By Robert J. Burrowes

For many people desperate to see a return to a life that is more familiar, it is still easy to believe that the upheavals we have experienced since March 2020 and the changes that have been wrought in their train are ‘temporary’, even if they are starting to ‘drag on’ somewhat longer than hoped.

However, anyone who is paying attention to what is taking place in the background is well aware that the life we knew before 2020 has already ended and what is being systematically put in its place as the World Economic Forum (WEF) implements its ‘Great Reset’ will bear no comparison to any period prior to last year. See ‘Killing Democracy Once and for All: The Global Elite’s Coup d’état That Is Destroying Life as We Know It’.

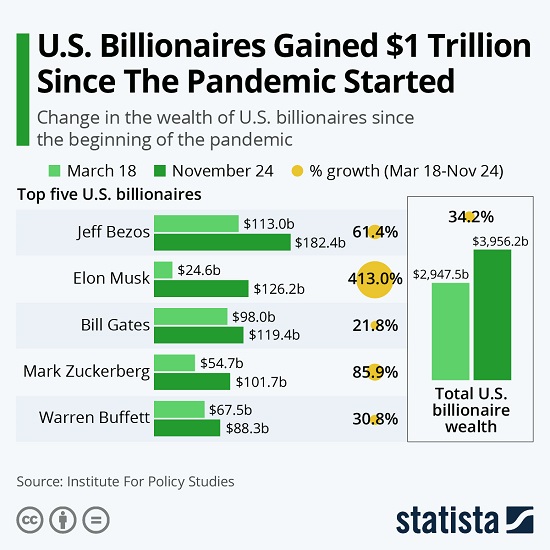

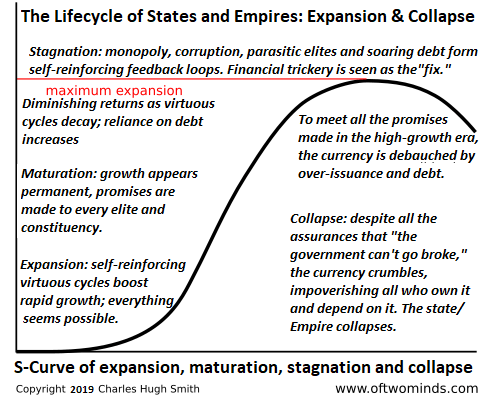

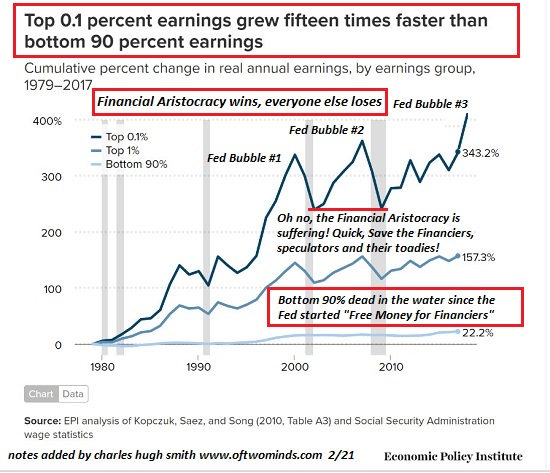

Of course, those of us who qualify as ‘ordinary people’ have had no say in the shape of what is being implemented: that shaping has been the prerogative of the criminal global elite which is now implementing a plan that has been decades in the making and built on hundreds of years of steady consolidation of elite power.

Also, of course, there is nothing about this shaping that is good for us. In simple terms, it is reshaping the human ‘individual’ so that previously fundamental concepts such as human identity, human liberty, human rights (such as freedom of speech, assembly and movement), human privacy and human volition are not just notions of the past but are beyond the comprehension of the typical ‘transhuman’. At the same time, the global elite is restructuring human society into a technocratic dystopia which is a nightmarish cross between ‘Brave New World’, ‘1984’ and the Dark Age. See ‘Strategically Resisting the New Dark Age: The 7 Days Campaign to Resist The Great Reset’.

The only question remaining is this: ‘Can we mobilize adequate strategic resistance – that is, resistance that systematically undermines the power of the global elite to conduct this coup and restores power to ordinary people – to defeat this coup?’

