It’s not that people are lazy, there’s something much deeper going on that requires better questions.

By Joe Martino

Source: The Pulse

Last time I wrote about the increasing mental health crisis happening around the world. I didn’t write it to bring about negativity but more so to bring awareness to the reality of our current moment. Awareness is the first step toward any change.

That piece coupled with a video I did the other day on a collectively felt sense of meaninglessness, I believe these two subjects go hand in hand.

Tied in with both of those subjects is the decade-over-decade increase in the difficulty of surviving financially in our modern world.

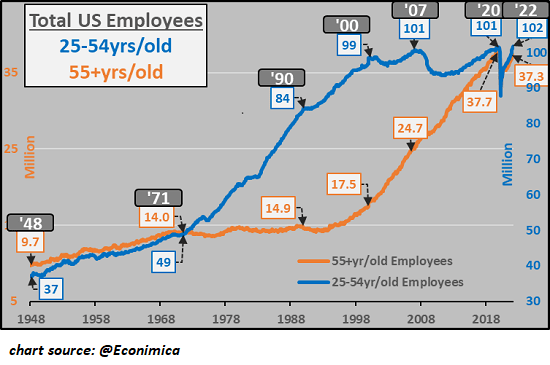

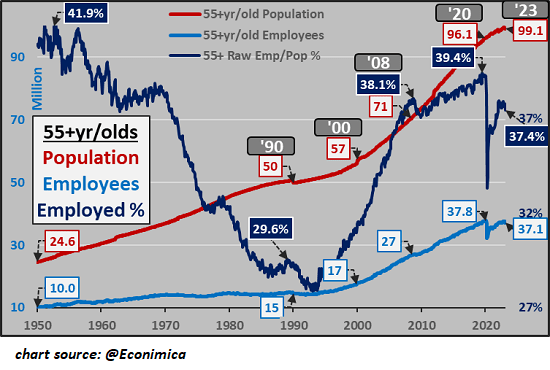

More and more younger people have been struggling to buy a home and make ends meet due to the high cost of living and stagnating wages. For many, affording necessities in life has become difficult despite working 40-60 hours per week.

This reality recently drove a viral TikTok video that highlights the frustration younger generations feel and the misconceptions associated with their position.

Before you watch it, conversations I have with people about this issue don’t just exist in the Gen Z and Millenial age group. I’ve spoken to people in their 50s and 60s who have also become completely disenfranchised about the state of work.

Also, Quiet Quitting is a trend on the rise. Simply put, people are going to work and doing the bare minimum to stay employed at greater and greater rates. Gallup estimates that in the US 50% of employees have Quiet Quit and that it’s an increasing crisis. In Japan, 94% of employees report being disengaged at work.

Perhaps unsurprisingly, Gallup blames the trend on poor management. This is where humans really have to start waking up and thinking bigger in my opinion, more on this shortly.

Alright, let’s get to the video.

She makes many good points, and if we take her words to heart, clearly she isn’t lazy and trying to ‘not work.’ She is passionate about her work but sees the gap between salary and the reality of living a comfortable life. She also sees the value in work… just not like how it is today.

Not surprisingly, many have agreed with her while many have attacked her. Let’s explore why she might feel this way about life and work. (Note: There is an element that sometimes people can judge, hate, and avoid work so much that it’s a self sabotage situation, I talk about that here.)

- She and the generation she represents, even people like her from other generations, are just lazy or may even grow out of this idea.

- She’s lying about enjoying her job and if she were to quit and do something she likes she’d find just enough satisfaction to not care about the fact that she can’t afford to do anything beyond eat, have shelter, and enjoy a few things.

- Maybe she’s just permanently unhappy and therefore no matter what she does, she will find a way to frame it as negative and bad.

- From a position of common sense and orienting to our current environment, this girl realizes the losing game she is part of and is making the observation that this isn’t a reasonable game to play.

As an extension to number 4, the fact that multiple generations of people not only realize how rigged the game is, don’t want to play the game AND are saying something about it provides an evolutionary pressure for society to address it.

The key is, can we listen vs. sitting in judgment?

Oddly, reaction videos are all the craze on YouTube these days. When people make videos like hers or when something happens, creators turn on their cameras and watch the video while simultaneously reacting to it.

Usually, creators reacting to videos like this from Gen Z’ers are well off themselves or conservatives. Their career often stems around having a ‘hot take,’ creating polarity, and leaning into drama so their content can get a lot of views and thus pay their bills.

Sadly, this dynamic in content creation is often missed by the user, not realizing that the host of the video says what they say primarily because they know it will make them money even if it’s not entirely what they think.

