By James Howard Kunstler

Source: Kunstler.com

“The powerful are panicking, and so they should. Their secrets are leaking.” —Miranda Devine

“It’s all just snake oil. We want to save the planet, and the life upon it, but we’re not willing to pay the price and bear the consequences. So we make up a narrative that feels good and run with it.” — Raul Ilargi Meier

“2023 could be a pivotal year for the USA if the pervasive lying can be exposed, digested, and believed. All that exposure has to happen amidst continuing boondoggles toward the Great Reset agenda.” – Truman Verdun

“More borrowing only ever makes sense if you are expecting a larger economy in the future. All economic expansion is based on energy. Countries with energy can expand, those without cannot.” — Chris Martenson

“To be an enemy to America can be dangerous, but to be a friend is fatal.” — Henry Kissinger

“The incorrect narrative provided by mainstream media (MSM) is that climate change is our worst problem. To lessen this problem, citizens need to move quickly away from fossil fuels and transition to renewables. The real narrative is that we are running short of fossil fuels that can be profitably extracted, and renewables are not adequate substitutes. However, this narrative is too worrisome for most people to handle.” — Ugo Bardi

It’s hard to contemplate 2023 without spiraling into nausea, tachycardia, and cold sweat. But it is an inescapable duty here to lay out the probabilities ahead. I’ve been doing this forecast thing for some years now, and, of course, I am often wrong, so take some solace in that and relax. Maybe the new year will be all unicorns, rainbows, talking gerbils, and candied violets.

2022 sure was a cold shower. The long emergency I talk so much about finally got up to cruising speed, with the ectoplasmic “Joe Biden” revving our country into economic, political, and cultural collapse — a hat-trick of calamity — and he did it more swiftly and directly than any emperor managed in late-day Rome, with policies and actions 180-degrees contra to America’s public interest — cheered on by a thinking class that had obviously lost it consensual mind.

Was the governing strategy simply to do the opposite of what the loathed and detested Mr. Trump would do? Could it be that simple or that automatic? The thinking class’s eyes have a zombified glaze these days. It’s obvious, you might agree, that “Joe Biden” is not in charge of anything, really. He’s an animatronic figure programmed to read a teleprompter and not much else. Half the time, he can’t even find his way off-stage after doing that one trick. The claque pulling his strings just may be the crew you see around him (you know, WYSIWYG): Susan Rice, Ron Klain, Jake Sullivan, Antony Blinken, Victoria Nuland, and company. Ms. Rice has kept herself completely hidden backstage at the White House for two years. Nobody ever hears about her or sees her. Weird, a little bit, for the Director of the Domestic Policy Council.

Or else, are there puppeteers deeper in the shadows, say, “JB’s” former boss Barack Obama, Der Schwabenklaus and his WEF retinue, Bill Gates and other tech billionaires, the “systemically important” bankers, George Soros…? Or some coven of super-elite warlocks we’d never heard of? The US leadership dynamic is truly mystifying and has been for two whole years. Will mysteries be revealed in 2023? Personally, I think so. Things are lining up in that direction, though who knows whether the damage can even be reversed at this point. And now onto the shape of things to come….

Economy

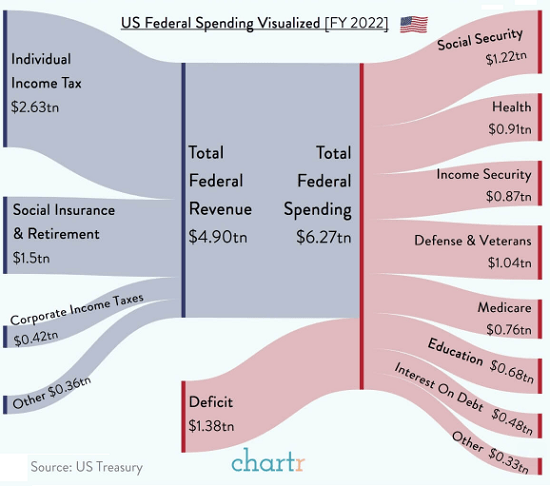

All you can really say is that the folks running things have hijacked every module of our nation’s interests and tilted them down into decadence and ruin. They’ve tanked whatever’s left of the US economy with an array of surefire idiotic maneuvers. By spending trillions of dollars that don’t exist to buy votes, they’ve inflated away our money’s purchasing power — an Econ 101 level mistake. The “Green New Deal” is a swindle, an out-front, in-your-face nefarious operation to subvert Western Civ by the WEF, and its stooges — laid out explicitly in its house publications.

