By Charles Hugh Smith

Source: Of Two Minds

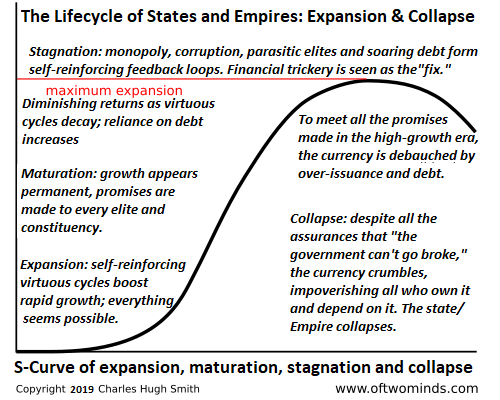

The cycles of The Fourth Turning, Fischer and Turchin are all in alignment at this point in history..

The 1997 book The Fourth Turning: An American Prophecy proposed a cyclical pattern of four 20-year generations which culminate in a national crisis every 80 years. The book identifies these dates as Fourth Turnings: 1781 (Revolutionary War), 1861 (Civil War) and 1941 (global war). add 80 years and voila, 2021.

I use the term Fourth Turning generically to describe an existential crisis that decisively changes the course of national identity and history.

In other words, we don’t have to accept the book’s theory of generational dynamics to accept an 80-year cycle. There are other causal dynamics in play that also tend to cycle: the credit (Kondratieff) cycle, for example.

While each of the previous existential crises were resolved positively, positive outcomes are not guaranteed: dissolution and collapse are also potential outcomes.

David Hackett Fischer’s book The Great Wave: Price Revolutions and the Rhythm of History proposes another cycle: humans expand their numbers and consumption until they’ve exploited and depleted all available resources.

As resources become scarce, societies and economies unravel as humans do not respond well to rising prices generated by scarcities.

The unraveling continues until consumption is realigned with the resources available. In the past this meant either a mass die-off that drastically reduced human numbers and consumption (for example, The Black Plague), a decline in fertility that slowly reduced population to fit resources, mass migration to locales with more resources or the discovery and exploitation of a new scalable energy source that enabled a new cycle of rising consumption.

The 14th century Black Death reduce Europe’s population by roughly 40%, enabling depleted forests to regrow and depleted agricultural land to restore fertility.

Once the human population regained its numbers and consumption in the 17th century, wood was once again under pressure as the key source of energy, shipbuilding, housing, etc.

The development of steam power and the technologies of mining enabled the exploitation of coal, which soon replaced wood as the primary energy source.

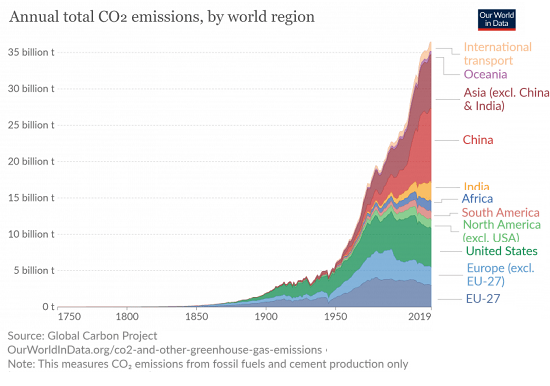

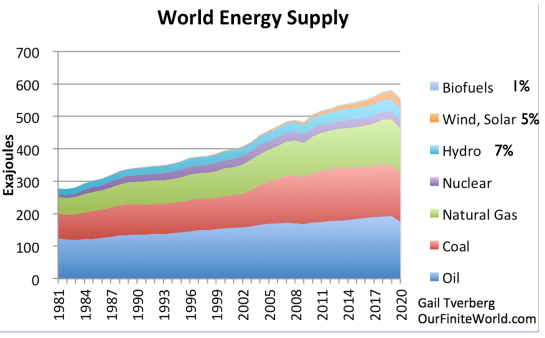

Oil and natural gas added to the energy humans could tap, followed (at a much more modest level) by nuclear power. Despite gargantuan investments, the recent push to develop solar and wind energy has yielded very modest results, as globally these sources provide about 5% of total energy consumption. (See chart below)

It’s self-evident that despite breezy claims of endless expansion of consumption, the global human population has now exceeded the resources available for practical extraction. Energy, fresh water, wild fisheries and fertile soils have all been exploited and the easy/cheap-to-extract resources have been depleted.

(The chart below of global CO2 emissions is a proxy for energy / resource consumption.)

So once again it’s crunch-time: either we proactively reduce consumption to align with available resources, or Nature will do it for us via scarcities.

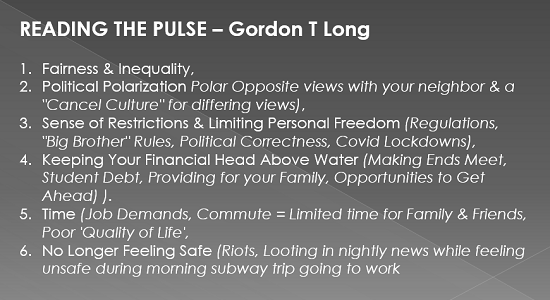

Peter Turchin proposed another socio-economic cycle of 50 years in his book Ages of Discord: in the integrative stage, people find reasons to cooperate. In the disintegrative stage at the end of the cycle, people no longer find much common ground or reasons to cooperate. Political, social and financial extremes proliferate, culminating in a rolling crisis.

In Turchin’s analysis, the previous 50-year age of discord began around 1970, and the current era of discord began in 2020. Those who lived through the domestic terrorism, urban decay, stagflation and political/social/legal crises of the 1970s recall how inter-related crises dominated the decade.

