By Dr. Tim Coles

Source: Waking Times

There is a new, mega-rich global elite consisting of a small number of billionaires and multibillionaires. Many of them made their money in the technology sector. Others play financial markets or inherit fortunes. They are wealthier and more powerful than some entire nation-states.

The British Ministry of Defence (MoD) says:

“Whilst there have always been differences between the wealthier, better educated and the less privileged, these differences appear likely to widen in the coming decades.”

The mega-rich deliberately order the world in ways that guarantee their wealth by institutionalising inequality. Occasionally, this is admitted. In 1997, a book published by the Royal Institute for International Affairs in the UK acknowledged:

“The present international order may not be the best of all possible worlds, but for one of the ‘fat cats of the West’ enjoying a privileged position in an international society that is structured and organised in ways which perpetuate those privileges, there are good reasons for not pursuing radical change.”

This is also true of internal policymaking. The third richest man in the world, Warren Buffett (worth over $80bn), confirmed this: “There’s been class warfare for the last 20 years, and my class has won.” This echoes his statement in 2006, just prior to the global financial crisis: “There’s class warfare all right… but it’s my class, the rich class, that’s making war, and we’re winning.” Around the same time, the liquidity firm Citigroup circulated an investor memo, stating: “Society and governments need to be amenable to disproportionately allow/encourage the few to retain that fatter profit share.” More recently, the UK MoD admitted: “In the coming decades, the very highest earners will almost certainly remain rich, entrenching the power of a small elite. Vested interests could reduce the prospect of economic reforms that would benefit the poorest.”

Consider the enormous concentration of wealth and power that results from this imbalance.

Ever-Increasing Power

Global and national inequality is staggering and getting worse. By 2011, a mere 147 – mainly US and European – corporations owned and controlled 40% of world trade and investment. Just four corporations influence the profitability and power of these 147: McGraw-Hill, which owns Standard & Poor’s ratings agency; Northwestern Mutual, owner of the indexer Russell Investments; the CME Group, which owns 90% of the Dow Jones market index; and Barclay’s bond fund index. Evaluative decisions by analysts at these firms affect the wealth and performance of each of the 147 giants.

That’s corporate wealth concentration. But what about wealth concentration among individuals?

There are 7.7 billion people in the world. Of those, just 2,153 are billionaires. According to Forbes, their combined wealth totals $8.7 trillion. The list of billionaires reflects where power is most concentrated: in the US. While China and Europe’s number of billionaires declined in the previous 12 months, the US and Brazil gained billionaires. The US is home to 607 billionaires or 0.000001% of the population. It is worth noting that President Donald Trump was a billionaire before he came to power. Trump has cut taxes for his fellow billionaires. As an indication of continued wealth concentration, consider the wealth disparity among the billionaire class itself. He Xiangjian, founder of the Midea Group, is the joint-50th richest person, worth over $19.8bn. Jeff Bezos, by comparison, the founder of Amazon, is the richest man in the world, worth over $131bn – more than six times He Xiangjian.

Part of the problem has been the US-led imposition of an economic dogma called “neoliberalism” (which is neither new nor liberal) on much of the rest of the world.

Neoliberalism can be roughly defined as:

1) Financialisation, i.e., allowing investors to make money from money as opposed to tangible things;

2) Deregulating financial services;

3) Taking out government insurance policies so that working people bail out financial institutions;

4) Cutting taxes for the wealthy;

5) Privatising public services to reduce social mobility;

6) Imposing austerity to make markets more attractive to investors.

