The Coup de Grâce–>The Great Reset

By Robert J. Burrowes

Building on millennia of learning how to structure and manage an economy to accumulate and consolidate control and wealth in particular hands, as explained in Part 1 of this investigation, the Global Elite launched its final coup in January 2020 under cover of the fake Covid-19 ‘pandemic’. Using the health threat supposedly implied by the existence of a pathogenic ‘virus’, the bulk of the world population was terrorized into submitting to an onerous series of violations of their human rights which was tantamount to a declaration of martial law. See ‘The Final Battle For Humanity: It Is “Now or Never” In The Long War Against Homo Sapiens’.

Under a barrage of propaganda delivered by Elite agents – including organizations such as the World Economic Forum, the United Nations, the World Health Organisation, governments, the pharmaceutical industry and corporate media as well as individuals such as Klaus Schwab, Yuval Noah Harari and Bill Gates – people were compelled to wear masks, use QR codes, stay locked down in their homes and, later, submit to a series of experimental but involuntary gene-altering bioweapons to acquire a ‘vaccine passport’, among other measures.

Particularly importantly, these restrictions effectively shut down the mainstream economy with vast sectors of industry either closed outright or unable to function in the absence of locked-down or, later, bioweapon-injured or bioweapon-killed staff. For just one discussion of the vast evidence available of Covid-19 ‘vaccine’ injuries and deaths, watch ‘3.5 BILLION could be injured or killed by the jab. Are YOU ready?’ which is briefly discussed here: ‘Dr. David Martin blasts health authorities for turning roughly 4 billion people into “bioweapons factories”’.

This inevitably adversely impacted the entire supply chain: That is, the process that connects the production of raw materials, such as food grown on farms and minerals mined from the Earth, to factories that produce everything from canned food to computers, and then to outlets that sell these products to the public. All components of this chain were either shut down completely at one or more times, as part of the imposed restrictions or other policy measures – watch, for example, ‘Biden pays farms to STOP – EU out of Feed – Meat taxes & Chicken permits – Up to you to GROW FOOD!’ – or just substantially curtailed by the unavailability of essential inputs, ranging from replacement parts to competent labour.

To exacerbate matters, the transport industry (trucking, railroads, shipping, airlines) was also effectively shut down, containers became unavailable (because they were in the wrong places) and logistics corporations (that organize the movement of trade goods) were disabled, including by cyber attacks. The airline and tourist industries were just two industries that were profoundly disrupted. But so was much of small business, with many businesses destroyed. As a result, hundreds of millions of people lost employment, many permanently, throughout the industrial economies and millions more were starved to death in Africa, Asia and Central/South America because the day-to-day economy, by which many survive, was shuttered and any ameliorative measures by governments and international organizations were, deliberately, woefully inadequate (or were siphoned into elite wallets). See ‘The Global Elite’s “Kill and Control” Agenda: Destroying Our Food Security’.

But ‘behind the (obvious) scenes’ outlined above, there has been a great deal more going on that has been deliberately concealed from public view, and this has been considered and discussed by some fine analysts.

According to Catherine Austin Fitts, using ‘national security’ as the justification, the U.S. National Security Act 1947 and the CIA Act 1949 were the basis of a series of Acts and Executive Orders that ‘created a secrecy machinery’ which essentially meant that ‘the most powerful financial interests in the world can keep a whole bunch of money secret’, thus creating a secret black budget. And, starting in 1998, according to US federal government documentation, huge sums of money were not accounted for while private equity firms began exploding and, despite having no capacity to raise such amounts, were suddenly investing huge sums of money in emerging markets. According to Fitts ‘we are now missing over $US21 trillion’, which she calls a ‘financial coup d’etat’ that is clearly in ‘massive violation’ of the US constitution. The financial value of what has transpired under the Covid-19 narrative is that the ‘magic virus’ can be used to explain, for example, why there is no money for healthcare or pension funds cannot pay on retirement those who paid into them throughout their lives. Watch ‘We Need to Talk about Mr Global – Part Two’ with a simple summary here: ‘The Real Game of Missing Money’.

