By Colin Todhunter

Source: Global Research

In October 2019, in a speech at an International Monetary Fund conference, former Bank of England governor Mervyn King warned that the world was sleepwalking towards a fresh economic and financial crisis that would have devastating consequences for what he called the “democratic market system”.

According to King, the global economy was stuck in a low growth trap and recovery from the crisis of 2008 was weaker than that after the Great Depression. He concluded that it was time for the Federal Reserve and other central banks to begin talks behind closed doors with politicians.

In the repurchase agreement (repo) market, interest rates soared on 16 September. The Federal Reserve stepped in by intervening to the tune of $75 billion per day over four days, a sum not seen since the 2008 crisis.

At that time, according to Fabio Vighi, professor of critical theory at Cardiff University, the Fed began an emergency monetary programme that saw hundreds of billions of dollars per week pumped into Wall Street.

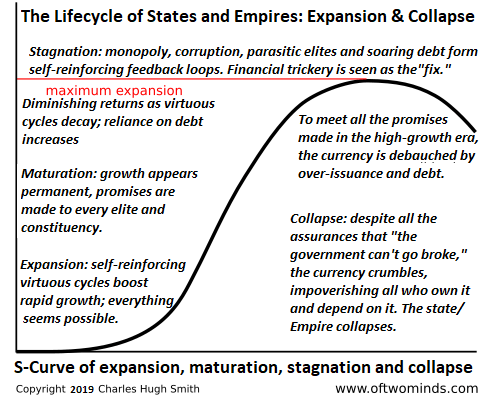

Over the last 18 months or so, under the guise of a ‘pandemic’, we have seen economies closed down, small businesses being crushed, workers being made unemployed and people’s rights being destroyed. Lockdowns and restrictions have facilitated this process. The purpose of these so-called ‘public health measures’ has little to do with public health and much to do with managing a crisis of capitalism and ultimately the restructuring of the economy.

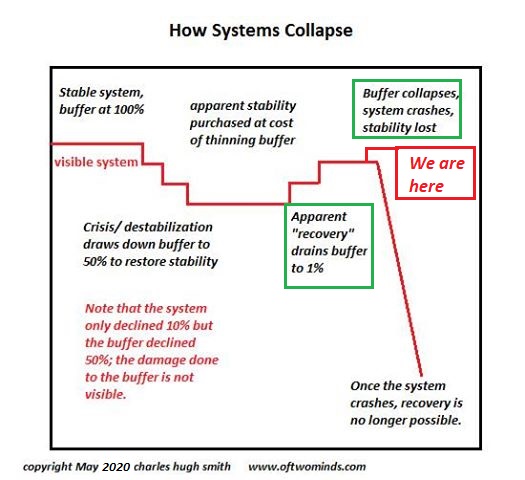

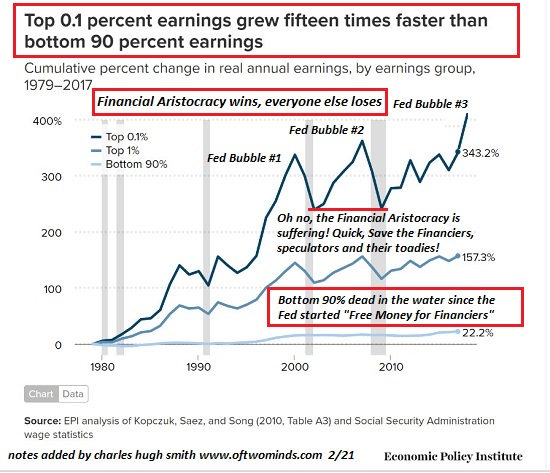

Neoliberalism has squeezed workers income and benefits, offshored key sectors of economies and has used every tool at its disposal to maintain demand and create financial Ponzi schemes in which the rich can still invest in and profit from. The bailouts to the banking sector following the 2008 crash provided only temporary respite. The crash returned with a much bigger bang pre-Covid along with multi-billion-dollar bailouts.

The dystopian ‘great reset’ that we are currently witnessing is a response to this crisis. This reset envisages a transformation of capitalism.

Fabio Vighi sheds light on the role of the ‘pandemic’ in all of this:

“… some may have started wondering why the usually unscrupulous ruling elites decided to freeze the global profit-making machine in the face of a pathogen that targets almost exclusively the unproductive (over 80s).”

