By Timothy Alexander Guzman

Source: Silent Crow News

Since Bitcoin (BTC) was introduced to the world as an alternative to the current central bank system with a dying US dollar that is backed by nothing as its reserve currency, but now there is a plan by several governments to move ahead with implementing their own central bank digital currencies (CBDCs), which is a digital form of currency that is still backed by, you guessed it, nothing. The Nigerian government had made the decision to be the financial guinea pig for the globalist CBDC scheme, and so far, it has failed and that’s the good news. The bad news is that certain governments are still moving forward with the idea of using government-issued digital currencies. In the case of Nigeria, its citizens rejected their government’s plan to issue CBDCs by restricting cash in efforts to create a cashless society and so far, it seems that it has failed in epic fashion according to an opinion piece by author Nicholas Anthony that was published by coindesk.com ‘Nigerians’ Rejection of Their CBDC Is a Cautionary Tale for Other Countries’ is a warning to governments who are willing to take the same step:

In Nigeria, citizens have taken to the streets to protest the nation’s cash shortage, further objecting to their government’s implementation of a central bank digital currency (CBDC). The shortage came about due to cash restrictions aimed at pushing the country into a 100% cashless economy. Yet, instead of adopting the CBDC, Nigerian protesters are demanding paper money be restored.

The country’s experience strongly suggests the average citizen understands that CBDCs present a substantial risk to financial freedom while providing no unique benefit

Not only did the Nigerian people reject CBDCs, but they also demanded a return to paper currencies because they quickly found out that financial freedoms would be severely limited.

The concerns ranged from risking financial privacy to the possibility of financial oppression by government institutions. Anthony mentioned how “the Nigerian government has unleashed a flurry of tricks to spur adoption, but none has proven effective.” He even gave credit to the Nigerian government in terms of using modest approaches to influence its citizens to use CBDCs and it still failed:

To its credit, the Nigerian government initially tried to encourage use through modest measures. In August 2022, it removed access restrictions so that bank accounts were no longer required to use the CBDC. Then, in October, it offered discounts if people used the CBDC to pay for cabs. Yet, neither effort proved to be fruitful. Put simply, Nigerians prefer cash

However, the Nigerian government continued its assault on cash:

Unfortunately, the Nigerian government doubled down and moved to more drastic measures by restricting cash itself. In December the Central Bank of Nigeria began restricting cash withdrawals to 100,000 naira (US$225) per week for individuals and 500,000 naira ($1,123) for businesses.

To make matters worse, the Nigerian government also chose to redesign the currency during this time in a “move aimed at restoring the control of the Central Bank of Nigeria (CBN) over currency in circulation” and to “further deepen the push to [a] cashless economy,” according to a CBN press release

The Nigerians had a hard time adapting to the government’s restrictions on their hard earned cash, so they posted their concerns on Twitter, Tik Tok and other social media platforms to let the world know what went wrong. Soon after, major protests erupted on the streets because of the cash shortages imposed by the Central Bank of Nigeria:

The government decided to redesign the currency to restore control over the Central Bank of Nigeria as its governor, Godwin Emefiele claimed that “the destination, as far as I am concerned, is to achieve a 100% cashless economy in Nigeria.” To add insult to injury, “the company that designed the Nigerian CBDC called the cash restrictions a creative use of marketing and said other countries could be expected to take similar steps.” A top manager from a financial institutional ratings firm called Agusto and Co., Ayokunle Olumbunmi said that the central bank “doesn’t want us to be spending cash. They want us to be doing transactions electronically, but you can’t legislate a change in behavior.” Anthony concluded that the idea of CBDCs will not go very far, “CBDCs may be popular among central bankers, but money is ultimately a tool for the people. So long as the risks outweigh the benefits, it’s unlikely any CBDC will gain traction in Africa or elsewhere.”

Nicholas Anthony was correct to point out that CBDCs will not become mainstream as several countries have already demonstrated their unwillingness to move forward with the new form of digitized currencies.

