By

Source: ProMarket

Four decades ago, writes Tim Wu in the introduction to his recent book The Curse of Bigness, the United States and other countries entered into a sweeping experiment that radically transformed their economies and politics. The experiment in question consisted of abandoning most checks on anticompetitive conduct, thus allowing concentrated corporate power to grow undisturbed.

The result: an increasingly concentrated global economy marked by historic levels of inequality and extreme concentrations of economic and political power, with disaffected voters being lured by radical far-right nationalists across the West. “We have managed to recreate both the economics and politics of a century ago—the first Gilded Age,” Wu writes.

Now, he warns, liberal democracies risk making yet another grave historical error by ignoring the well-established link between the concentration of economic power and the rise of authoritarianism. That monopolization poses an existential threat to democracy has been widely known throughout history: Louis Brandeis famously referred to this threat as the “curse of bigness”; in Germany, the rise of fascism was partly facilitated by monopolists and industrial cartels.

Yet in recent decades, explained Wu in an interview with ProMarket, much of this history has been forgotten. The legacy of Brandeis, America’s leading defender against bigness, has been “neglected, almost forgotten,” along with the greater antimonopoly tradition that has been an integral part of US politics for over 200 years. Which is why he decided to write The Curse of Bigness, a slim book that is equal parts historical polemic and urgent call to action.

Wu, the Julius Silver Professor of Law, Science and Technology at Columbia Law School and also the author of The Attention Merchants and The Master Switch, is perhaps best known for coining the term “net neutrality.” In his interview with ProMarket, he discussed the parallels between the monopolies of today and those of the first Gilded Age and explained why breaking up dominant companies is crucial, particularly when it comes to Facebook.

[This conversation has been edited and condensed for length and clarity]

Q: I want to start with Brandeis, who famously coined the phrase “curse of bigness.” In the book, you write that Brandeis “has been done a disservice.”

Yes, I think he has been. I think his economic vision has been forgotten. There are powerful ideas in it, very appealing in our times, very appealing through much of American history. So I wanted to try to do justice to and resurrect the Brandeisian strain of thought when it comes to economic policy.

Q: You point to many parallels between Brandeis’s time and ours, but one that especially haunts the book is the rise of neo-fascist movements around the world and the potential link between large business groups and aspiring authoritarians. Did you feel a certain sense of urgency in writing this book and making this link at this particular moment in time?

There is something alarming about the rise of extremist governments around the world. It has something to do with a sense of discontent as to how the economy functions for people, and that did give the writing of this a sense of a sense of urgency and a sense of a historic moment.

It’s a dangerous moment around the world and in the United States. I don’t think we have a complete understanding of what causes fascist uprisings, but I have a strong instinct, and I think many people do too, that there are economic origins to fascism that are very important and that, among other things, we really need to understand how to prevent people from turning to fascist, neo-nationalist, and extremist answers. I would suggest that has a lot more to do with economic policy than people think.

Q: That is something many of the “big is beautiful”-type arguments about private monopolies seem to ignore: the historical precedents of concentrated economic power contributing to the rise of authoritarian regimes.

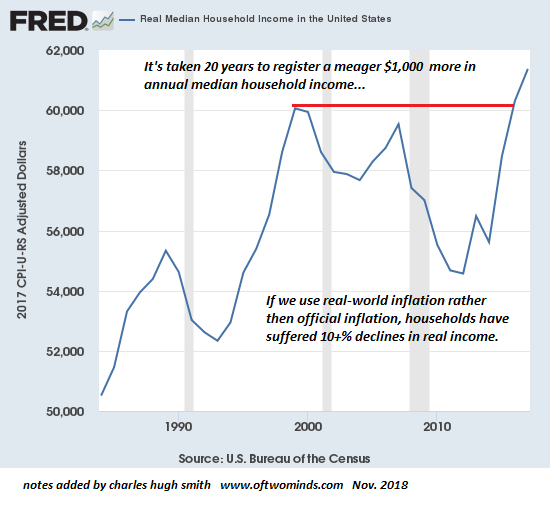

I think that’s right. Also, it ignores [the fact] that there’s more to people’s lives than their lives as customers. People are also workers, and it’s one thing to face scale when you’re buying things and another thing to face scale when you’re an employee looking for a job and in a difficult bargaining position.

