By Charles Hugh Smith

Source: Of Two Minds

As long as central banks create and distribute trillions in conscience-free credit to conscience-free financiers and corporations, the incentives for sociopathy only increase.

“Sociopath” is a word we now encounter regularly in the mainstream media, but what does it mean? Here is a list of 16 traits, many of which are visible in lionized corporate and political leaders and entrepreneurs.

One key trait is a lack of moral responsibility or conscience; the sociopath feels no remorse if he/she takes advantage of people or exploits them.

Sociopaths are masters of superficial charm, intelligence and confidence, and adept at massaging or misrepresenting reality up to and including outright lying to persuade others or get their way.

Like all psychological syndromes (manic depression, autism, bipolar disorder, etc.), there is a wide spectrum of sociopathological traits, some of which may offer some adaptive benefits (and hence their continued presence in the human genome). In other words, an individual can have a few of the traits in greater or lesser proportions.

Thus the modern BBC Sherlock Holmes (played by Benedict Cumberbatch) describes himself as a “high-functioning sociopath” (though many contest this diagnosis of the original Holmes in Arthur Conan Doyle’s stories).

Anyone who has read Walter Isaacson’s biography of Steve Jobs can readily see manifestations of sociopathy in Jobs: his famous “reality distortion field,” his refusal to accept that he’d fathered a daughter, his lack of empathy, his wild emotional swings (from verbal abuse to weeping), his dietary extremes, his charm, so quickly turned on or off, his uneven parenting, and so on. His obsessive-compulsive behavior was also on full display. Yet Jobs is lauded and even worshiped as a genius and unparalleled entrepreneur. Was this the result of his sociopathological traits, or something that arose despite them?

The ledger of costs and benefits of Jobs’ output is weighted by the global benefits of the products he shepherded to market and the hundreds of billions of dollars in sales and net worth he generated for investors while the head of Apple. Though narcissistic in many ways (with the resulting negative effects on many of his intimates), Jobs was clearly focused on creating “insanely great” products that would benefit customers and users. Despite his sociopathological traits, there is no evidence he set out to deceive anyone with the objective of exploiting their good will or belief in his vision to skim billions of dollars from unwary investors.

But the ledgers of others manifesting sociopathy are far less beneficial, as the billions of dollars they generated were in essence a form of fraud.

The rise and fall of WeWork is a recent textbook example of sociopathy reaping enormous financial gains for the sociopaths without creating any actual value. There are plenty of media accounts of the founders’ excesses (including the goal of becoming the world’s first trillionaire), some of which we might have expected to raise flags in venture capitalists, board members, etc., but these traits were overlooked in the rush for all involved to garner billions of dollars in fees and net worth when WeWork went public.

This example (among many) illustrates that sociopathy is incentivized in our socio-political-economic system, and sociopathic “winners” are lionized as epitomes of ambitious success. (The entire charade of the stock market rising due to Federal Reserve-enabled stock buybacks is an institutionalized example of sociopathy.)

Correspondent Tom D. recently summarized the core dynamic and consequence of this systemic incentivization of sociopathy:

I’ve been a successful business owner, but I’m not a sociopath–I deliver value to my customers, my investors, and I don’t move forward if I see anyone being substantially hurt by my actions.

My peers and I look at organizations such as WeWorks, see the rewards reaped by the sociopathic leaders, and realize we are at a constitutional disadvantage working within such a system.

I could never conceive of taking a $700-900m payday at the expense of investors for whom I’ve generated no value whatsoever.

I simply could not do it.

If ‘out-sociopathing’ the sociopaths is what it takes to ‘succeed’ in todays business climate– I’ll fail.

So I don’t try.

From the sociopath’s standpoint, that’s probably a feature not a bug–one that helps keep effective competition out of the marketplace.

I wonder how much of civilizational decline is simply due to good people accepting their lot and opting out.

If the system incentivizes conscience-free sociopaths more than it incentivizes those creating real value, the system will eventually fall into the equivalent of Gresham’s law (“bad money drives out good money”): the con-men and fraudsters will drive out entrepreneurs with a conscience who create real value for customers, investors and society at large.

If we look at recent IPOs and compare them to the Apple IPO, it seems we’ve already reached that point. Apple went public as a highly profitable company. Uber, Lyft, Beyond Meat and WeWork (if their IPO fraud hadn’t been revealed) are all unprofitable, in some cases losing billions of dollars with little prospect for eventual profits.