There is no way we can run our society as currently outfitted on any combination of alt.energies. All the Greenies can really accomplish with this crusade is to destroy the complex systems we rely on faster than would happen in the normal course of things, foreclosing any chance of an orderly retreat to a plausibly downscaled arrangement for daily life. We are exiting the current system anyway, like it or not — the longstanding thesis of The Long Emergency.

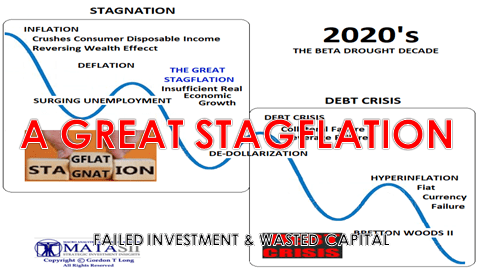

This gets to the heart of the conundrum we face. Ill-intentioned as the WEF and its allies may be, the world is heading toward a Great Re-set. The catch is, it won’t be the WEF’s version of it, their schematic techno-nirvana with a tiny comfortable elite lording over the bug-eating hoi-polloi. They somehow miss the glaring point that the energy required to run their precious transhuman tech won’t be there. By the way, the WEF’s core idea of central control by a coordinated world government is at odds with the core reality of the times ahead, which is that life is about to get much more local and downscaled — the exact opposite of centralized. Everything organized at the giant scale is veering into failure: empires, global corporations, hypertrophic cities, giant universities, giant farms, you name it. Their business models are broken. The activities these things represent have to get smaller, finer, and more regional. Depending on what we’re able to salvage and re-purpose from the fabricated leftovers of Modernity, we’ll be lucky to land back in life lived at the level of the early 1800s. Or else, if we really mess up, we’ll plunge haplessly into a dark age in a resource-stripped world.

The “Green New Deal,” based on a combination of wishful thinking and self-destructive malice, includes the deliberate undermining of what’s left of America’s oil industry by cancelling pipelines, drilling licenses on public lands, draining the strategic petroleum reserve, and other efforts to sabotage what’s left. America still has a lot of oil in the ground, yet much of it is hard to get at and uneconomical to produce at the scale required. It’s a money-loser, and losing money consistently doesn’t pencil out for any real business.

This hard reality is especially true of shale oil, which had a good run production-wise 2009 to 2022, though the producers could barely make a dime at it. The shale oil “miracle” was largely a byproduct of near-zero interest rates. Investors flocked to it after 2009 because they couldn’t get any yield from bonds. Shale oil was played-up as a sure thing. It took investors a decade, and over a hundred oil company bankruptcies, to catch on — and now shale oil can’t attract enough new investment to keep up the giant operations at scale. The main shale oil regions, the Permian Basin in Texas and the Bakken fields of North Dakota, have entered permanent decline as they run out of “sweet spots” to drill and frack. Considering the new era of capital scarcity ahead, money for shale oil companies will be even harder to get and we’ll get less shale oil every year, while conventional oil continues its own remorseless decline. The catch here is that oil prices are just as likely to go down as up because the foundering economy creates substantial demand destruction — meaning that customers drop out of the market.