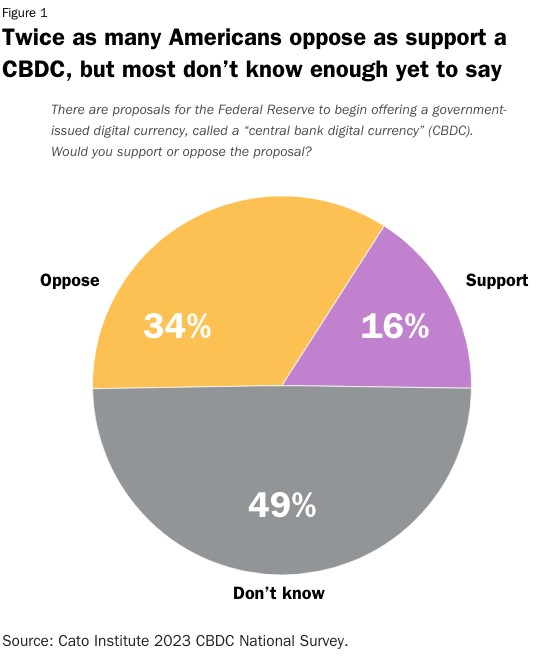

The average human being on earth understands that CBDCs is a bad idea, even in the United States where two-thirds of the population believes almost anything that their government tells them to believe are skeptical of CBDCs according to the Cato Institute, a think tank who also published an article by Nicholas Anthony on the findings of a survey that was conducted by the US federal Reserve Bank on how people view CBDCs. Here is what they found, “Specifically, more than 66 percent of the 2,052 commenters were concerned or outright opposed to the idea of a CBDC in the United States (Figure 1).”

Bitcoin.com published an article on the GOP’s 2024 presidential candidate, Florida’s governor, Ron DeSantis who is opposed to CBDCs, ‘Ron DeSantis Vows to Prohibit CBDC, ‘Woke Politics,’ and ‘Financial Surveillance’ in Florida,’ he said “I think what the danger of the digital currency is that, one, they want to make that the sole currency, they want to get rid of crypto,” DeSantis continued, “They don’t like crypto because they can’t control crypto. So, they want to put everything in a central bank digital currency.” There were other politicians who also have similar views on CBDCs:

DeSantis shares the view of several Republican officials who have criticized the idea of a central bank digital currency (CBDC). Minnesota congressman Tom Emmer introduced the Central Bank Digital Currency (CBDC) Anti-Surveillance State Act, while Texas senator Ted Cruz has created legislation against the government developing a CBDC. Georgia representative Marjorie Taylor Greene has also spoken out against CBDCs, and 2024 Democratic presidential candidate Robert Kennedy Jr. has warned that a central bank digital currency could lead to financial slavery

Cash is King! How the CBDC Failed in Japan and Ecuador

Cointelegraph.com, an independent digital news platform that focuses on crypto assets, blockchain technology and emerging fintech trends published an article last year written by Helen Partz based on which countries have rejected CBDCs for one reason or another titled ‘Some central banks have dropped out of the digital currency race’ mentions Japan, who is a major player in the global economy, ultimately rejected developing a CBDC scheme. The Bank of Japan (BOJ) started testing their digital currency proof-of-concept in 2021 and had planned to finish the first phase by 2022 but in January “former BOJ official Hiromi Yamaoka advised against using the digital yen as part of the country’s monetary policy, citing risks to financial stability.”

The BOJ issued a report in July 2022 and stated that it had no plan to establish a CBDC system since there is a “strong preference for cash and high ratio of bank account holding in Japan” and that the regulator suggested for a CBDC to be used as a “public good” and it “must complement and coexist” with “private payment services in order for Japan to achieve secure and efficient payment and settlement systems.” However, it also said that “the fact that CBDC is being seriously considered as a realistic future option in many countries must be taken seriously,” in other words, the CBDC scheme in Japan will not move forward although several countries are still in the early stages of developing a plan for the use of CBDCs, but for Japan, cash is still and will be king well into the foreseeable future.