Further, we never get to the bottom of what people bring forth because we are skipping the step of coming to the table in good faith and empathizing with each other’s position. Instead, we get a culture stuck in a debating/debunking/warring mindset. Good luck getting good faith conversation to go viral when most out there are focused on hi-jacking your attention.

Sensing Beyond The Surface

Sensing Beyond The Surface

- ‘Working’ is Important – Being part of something, contributing to something, living in a community and having a role, all add meaning and purpose to life.

Being a creative, productive person is a necessity for human well-being, even if only for a few hours a day. No one is saying let’s sit around and do nothing all day. But should we have to work 40 or 50 hours a week to simply survive? No, that is the result of poor system design. We have advanced our technology incredibly to provide the necessities of life yet we work more than we ever have. Doesn’t something seem wrong there?

Our cultural idea of needing to work 40 hours a week for most of our lives ‘just to be a contributor’ is rather warped. Many cultures have thrived working a few hours a day, yet look at us – working constantly yet experiencing mental illness, poor health, and meaninglessness at massive rates.

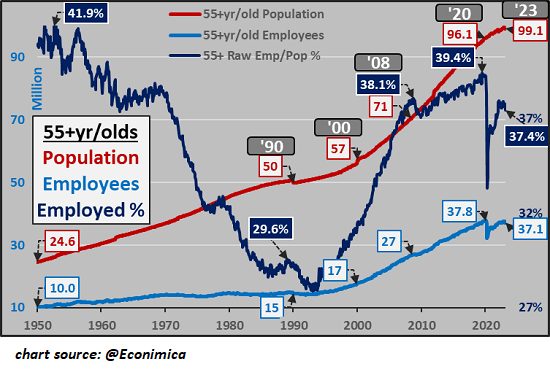

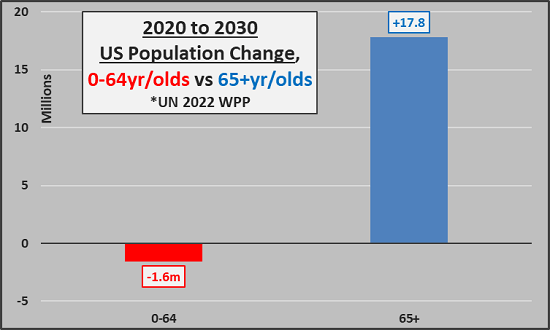

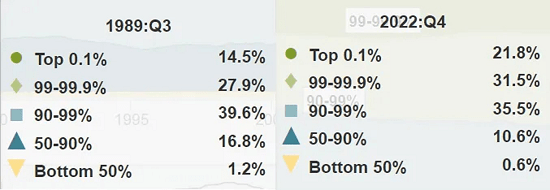

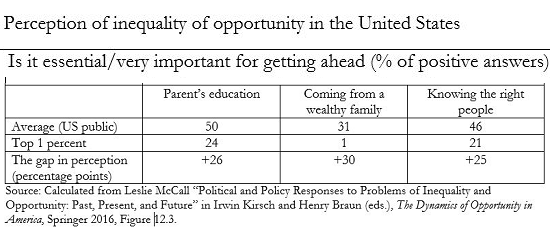

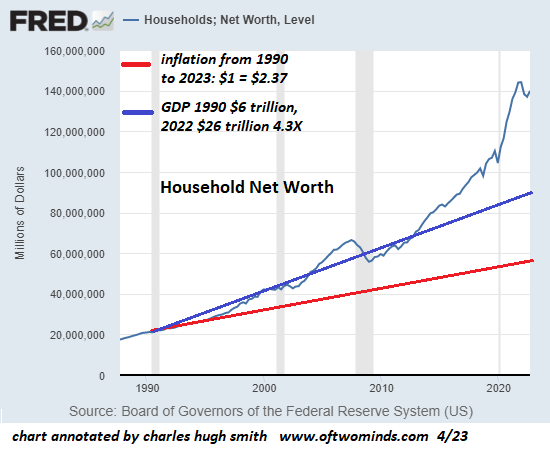

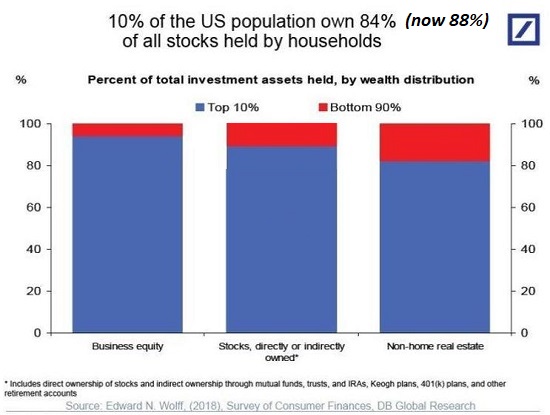

