By Veniamin Popov

Source: New Eastern Outlook

A growing number of media outlets in America and in Europe have recently reached the conclusion that “rules-based international order” long espoused by the West has failed.

In essence, this means that the position of the Western powers in the world has weakened: they have failed to destroy the Russian economy by imposing sanctions, and the war in Gaza has demonstrated that the US and the Western European countries are far from all-powerful.

The media frequently claim that Russia’s special military operation in Ukraine has changed the international situation, in that it has made clear the limited capabilities of the West and deepened the rift between the West and the Global South.

The Ukrainian conflict and the war in Gaza have demonstrated to the whole world, and above all to ordinary people in the West, that their ruling elites are unable to grasp this reality, lack strategic vision and are generally guided by their own personal interests.

The ruling elites in the West have demonized Russia in every possible way and have come to believe the myth that Russia can be strategically defeated. This is a huge miscalculation and this conclusion will become obvious to all in the very near future. The present author is reminded of the junker Grushnitsky, in Lermontov’s “A Hero of Our Time,” a fantasist who plays the role of an unworldly romantic for so long that he begins to believe it himself.

As Vladimir Putin has aptly put it, “Russophobia, like any other ideology based on racism, national superiority and exclusivity, blinds the person who subscribes to it and deprives them of reason.”

The state of the “rules-based international order” is becoming increasingly alarming for many Western powers. According to an article published in the weekly journal the Economist on February 15, so-called national conservatives, who “suspect free markets of being rigged by the elites,” are gaining in influence in the US and Europe. They are also hostile to migration, despise pluralism, especially multiculturalism, and are obsessed with dismantling institutions they see as tainted by globalism.

Despite their differences, these national conservatives are united by their hostility to shared enemies, including migrants, especially Muslims, globalists and all their perceived enablers. Donald Trump is leading in the polls in America. The far right is expected to make gains in the European Parliament elections in June. In Germany last December, support for the far-right Alternative for Germany party (AFD) reached a record high of 23 percent, according to polls. Anticipating Rishi Sunak’s loss in the elections, the right wing of Britain’s Conservative Party are hoping to grab power in the party. In 2027, Marine Le Pen may well become president of France.

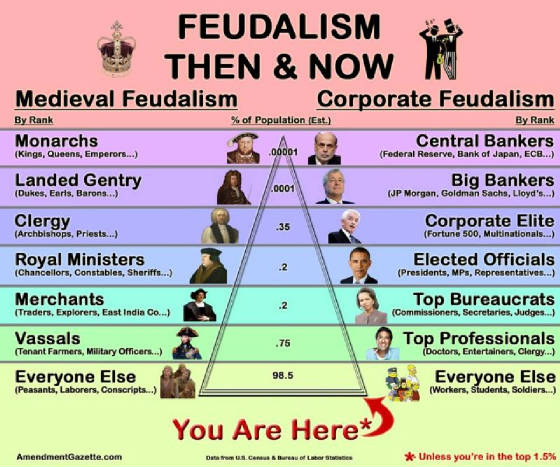

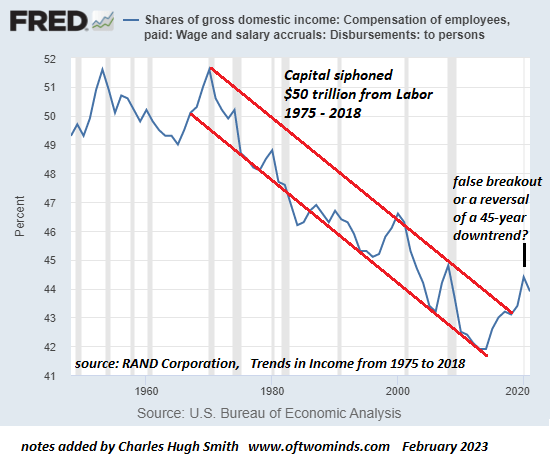

According to the Economist, the current authorities need to take people’s legitimate concerns seriously: the public in many Western countries see illegal migration as a source of unrest and a drain on the public purse. They worry that their children will grow up poorer than they are. They are concerned about losing their jobs to new technologies. They believe that institutions such as universities and the press have been hijacked by hostile, illiberal, left-wing elites. They view the globalists who have flourished over the last few decades as members of a self-serving, arrogant caste.

These complaints have real merit and mocking them only confirms how detached from reality the elites have become.

The position of Washington and its hangers-on in Europe in relation to Israel’s war crimes against the Palestinians in Gaza has added significantly to the public’s distrust of the West’s ruling elites. By openly supporting the actions of the Netanyahu government, the governments of the Western powers are convincing everyone, including their own populations, of their own policy of double standards: only the lives of Israelis are valued and massacres of Arabs are allowed.

As the Saudi newspaper Arab News reports, Arab and Muslim Americans, and 60 percent of all other Americans, have for months wanted President Joe Biden to pressure Israel into agreeing to an immediate ceasefire in Gaza. The White House has, in effect, ignored these pleas.

