By Charles Hugh Smith

Source: Of Two Minds

I do not claim any expertise in social contract theory, but in broad brush we can delineate two implicit contracts: one between the citizenry and the state (government) and another between citizens.

We can distinguish between the two by considering a rural county fair. Most of the labor to stage the fair is volunteered by the citizenry for the good of their community and fellow citizens; they are not coerced to do so by the government, nor does the government levy taxes to pay its employees or contractors to stage the fair.

The social contract between citizens implicitly binds people to obeying traffic laws as a public good all benefit from, not because a police officer is on every street corner enforcing the letter of the law.

The social contract between the citizens and the state binds the government to maintaining civil liberties, equal enforcement of the rule of law, defending the nation, and in the 20th century, providing social welfare for the disadvantaged, disabled and low-income elderly.

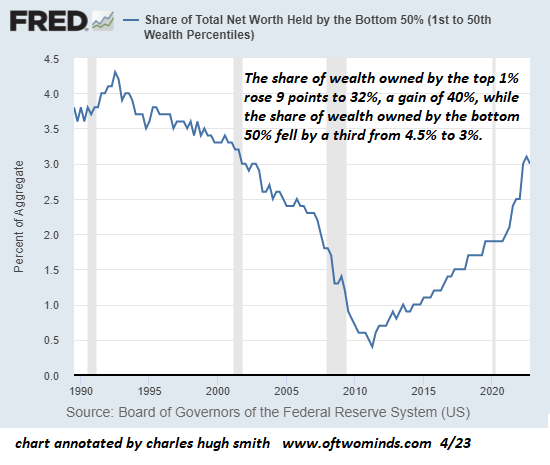

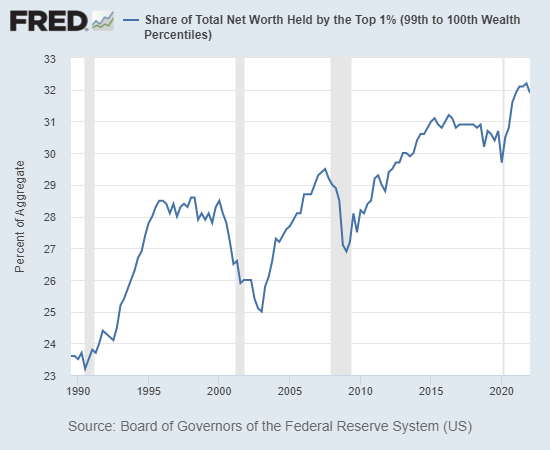

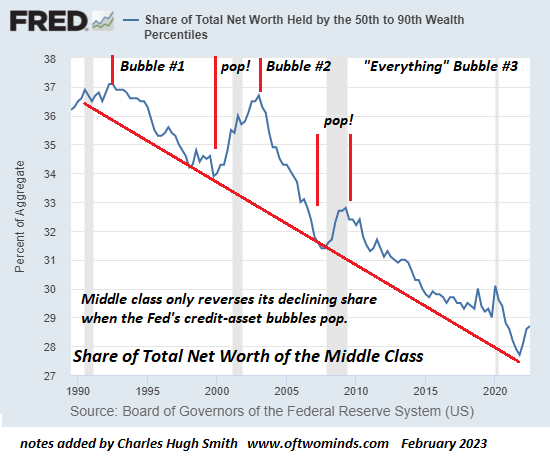

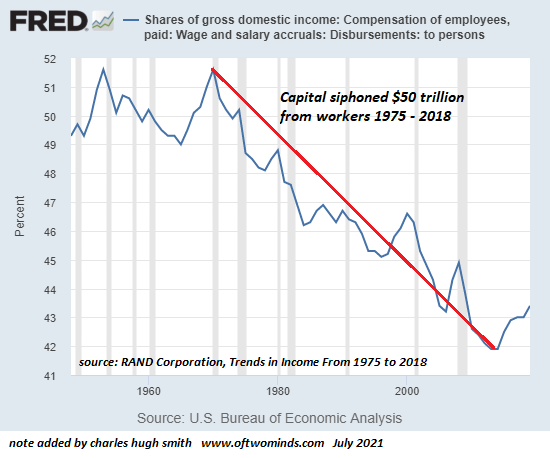

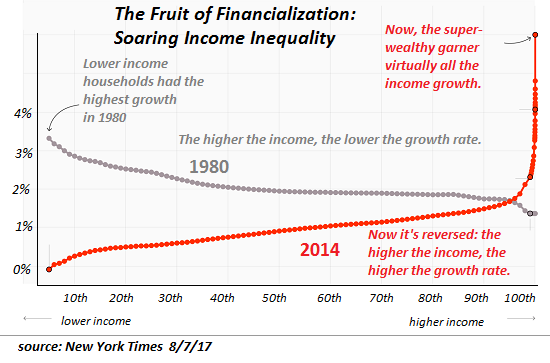

Critiques of “trickle down economics” focus on income inequality as a key metric of the Social Contract: rising income inequality is de facto evidence that the Social Contract is broken.

I think this misses the key distinction in the Social Contract between citizens and the state, which is the legitimacy of the process of wealth creation and the fairness of the playing field and the referees, i.e. that no one is above the law.