Vighi describes how, in pre-Covid times, the world economy was on the verge of another colossal meltdown and chronicles how the Swiss Bank of International Settlements, BlackRock (the world’s most powerful investment fund), G7 central bankers and others worked to avert a massive impending financial meltdown.

The world economy was suffocating under an unsustainable mountain of debt. Many companies could not generate enough profit to cover interest payments on their own debts and were staying afloat only by taking on new loans. Falling turnover, squeezed margins, limited cashflows and highly leveraged balance sheets were rising everywhere.

Lockdowns and the global suspension of economic transactions were intended to allow the Fed to flood the ailing financial markets (under the guise of COVID) with freshly printed money while shutting down the real economy to avoid hyperinflation.

Vighi says:

“… the stock market did not collapse (in March 2020) because lockdowns had to be imposed; rather, lockdowns had to be imposed because financial markets were collapsing. With lockdowns came the suspension of business transactions, which drained the demand for credit and stopped the contagion. In other words, restructuring the financial architecture through extraordinary monetary policy was contingent on the economy’s engine being turned off.”

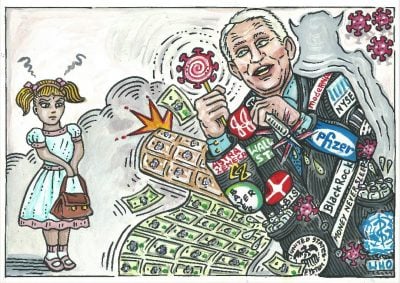

It all amounted to a multi-trillion bailout for Wall Street under the guise of COVID ‘relief’ followed by an ongoing plan to fundamentally restructure capitalism that involves smaller enterprises being driven to bankruptcy or bought up by monopolies and global chains, thereby ensuring continued viable profits for these predatory corporations, and the eradication of millions of jobs resulting from lockdowns and accelerated automation.

Author and journalist Matt Taibbi noted in 2020:

“It retains all the cruelties of the free market for those who live and work in the real world, but turns the paper economy into a state protectorate, surrounded by a kind of Trumpian Money Wall that is designed to keep the investor class safe from fear of loss. This financial economy is a fantasy casino, where the winnings are real but free chips cover the losses. For a rarefied segment of society, failure is being written out of the capitalist bargain.”

The World Economic Forum says that by 2030 the public will ‘rent’ everything they require. This means undermining the right of ownership (or possibly seizing personal assets) and restricting consumer choice underpinned by the rhetoric of reducing public debt or ‘sustainable consumption’, which will be used to legitimise impending austerity as a result of the economic meltdown. Ordinary people will foot the bill for the ‘COVID relief’ packages.

If the financial bailouts do not go according to plan, we could see further lockdowns imposed, perhaps justified under the pretext of ‘the virus’ but also ‘climate emergency’.

It is not only Big Finance that has been saved. A previously ailing pharmaceuticals industry has also received a massive bailout (public funds to develop and purchase the vaccines) and lifeline thanks to the money-making COVID jabs.

The lockdowns and restrictions we have seen since March 2020 have helped boost the bottom line of global chains and the e-commerce giants as well and have cemented their dominance. At the same time, fundamental rights have been eradicated under COVID government measures.

Capitalism and labour

Essential to this ‘new normal’ is the compulsion to remove individual liberties and personal freedoms. A significant part of the working class has long been deemed ‘surplus to requirements’ – such people were sacrificed on the altar of neo-liberalism. They lost their jobs due to automation and offshoring. Since then, this section of the population has had to rely on meagre state welfare and run-down public services or, if ‘lucky’, insecure low-paid service sector jobs.

What we saw following the 2008 crash was ordinary people being pushed further to the edge. After a decade of ‘austerity’ in the UK – a neoliberal assault on the living conditions of ordinary people carried out under the guise of reining in public debt following the bank bail outs – a leading UN poverty expert compared Conservative welfare policies to the creation of 19th-century workhouses and warned that, unless austerity is ended, the UK’s poorest people face lives that are “solitary, poor, nasty, brutish, and short”.

Philip Alston, the UN rapporteur on extreme poverty, accused ministers of being in a state of denial about the impact of policies. He accused them of the “systematic immiseration of a significant part of the British population”.

In another 2019 report, the Institute for Public Policy Research think tank laid the blame for more than 130,000 deaths in the UK since 2012 at the door of government policies. It claimed that these deaths could have been prevented if improvements in public health policy had not stalled as a direct result of austerity cuts.