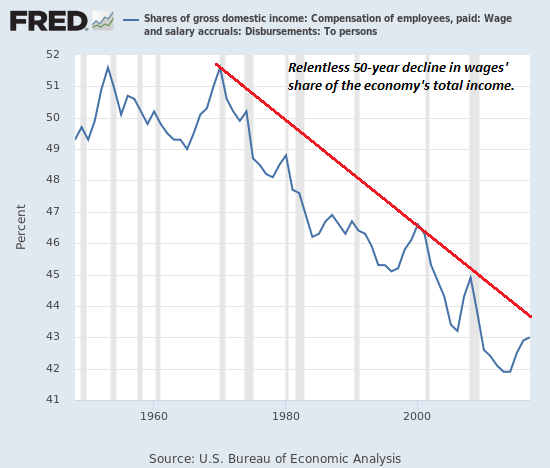

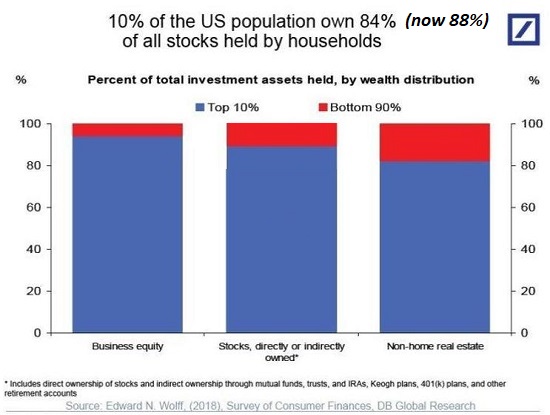

Neoliberalism has cut taxes for the super-rich, enabling them to hold onto their wealth at the expense of others. According to Oxfam, the average rate of personal income tax for the wealthy was 62% in 1970. In 2013, it was 38%. In the UK, the poorest 10% pay a higher proportion of their income in taxes than the richest 10%. Global GDP, i.e., how much money there is in the world, is $80 trillion. But, of this, $7.6 trillion is untaxed. In the decade since the financial crisis, the number of billionaires doubled. This reveals that the system rewards greed. In 2017, 43 people owned as much wealth as half the world’s poorest. In 2018, the number was 26.

To put all this into perspective, Jeff Bezos owns as much wealth as the poorest fifty countries. When it comes to more ‘developed’ nations, Bezos’s wealth equals the entire GDP of Hungary. Consider how Bezos makes his money. Amazon is a corporation that primarily advertises and delivers products. The innovation, design, and investment in and of those products is the work of others. Amazon treats “workers like robots” by spying on them, discouraging unions, offering insecure contracts, and encouraging long hours. Amazon is also notorious for paying little or no corporation tax. Amazon is an online retailer. The Internet was developed by the US Defense Department in the 1960s as ARPANET, with public money. The satellites that enable online transactions are first and foremost military hardware. Not only did Amazon take advantage of state-funded innovation, but it also rewards government investors by selling the CIA cloud technology and the Pentagon artificial intelligence.

Bezos is far from being the only one. Bill Gates’s Microsoft and the late Steve Jobs’s Apple, which became the first trillion-dollar company, also enjoy low taxes, technologies developed with government grants, and procurement contracts.

Consider also the immoral activities of other hi-tech nouvelle méga riche. Without making it clear to users, Facebook founder Mark Zuckerberg (worth $66bn) has made his money by selling personal data to insurers and advertisers. Scientists have used Facebook in social media experiments without the knowledge or consent of users in an effort to see how memes affect mood.

Other mega-rich, including the hedge fund manager Robert Mercer of Renaissance Technologies, used Facebook to market political candidates. Other tech billionaires include Google founders Larry Page and Sergey Brin. Google technology was funded by the CIA’s venture capital firm In-Q-Tel. Also relying on technologies developed by the Pentagon with workers’ tax dollars, the company cooperates with the National Security Agency to spy on citizens and it has even enabled US assassination programmes.

Consequences

How do the billionaires get away with it, and what are the social and political consequences? The examples below are from the US, but it should be noted that the US exports its mega-wealth model.

A study by Martin Gilens and Benjamin I. Page on plutocracy (government by the rich) notes that the rich buy political parties. Politicians draft and/or vote for laws that help the rich. The authors analysed 1,779 policy issues in the US and conclude that “average citizens and mass-based interest groups have little or no independent influence.” Unlike the public, “economic elites and organised groups representing business interests have substantial independent impacts on US government policy.” Other research into wealth inequality in the US finds that “[c]ertain policies, such as the decreased support for unions and tax cuts favouring the relatively well-off and corporations, have benefitted a small minority of the population at the expense of the majority and have thus contributed to widening income inequality.”

At the turn of the last century, 9% of American families owned 71% of the nation’s wealth. The elite of the day included familiar names: John D. Rockefeller (oil), J.P. Morgan (banking), W. Averell Harriman (industry), and so on. Things balanced out after the Second World War, with the majority of Americans becoming middle class. Gradually, state controls over the economy were removed, and the situation reverted to the inequality of bygone centuries.

Since the 1970s, the US middle class has been shrinking. Until recently, the middle classes of Asia grew, precisely because strong Asian economies (notably China, South Korea, and Singapore) either retained some state controls or refused to adopt the US neoliberal model.

Alan B. Krueger, a labour economist and key Obama advisor, explains that, “since the 1970s income has grown more for families at the top of the income distribution than in the middle, and it has shrunk for those at the bottom.” Between 1979 and 2007, the top 1% ((multi)millionaires and (multi)billionaires) enjoyed a 278% increase in their after-tax incomes. But 60% of Americans saw their incomes rise by just 40%, which when adjusted for rising living costs means stagnation. Krueger notes that during that period, $1.1 trillion of annual income was moved to the top 1%. “Put another way, the increase in the share of income going to the top 1% over this period exceeds the total amount of income that the entire bottom 40 percent of households receives.”