In response to this stance, Muslim Americans in nine potentially wavering states met in Dearborn, Michigan, in December 2023 under the slogan “Abandon Biden, Truce Now.” They have vowed not to vote for Biden in the presidential election unless he changes the policies that are enabling Israel’s genocide in the Gaza Strip possible.

The US journal Foreign Affairs, in an article entitled “Gaza and the End of the Rules-Based Order” quotes one G7 diplomat: “We have definitely lost the battle in the Global South. All the work we did with the Global South (around Ukraine) was lost. … Forget the rules, forget the world order. They will never listen to us again.”

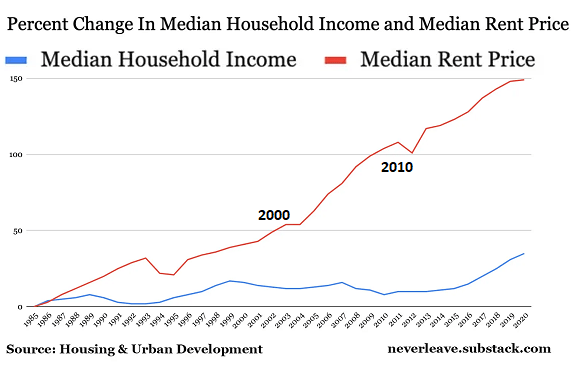

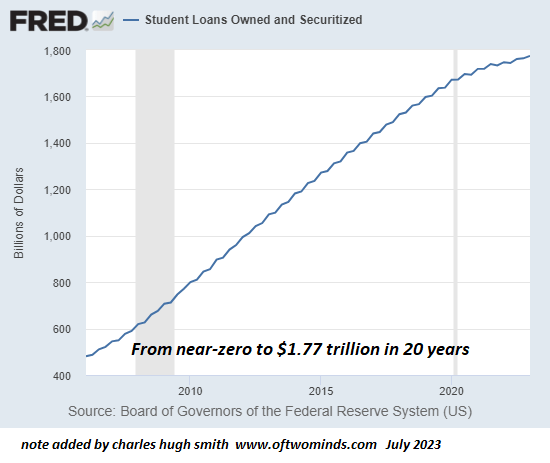

The economic recession, which has become a permanent situation for many European states, also provides little room for optimism. In the US, the high inflation and huge government debt are expected to worsen this spring and summer, according to some analysts. The most closely watched indicator of opinions about the economy, a monthly poll conducted by the University of Michigan, has reported that public confidence is at an exceptionally low ebb, about the same level as during the 2007-2009 global financial crisis.

With the presidential election just nine months away, this gloomy mood has become a serious problem for the Democrats. President Joe Biden is already facing a host of challenges to his bid for a second term, starting with concerns about his fitness for office as an 80-year-old man. Another major obstacle to his election bid is the opinion polls that give him low marks for his management of the economy.