Few people begrudge legitimately earned wealth, for example, the top athlete, the pop star, the tech innovator, the canny entrepreneur, the best-selling author, etc. The source of these individual’s wealth is transparent, and any citizen can decline to support this wealth creation by not paying money to see the athlete, not buying the author’s books, not shopping at the entrepreneur’s stores, etc.

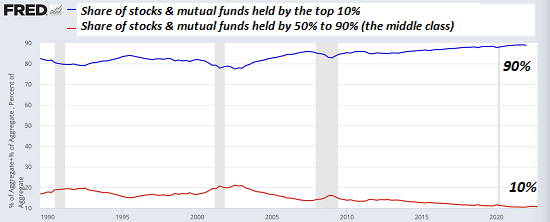

The Social Contract is broken not just by wealth inequality per se but by the illegitimate process of wealth acquisition, i.e. the state has tipped the scales in favor of the few behind closed doors and routinely ignores or bypasses the intent of the law even as the state claims to be following the narrower letter of the law.

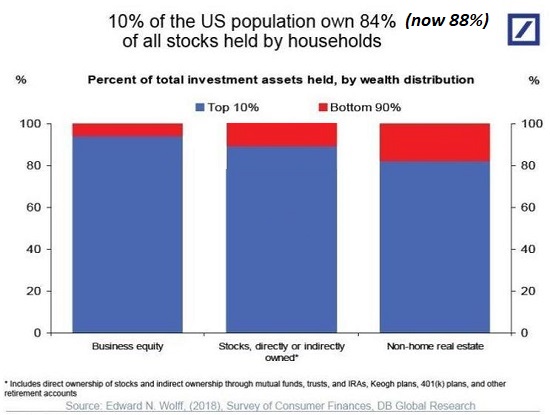

By this definition, the Social Contract in America has been completely smashed. One sector after another is dominated by cartel-state partnerships that are forged and enforced in obscure legislation written by lobbyists. Once the laws have been riddled with loopholes and the regulators have been corrupted, “no one is above the law” has lost all meaning.

Those who violate the intent of the law while managing to conjure an apparent compliance with the letter of the law are shysters, scammers and thieves who exploit the intricate loopholes of the system, all the while parading their compliance as evidence the system is fair and just. In this way, the judicial system becomes part of the illegitimate process of wealth accumulation.

In America, political and financial Elites are above the intent of the law. Is bribery of politicos illegal? Supposedly it is, but in practice it is entirely and openly legal.

This is the norm in banana republics, whose ledgers are loaded with thousands of codes and regulations that are routinely ignored by those in power. In the Banana Republic of America, financial crimes go uninvestigated, unindicted and unpunished: banks and their management are essentially immune to prosecution because the crimes are complex (tsk, tsk, it’s really too much trouble to investigate) and they’re “too big to prosecute.”

The rot has seeped from the financial-political Aristocracy to the lower reaches of the social order. The fury of those still working legitimate jobs and paying their taxes is grounded in a simple, obvious truth: America is now dominated by scammers, cheaters, grifters and those gaming the system, large and small, to increase their share of the swag.

The honest taxpayer is a chump, a mark who foolishly ponies up the swag that’s looted by the smart operators. Everyone knows that the vast majority of wealth accumulation in America flows not from transparent effort on a level playing field, but from persuading the Central State (the Federal government and the Federal Reserve) to enforce cartels and grant monopolistic favors such as tax shelters designed for a handful of firms and unlimited credit to private banks.

When scammers large and small live better than those creating value in the real economy, the Social Contract has ceased to exist. When the illegitimate process of wealth acquisition–a rigged playing field, a bought-off referee, and an Elite that’s above the law by every practical measure–dominates the economy and the political structure, the Social Contract has been shattered, regardless of how much welfare largesse is distributed to buy the complicity of state dependents.

Once the chumps and marks realize there is no way they can ever escape their exploited banana-republic status as neofeudal debt-serfs, the scammers, cheats and grifters large and small will be at risk of losing their perquisites. The fantasy in America is that legitimate wealth creation is still possible despite the visible dominance of a corrupt, venal, self-absorbed, parasitic, predatory Aristocracy. Once that fantasy dies, so will the marks’ support of the Aristocracy.

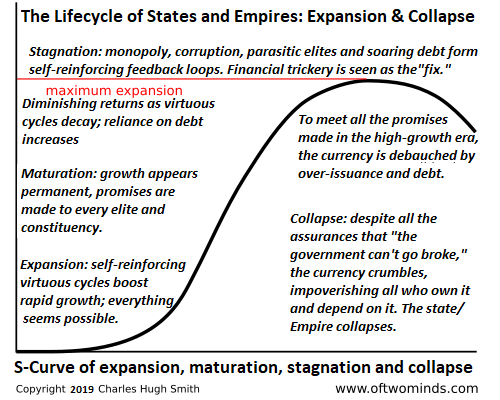

As Voltaire observed, “No snowflake in an avalanche ever feels responsible”: every claim, every game of the system, every political favor purchased is “fair and legal,” of course. This is precisely how empires collapse.

In broad brush, we can trace the transition from feudalism to capitalism to the present financialized, globalized cartel-state neofeudalism and next, to a synthesis built on the opposite of neofeudalism, which is decentralization, transparency, accountability, legitimacy and the adaptive churn of competing ideas and proposals.