The exportation of this model means that Australia, Britain, and Canada became what the billionaire-dollar liquidity firm Citigroup calls “plutonomies,” economies in which the rich drive luxury goods markets such as jewellery, fashion, cruises, and sports cars: hence the recent entry of celebrity Kylie Jenner into the billionaire class. The Citigroup document also notes that in plutonomies the top 1% owns 40% as much wealth as the bottom 95%. No matter where you live, you can’t escape the institutional structures that create inequality.

The US military exists, in part, to maintain the unjust status quo. Yet, it acknowledges the dangers of dominance: “A global populace that is increasingly attuned and sensitive to disparities in economic resources and the diffusion of social influence,” thanks in part to the very technologies that enrich the rich, “will lead to further challenges to the status quo and lead to system rattling events,” like Brexit or the Yellow Vest protestors in France.

The mega-rich and international think tanks and forums they sponsor are beginning to reluctantly accept that their status quo political puppets might get voted out of office and give way to so-called far-left or far-right parties unless they address wealth inequality.

New Paradigms of Control

The question, then, is how to deal with the restless and disaffected majority while not radically altering the system and taking away the privileges of the elite. In 1961, US President John F Kennedy said: “If a free society cannot help the many who are poor, it cannot save the few who are rich.” In the 1980s, World Economic Forum founder Klaus Schwab said: “Economic globalisation has entered a critical phase. A mounting backlash against its effects… is threatening a very disruptive impact on economic activity and social stability in many countries… This can easily turn into revolt.” More recently, he said: “Today, we face a backlash against that system and the elites who are considered to be its unilateral beneficiaries.” Likewise, the billionaire Johann Rupert of Cartier jewellery (one of the many luxury services driving plutonomies) said: “We are destroying the middle classes at this stage and it will affect us.” Similarly, the British MoD discusses “[m]anagement of societal inequalities,” as opposed to the elimination of social inequality.

Many of the new elites make people redundant by automating the workplace. While Amazon still relies on human shelf-stackers and delivery drivers, it uses an increasing number of physical robots to stack shelves and algorithmic robots to assist online customers. Likewise, Facebook and Google’s content filters rely on heavy automation. This is creating precarious employment conditions. According to the Washington Post (which is owned by Bezos): “…the modern emerging workforce of tech, urbanised professionals, and ‘gig economy’ labourers all represent an entirely new political demographic.” Politicians then “focus more on education, research and entrepreneurship, and less on regulations and the priorities of labour unions.”

But there are many problems. For one thing, the financial services economy, which markets everything, has made “education” a form of unsustainable debt. The quality of US education is notoriously low by world standards, and many young people are “overqualified” for menial jobs, like delivering for Uber or stacking shelves in Amazon warehouses. The UK MoD acknowledges that, “Freelance work is… often low-paid, lacking the benefits and security of formal employment and, therefore, the growth of the gig economy could increase inequality.”

The crisis of what to do with a young, indebted, restless population automated out of steady work by – and competing with – algorithms and physical robots has been considered for at least 50 years.

Traditionally, ‘education’ meant brainwashing children to work in menial jobs for life in adulthood. But as the economy changes and employment becomes less stable, new methods of ‘education’ for re-skilling adults are required. In the late 1960s, future political advisor Zbigniew Brzezinski authored a book in which he advocated for lifelong learning as a way of re-skilling an aging population that finds its employment opportunities diminished, as small-to-medium-sized businesses get overtaken by tech giants. Around the same time, the British Labour Party (when it was a real labour party) introduced the Open University with the aim of providing lifelong learning. Likewise, in the 1980s, futurist Alvin Toffler envisaged an “electronic village” in which flexible working hours and lifelong learning would be required in a hi-tech economy.

To keep the poor from rioting while trapping them in a system that works for those who design it, today’s multibillionaire elites help to privatise public services and education by offering scholarships and infrastructure investments. In doing so, they train poor people to work for their system by developing others’ technology skills while hiding their own taxable wealth in charity foundations.

Howard G. Buffett is the son of Warren. While enjoying largely tax-free wealth that further impoverishes the global poor, the Buffetts, via Howard’s foundation, invest in dams and irrigation in the poorest nations of Africa. Bezos’s foundation awards scholarships for STEM courses (Science, Technology, Engineering, Mathematics). Zuckerberg’s foundation seeks “to find new ways to leverage technology, community-driven solutions, and collaboration to accelerate progress in Science, Education, and within our Justice & Opportunity work.”

Conclusion

By using free online services, we have allowed ourselves to be the products that tech giants sell to advertisers. By not organising to raise taxes on the mega-wealthy, we have underfunded our public services. By not keeping an eye on who’s funding what, we’ve allowed our political parties to hoover up donations from elites. By failing to understand the economy, we’ve allowed a new normal of instability and political uncertainty to flourish to the advantage of asset managers and hedge fund investors. As the US pursues global domination, this model will continue to be exported. It’s time to wake up.