Natural gas involves similar dynamics. There seems to be a lot of it for now in the Marcellus formation spread over Pennsylvania, Ohio, West Virginia, and into New York (where fracking has been prohibited for years). Natgas is very useful for electric generation, home heating, and some manufacturing, but not so much for transportation. Shale gas production is also based on “sweet spots” for drilling and there are fewer of them every year. The depletion curve for natgas is even more extreme than it is for oil: the flow stops all at once. The early shale gas plays in the southern US — Haynesville, Fayetteville, Barnett — have been in decline for years. As with shale oil, producing shale gas is expensive, with all the trucks ceaselessly delivering sand, water, and fracking chemicals to the drilling pads, and then transporting waste liquids off-site. Prediction: in 2023, we’ll hear the first rumblings about “nationalizing the oil industry,” which will be a giant step toward killing it altogether, given the all-around incompetence of government.

The strategy of changing out oil-based cars and trucks for electric vehicles (EVs) is a loser on several counts beyond the disruption and instability facing US oil production. One, it’s premised on the fantasy that we can continue living in a suburban sprawl arrangement by other means. Two, the electric grid is too inadequate and fragile to support the charging of so many millions of EVs in addition to everything else we ask it to do. Three, the middle class is being decimated, so there are fewer credit-worthy customers for cars priced out of their shrinking budgets anyway. Four, far less capital will be available for consumer loans. The car industry itself may not survive the re-possession orgy coming in 2023 for defaulted auto loans. That shortfall will infect banking, too. The economy is already hurting. The “Green New Deal” will cut its wobbly legs off.

Similarly, the new mandates against the use of nitrogenous fertilizers (made from natgas). European countries are already on-board with this WEF folly. The Netherlands, Europe’s leading food producer, is going so far as to forcibly shut down thousands of farms and limit fertilizer use on the remaining ones. Germany is likewise limiting fertilizers. Canada fell in line next. Prediction: in early 2023, “Joe Biden” will set in motion anti-fertilizer policies in the US. There will be plenty of squawking in the big farming states, rising to angry protests. The tractor convoys may invade Washington. The situation sets up a grim prospect for the US food supply: scarcity, high prices, and hunger ahead.

The Ukraine bread-basket is out of the picture in 2023, unless military action ends well before planting season. Thanks to “Joe B’s” stupid sanctions policy, a more vulnerable Europe can’t depend on Russia, another world-leading grain producer. By summer, the projected harvests all over Western Civ will be inadequate to feed the existing populations. Routine grain exports to the poor nations of the “global south” will stop and a lot of people will starve in those countries. By then, it will be too late to fix anything. The price of food will soar throughout Western Civ, aggravating other economic crises that will amount to metastasizing poverty. Populations will get very restless. Governments will fall (candidates: France, Germany, UK, Australia, the USA). In some places they will not recover in their prior form.

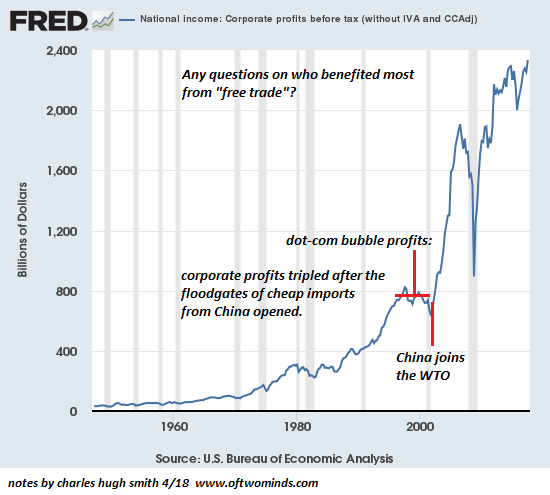

As a general proposition, Globalism is done. That got that underway in earnest with the Covid shut-downs. Now, geopolitical friction gets worse and trade relations deteriorate further. There will still be trade between nations, but much reduced. Global supply chains are already wrecked, especially for specialized mechanical replacement parts and electronic components. It will be harder to fix cars, trucks, turbines, really any sort of machine, including computers and things run by them. A lot of commercial activity will just stop.