Ecuador is another example as its central bank, Banco Central del Ecuador (BCE) who launched its own electronic currency known as dinero electrónico (DE) in 2014 to increase some sort of financial inclusion for the public as well as to control the flow of fiat currencies. According to Partz “As of February 2015, Ecuador managed to adopt DE as a functional means of payment, allowing qualified users to transfer money via a mobile app. The application specifically allowed citizens to open an account using a national identity number and then deposit or withdraw money via designated transaction centers.” But industry observers were not so sure that the DE can take the form of a CBDC since Ecuador’s currency is the US dollar, and since Ecuador does not currently have its own sovereign currency, many were not so sure that they can call the DE, a form of CBDC. “The Ecuadorian government cited the support of its dollar-based monetary system as one of the goals behind its DE platform after it started to accept U.S. dollars as legal tender in September 2000.” It seems that Ecuador remains skeptical on any possibility that issuing CBDCs will be a success:

According to online reports, Ecuador’s DE operated from 2014 to 2018, amassing a total of 500,000 users at its peak out of a population of roughly 17 million people. The project was eventually deactivated in March 2018, with the BCE reportedly citing legislation abolishing the central bank’s electronic money system. Passed in December 2021, the law stated that e-payment systems should be outsourced to private banks.

Years after dropping its central bank digital money initiative, Ecuador has apparently remained skeptical about the whole CBDC phenomenon. In August 2022, Andrés Arauz, the former general director at Ecuador’s central bank, warned eurozone policymakers that a digital euro could potentially disrupt not only privacy but also democracy

Bottom line, the CBDC will not be a standard for financial transactions for the few countries who already tried launching their versions of digital currencies.

However, in the US, the Federal Reserve’s ‘FedNow’ was supposed to be launched sometime in July 2023. Here is the Federal Reserve’s Press Release:

The Federal Reserve announced that the FedNow Service will start operating in July and provided details on preparations for launch. The first week of April, the Federal Reserve will begin the formal certification of participants for launch of the service. Early adopters will complete a customer testing and certification program, informed by feedback from the FedNow Pilot Program, to prepare for sending live transactions through the system.

Certification encompasses a comprehensive testing curriculum with defined expectations for operational readiness and network experience. In June, the Federal Reserve and certified participants will conduct production validation activities to confirm readiness for the July launch.

“We couldn’t be more excited about the forthcoming FedNow launch, which will enable every participating financial institution, the smallest to the largest and from all corners of the country, to offer a modern instant payment solution,” said Ken Montgomery, first vice president of the Federal Reserve Bank of Boston and FedNow program executive. “With the launch drawing near, we urge financial institutions and their industry partners to move full steam ahead with preparations to join the FedNow Service”

For the US population, FedNow is a test that will eventually fail. People will be skeptical about a central bank digital currency once it proves that it is used to surveil people’s spending habits and control what they spend their money on, and God forbid they are anti-war, anti-vaccine activists, homeschoolers, pro-gun supporters or conspiracy theorists, the bankers can cut them off from using CBDCs and then what happens? Will there be riots in the streets?

Since Bitcoin was introduced as an alternative to central bank control, the creation of the CBDC is their answer in hopes of retaining their power, but that idea is not likely to happen, it will in some way, backfire.

