By Prof. Anthony J. Hall

Source: Global Research

In late February the international news cycle moved between two very important focuses. One addressed controversies in Canada. The other continues to highlight events unfolding primarily in Russia, Ukraine, and the USA. While different in many ways, both stories have many-faceted worldwide implications.

Both involve configurations of power and intrigue that overlap in crucial ways. Both involve conflicts with profound life-and-death implications. Both conflicts highlight that humanity and our civilizational inheritances are at a crossroads.

At this parting of the ways, the most well-travelled autobahn looming up ahead points towards tyrannies far more extreme than anything we have known in history so far.

Whatever highway we follow, it seems there is no escaping the onslaught of new forms of aggressive warfare that are fast pushing humanity into a jagged collision with high-tech weaponry capable of unprecedented destruction. To say we are living in dangerous times is a gross understatement.

Will humanity be subjected to even greater extremes of outright militarization? Will we continue to be assaulted by a novel array of overt and covert tactics aimed at radically re-engineering society as well as the very genetic attributes of the human genome? Will human beings continue to be reconfigured to advance the conditions of our decline into submissive enslavement? Will we continue to be subject to litanies of media lies, strategies of behavior modification, and unregulated medical experiments aimed at merging our biological persons with aspects of digital technology?

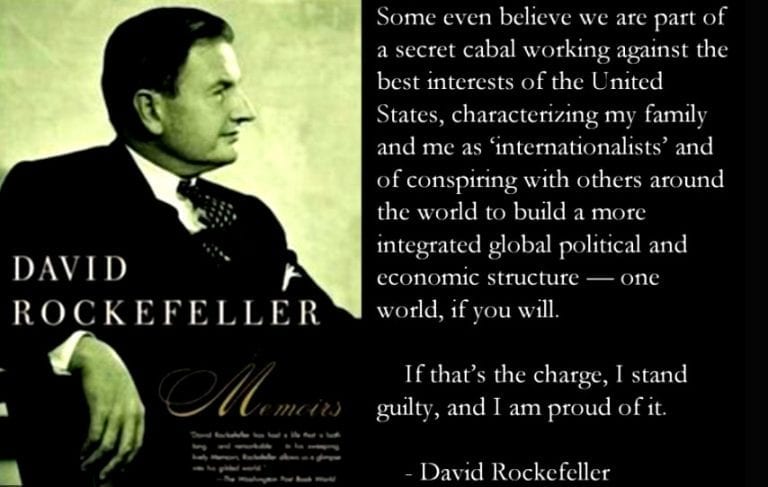

Some common themes wind through the convoluted array of unregulated assaults that menace humanity’s very survival in anything like the God-given form we inherited from nature. Powerful enemy forces are exploiting for their own self-interested advantage, our credulousness, naivety, and susceptibility to programs of mind control. The goal of the master class, it seems, is to modify our behavior so we can be better integrated into a world of pervasive robotization.

Enslavement With the Help of Digital IDs Combined with Cashless Transactions

Right now in the Western countries’ onslaughts of psychological warfare are integral to the military showdown initiated in Eurasia.

While experts in “perception management” are using the media to lure the public into single-minded condemnation of Russia, our attention is being drawn away from stunning revelations coming to light in our midst.

The disclosures underway illuminate the role of COVID Officialdom in forcing on us through mandates and other coercive techniques, highly lethal and injurious medical procedures. These procedures have been purposely designed to induce pathogenic outcomes and depopulation agendas. Throughout Europe and North America, dramatic increases in all-cause rates of death are being reported especially by life insurance companies and funeral homes.

France’s Finance Minister: “We’re waging an all-out economic and financial war on Russia”

One result is that Pfizer and Moderna investors are “running for the exit.” Former BlackRock investment advisor, Edward Dowd, has sounded the alarm on Moderna and Pfizer “as sinking ships that investors need to abandon.”

See this.

The bad news for the vaccine companies and their notoriously negligent regulators is compounded by the fact that their indemnification is threatened.

The companies and their regulators can be sued if it can be demonstrated that they have lied about their products. Indeed, they have lied on an epic scale and continue to do so. The evidence is clear that the inadequately-tested medical injections advertised as “safe and effective” are no such thing. Now there are headlines proclaiming, “Pfizer and Moderna are modern versions of Enron.”