To take this further: I don’t like excessive pricing or price gouging, but the vision of antitrust over the last 40 years has been that the best of all possible worlds is one where you have relatively mild reductions in prices for consumer goods. Let’s just say there’s more to life than that. It’s not always clear that economics can get at it, but the focus on price in antitrust yields very narrow results.

| “I don’t like excessive pricing or price gouging, but the vision of antitrust over the last 40 years has been that the best of all possible worlds is one where you have relatively mild reductions in prices for consumer goods. Let’s just say there’s more to life than that.” |

Q: Unlike many people involved in the antitrust debate, even those that support vigorous enforcement, you don’t shy away from what Robert Pitofsky called the “political content of antitrust.” In fact, you seem to embrace it. What would you say is the political role of antitrust?

Ultimately, antitrust is a kind of constitutional check on private power. You can’t understand antitrust law without understanding its relationship with power. This is the centerpiece of the book and the original soul of antitrust law. It wasn’t so concerned with the details with price. It just had a sense that there needed to be some kind of outer limit on private power, much like there’s a limit on public power set by the constitution.

Q: What do you say to criticisms that you’re leading antitrust through uncharted waters, and that reinstilling political values into antitrust risks turning antitrust into a blunt political tool, much like what Trump is threatening to do with tech platforms?

I think this is confusing two meanings of the word “political.” There’s a narrow political sense in which a law can be used to punish your opponents or save your friends—consumer welfare antitrust can be used to do that already. But there’s also the broader sense of the law informed by constitutional values or concerns about power. That is also political, but in a much broader sense. That is the best sense in which the law has been enforced in the best moments of its history—the sense that a firm has become too powerful and too dominant to be tolerated in a land which calls itself free. It’s important not to confuse those two ideas of the term “political.”

Q: You compare the first Gilded Age to our own. Where do you see parallels between the monopolists of the Gilded Age, people like John D. Rockefeller and Andrew Carnegie, and present day dominant firms? Google and Facebook are not shooting workers, after all.

There’s some traces of the same ideology. Peter Thiel is a prominent example: He calls his [ideology] libertarianism, but it’s not much different than 19th century social Darwinism, which worships the monopoly form and holds the idea that we should see our society as a winner-take-all, survival of the fittest, “The strong shall rule, the weak shall serve them” kind of undertaking. Google and Facebook have much kinder public faces, but—particularly with Facebook—I’m not sure underlying it they think that much differently.

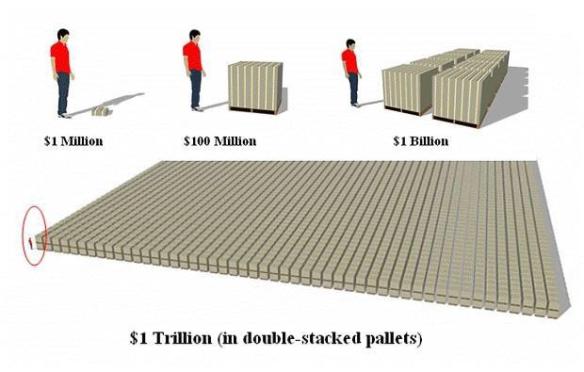

There are other parallels as well, particularly levels of individualized personal wealth that the world has never seen before. In the concentration of wealth is a glorification of wealth, and almost a fetishization with accumulating amounts of money that no person could spend in their lifetime. A lot of projects in Silicon Valley get bent to the need for monstrous payouts and it ends up getting in the way of what would otherwise be good projects or better ways to run companies.

Obviously, as I explore in the book, the economic structure is also similar, where you have an overall economy dominated by fewer entities and greater levels of inequality.

Q: Another parallel seems to be this belief in the goodness of monopolies and the benefits they bring humanity. The ruthless robber barons, who threatened to crush rivals who didn’t submit to their will, genuinely believed they were doing the good, moral thing, for the betterment of humankind.

That’s right. But I think this has less to do with Silicon Valley and more to do with Wall Street today, this very fragmented morality, the idea that somehow the right thing to do is not exactly what we would usually call the ethical thing: It’s right to destroy your rivals, it’s right to lie and cheat so long as you get away with it.

| “If you’re looking for the one big signal failure of the last 20 years, it’s got to be merger review. There has been an inexplicable allowance of so many industries to merge down to four or three players, sometimes two, sometimes even a monopoly. Europe is as guilty of this as the United States.” |

Q: You write that the priority for neo-Brandeisian antitrust would be reforming the process of merger review. Why is merger review the top priority, and how should it be reformed?