When it comes to Bitcoin, it’s a different story. In an interesting article written by Jay Speakman of beincrypto.com ‘When You Buy Bitcoin You Gain Freedom’ says that “in a world where economic and political uncertainties abound, owning Bitcoin (BTC) could provide the path toward financial freedom and autonomy. It’s no longer just about investing in a digital asset. It’s about making a revolutionary move to gain control over your finances and future.” Speakman makes several main points on why people should own Bitcoins and one of those points is that owning sovereign cryptos such as Bitcoins, Ethereum’s and others is a step towards financial freedom:

It provides the opportunity to participate in the global economy without the limitations of traditional banking systems. Bitcoin is not subject to government regulations. At least not yet, and it is free from the inflationary policies which can erode fiat currency values. This means Bitcoin provides an alternative and potentially more secure, store of value

Another reason for owning Bitcoins is for future investment purposes:

Investing in Bitcoin is no longer simply making money. It is about investing in your future and securing your financial freedom. Bitcoin’s decentralized financial system operates independently of central authorities or governments. This means it is resistant to censorship and regulation. Bitcoin holders can make transactions without the need for banks, which are subject to government intervention

“Investment Diversification” is another reason to own Bitcoins since putting all your eggs in one basket, especially in a globalist banking system, is a bit risky:

Investing in Bitcoin can provide portfolio diversification as it is not correlated to traditional assets such as stocks and bonds. This means it may provide a hedge against inflation and market volatility, mitigating the risks associated with traditional investment portfolios

However, owning Bitcoins does have risks like everything else since the “market is notoriously volatile. Prices often fluctuate wildly based on a range of factors, from government regulations to media coverage.” Speakman also mentions that “BTC transactions can result in a permanent loss of funds. There is also the risk of hacking and theft, as these transactions are irreversible and untraceable.”

In conclusion, the article lays out what owning Bitcoins could mean for individuals and investors alike especially for those who do not trust the traditional banking system:

The decision to buy BTC is more than just a financial investment. It’s a move towards financial freedom, control, and security. Bitcoin’s feature of allowing individuals to act as their own banks. Providing a secure alternative to traditional banking systems which have exhibited instability and vulnerability to failures. Furthermore, the appeal goes beyond just financial security and autonomy. The digital currency resonates with libertarians who value individual freedom and limited government intervention. Despite a torrent of dissenting voices Bitcoin continues to gain mainstream adoption. As the technology continues to mature, it may address some of the concerns raised by the dissenting voices.

Investing in digital assets may involve risks such as volatility and the potential for hacking and theft. Yet, the benefits of financial freedom outweigh the downsides. As the world becomes increasingly uncertain, owning Bitcoin could be the first step toward financial security and autonomy

When you look at the difference between CBDCs along with the system imposed by international banking cartels who still maintain some form of financial dominance versus the Bitcoin revolution, there is a difference. CBDCs means no financial freedoms and owning Bitcoins means the exact opposite. Even though Bitcoins are still in the early stages, there is hope in the new crypto technology. But like everything else, you should be cautious, do not invest 100% of your net worth in just one asset, in other words, invest maybe 5% in bitcoins, and the rest? 15% in emergency preparedness (food, water filters, guns, flashlights, etc.) 20% in real estate or invest in a second passport, 20% in hard assets like gold, silver and copper, 20% in high-end watches, antiques, aged wines and liquor, collectibles etc. and the last 20% in foreign stocks especially those that are in politically stabilized environments or in gold and silver mining companies, but that’s just my opinion.

Government-backed CBDCs will be a failure because the people already do not trust international banking cartels to totally control their finances. So, for these banks to have total control over your financial wellbeing under their CBDC scheme would be an extremely difficult task for them to manage.

The banking cartel or the financial bureaucrats are about to discover that they will be in over their heads with an angry population. Just imagine if the banking cartels, certain governments and their corporate conglomerates are in control over the people’s finances, they will get to determine who eats and who will starve. This is the ultimate power grab the globalist bankers have been dreaming about for a very long time, but will the people stop this from happening? I’m an optimist, so I believe that they will demand their financial freedoms and that is something of value that they can hold and control in their own hands. The case for CBDCs will be a hard sell, so central banks who are proposing this idea should think twice about what they are trying to impose on the public, if not, they will face some form of resistance just like they did in Nigeria.