By Charles Hugh Smith

Source: Of Two Minds

Inequality is America’s Monster Id, and we’re continuing to fuel its future rampage daily.

What’s changed and what hasn’t in the past year? What hasn’t changed is easy:

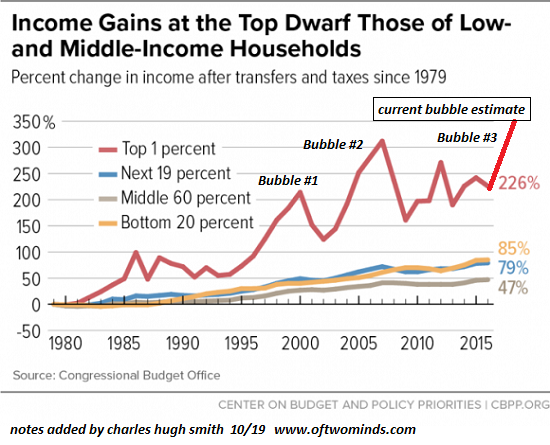

1. Wealth / income inequality is still increasing. (see chart #1 below)

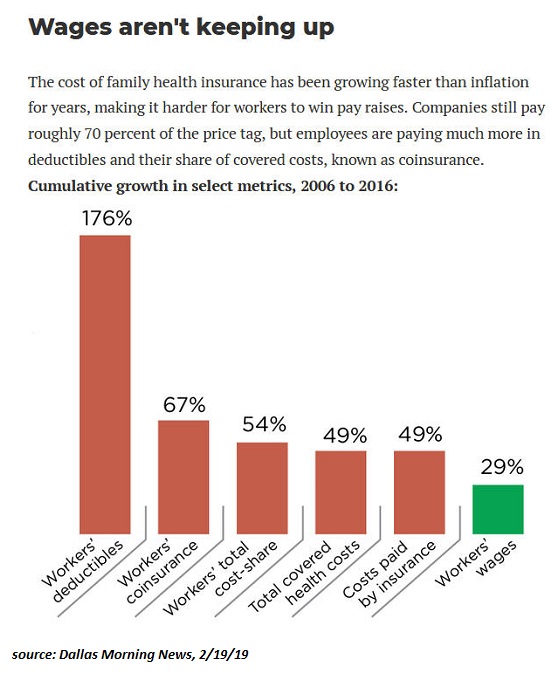

2. Wages / labor’s share of the economy is still plummeting as financial speculation’s share has soared. (see chart #2 below)

What’s changed is also obvious:

1. Money velocity has cratered. (see chart #3 below)

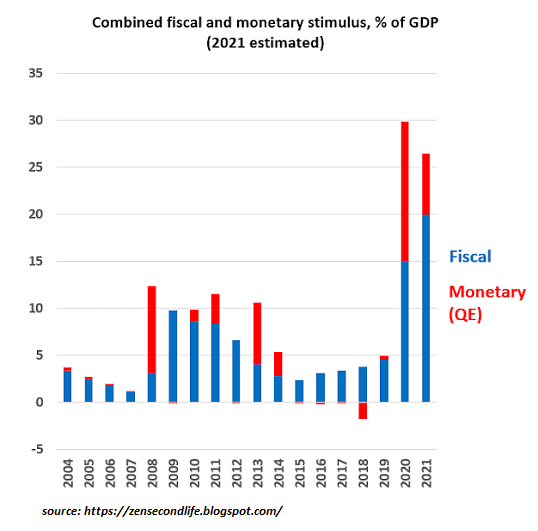

2. Federal borrowing / spending has skyrocketed, pushing federal debt to unprecedented levels. (see chart #4 below)

3. Speculation has reached the society-wide mania level. This is evidenced by record margin debt levels, record levels of financial assets compared to GDP and many other indicators. (see chart #5 below)

Interestingly, every one of historian Peter Turchin’s 3-point Political Stress Index is now checked. Recall that these are core drivers of consequential social disorder, the kind that leads to empires collapsing, the overthrow of ruling elites, social revolutions, etc.

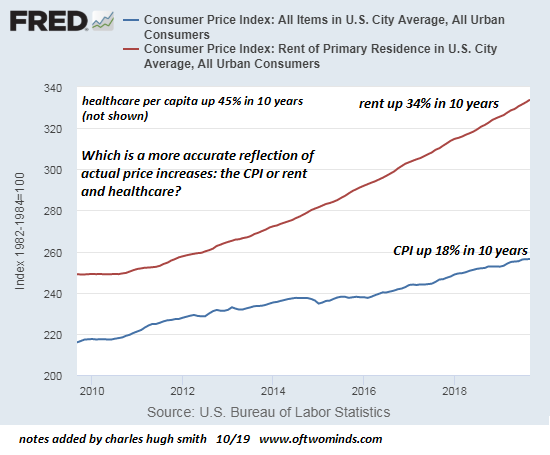

1. Stagnating real wages (i.e. adjusted for real-world inflation): check

2. Overproduction of parasitic elites: double-triple check

3. Deterioration of central state finances: check

But what about social changes? This is an interesting topic because social changes are less easily tracked (few even ask relevant questions and compile the data). Social trends are often more difficult to discern, as surveys may not track actual changes in behavior: people may give answers they reckon are expected or acceptable.

Here are four long-term trends that may have been accelerated by the pandemic:

1. The residents of overcrowded tourist destinations are sick of tourists and are demanding limits that protect increasingly fragile environments and resident quality of life.

Here’s a typical observation of a resident in Hawaii now that tourists are coming back:

Sunday I saw a group of 30 spring break tourists littering the beach with red cups and bottles of alcohol and trash. They had a table full of booze on the beach and were happily leaving their trash everywhere. No masks and no cares for Hawaii. When they left, instead of using the beach access they all climbed over the fence into someone’s yard because it saved them a minute of walking.

No I don’t miss tourists.

This is a global phenomenon. The absence of tourists has awakened a powerful sense that the profits (which flow into elite hands, not local economies) have taken precedence over the protection of what makes the destination worth visiting.

2. Work from home is here to stay. The benefits are too personal and powerful. Corporations demanding a return to long commutes and central offices will find their most productive employees are giving them “take this job and shove it” notices as they find positions with companies that understand that you can’t turn back the clock or ignore the benefits of flexible schedules.

3. Consumer behaviors have changed and are continuing to change. This is not just an expansion of home delivery; it’s a re-appraisal of big-ticket spending on concerts, entertainment, sports events and many other sectors that depend solely on free-spending consumers who ignore the recent doubling or tripling of prices.

4. Perceptions of the wealthy are changing. I touched on this topic in The Coming War on Wealth and the Wealthy (1/5/21) and The Coming Revolt of the Middle Class (1/27/21). Inequality is America’s Monster Id, and we’re continuing to fuel its future rampage daily.