But if $US21 trillion missing already sounds like a lot, it doesn’t end there, as Fitt’s recent discussion with Professor Mark Skidmore makes perfectly clear in ‘The Financial Coup: More Missing Money & FASAB Standard 56’. Fitts observes:

‘We are now over $US100 trillion of undocumentable adjustments if we use their most recent figures and so I would say we are describing a financial system which is completely and utterly out of control…. If any of the allegations about financial fraud in the 2020 [US Presidential] election are true, and I believe that many of them are, we’ve now delinked both the election system and the finances [from] the constitution and the law so we are are now operating both in terms of who governs and how they spend the money completely outside of the law and completely outside of any democratic process. So this is a coup.’

To which Professor Skidmore responds:

‘The reason that I really struggled… watching what was going on during the last financial crisis, [was that] I thought ‘Wow we don’t have the rule of law’. It was so obvious that we didn’t ten years ago and it’s like it’s devolving even more and so I am not sure how much further we can go before we are just completely devoid of the rule of law at least for a subset of the very powerful.’

As an aside, while genuinely appreciative of the research of Fitts and Skidmore, as outlined earlier in this article and previously demonstrated, democracy has always been a sham and the Elite has always operated beyond the rule of law, routinely corrupting national political processes in pursuit of Elite ends. See ‘The Elite Coup to Kill or Enslave Us: Why Can’t Governments, Legal Actions and Protests Stop Them?’ All we are seeing in the current context is Elite corruption being flaunted in a way that reflects the sure knowledge that it can act corruptly, on a global scale, with impunity.

But to return to the subject at hand: In 2019, the central bankers of the G7 countries met for their regular conference at Jackson Hole, Wyoming and agreed to the ‘Going Direct Reset’, a plan devised (and later orchestrated) by BlackRock – see ‘Dealing with the next downturn’ – and, as explained by John Titus, the fundamental purpose of this ‘Reset’ was to orchestrate the largest asset transfer in history under cover of the forthcoming Covid-19 ‘pandemic’. Watch ‘Larry & Carstens’ Excellent Pandemic’ with a summary here: ‘Summary – Going Direct Reset’.

In the words of Titus: ‘In a nutshell, the arrival of the 2020 pandemic was about as accidental as an assassination. The pandemic narrative is nothing but a cover story to conceal from the public what in reality is the biggest asset transfer ever.’ See ‘Summary – Going Direct Reset’.

While you can learn the mechanics of how this was conducted in the excellent documents and videos immediately above, as Fitts points out in relation to the central banks: ‘Controlling and having access to data on fiscal and monetary policy is the basis of huge fortunes.’ And, combined with the secrecy that has protected their manipulations from public view – ‘if you look at all the technology and assets that have been transferred, by questionable means, into private and corporate hands, the liability is over the top’ – it has engendered the view that their only way forward is ‘complete, total central control’.

Central Bank Digital Currencies

How will this ‘total control’ be achieved? One key element will be the introduction of Central Bank Digital Currencies (CBDCs). According to Fitts: The fundamental value of digitized systems, from the elite perspective, is that they enable centralized control. So, by creating CBDCs the financial transaction control grid becomes the means by which you enable centralized control; that is, slavery. Watch ‘We Need to Talk about Mr Global – Part Two’.

How does this work? CBDCs allow the Central Bank to determine exactly what products and services your digital currency can be spent on, when it can spent and where it can be spent. It also allows the issuing authority to freeze, reduce or empty your bank account, and to alter its functionality with the latest ‘update’, based on your ‘social credit score’, political allegiance or if you do not comply with certain directives. But it goes beyond this.

