By Brandon Smith

Source: Activist Post

Few people are familiar with a little event around 1200 BC called the Bronze Age Collapse in the region known as the Levant (now known as the Middle East). Most folks are taught that history and progress travel in a straight line and that each generation improves upon the culture and innovations of previous generations. This delusion is constructed around a Smithsonian-influenced view of the past. In reality, history tends to go in a circle, or a spiral, with innovation leading to ease, ease leading to laziness and corruption, and corruption leading to weakness and collapse.

Over and over again, humanity reaches for Elysium on Earth only to be slapped back down. The survivors then build grass huts on top of the ruins of the old empires and they start over from scratch. Why does the Bronze Age catastrophe matter? Obviously, because history tends to rhyme.

The Levant at this time was rich with civilization and trade, composed of a host of kingdoms that represented the known world including the Egyptians, Babylonians, Minoans, Mycenaeans, Hittites, etc. They had vast economic networks, agriculture, industry and written libraries. The proximity of the kingdoms allowed for such extensive trade relations that this period is often referred to by modern historians as the first “globalized economy” (sound familiar?).

What took centuries to build was destroyed in a single generation by a series of disasters. A “mega-drought” caused kingdoms without consistent water resources to lose agricultural production leading to widespread famine and disease (yes, the climate can and does change dramatically regardless of human carbon footprint). Trade was disrupted by internal disputes, and a mysterious invasion of a group of roaming raiders called the “sea people” is documented as a primary factor in collapse.

The Sea People attacked numerous kingdoms, but many of them were also refugees flooding into the region. They disrupted cultures and economies and dragged a number of empires into the dust. This all happened in less than 30 years. Sadly, because only the elites of these civilizations were able to read and write, languages and historical documentation were lost.

This initiated a dark age which lasted for centuries. Humanity was set back, essentially to zero, while scratching and surviving among temples and pyramids of past generations. They must have looked up at those decaying marvels of architecture from hundreds of years ago and wondered “What the hell happened to us?”

Not everything perished, of course. The Egyptian dynasties were in decline, but they managed to hold together far better than their counterparts across the Levant. However, the event represented a setback to human knowledge that was detrimental. One might suggest that if the Bronze Age Collapse never occurred we might be a space borne species traveling the stars by now.

Then again, maybe these cultures were so corrupt that they needed to fail so that something better could be built in their place?

What does any of this have to do with the state of the Middle East today? The smart readers out there surely see what I’m getting at. The intricate relationships and trade mechanisms of the Bronze Age led to great wealth and prosperity, but they were terribly fragile. That same interdependency resulted in their demise as they tumbled like dominoes on top of each other.

The globalization and collectivist war mongering of today is leading to a similar worldwide implosion. Our irrational ties to foreign entanglements and economies could very well destroy civilization again. Consider what are we about to see as the Israel/Palestine war unfolds…

Multiple Nations Dragged Into The Conflict

If you were wondering what the “October surprise” was going to be, well, now you know. I will make my position on this situation clear – I don’t care about either side. I care about innocent civilians, but other than that the war is irrelevant. I am an American and I care about America. The same goes for Ukraine and Russia. Their wars are not our wars, and I am highly suspicious every time our political leaders try to lure us into choosing a side when foreigners start shooting each other. To summarize: All wars are banker wars.

The Israelis enjoy our money but they have a history of proven elicit operations to lure us into war (USS Liberty, anyone?). The Palestinians and most of the Muslim world despise the West and Christianity in general (and I don’t really care who started it, the fact remains that our cultures are completely incompatible and this will never change). Just because we happen to find common ground on fighting back against the insane trans agenda does not mean I’m willing to accept draconian Sharia Law in my community.

Both sides use tactics that deliberately target civilians. I’m not talking about collateral damage like we saw in Iraq and Afghanistan, I’m talking about groups that are consciously and brazenly engaged in plans for genocide. Bottom line? There are no “good guys” to join with. It’s a complete sh*t show of ancient tribal nonsense that Westerners should stay away from.

For those who disagree, ask yourselves this – Are you truly willing to go pick up a rifle and fly to Israel or Gaza to fight and die for either side? If so, then go do it and stop demanding others do it for you. If not, then shut up.