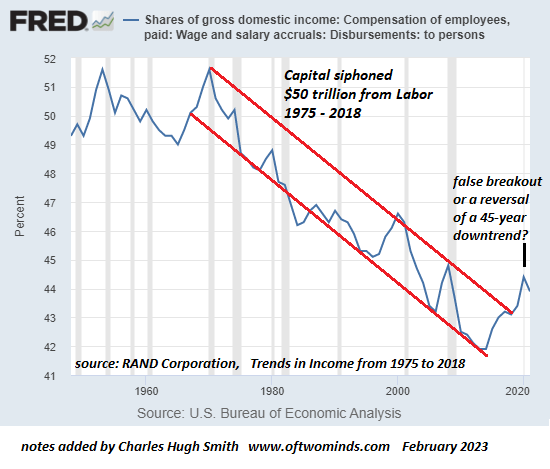

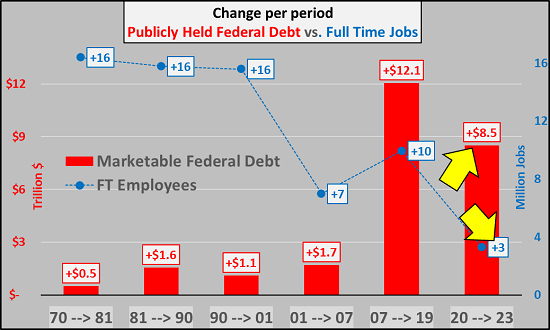

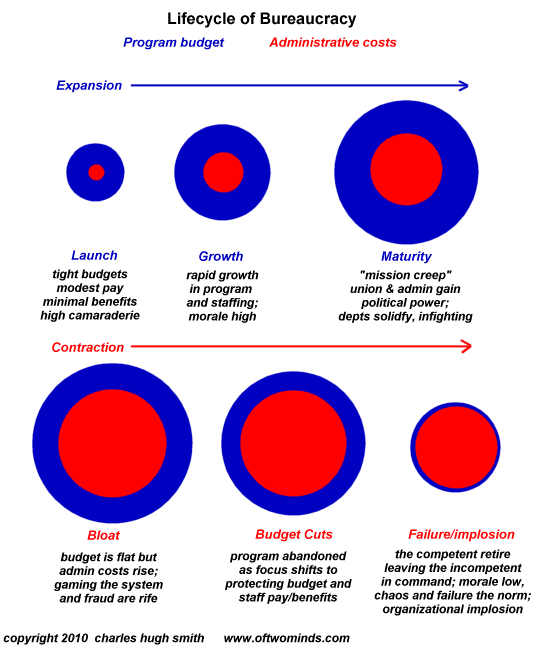

It would benefit us to have a deeper look at WHY our society is currently producing results no one wants all while destroying our environment and people. Too many discussions about this topic think small and are limited to lazy questions from system protectors or political ideologies. This won’t get us to the root of the issue and why people feel the way they do. - Cost of Living is Too High, But Why? – I’m 36, when my parents were my age one worked a mid-level job in corporate and the other a grocery store. They made enough to buy a fairly big house near Toronto, pay off the mortgage by 40 and raise two kids. These days, they’d need to make $100,000+ each just to buy the same house, and forget about paying off the mortgage by 40. Even when interest rates were 22% back then, things were a lot easier.

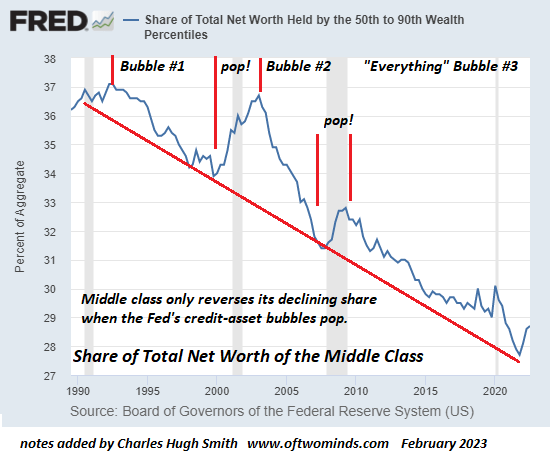

Often, when I talk about mortgage rates with older generations, and how it is becoming hard to afford homes, they say “Back in my day rates were 18% – 22%.” The sense that people aren’t listening to what is being said is palatable. We’re not thinking clearly. In 1945 a US citizen dedicated on average 25% of his salary to pay rent/mortgage. In 2019 it was 47%. It’s higher now. And of course in that time interest rates have come down dramatically. Plain and simple, the cost of living has risen incredibly and wages didn’t climb at anywhere near the same rate.