If you’re looking for the one big signal failure of the last 20 years, it’s got to be merger review. There has been an inexplicable allowance of so many industries to merge down to four or three players, sometimes two, sometimes even a monopoly. Europe is as guilty of this as the United States. In many cases, it seems like the question was not how are we going to stop this [merger], but what kind of conditions are [merging companies] going to agree to, which is not the way merger review was intended. Merger review is not intended to be a big set of commitments that companies make, but rather the actual blocking of mergers. There’s been some recovery from that, particularly in the United States near the end of the Obama administration, but merger review has been in a crisis point.

It’s possible Congress could act and reaffirm that it meant what it said when it passed the 1950 Merger Act. It’s possible you could add greater burdens for larger mergers, or mergers that pass some structural threshold. Another way would be to open merger review to more public scrutiny. I understand some of the arguments in favor of secrecy, but I think that in the case of really big blockbuster mergers there’s just too much at stake. Having more public awareness and more groups involved would be good actually, given the important political consequences.

Q: What’s interesting about European antitrust is that although they’ve taken on several big cases in recent years, in terms of mergers European competition authorities don’t put up a lot of a fight.

I agree. I think that Europe, if anything, has been worse than the United States for the last ten years. The beer merger of Anheuser-Busch InBev and SABMiller was inexplicably approved, creating a monopoly. Telecom mergers across Europe have been allowed, bringing multiple markets down to three [competitors].They allowed the Monsanto-Bayer merger—I’m not sure what they were thinking with that one.

Overall, I think consent decrees appeal to academic economists, but they have a bad track record. One problem with consent decrees is that you have the most talented attorneys and economists negotiating these on the government side, but once they’re done, they’re given to an enforcement bureau which is typically not heavily staffed. And sometimes it can be forgotten, and certainly not enforced with any kind of vigor.

Structural separation is self-executing. The blocking of mergers is self-executing. You don’t have to have the government constantly trying to make sure the thing is working. I think Europe has really gone down the wrong path in that direction.

Q: Another solution you explore in the book is breaking up dominant companies. One company you point to in this regard is Facebook—you call for breaking up Facebook, separating it from Instagram and WhatsApp. Why single out Facebook? And what would breaking up Facebook accomplish, considering its business model is at this point shared by the majority of online platforms?

I think it’s crucial to break up Facebook, particularly from WhatsApp and Instagram. In some ways, I think the burden should be on Facebook to explain why they shouldn’t be broken up.

Will that make a difference? I think it will. I have faith in improved competition. I don’t think there’s strong evidence of great efficiencies that come from having all of the major social networks under one roof. It’s hard to see any real loss of so-called efficiencies, at least ones that matter to consumers.

People are looking for somewhere to switch, but they don’t have anywhere to go. WhatsApp can easily be that platform, and its leadership has different values, or at least had different values before they left.

|

“I think it’s crucial to break up Facebook, particularly from WhatsApp and Instagram. In some ways, I think the burden should be on Facebook to explain why they shouldn’t be broken up.” |

Q: In a recent post in Medium, you laid out ten antitrust cases the government should be investigating. Which ones would you say are the most pressing?

Someone has to stop the T-Mobile/Sprint merger. Maybe it will be the states, but someone has to stop that merger. I already mentioned the Facebook breakup, which I think is big and symbolically important.

I think the Justice Department actually is already working on this, but the Live Nation-Ticketmaster matter has been sitting there for a long time. It’s not the biggest industry, but it’s still a case with a lot of anticompetitive conduct.

And I would like to take a look back at the airline mergers and ask whether we should consider breaking down the triopoly. The state of the airlines is really unacceptable.

Q: It’s been roughly a year since the repeal of net neutrality. You, of course, famously coined the term net neutrality. What would you say is the importance of net neutrality, in terms of competition and the bigness debate?

It’s really a parallel discussion but the same issue, which is: When you have monopolies that don’t seem to be going anywhere, should they be completely unconstrained? Or should there be some rules as to how they conduct themselves? It’s always been a parallel to this question of antitrust, but they’re part of the same discussion. For some reason, we’ve moved in the direction of extreme, radical, laissez faire [responses] for all of these questions. But people are starting to move in different directions now, and the backlash is inevitable.