But here’s what’s going to happen: the establishment will seek to force Americans and Europeans into these wars regardless. The corporate media and some political leaders are already suggesting that the recent full-scale attack on Israel was planned by governments outside of Gaza. Some are accusing Iran, and others accuse Lebanon. From the extensive amount of footage of the attack that I have examined, I have no doubt that someone other than the Palestinians orchestrated the event. The tactics were far too advanced and far too coordinated; the Palestinians have never been all that smart when it comes to military strategy.

Who drafted the attack is another question entirely. So far there are a lot of rumors but no hard evidence leading to any specific governments. Another big question is, how did the Palestinians manage to organize all of this and execute the invasion WITHOUT Israeli intel services knowing about it? Mossad is known to be one of the most intrusive and pervasive covert agencies in the world, yet they were caught completely off guard by this unprecedented attack? I think not.

I’m reminded of the events of 9/11 and the strange series of intelligence failures that preceded it. I’m also reminded of the lies, propaganda and the reactionary response which led to two decades of meaningless war.

I’m going to call it here – in a couple of weeks we will hear reports that many of the soldiers involved in the incursion were NOT Palestinian. They will claim some of them are from Iran, Syria, Lebanon, etc. There will be intel that says Iran was a major backer of the plan (The Wall Street Journal already claims this is the case, but they have not provided any compelling proof, yet).

A US carrier strike group is on the way to the region now, and this is just the beginning. Europeans will be pressured to go to war, American conservatives in particular will be waterboarded with propaganda telling us that an “attack on Israel is an attack on the US.” It will be a lot like the rhetoric Neo-cons and leftists used during the initial invasion of Ukraine, but multiplied by a thousand. To be clear, both Biden and Trump have been rattling sabers and testing the waters of war, so don’t think that we can avoid this simply by voting.

Multiple Fronts

Israel is going to pound Gaza into gravel, there’s no doubt about that. A ground invasion will meet far more resistance than the Israelis seem to expect, but Israel controls the air and Gaza is a fixed target with limited territory. The problem for them is not the Palestinians, but the multiple war fronts that will open up if they do what I think they are about to do (attempted sanitization). Lebanon, Iran and Syria will all immediately engage and Israel will not be able to fight them all – Hell, the Israelis got their asses handed to them by Lebanon alone in 2006.

This will result in inevitable demands for US/EU intervention.

East vs West

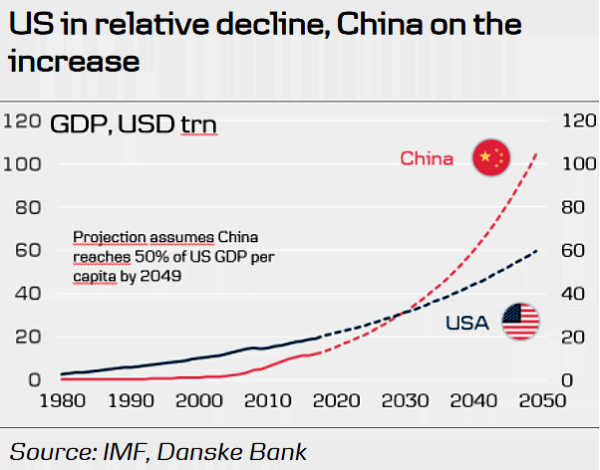

Depending on the extent of the Western reaction, the BRICS nations may be compelled to get involved. This may not be on a kinetic level, but there is a chance. Russia has strategic security treaties with Iran and Syria. China has numerous economic interests and influence in the region as the world’s largest importer/exporter.