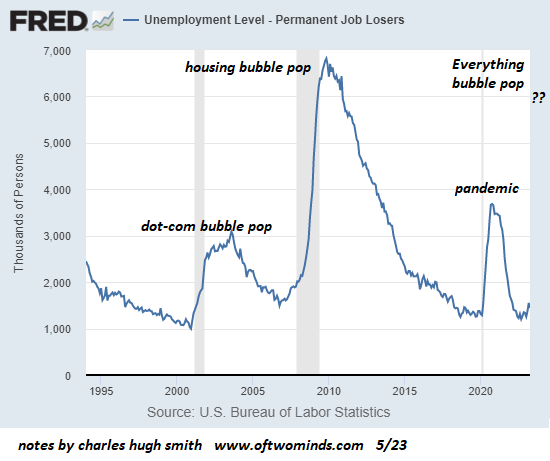

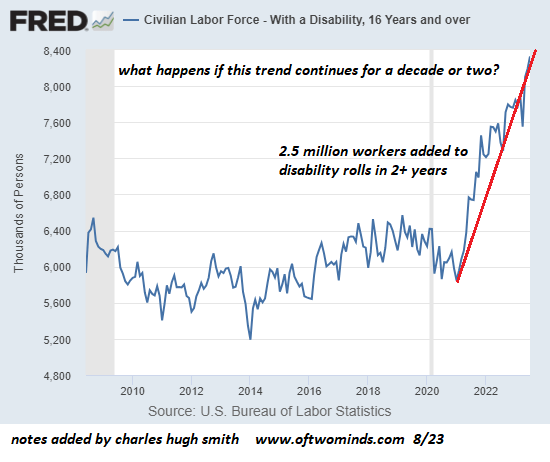

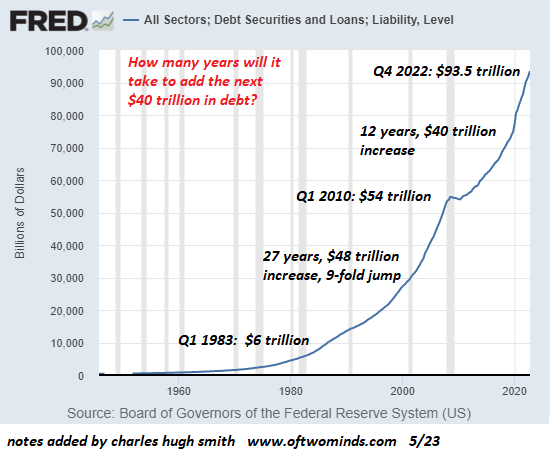

This is a losing game, and only set to get worse given the path we’re on. That said, this is what anyone should expect in a system driven by fractional reserve banking. When we understand the design of our system, we understand this isn’t about one political view or another, it’s about bad system design. We have to think deeper. - Evolutionary Pressure – As our society declines more and more, younger people who look ahead to their future see something undesirable. The life their parents lived is no longer possible and they see the game is rigged. They aren’t lazy, they are demoralized.

A left hemisphere reductionist and othering view, who sees humans as cogs in a system might say “Nah, people are lazy. Grow up. Things are fine.” Yet when we take a step back and include a sense of something sacred, our entire perspective changes. Why are we seeing life and merely working to uphold a rigged economy? Is this really all we are capable of? Why are we always trying to protect societal design producing results we don’t like? Do we realize we made all this up and it can be different?

Sure, there are aspects of younger generations that I think are immature too, we’ve all been through it, but at the same time, younger people are not buying the rigged game and thus are not dying to play it. They are right. They are smart to speak up.

And to tie things back to meaninglessness and mental health issues, I think we’re seeing now how this all ties into our current moment. People don’t thrive playing a losing game where basic needs are gated behind 100 foot walls.

Movements toward system redesign have been around for many many decades. It’s not a new idea to discuss how rigged, limiting, and problematic our existing societal design is, but more people are waking up to it now.

When I spoke about this stuff in 2009 and 2010, most people laughed at me thinking I was nuts. Now, they mostly agree with me. We’re on fertile ground for something new. For a while, we’ll likely live feeling and sensing the possibility of a new society while living in the old. Feeling that we’re not sure we quite belong to a visible society entirely.

This is the Metacrisis. This is the shift in consciousness as I’ve always called it. It’s an evolutionary pressure that begs us to look deeper than political ideology and hot takes on why someone we don’t agree with is wrong. It begs us to re-taste the sacred. To examine what it means to be human and why we’re here.

I believe the speed at which it unfolds is intimately connected to the quality of our attention, consciousness and state of being. The more capacity we have to steward a better world, the more it will unfold.

Change starts within.