But before I answer that question, I wish to highlight just one element of the elite coup that is taking place and outline the profound changes that are being left in its wake unless we stop them.

These changes are essentially related to the capacities of computerized technologies to deprive us of what little we have left of our financial autonomy, including because any notion of privacy is rapidly vanishing.

Vanishing Money

One reason for highlighting the issue of money is because while it is good to see increasing critical attention being paid to the ‘injectables’ program, with its devastating consequences for humanity, far too little attention is being paid to the profoundly important transformation being wrought under cover of the elite-driven narrative which has virtually all people’s attention distracted from this deeper agenda. And while this deeper agenda entails a great many aspects, one subset of these is related to the way in which the global financial system is being re-engineered to play its role in fully controlling the human population.

In a series of reports issued in early 2020, the Deutsche Bank claimed that ‘cash will be around for a long time’. See the three reports accessible from ‘Transition to digital payments could “rebalance global economic power”’.

However, these reports are contradicted by other research and the ongoing evidence that cash is vanishing. Most importantly, there is no doubt about the elite intention in this regard. They want cash gone.

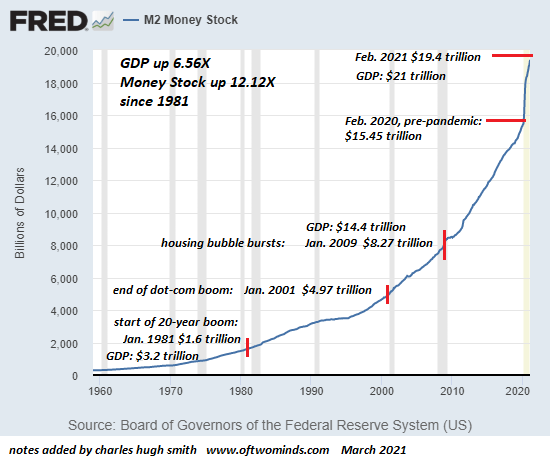

The digitization of money has been occurring for decades and it is now being accelerated dramatically.

Moreover, the World Economic Forum and other elite organizations have been actively working towards achieving a cashless economy for years. To get a sense of this trend, see ‘Why we need a “less-cash society”’ and ‘The US should get rid of cash and move to a digital currency, says this Nobel Laureate economist’.

Notably, in this respect, the ‘Better Than Cash Alliance’ has 78 members ‘committed to digitizing payments.’ If you think that this is a grassroots initiative set up by people like you and me, you will be surprised to read that the Bill & Melinda Gates Foundation is a ‘Resource Partner’ to the initiative along with some UN agencies, many national governments and corporations such as Mastercard and Visa.

So while the trend toward a cashless society has been progressing steadily for some decades, with countries like Denmark, Norway and Sweden already virtually cashless and India rapidly moving in that direction – see ‘India’s PM Modi defends cash ban, announces incentives’ – the so-called ‘Covid-19 pandemic’ was contrived partly to provide a pretext for further accelerating the move from cash to cards and apps, with increasing numbers of people using the digital methods, even for small sums, partly because some people were scared into believing that the ‘virus’ could be transmitted by bills and coins.

But there is more. In addition to measures not mentioned here, other plans include the use of a facial scan that records your entry to a store and is linked to artificial intelligence that identifies you and your credit rating. This then enables, or otherwise, your ability to pay for goods and services based on this facial scan.

‘Does all of this matter’, you might ask. Well the convenience of cards and apps has two significant costs: your privacy and your freedom. You lose both simply because while paying with cash is anonymous, paying by card or app leaves a digital trail that is as difficult to follow as an elephant whose tail you are already holding. And this digital trail forms a vital part of the surveillance grid that enables all of those who are tracking and documenting your movement, your payments and your behaviour to do so without leaving the comfort of their chairs. For more detail on this, watch ‘Cash or card – will COVID-19 kill cash?’ which is embedded in the article ‘Cash or Card – Will COVID-19 Kill Cash? Leaving a Digital Footprint With Every Payment’.