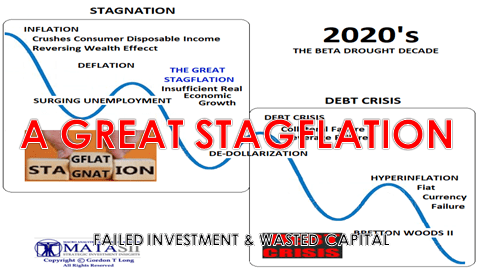

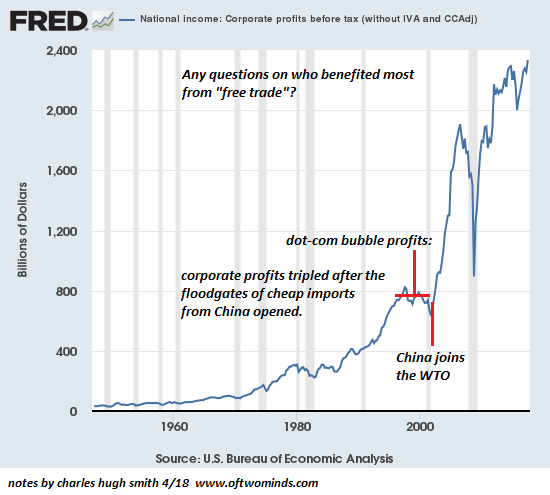

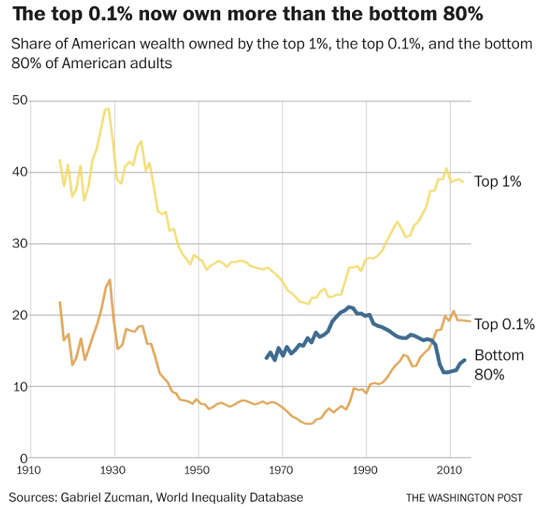

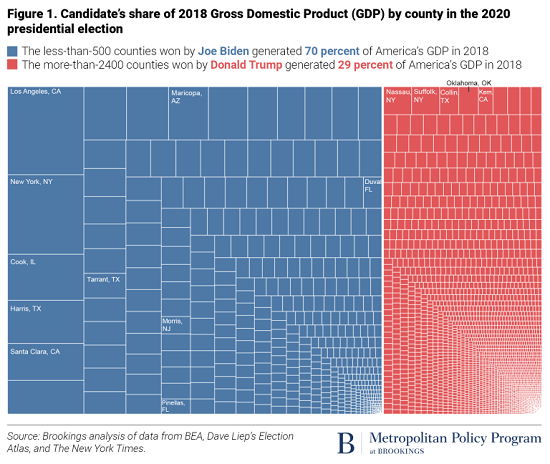

These nations might retaliate with the same kind of financial warfare that the West used against Russia – with China and the BRICS cutting off the dollar as the world reserve currency. This would add to the crippling inflation we are already experiencing.

Terror Attacks And False Flags

If you thought things might be eerily quiet on the terrorism front lately, that’s now over. I would be shocked if we made it another six months without multiple attacks tied back to Islamic groups. Some of them will be real and some of them will be staged, and telling which is which will be difficult.

The thing is, wide open borders in the West have made this far more likely and the establishment knows it. In my opinion they WELCOMED IT. If they can get at least one crazy Muslim to shoot up a strip mall or blow up a football stadium, they will have all the leverage they need to con Americans into another ground war in the Middle East. Do we need to “fight them over there so we don’t have to fight them here?” That’s garbage thinking. We should not be letting them over here in the first place.

Europe in particular is playing with fire. National governments and the EU have invited tens-of-millions of these people to their doorsteps and now they face a serious conundrum. There are Sharia Law communities all over Europe, there are millions of military-age Muslim men with every opportunity to do great harm. And, there are millions of woke leftists currently cheering them on, thinking that this is some form of “decolonization.”

Closure Of The Strait Of Hormuz, Skyrocketing Oil Prices

I have been warning about this scenario for many years; it was only a matter of time before tensions with Iran gave them a rationale to close the Strait Of Hormuz and shut down 30% of all oil exports from the Middle East to the rest of the world. Keep in mind, Europe is suffering from extensive energy inflation, in part because of the economic crisis and also because of sanctions against Russia.