Europe has already blundered into buying its one-way ticket to Palookaville. Germany and the rest paid for that ticket by going along with feckless US policy to “weaken” Russia with sanctions (mission not accomplished). The coup de grace was the US wrecking the Nord Stream pipelines. So, Euroland has inadvertently decided to ditch its industrial base, which means they go medieval or worse. They have committed economic suicide. They’d better hope reincarnation is for-real. Anyway, they’re not coming back from this fiasco the way they went into it, that is, the way things were. When the shock of winter is over in early 2023, strife will be the new leitmotif in the Old World. People grow desperate in the six-weeks-wont of springtime. Nations crack up.

America’s economy largely hinges on finance now that financialization replaced manufacturing as the basis for prosperity. Alas, financialized prosperity is false prosperity, since it consists mainly of borrowing ever greater amounts of money to keep up the mere appearance of prosperity. In real life, prosperity requires producing things of value, not just trading increasingly abstract financial instruments purporting to represent money. I’ve discussed this enough in books, prior blogs, and previous forecasts. Suffice it to say we’ve run out the string on this stunt. All we’re left with now is the debt markers, documents that purport to represent wealth. The collateral is all the stuff we produced previously that is still standing: buildings, developed properties, public works. A lot of this stuff is deteriorating quickly, losing its value — for instance the tens of millions of suburban houses built with shitty, short-lived materials like strand-board and vinyl… all the cars….

Financialization led to the current inflation in our debt-based money system. More borrowing becomes more money going into existence, chasing a declining amount of goods as production falls off and supply lines choke. Services also suffer. People can’t afford to eat out, get acupuncture, visit hair-dressers. When the inflation is bad enough, say more than ten percent annually, it will cause enough economic damage to provoke a big contraction in activity, bringing on a deluge of loan defaults on mortgages, car payments, and corporate obligations. Loan defaults cause money to disappear from the system. This flips inflation into deflation. The bond-market is blowing up as this occurs, because bonds are debts and they’re not being serviced or paid-off. The imploding bond market infects the stock markets and they crash, too.

Before long, nobody has money, except people who invested in gold and silver. Prediction: the change-over from inflation to deflation comes in summer of 2023 and gathers momentum into the fall. The implosion leads to economic conditions worse than the Great Depression of the 1930s because our social and family arrangements have disintegrated along with our towns and cities. Civil disorder ignites. The government attempts lockdowns, but this time without a disease to blame it on. It’s no longer safe to be a politician.

The Covid-19 Story Backfires Badly and Hell Breaks Loose

Against the backdrop of a developing economic depression, the public can no longer avoid seeing the calamity that the mRNA vaccines have instigated. Early death is in the news daily now and from exactly the adverse effects that have been derided as “conspiracy theory” by public health experts since 2021: myocarditis, blood clots, organ damage, neurological illness, unusually aggressive cancers, damaged immune systems. Meanwhile, America’s public health aristocracy — Dr. Tony Fauci, Rochelle Walensky, Francis Collins, Deborah Birx, Surgeon General Vivek Murthy, and many, many others will be compelled to testify under oath before newly re-constituted House committees and finally answer for all their dishonesty in the Covid-19 response saga. They lied about everything, especially the “vaccines?” It will go worse for them as public sentiment turns from submission to official bullshit to rage over a deadly fraud.

By then, the past efforts of this gang to mislead the public on Twitter and other social media will be well-documented. The exposed slime-trail of money and corruption between Pharma and federal bureaucrats will finally make an impression on the long-bamboozled nation. The mainstream media will be dragged into this morass and the public will begin to understand how the newspaper editors and TV news producers, too, were bought off by Pharma and controlled by the national security state to pimp for the Democratic Party and globalist interests outside the USA. This exposure could be the end of the great legacy news organs, The New York Times and the rest of the gang. Their executives will have to testify along with everyone else. They might not be prosecuted — in a gesture of respect for the First Amendment — but rather will suffer badly from their loss of credibility.

All of this will aggravate the animus against the government and the Democrat Party’s “Joe Biden” regime — which will be under assault from separate inquiries into the Hunter Biden laptop and its abundant evidence of bribery and treason, and hearings about the wide-open border, payments to Ukraine, and the gestapo-like behavior of the FBI.