But it goes beyond this. As touched on above in relation to privacy and explained at some length by Whitney Webb, ‘there is a related push by WEF partners to “tackle cybercrime” that seeks to end privacy and the potential for anonymity on the internet in general, by linking government-issued IDs to internet access. Such a policy would allow governments to surveil every piece of online content accessed as well as every post or comment authored by each citizen, supposedly to ensure that no citizen can engage in “criminal” activity online.

‘Notably, the WEF Partnership against Cybercrime employs a very broad definition of what constitutes a “cybercriminal” as they apply this label readily to those who post or host content deemed to be “disinformation” that represents a threat to “democratic” governments. The WEF’s interest in criminalizing and censoring online content has been made evident by its recent creation of a new Global Coalition for Digital Safety to facilitate the increased regulation of online speech by both the public and private sectors.’ See ‘Ending Anonymity: Why the WEF’s Partnership Against Cybercrime Threatens the Future of Privacy’.

But to get back to cash: Unfortunately for us, the global elite does not intend to leave the abolition of cash to our ‘preference for the convenience of cards’ and other moves to entice us to switch to digital payment. It fully intends to force us to accept digital methods as the only means of payment.

In part, this is because electronic payments are extremely lucrative for banks and payment service providers, while the data broker industry is also making huge revenues. See ‘Cash or Card – Will COVID-19 Kill Cash? Leaving a Digital Footprint With Every Payment’.

And in some ways, ‘killing cash’ is simple. Two obvious ways of doing so are by removing ATMs (including from shopping centres) and closing local bank branches so that cash is simply unavailable. As has been happening for some time. See ‘Why Are ATMs Disappearing at an Alarming Rate after a Wave of Branch Closures?’ and ‘Australian bank branches and ATMs are vanishing’.

But, in this instance, even profitability is at the trivial end of the elite motivation spectrum.

Cash is being forced out of existence because it undermines the elite agenda to take all power from ordinary people.

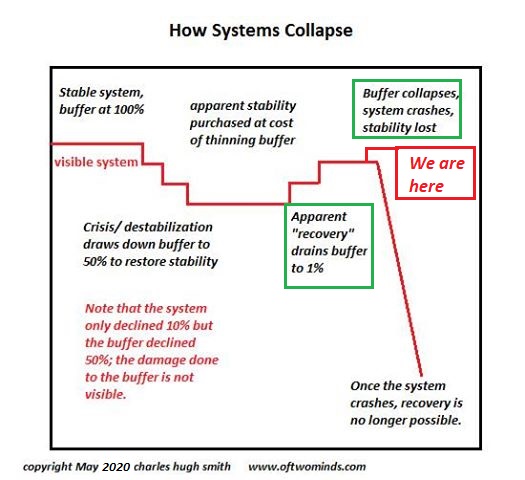

So, in parallel with other regressions over the past 18 months as the elite coup to take complete control of our lives has continued to unfold, there have been ‘warnings’ from various institutions – including the World Economic Forum and the Carnegie Endowment for International Peace – about the possibility of an ‘allegedly imminent cyber attack that will collapse the existing financial system’.

Following a simulation in 2020, in which the World Economic Forum along with the Russian government and global banks conducted a high-profile cyberattack simulation that targeted the financial industry, another simulation was held on 9 July 2021 involving the World Economic Forum and the Russian government-owned Sberbank as well as other key financial agents. See ‘Cyber Polygon’ and ‘Cyber Polygon 2021’. In reality, of course, such a collapse of the financial system would constitute ‘the final yet necessary step’ to implement the World Economic Forum’s desired outcome of forcing a widespread shift ‘to digital currency and increased global governance of the international economy’.

If this financial collapse happens, the ‘solution’ suggested by key agencies – ‘to unite the national security apparatus and the finance industry first, and then use that as a model to do the same with other sectors of the economy’ – will ensure that we lose what little control is left in our lives, not just in relation to our financial resources but in all other domains as well. For a full explanation, see ‘WEF Warns of Cyber Attack Leading to Systemic Collapse of the Global Financial System’.

And for another account of the deeper agenda and its financial impacts already, including its ‘economic genocide’, as well as what is yet to happen, watch this interview of Catherine Austin Fitts: ‘Globalist Central Banking New World Order Reset Plan’.