Over the past 10 years in the UK, according to the Trussell Group, there has been rising food poverty and increasing reliance on food banks.

And in a damning report on poverty in the UK by Professor David Gordon of the University of Bristol, it was found that almost 18 million cannot afford adequate housing conditions, 12 million are too poor to engage in common social activities, one in three cannot afford to heat their homes adequately in winter and four million children and adults are not properly fed (Britain’s population is estimated at around 66 million).

Moreover, a 2015 report by the New Policy Institute noted that the total number of people in poverty in the UK had increased by 800,000, from 13.2 to 14.0 million in just two to three years.

Meanwhile, The Equality Trust in 2018 reported that the ‘austerity’ years were anything but austere for the richest 1,000 people in the UK. They had increased their wealth by £66 billion in one year alone (2017-2018), by £274 billion in five years (2013-2018) and had increased their total wealth to £724 billion – significantly more than the poorest 40% of households combined (£567 billion).

Just some of the cruelties of the ‘free market’ for those who live and work in the real world. And all of this hardship prior to lockdowns that have subsequently devastated lives, livelihoods and health, with cancer diagnoses and treatments and other conditions having been neglected due to the shutdown of health services.

During the current economic crisis, what we are seeing is many millions around the world being robbed of their livelihoods. With AI and advanced automation of production, distribution and service provision on the immediate horizon, a mass labour force will no longer be required.

It raises fundamental questions about the need for and the future of mass education, welfare and healthcare provision and systems that have traditionally served to reproduce and maintain labour that capitalist economic activity has required.

As the economic is restructured, labour’s relationship to capital is being transformed. If work is a condition of the existence of the labouring classes, then, in the eyes of capitalists, why maintain a pool of (surplus) labour that is no longer needed?

A concentration of wealth power and ownership is taking place as a result of COVID-related policies: according to research by Oxfam, the world’s billionaires gained $3.9 trillion while working people lost $3.7 trillion in 2020. At the same time, as large sections of the population head into a state of permanent unemployment, the rulers are weary of mass dissent and resistance. We are witnessing an emerging biosecurity surveillance state designed to curtail liberties ranging from freedom of movement and assembly to political protest and free speech.

The global implications are immense too. Barely a month into the COVID agenda, the IMF and World Bank were already facing a deluge of aid requests from developing countries that were asking for bailouts and loans. Ideal cover for rebooting the global economy via a massive debt crisis and the subsequent privatisation of national assets.

In 2020, World Bank Group President David Malpass stated that poorer countries will be ‘helped’ to get back on their feet after the various lockdowns but such ‘help’ would be on condition that neoliberal reforms become further embedded. In other words, the de facto privatisation of states (affecting all nations, rich and poor alike), the (complete) erosion of national sovereignty and dollar-denominated debt leading to a further strengthening of US leverage and power.

In a system of top-down surveillance capitalism with an increasing section of the population deemed ‘unproductive’ and ‘useless eaters’, notions of individualism, liberal democracy and the ideology of free choice and consumerism are regarded by the elite as ‘unnecessary luxuries’ along with political and civil rights and freedoms.

We need only look at the ongoing tyranny in Australia to see where other countries could be heading. How quickly Australia was transformed from a ‘liberal democracy’ to a brutal totalitarian police state of endless lockdowns where gathering and protests are not to be tolerated.

Being beaten and thrown to the ground and fired at with rubber bullets in the name of protecting health makes as much sense as devastating entire societies through socially and economically destructive lockdowns to ‘save lives’.

It makes as much sense as mask-wearing and social-distancing mandates unsupported by science, misused and flawed PCR tests, perfectly healthy people being labelled as ‘cases’, deliberately inflated COVID death figures, pushing dangerous experimental vaccines in the name of health, ramping up fear, relying on Neil Ferguson’s bogus modelling, censoring debate about any of this and the WHO declaring a worldwide ‘pandemic’ based on a very low number of global ‘cases’ back in early 2020 (44,279 ‘cases’ and 1,440 supposed COVID deaths outside China out of a population of 6.4 billion).

There is little if any logic to this. But of course, If we view what is happening in terms of a crisis of capitalism, it might begin to make a lot more sense.

The austerity measures that followed the 2008 crash were bad enough for ordinary people who were still reeling from the impacts when the first lockdown was imposed.

The authorities are aware that deeper, harsher impacts as well as much more wide-ranging changes will be experienced this time around and seem adamant that the masses must become more tightly controlled and conditioned to their coming servitude.