Here’s a scenario for you: The Justice Department will be drowning in criminal referrals. The FBI will be in a state of paralysis, unable to carry out more insults against US citizens as its systematic crimes are revealed. When the DOJ dithers about bringing action, the public will be even more enraged. The current Attorney General, Merrick Garland, gets dragged into Congress to answer for his misconduct and the resulting humiliation will run him out of office. “Joe Biden” may be forced to resign, drowned in a sea of troubles and scandals revealed. A deal will be made to let Veep Kamala Harris off the hook in exchange for her resignation.

That will leave the Republican Speaker of the House, whoever it is, to become president. He will fire every political appointee in the executive branch and replace them with people who will follow the law. It will look like a promising return to decency and the rule of law. But the damage to America’s prestige will have been so gross by then that the federal government has lost legitimacy. The financial crisis, meanwhile, puts the government into something that smells like bankruptcy. The country is in a ferocious depression, the people have no money, but neither does the government. Real authority devolves to states and localities. The playing out of these dynamics also depends on what is happening outside the USA.

Europe in Macro

Don’t forget, Europe, the west end of the Eurasian landmass, used to be an important part of the world, with an aggregate GDP greater than even the USA’s or China’s. Europe is the birthplace of Western Civ, a division of the human project the past few thousand years that yielded tremendous advances in science, art, music, philosophy, and organized intelligence generally. Now it is on the rocks. Europe, in the aggregate, as represented, say, by the European Union, or NATO, made a grave error going along with the USA’s foolish Neocon project to make a heap trouble in Ukraine in order to “weaken” Russia.

Russia was no longer a threat to the USA after 1991. Once the USSR was done as a political entity, and after Russia recovered from the daze of collapse, it wanted to be treated by the West as a normal European nation. Russia became a market economy, like all the others in Europe. It held elections like the others, had a legislature, a new body of property law, a private news media, regular banks, and all the other trappings of modern political normality. Russia even requested early-on to become a member of NATO. The USA and Europe refused NATO membership, but also refused to admit Russia into European normality. Instead, led by the USA, the West conducted an asset stripping operation which hampered Russia’s redevelopment.

Otherwise, the West mostly ignored Russia, and in spite of all that Russia got back on its feet, got some industries going, especially oil-and-gas, and enjoyed two decades of relative stability. Russia eventually began reaching out in the world and made trade agreements with other countries. It built those Nord Stream gas pipelines. It organized a regional “customs union” among its Eurasian neighbors that functioned rather like the Eurozone.

As that was all happening — pay attention — around 2010 then-Secretary of State Hillary Clinton sat on a State Department’s Committee on Foreign Investment in the United States (CFIUS) that threatened to block the sale of a Canadian company, Uranium One, to Rosatom, the Russian State Atomic Energy Corporation, on the grounds that Uranium One’s assets included 20-percent of the USA’s uranium supply. Selling all that American uranium to Russia looked kind of bad, you’d think, and you’d be right. But then, suddenly, about $150-million dollars poured into the Clinton Foundation — much of it from Uranium One’s owner, one Frank Giustra — plus Bill Clinton happened to get a half-million dollar speaking gig in Russia, and… whaddaya know, CFIUS ended up approving the sale. The public hardly heard a peep about it. (Where was the US new media?)

During that same period, Hillary Clinton also helped facilitate the transfer of American bio-medical, nuclear, and Info technology to the high-tech consortium called Skolkovo, Russia’s version of Silicon Valley. Much of the tech at issue was dual-use, good for civilian and military applications. Again, tens of millions of dollars gushed into the Clinton Foundation from the corporate participants in the Skolkovo deal. Crickets from the news media again.

In 2011, relations between the US and Russia soured when President Putin accused the US of fomenting protests in Russia over its parliamentary elections. And from there, our State Department decided that Russia and the USA could not even pretend to be friendly.