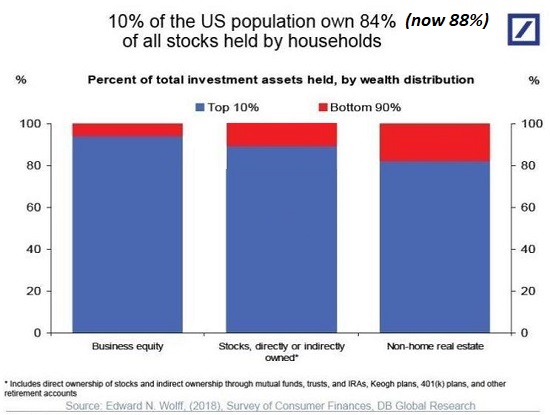

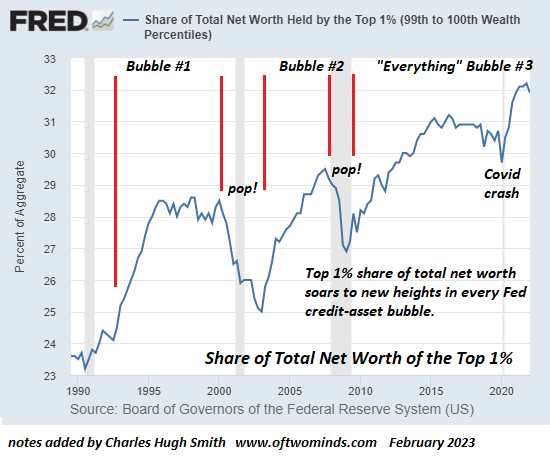

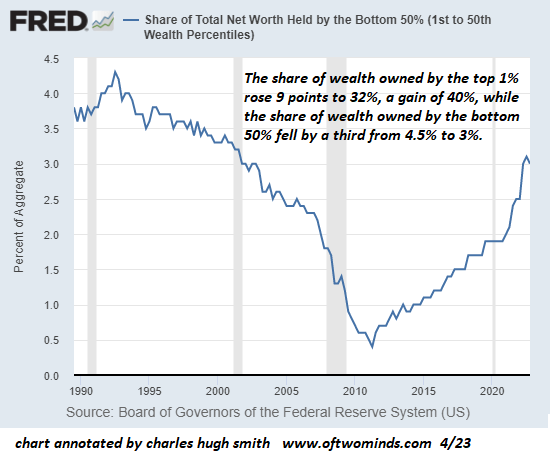

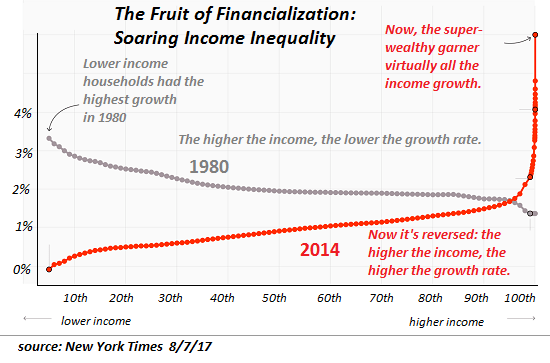

The current economic problems are exacerbated by growing inequality, the worsening drug crisis and the proliferation of firearms. The promotion of non-traditional sexual orientation and the encouragement of same-sex couples have cause legitimate outrage to many conservative religious people.

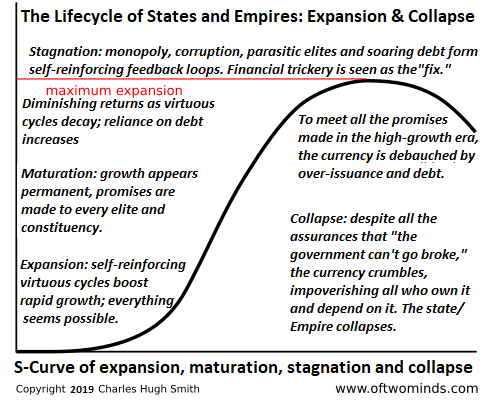

In the European Union between June 6 and 9, more than 400 million voters in 27 countries will elect 720 MEPs to represent them for the next five years. Observers predict an increase in the influence of right-wing conservative parties. One major reason for the heightened interest in the upcoming election is the unprecedented corruption scandal that erupted in the European Parliament in December 2022, when the vice president and several other officials, including three MEPs, were accused of taking bribes. The investigation is ongoing, but it has already revealed instances of illegal activities and immoral behavior on the part of MEPs. Conservatives accuse the EU of being an opaque bureaucracy with vastly overpaid staff, which is disconnected from the reality experienced by ordinary residents of the EU member states, and which spends its vast budgets – totaling hundreds of trillions of euros – not for the common good but for the personal whims and fantasies of its leaders. Inflation and the cost of living are still rising in many European nations, while many blame EU bureaucrats in Brussels for policies such as the Green Deal that have made life more expensive for Europeans by raising the prices of fuel, food and most other essentials. In addition, anti-Russian sanctions, which have led to the rejection of cheap energy from Russia by a number of European countries, have had a negative impact on the well-being of ordinary citizens.

Over the past few weeks, thousands of farmers from across Europe, particularly from Germany, France, Poland, Spain, and Belgium, have taken to the streets to protest against additional spending on Ukraine and against new EU environmental policies that make farming unviable.

The short-sighted policy of the Western elites with regard to the crises in Ukraine and the Gaza Strip is leading to a loss of confidence in the ruling authorities on the part of ordinary citizens. It is easy to imagine their reaction in the event of any further military setbacks by Ukraine or any worsening of the situation within the country.

The position taken by many developing nations with regard to the current international processes is highly symptomatic. In an editorial for the Arabic international newspaper Asharq Al-Awsat, Editor-in-Chief Grhassan Charbel writes: “Zelensky’s position reminded me of remarks by the late Egyptian President Hosni Mubarak to former Iraqi Foreign Minister Hoshyar Zebari, that ‘the one who is covered by the Americans is naked.’ The same phrase could be said by Putin to Zelensky.

Putin has the right to be sarcastic. The leaders of the West did not accept that he could not lose… That he went to Ukraine to punish the entire West and to launch a major coup against a world that was born from the collapse of the (Berlin) Wall and the disappearance of the Soviet Union.”

It is no coincidence that the ruling circles of Western Europe are currently not hiding their anxiety about what they refer to as the “threat posed by Trump and Russia.”

In fact, everything we see happening testifies to the inadequacy of the current ruling elites in the West, who are unable to reasonably and rationally assess the emerging situation, guided as they are solely by short-term personal interests.

It is very possible that they will be swept away by a wave of new unexpected events, and new leaders will come to power.

It is therefore highly likely that 2024 will be a turning point in many respects.