Venture capital folks explain this by noting that the flood of central bank credit-money-creation has generated trillions of dollars of liquid capital seeking “the next big thing” that will “disrupt” existing models and therefore generate billions in profits.

This pinpoints one key source of the incentivization of sociopaths: central banks’ creation of trillions of dollars of conscience-free capital seeking a quick profit anywhere on the planet, by any means available.

Conscience-free capital is an easy mark for a conscience-free sociopath. It’s a marriage made in heaven, a perfect match.

Those with a conscience are essentially squeezed out of the system. The choice is binary: either play and lose or opt out.

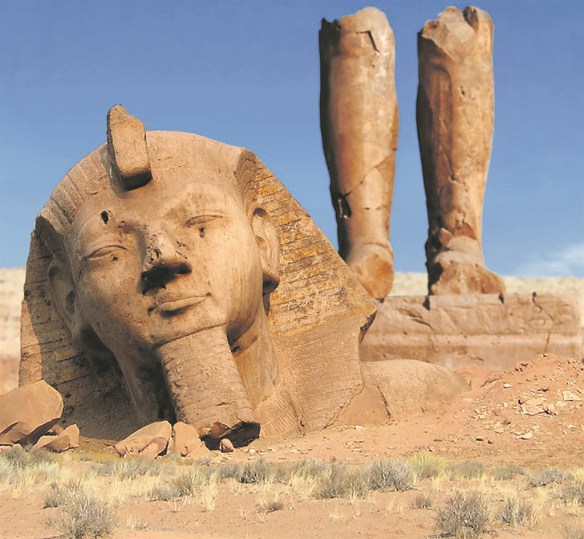

I’ve written about “opting out” since 2009, since it was one of the few options available to commoners in the final decline of the Western Roman Empire. If we feel we’re at a systemic disadvantage, i.e. the system is rigged against us, opting out makes much more sense than sacrificing oneself in a fruitless battle to stay alive in a system that incentivizes amoral sociopaths.

If we consider what generates outsized success in our rapidly changing economy, we find a variety of factors supporting “winner take most” asymmetric gains. As economist Michael Spence has observed, those who develop new business models earn outsized gains because new forms of capital and labor that are scarce create the most value.

Many of these new business models disintermediate existing models, obsoleting entire layers of middlemen and management.

Netflix is a good example: the move from mailing CDs to streaming content obsoleted cable companies. Now Disney is disrupting Netflix by launching its own streaming service at $6.99 a month, offering content that cable subscribers had to pay $60+ a month to access via a “premium” cable add-on, most of which they didn’t even use.

In contrast, WeWork sold itself as a “tech innovator” when in fact it was simply a commercial real estate packager, leasing large spaces and chopping them up into small spaces with common areas and a few services.

How does our system incentivize sociopathy? By focusing exclusively on short-term gains reaped from IPOs (initial public offerings) and by blindly seeking “the next disruptor that will generate billions,” the system is easy prey for charming sociopaths who can tell a good (if not quite truthful) story.

The amoral sociopath with the story attracts amoral sociopaths in venture capital, banking and politics, as these fields are all focused on short-term, outsized, quickly skimmed gains, regardless of the consequences to investors or society at large.

What would change this incentivization of sociopathy? Ending the Federal Reserve’s delivery of trillions of dollars in conscience-free capital to sociopaths and limiting the VC-IPO flim-flam machine would be a start, but given Wall Street’s dependence on these profits and the millions the Street gives to political campaigns, this is politically unfeasible. Any such regulation that reaches Congress will be watered down or larded with loopholes.

There may be no way to excise the incentives for sociopathy, because the incentives all favor the sociopaths’ most fertile ground: the Federal Reserve’s money spigot of nearly free money for the most sociopathological financiers and corporations; amoral, conscience-free greed; the worship of short-term gains, regardless of consequences, and the extreme profitability of rigged games and The Big Con PR (“we’re only evil when it’s profitable, which is, well, all the time”.)

As long as central banks create and distribute trillions in conscience-free credit to conscience-free financiers and corporations, the incentives for sociopathy only increase, and the incentives for everyone else to opt out increase proportionately.

What happens next? The dead wood of sociopathy is ignited by a random lightning strike, and the entire financial system (and the economy it feeds) burns to the ground in an uncontrollable conflagration of blowback, consequence and karma.