As blanket coverage of the Ukrainian conflict dominates the media, the next stage in the insidious COVID con is being executed with blitzkrieg speed. The objective is to rush humanity into a privatized system of universalized and standardized Digital ID before most people have an opportunity to get informed on the fuller implications.

The growing contingent of people devoted to principled non-compliance to the myriad COVID frauds must resist allowing the COVID hucksters to advance their diabolical agenda. The COVID con men and women must be forced to back away from their attempt at making sweeping appropriations and instrumentalizations of yet more elements of our private information. We need to hold the line against slick kleptocrats seeking total control of everything through digital invasion and theft of the little that remains of our personal realms.

Included in the Digital ID con job is the creation of a new type of One World digital currency presently being rushed into existence by the private central banks holding membership in the Swiss-based Bank of International Settlements (BIS). This process is being pushed ahead in partnership with the dystopian World Economic Forum (WEF).

Recently Klaus Schwab, the WEF’s founder, bragged that more than one-half of Prime Minister Justin Trudeau’s Canadian cabinet is infiltrated with WEF insiders. Chrystia Freeland, the Deputy Prime Minister of Canada, is one of them.

In fact Freeland is currently a prominent member of the WEF’s governing body of trustees. As shall become clear, Freeland is emblematic of the abundant conflicts-of-interest and round-the-clock lies that have come to characterize the Liberal Party during the time of Trudeau’s denigration of public office in Canada.

See this, this, this and this.

A pervasive system of social credit scoring is taking shape with the rush to entrench in many jurisdictions a transnational system of Digital IDs. The other necessary element is our willingness to go along with the creation of a single digital currency. The new system requires the consolidation of a One World megabank that is meant as a key element in the so-called Great Reset.

The advancement of a system of total surveillance and total control requires the termination of all cash transactions. Hence our insistence on continuing the conduct of business through the circulation of cash must be an expression of our principled non-compliance.

The merger of Digital ID together with the replacement of cash transactions would give central authorities the ability to cut off our “freedoms,” including, for instance, even our capacity to buy food. The entrapment of people in digital enclosures would put the vast majority of humans in a virtual penitentiary of unmitigated top-down authority.

See this.

A Matter of Life or Death for Russia

The creation of a social credit dystopia is being pushed rapidly forward under the cover of wall-to-wall coverage devoted to Russia’s intervention in Ukraine. According to Russian President Vladimir Putin, Russian troops are intervening with the goal of “demilitarizing and denazifying Ukraine.”

It is also thought that Putin intends to dismantle about fifteen US biological warfare labs. The Pentagon sponsors of these “research facilities” for mass murder would have us believe they are engaged in a “Biologic Threat Reduction Program.”

In his memorable speech of 24 Feb., Putin claims that the Russian mission in Ukraine, “is not a plan to occupy the Ukrainian territory.” The Russian government asserts that its actions in Ukraine are necessary for the protection of the Russian Mother Country. Over many years Putin has been stressing the themes that the Russian Armed Forces are now acting upon.

The explanation of this military operation as an act of self-defense depends on a historical analysis highlighting the decades-long campaign to strangle Russia in a boa constrictor’s grip of NATO’s aggressive militarism. The core agreements enabling the end of the Cold War have been violated by the patterns of NATO’s expansion since 1991.

NATO has been ingesting former Soviet republics into a US-backed militarized zone of organized anti-Russia zealotry. As Putin warned again and again over recent years, the US goal of transforming Ukraine into yet another militarized enemy of Moscow established a “red line,” a “matter of life or death” for Russia.

See this.

Note to readers: Please click the share buttons above or below. Follow us on Instagram, @globalresearch_crg and Twitter at @crglobalization. Forward this article to your email lists. Crosspost on your blog site, internet forums, etc.

Dr. Anthony Hallis editor in chief of the American Herald Tribune. He is currently Professor of Globalization Studies at University of Lethbridge in Alberta Canada. He has been a teacher in the Canadian university system since 1982. Dr. Hall, has recently finished a big two-volume publishing project at McGill-Queen’s University Press entitled “The Bowl with One Spoon”.

He is a regular contributor to Global Research.