. Much of Microsoft’s profits come from the fact that other people can’t copy their software—which they’ve arbitrarily labeled “piracy”—without facing legal repercussions enforced by the state and its legal system. In that sense, outsized fortunes are a consequence of laws, and not a feature inherent to technology:

…inequality is not in fact driven by technology, it is driven by our policy on technology, specifically patent and copyright monopolies. These forms of protection do not stem from the technology, they are policies created by a Congress which is disproportionately controlled by billionaires.

If the importance of these government granted monopolies is not clear, ask yourself how rich Bill Gates would be if any start-up computer manufacturer could produce millions of computers with Windows and other Microsoft software and not send the company a penny. The same story holds true with most other types of technology. The billionaires get rich from it, not because of the technology but because the government will arrest people who use it without the patent or copyright holder’s permission.

This point is central to the debate on the value of billionaires. If we could get the same or better technological progress without making some people ridiculously rich, then we certainly don’t need billionaires. But in any discussion of the merits of billionaires, it is important to understand that they got their wealth because we wrote rules that allowed it. Their immense wealth was not a natural result of the development of technology.

Farhad Manjoo promotes billionaire ideology in proposal to get rid of billionaires (Dean Baker, Real World Economic Review)

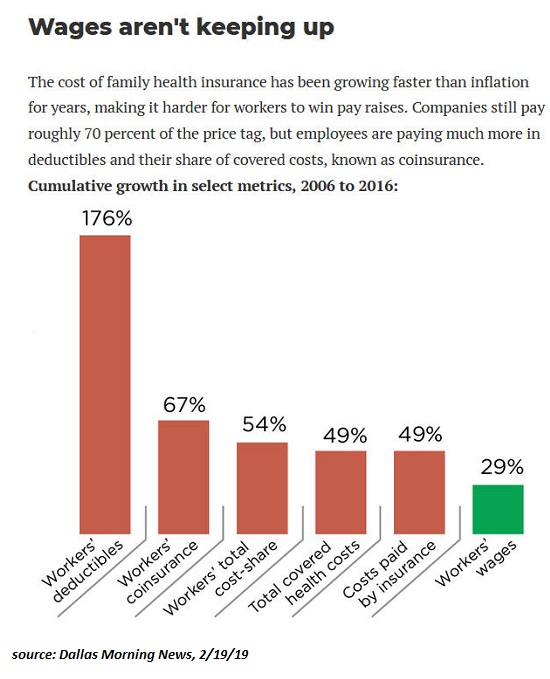

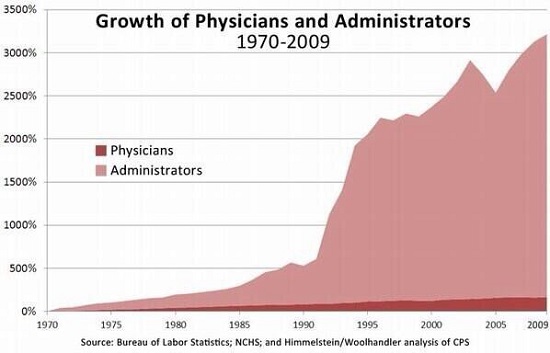

Baker has also pointed out that outsized salaries in many fields are determined by limiting competition though things like wildly expensive education and licensing requirements, which are ultimately determined by the government. Doctors and lawyers do not have compete against the wage rates in India or China thanks to the legal system, for example. Everyone else, however, is required to compete against the entire world for jobs.

On a global level, most billionaires are not the result of “hard work” or doing things beneficial for their society:

The vast majority of the world’s billionaires have not become rich through anything approaching ‘productive’ investment. Oxfam has showed that, approximately one third of global billionaire wealth comes from inheritance, whilst another third comes from ‘crony connections to government and monopoly’.

Why on Earth Shouldn’t People Be Able to Be Billionaires? (Novara Media)

And the monopolies that allow billionaires to exist are not good for the economy as a whole. In fact, they are highly detrimental, as Chris Dillow further points out:

What’s more, monopoly pricing is a form of tax – a tax which often falls upon other, smaller businesses…In this sense, not only are billionaires a symptom of an absence of a healthy competitive economy, but they are also a cause of it: their taxes on other firms restrict growth and entrepreneurship…

Tories are wrong, therefore, to portray attacks on the mega-rich as the politics of envy. It’s not. The existence of billionaires is a sign and cause of a dysfunctional economy…

In fact, logically, it is rightists who should be most concerned by the concentration of wealth. We lefties can point to it as evidence that the system is rigged. But Tories should worry that it undermines the legitimacy of the existing order not only because people don’t like inequality, but because it slows down economic growth and so encourages demands for change.