Jump ahead to 2014: Neocons in the Obama administration figured it was time to cut Russia back down to size. That effort crystalized around the former Soviet province, Ukraine, and blossomed into the US-sponsored-and-organized Maidan Revolution, utilizing Ukraine’s sizeable Stepan Bandara legacy Nazi forces in the vanguard, to foment violence in Kiev’s main city square. The US shoved out elected Ukraine President Yanukovych — who angered America by pledging to join Russia’s Custom’s Union instead of the EU — and installed its own puppet Yatsenyuk, who was ultimately replaced by the candy tycoon, Poroshenko, replaced by the Ukrainian TV star, comedian Volodymyr Zelensky. Ha Ha. Who’s laughing now? (Nobody.)

From 2014-on, Ukraine, with America’s backing, did everything possible to antagonize Russia, especially showering the eastern provinces of Ukraine, called the Donbas, with artillery, rockets, and bombs to harass the Russia-leaning population there. After eight years of that, and continued American insults (the Steele Dossier, 2016 election interference), and renewed threats to drag Ukraine into NATO, Mr. Putin had enough and launched his “Special Military Operation” to discipline Ukraine. Once that started, American Defense Secretary Lloyd Austin stated explicitly to the world that America’s general policy now was to “weaken Russia.”

That declaration was accompanied by America’s policy to isolate Russia economically with ever more sanctions. Didn’t work. Russia just turned eastward to the enormous Asian market to sell its oil and gas and utilized an alternate electronic trade-clearance system to replace America’s SWIFT system. Sanctions also gave Russia a reason to aggressively pursue an import-replacement economic strategy — manufacturing stuff that they had been buying from the West, for instance, German machine tools critical for industry.

Russia did sacrifice more than $50-billion in financial assets stranded in the US banking system — we just confiscated it — but, ultimately, that only harmed the US banking system’s reputation as a safe place to park money, and made foreign investors much more wary of stashing capital in American banks. Net effect: the value of the ruble increased and stabilized, and Russia found new ways to neutralize American economic bullying.

Europe was the big loser in all that. For a while, Europe could pretend to go along with the US / NATO project, pouring arms and money into Ukraine, and at the same time depend on Russian oil and gas imports. Eight months into the Ukraine-Russia conflict, the US blew up the Nord Stream One and Two pipelines, and that was the end of Europe’s supply of affordable natgas, to heat homes and power industry. In a sane world, that sabotage would have been considered an act of war against Germany by the USA. But it only revealed the secret, humiliating state of vassalage that Europe was in. Europe had already made itself ridiculous buying into the hysteria over climate change and attempting to tailor its energy use to so-called “renewables” in history’s biggest virtue-signaling exercise. Germany, the engine of the EU’s economy, made one dumb mistake after another. It invested heavily in wind and solar installations, which fell so short of adequacy they were a joke, and it closed down its nuke-powered electric generation plants so as to appear ecologically correct.

So now, Germany, and many other EU member states, teeter on the edge of leaving Modernity behind. They managed to scramble and fill their gas reserves sufficiently this fall to perhaps squeak through winter without freezing to death, but not without a lot of sacrifice, chopping down Europe’s forests, and wearing their coats indoors. Now, only a few days into Winter, it remains to be seen how that will work out. We’ll know more in March of the new year. France had been the exception in Europe, due to its large fleet of atomic energy plants. But many of them have now aged-out, some shut down altogether, and “green” politics stood in the way of replacing them, so France, too, will find itself increasingly subject to affordable energy shortages.

Prediction: Europe’s industry will falter and close down by painful increments. The EU will not withstand the economic stress of de-industrialization. It will shatter and leave Europe once again a small continent of many small fractious nations with longstanding grudges. Some of these countries may break-up into smaller entities in turn, as Yugoslavia, Czechoslovakia, and Russia did in the 1990s. Keep in mind, the macro trend world-wide will be downscaling and localization as affordable energy recedes for everyone. Since the end of World War Two, Europe was the world’s tourist theme park. Now it could go back to being a slaughterhouse. The Euro currency will have to be phased out as sovereign bankruptcies make the EU financial system untenable, and animosities and hostilities arise. Each country will have to return to its traditional money. Gold and silver will play a larger role in that.