Beyond this, if you want some insight into another key threat in the cybercrime realm, check out this video by the Ice Age Farmer in relation to the cyber threat to the power grid. See ‘“Next Crisis Bigger than COVID” – Power Grid/Finance Down – WEF’s Cyber Polygon’.

So How Can We Resist?

Fortunately, there is some resistance already.

In response to concerns in the United States that businesses that refuse cash will disadvantage communities with poor access to traditional banking systems, there are signs that ‘a national movement protecting consumers’ ability to pay in cash may be emerging’ with a number of states and cities already outlawing cashless outlets. See ‘Cash or Credit? State and City Bans on Cashless Retailers Are on the Rise’.

Realistically, however, given what is at stake, considerable elite pressure will be applied to reverse these decisions in time. So we need our defense to be more rigorous and less reliant on agents who are unlikely to be tough enough to defend our interests or will be sidelined or killed for doing so, as at least two national presidents who resisted the elite intention last year have since been killed. See ‘Coronavirus and Regime Change: Burundi’s Covid Coup’ and ‘John Magufuli: Death of an African Freedom Fighter’.

Moreover, given the likelihood that the financial system will be deliberately crashed at some point – and possibly soon – we need to employ a variety of tactics, that build resilience into our resistance, to defeat this initiative.

Hence, storing and paying with cash, moving your accounts to local community banks or credit unions (and away from the large corporate banks) and making the effort to become more self-reliant, particularly in food production, will increase your resilience, as will participating in local trading schemes, whether involving local currencies or goods and services directly.

As with all elements of the defense we implement, it will need to be multi-layered and integrated into the overall defense strategy. The elite intends to kill off many of us – as the depopulation measures within the coup, including the destruction of the global economy throwing 500,000,000 people out of work and killing millions as a result, as well as the ‘injectables’ program already killing tens of thousands, make perfectly clear – and enslave the rest.

For an integrated strategy to defeat the elite coup, see the ‘We Are Human, We Are Free’ campaign, which has 29 strategic goals for defeating the coup including meaningful engagement with police and military forces to assist them to understand and resist, rather than support, the elite agenda.

But for a simpler presentation, see the 7 Days Campaign to Resist The Great Reset. The Telegram group is here.

Conclusion

One of the interesting challenges about the current ‘Covid-19 Crisis’ is that it continues to very successfully distract most people from awareness of the deeper agenda: the Global Elite’s ‘Great Reset’ and related initiatives, such as that discussed above in relation to money.

Hence, apart from the perennial problem of raising awareness and mobilizing resistance among those still believing the elite-driven propaganda, we face two key strategic hazards.

The first hazard is a longstanding one: while virtually all people believe that elite agents – in this case, governments – are controlling events, much ‘resistance’ will focus on begging governments, through such things as petitions and protest demonstrations, to ‘fix it’ for us. The elite has long dissipated our dissent by having us direct it at one or other of its agents. This case is no different. And while we are not using our occasional large rallies to inform people how to resist powerfully every day of their life, these rallies are a waste of time whatever solidarity they build in the short term. History is categorically instructive on that point.

A second strategic hazard we face is that resistance to the ‘vaccine’ and the ‘vaccine’ passport might be ‘successful’ (in the sense that concerted actions stall some government implementation of some measures in relation to these two initiatives) and leave most people believing that they have ‘won’, while the deeper agenda remains in the shadows with virtually no-one resisting.

It is important, therefore, that those who are aware of the deeper agenda continue to provide opportunities for others to become aware of this too and the fundamental threat it poses to us all while also sharing how we can resist its key dimensions in a way that makes a difference. It is not enough to complain about elite agents, such as governments, the medical and pharmaceutical industries, and the corporate media.

We must strategically resist the elite coup itself with actions such as those in the 7 Days Campaign to Resist The Great Reset before we find ourselves locked in a technocratic prison without the free-willed minds necessary to analyze, critique, plan and act.

Robert J. Burrowes has a lifetime commitment to understanding and ending human violence. He has done extensive research since 1966 in an effort to understand why human beings are violent and has been a nonviolent activist since 1981. He is the author of ‘Why Violence?’ His email address is flametree@riseup.net and his website is here.