Biden has been trying to hide inflation by dumping oil from the strategic reserves onto the market, but now those reserves are the lowest they have been since 1983. Conveniently, this happened right before the strike on Israel. Our reserves are depleted as we go to war. Oil prices and gasoline prices will explode if Iran is implicated in the Israel attack. Iran will run a few giant oil tankers into the Hormuz, sink them, and make the strait impassable for months. Don’t be surprised of we see $200 per barrel oil next year, which will translate to around $7 per gallon gas or higher for much of the US.

A Push For A New Draft

Let’s be honest, current US recruitment numbers are a joke and the wokification of our military is making it weaker by the month. No American citizen with a legit warrior mindset or combat aptitude is going to join that circus freak show voluntarily. The establishment will try to regale conservatives and patriots with visions of “fighting the good fight for family and country” but most will not buy in. With attempts to ignite multiple fronts against Russia, China and the Middle East, they will start talking about a new draft system.

My belief is that this will fail miserably and would start a civil war rather than fill the ranks of the Army or Marines, but they may have a scheme to deal with this outcome…

Is This The Real Reason Why US Officials Are Encouraging The Migrant Invasion?

The reality is, America has its own invasion to deal with. During the Bronze Age Collapse certain empires (like Egypt) survived using an odd tactic – instead of fighting off the invading hordes of refugees, nomads and sea people, they HIRED them and inducted them into important positions within their military. Corrupt authoritarian rulers ultimately found that they faced more of a threat from their own starving peasants than they did from the outsiders, so they joined with them to put down local rebellions.

This might not be as useful in Europe, but in America I wonder if this was the intention all along; to bring in millions of military-age foreigners with little sympathy for the existing culture, then in the midst of collapse and conflict offer them automatic citizenship and benefits if they join the military. Not on the small scale the federal government has going today, but on an enormous scale the likes of which we have never seen.

Maybe the plan was always to leave the gates open and allow illegals to stroll in so that they could act as a mercenary contingent to fight in foreign wars or fight against American citizens should rebellion arise…

Plan C

The timing of the conflict in Israel is incredibly beneficial to globalists, and this might explain Israel’s bizarre intel failure. Just as US and British leaders had prior knowledge of a potential Japanese attack on Pearl Harbor in 1941 but warned no one because they WANTED to compel Americans to fight in WWII, the Palestinian incursion serves a similar purpose.

The covid pandemic and mandates failed to get the desired result of a global medical tyranny. The war in Ukraine failed to get desired results as the warhawks’ demands for boots on the ground against Russia fell apart. Perhaps this is just Plan C?

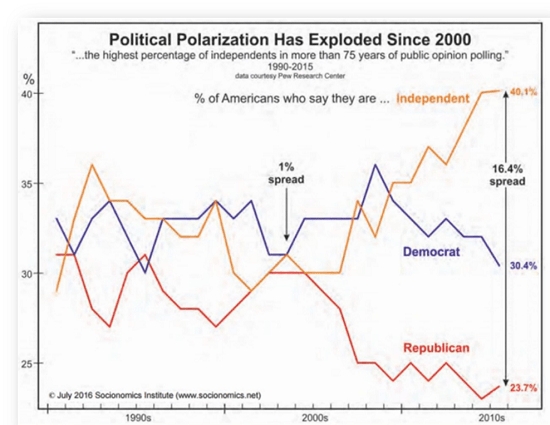

The establishment seems particularly obsessed with convincing US conservatives and patriots to participate in the chaos; there are a number of Neo-cons and even a few supposed liberty media personalities calling for Americans to answer the call of blood in Israel. Some have described the coming conflagration as “the war to end all wars.”

I believe that the real war is yet to truly start, and that is the war to erase the globalists from existence. They want us to fight overseas in endless quagmires in the hopes we will die out. And when we do, there will be no one left to oppose them. It’s a predictable strategy, but its success is doubtful. Another interesting fact about the Bronze Age Collapse – the elites were some of the first groups to be wiped out after the system broke down.