The USA poured over $100-billion into Ukraine in arms, goods, and cash in 2022. That largesse will not continue as America sinks into its Second Great Depression. In any case, much of that schwag was fobbed off with. The arms are spent, the launchers destroyed. A lot of weapons were trafficked around to other countries and non-state actors. Russia is going to prevail in Ukraine. The news emanating from American media about Ukraine’s military triumphs has been all propaganda. There was hardly ever any real doubt that Russia dominated the war zone strategically and tactically. Even its withdrawals from one city or another were tactically intelligent and worthwhile, sparing Russian lives. The Special Military Operation wasn’t a cakewalk because Russia wanted to avoid killing civilians and refrain from destroying infrastructure that would leave Ukraine a gutted, failed state. Over time, the USA proved itself to be negotiation-unworthy, and Ukraine’s president Zelensky refused to entertain rational terms for settling the crisis. So, now the gloves are off in Ukraine. As of December 29, Russia shut off the lights in Kiev and Lvov.

The open questions: how much punishment does Ukraine seek to suffer before it capitulates? Will Zelensky survive? (Even if he runs off to Miami, he may not survive.) What exactly will be left of Ukraine? In 2023 Russia will decide the disposition of things on-the-ground. Failed states make terrible neighbors. One would imagine that Russia’s main goal is to set up a rump Ukraine that can function, but cease to be an annoying pawn of its antagonists. Ukraine will no longer enjoy access to the Black Sea; it will be landlocked. The best case would be for Ukraine to revert to the agricultural backwater it was for centuries before the mighty disruptions of the modern era. Perhaps Russia will take it over altogether and govern it as it had ever since the 1700s — except for Ukraine’s brief interlude post-USSR as one of the world’s most corrupt and mal-administered sovereign states.

Bottom line: Ukraine is and always was within Russia’s sphere-of-influence, and will remain so. The USA has no business there and it will be best for all concerned when we bug out. Let’s hope that happens without America triggering a nuclear World War Three. (Yeah, “hope” is not a plan. Try prayer, then.) Mr. Putin’s challenge going into 2023 is to conclude the Ukraine hostilities without humiliating the USA to the degree that we do something really stupid.

Asia

The enormous region where most of the world’s people live is swirling with quickly changing dynamics. It’s hard to tell what kind of shape China is actually in at the close of 2022. The CCP capitulated on its extreme lockdown policy and now the country seems gripped by a new and severe outbreak of the Covid virus. It’s killing a lot of people, including quite a few higher-ups in the CCP. The world saw the beginning of a popular revolt in China through the fall of 2022 as demonstrations erupted. The political side remains opaque.

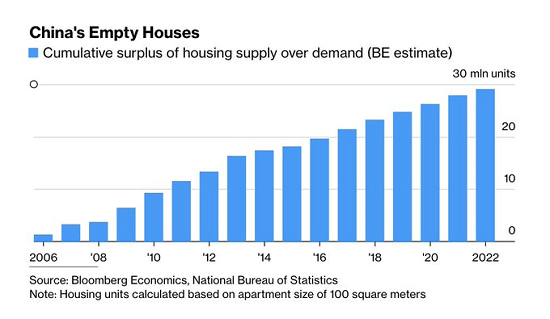

The economic side, less so. China’s wealth since year 2000 has derived from its immense factory capacity and cheap labor force. Globalism is wobbling, and with that the world’s supply line network. If trade relations with the USA continue to sour, both China and the USA will suffer. China will find itself at over-capacity, even for the giant Asian market. And they are competing with several other quickly-industrialized nations in the south, plus India, plus the old stalwarts South Korea and Japan.