In my analysis, the last period of discord in the 1970s was “saved” by the supergiant oil fields discovered in the 60s coming online in the late 1970s and early 1980s. That oil enabled a 40-year boom which is now ending, with no new scalable source of energy available to replace oil, much less enable an expansion of consumption.

In other words, the cycles of The Fourth Turning, Fischer and Turchin are all in alignment at this point in history. We have proliferating political, social and financial extremes and a forced transition to lower consumption to align with declining energy.

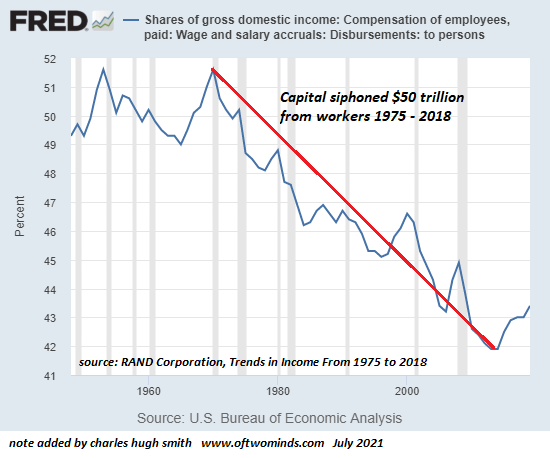

Turn, turn, turn. Right when we need to cooperate on transforming a high-consumption, bubble-dependent “waste is growth” Landfill Economy to declining consumption / Degrowth, we’re beset by discord and demographic pressures, as the promises made to the elderly back when it was expected that there would always be 5 workers per retiree cannot possibly be kept now that the worker-retiree ratio is 2-to-1 and there are no limits on healthcare spending for the elderly.

Humans are happy to expand their numbers and consumption and much less happy to consume less. They tend to start revolutions and wars in vain attempts to secure enough resources to maintain their profligate consumption and expansion.

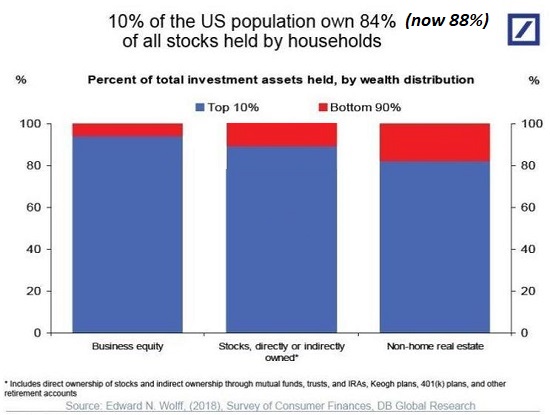

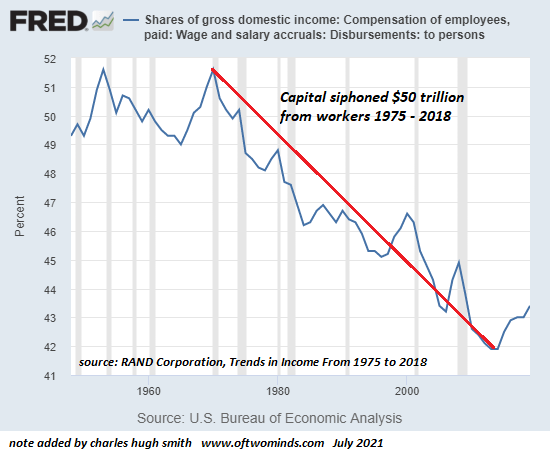

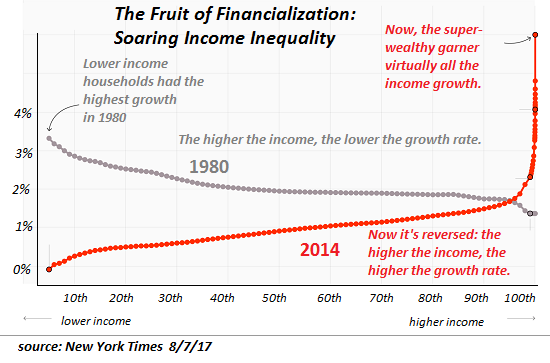

Today’s extremes of wealth and income inequality are optimized to spark political discord and revolts. The wealthiest 20% will be able to pay higher prices, but the bottom 40% will not. The middle 40% will find their disposable income, i.e. their income left over after paying for essentials, will drop to near-zero.

When 80% of the populace are crunched financially, revolutions and the overthrow of governments follow.

As I’ve outlined in previous posts, global inequalities are widening as the Core exploits its built-in advantages at the expense of the vulnerable Periphery.

Core nations will be much better able to maintain their consumption at the expense of the Periphery nations, which will experience sharp declines in purchasing power and consumption.

Previous Fourth Turnings have been resolved one way or another within 5 to 7 years. If this Turning began in 2020, we can expect resolution by 2025 – 2027.

As I explained in my book Global Crisis, National Renewal, those nations that embrace Degrowth will manage the transition, while those that cling to the endless-expansion, bubble-dependent Waste Is Growth model will fail.

This is why I keep talking about making Plans A, B and C to preserve optionality and reduce financial commitments and consumption now rather than passively await crises over which we will have little direct control.

As I’ve endeavored to explain, those anticipating decades of time to adjust are overlooking the systemic fragilities of the current global financial/supply systems. Tightly bound systems of interconnected dependency chains have been optimized to work perfectly in an era of expansion. They’re not optimized to gradually adjust to contraction; they’re optimized to break and trigger domino-like breakdowns in interconnected chains.

We don’t control these macro-trends, we only control our response.