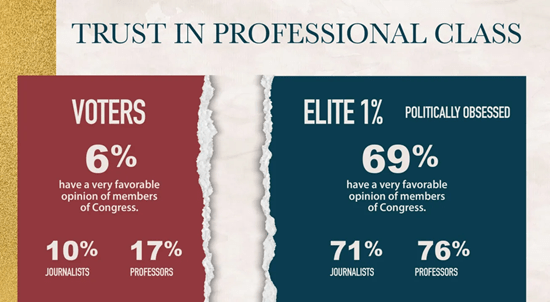

Furthermore, their existence is detrimental politically:

Controlling society’s wealth effectively gives the wealthy the right to plan economic activity. Billionaires – and the people who manage their money – determine which governments can access borrowing, which companies deserve to grow, and which ideas should be researched. This gives them an immense amount of political, as well as economic, power – allowing billionaires to provide favours to those politicians who helped them get rich in the first place.

Ultimately, the monopolisation of society’s resources by a tiny, closed-off elite means that most of society’s resources are used for dirty, unsustainable and unproductive speculation.

Why on Earth Shouldn’t People Be Able to Be Billionaires? (Novara Media)

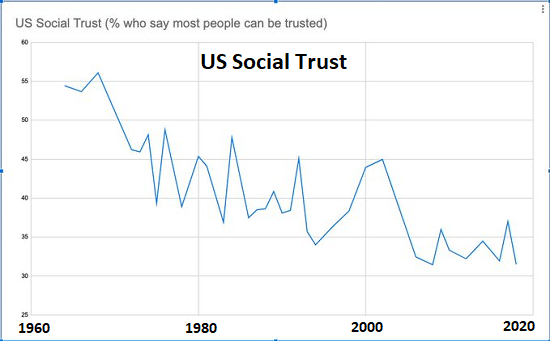

In fact, the proliferation of billionaires in the developed world has accompanied a period of slow growth and stagnation, not rapid growth. As has been pointed out ad nauseum, yet still fails to sink in, America’s fastest period of growth came when there were fewer billionaires and tax rates ranged from 50 to 90 percent. There is no evidence that the proliferation of billionaires has benefited society as whole. And now, billionaires are attempting to buy political offices outright, making a joke of democracy.

People defending billionaires are only defending raw power, not capitalism, not democracy, and certainly not free markets.

Stoller concludes:

[Billionaires] are not people with a bunch of dollar bills stacked to the moon, they are (largely) men with a strategic position of power protected by public laws and rules. They aren’t better or smarter than anyone else, they are simply politically adept and in the right place at the right time. There’s no reason we have to enable such people to run our culture. At the end of the day, tollbooths are nothing but bottlenecks on a road on which we would otherwise travel faster and more freely.

What is a Billionaire? (Matt Stoller)

So, should there be billionaires? The answer is no. And you should believe that if you consider yourself a libertarian free marketeer or a democratic socialist. Anyone asserting anything else is just a bootlicker or a toady.

Addendum:

Here’s a good piece explaining how billionaires are basically mad kings:

…one of civilization’s great challenges stems from millionaire rhyming with billionaire. In holding them in the same linguistic corner of our minds, we conflate them, yet they’re so mathematically distinct as to be unrelated. A millionaire can, with some dedicated carelessness, lose those millions. Billionaires can be as profligate and eccentric as they wish, can acquire, without making a dent, all the homes and jets and islands and causes and thoroughbreds and Van Goghs and submarines and weird Beatles memorabilia they please. Unless they’re engaging in fraud or making extremely large and risky investments, they’re simply no match for the mathematical and economic forces—the compounding of interest, the long-term imperatives of markets—that make money beget more money. They can do pretty much whatever they want in this life, and therein lies the distinction. A millionaire enjoys a profoundly lucky economic condition. A billionaire is an existential state.

This helps explain the cosmic reverence draped over so many billionaires, their most banal notions about innovation and vision repackaged as inspirational memes, their insights on markets and customers spun into best sellers. Their extravagances are so over the top as to inspire legend more often than revolution…

The Gospel of Wealth According to Marc Benioff (Wired)

One of the most potent demonstrations that the modern-day rich are mad kings, comes form the story of Adam Neumann of WeWork. This is the impression I got from the Behind the Bastards podcast on Neumann: The Idiot Who Made, and Destoryed, WeWork (Podtail)