The main problem for China, and indeed all the Pacific Rim nations on the Asian side: energy. China doesn’t have very much oil in the ground and is utterly dependent on imports. It has a lot of low-quality coal. It’s building coal and nuke plants like mad. Will that suffice? Electricity is great, but you need fossil fuels to run heavy industries. In the great shiftings of 2022, China made deals for getting more oil and gas from Russia. That might work for a while. But Russia’s energy resources are probably near peak production now. What happens on the way down from that peak? Maybe Russia will be less avid for sharing its fossil fuels with its neighbors. Maybe that will cause political friction. Maybe a desperate China will reach out and try to grab resources from Russia’s vast Siberian territories? Not next year, though….

The Neocon-led US foreign policy establishment is insane for sure, but the CCP is only not-crazy during times of great stability. Throw in some popular dissent and some economic distress, and the CCP could go cuckoo. Uncle Xi shows very Mao-like tendencies for creative despotism. The party must have a long game for Taiwan, but a distressed and crazed CCP, and an agitated Uncle Xi, could turn that into a short game out of desperation — and then what? We’d have two really crazed governments, the USA and China, ginning up the Eastern theater of World War Three. The upshot of predicament depends to some extent on how delicately Mr. Putin can organize America’s exit from Ukraine.

Prediction: For 2023 internal friction will preoccupy China as it attempts to square its operations with those pressing trends of our time: downscaling and relocalization. All this could easily lead to regional strife in China. For decades, the CCP has been the glue between its disparate peoples. It may prove to not be superglue.

Japan remains as enigmatic as ever. It has drifted economically for nearly forty years. Now it looks like it’s drifting into a sovereign bankruptcy as it loses control of its deeply-gamed bond markets. I’ll stick to my old predication that Japan is en route to going medieval. Its pre-industrial culture was very charming and worked well for long periods of history. Industrial modernity demoralized them. Japan imports all its oil. Without it, you can’t even begin to run a modern war machine, so there won’t be a second reaching-out for resources as in the 20th century. The Japanese will not be alone in the new medievalism when this era completes itself.

The Deep State, an Appreciation

America is at a crossroads, a threshold, a tipping point. Every vital institution in the land has been at least partially wrecked, most especially the ones in charge of the rule of law, which was the best thing we had going for us. The Deep State is for real — the weaponization of a national bureaucracy against the nation itself. Yet, it’s certainly not just an American thing; it’s happening across Western Civ. Is it some natural process of self-destruction? An auto-immune disorder of a giant cultural organism, with parts attacking the whole? The USA, Great Britain, Canada, and Australia took such special pride in being open societies and now they are consumed in censorious lunacy. Continental Europe had a sketchier history with liberty, the enlightened individualism of Everyman, though they actually birthed its principles. But now the whole works is infected and ailing, and by what? It’s as if some cosmic spike protein came among us all and got into our hearts.

Most major religions feature some version of the idea of death-and-rebirth, and it’s a fact that we see ourselves embedded in cycles, especially seasons. Things turn and return, are born, develop, degenerate, pass away. This was the brilliant application of Strauss and Howe’s Fourth Turning theory to the study of history, and by those terms we are have entered a deep secular winter of the human project. One can appreciate how the onset of winter spooked our prehistoric ancestors. They developed their prayerful ceremonies for bringing back the sun, and warmth, and new growth, dancing around the fire in the skins of animals, often making blood sacrifices to the mysterious forces in charge of… everything. The modern way of reenacting all that seems to be industrial-strength warfare. Many of us are praying right now that we don’t have to go through that.

More likely, I think, we’ll forego the nuclear fire and simply go through a collapse of the socioeconomic organization that our governance rests on, and the Deep State illness with it. It’ll come with plenty of hardship, but it will purge the poisons that have disordered us, and when we get through it, we’ll make new arrangements for daily life. For some years, I’ve been calling this process a long emergency, and now we seem to be right in the thick of it. I believe in the natural process called emergence. Systems transform themselves organically from one state to another when acted upon by the circumstances of time and place. The outcome is usually a surprise, and not all surprises are bad. So, adios 2022 and hello little baby 2023. Lead us where you will and let’s go forward into it bravely. As Bob said so many years ago, it’s all right, Ma. It’s life and life only….