According to the Bank for International Settlements:

‘The G20 has made enhancing cross-border payments a global priority and has identified CBDC as a potential way forward to improving such payments. A “holy grail” solution for cross-border payments is one which allows such payments to be immediate, cheap, universally accessible and settled in a secure settlement medium. For wholesale payments, central bank money is the preferred medium for financial

market infrastructures. A multi-CBDC platform upon which multiple central banks can issue and exchange their respective CBDCs is a particularly promising solution for achieving this vision, and mBridge is a wholesale multi-CBDC project that aims to advance towards this goal. It builds on previous work…. Project mBridge tests the hypothesis that an efficient, low-cost, real-time and scalable cross-border multi-CBDC arrangement can provide a network of direct central bank and commercial participant connectivity and greatly increase the potential for international trade flows and cross-border business at large…. All the while safeguarding currency sovereignty and monetary and financial stability by appropriately integrating policy, regulatory and legal compliance, and privacy considerations.’ See ‘Project mBridge: Connecting economies through CBDC’.

Apart from the fact that the G20 governments are distinctly unrepresentative of the world’s people, these words are typical of the type usually chosen when the Elite is intent on sugarcoating their lies to conceal their true agenda.

Fortunately, Agustin Carstens of the Bank for International Settlements has been more forthcoming: ‘We don’t know, for example, who’s using a $100 bill today, we don’t know who is using a 1,000 peso bill today. The key difference with the CBDC is the central bank will have absolute control on the rules and regulations that will determine the use of that expression of central bank liability, and also we will have the technology to enforce that.’ Watch ‘Cross-Border Payments: A Vision for the Future’. And here is the Bank of England advising government ministers in the UK on the issue of programming CBDCs: ‘Bank of England tells ministers to intervene on digital currency “programming”’. For a more detailed explanation, see ‘What Is Programmable Money?’ And for an update on progress in your country, see ‘CBDC: A Country-by-Country Guide’.

Before proceeding, however, it is worthwhile noting the conflict that is going on between the central banks and the commercial banks (the traditional actors in the retail banking sector, that is, the part of banking where people interact directly with a bank), as well as that between the commercial banks and the big tech companies, such as PayPal, Alipay, Facebook and Amazon that have developed or are developing their own digital currencies and/or payments systems outside the traditional financial system. While non-bank financial institutions long-ago overtook commercial banks in lending, bank influence generally continues to decline and is accelerating in the face of the competition from the technology giants. Why the conflict? Because a CBDC risks collapsing the commercial banking sector completely by eliminating retail banking and thus destabilizing the long-standing financial system. For some discussion of this, watch Alice Fulwood’s presentation ‘Could digital currencies put banks out of business?’ There is no doubt, of course, that this conflict will be resolved and that it will not be in our favour.

In any case, CBDCs are just one feature of their planned technocracy which includes digitizing your identity, issuing you a social credit score, geofencing you in one of the Elite’s ‘smart cities’ and feeding you insects and processed trash, among many other elements. See ‘Digitizing Your Identity is the Fast-Track to Slavery: How Can You Defend Your Freedom?’ and ‘Digital Currency: The Fed Moves toward Monetary Totalitarianism’.

And to elaborate the significance of imprisoning you in a ‘smart’ city, Patrick Wood points out the evidence both in the literature and in practice: The intention is to force us off the land, as is already happening in China, and at gunpoint if necessary, so that ‘vacated farm land’ can be combined ‘into giant factory farms to be operated by advanced technology such as agricultural robots and automated tractors’. Once relocated into the ‘smart’ city of the government’s choice, everyone will be subject to 24 hour surveillance using a plethora of ‘smart’ technologies such as biometric facial scanning, geospatial tracking and CBDCs, forced onto public transport which will not include the option of leaving the city, and confined to those work and other activities approved by the relevant technocrats. See ‘Day 9: Technocracy And Smart Cities’.

The bottom line, in simple language however, is the same as it has always been: Endlessly acting to consolidate their control over the rest of us, our money is being stolen by the Elite for their own ends and they are not required to report it and they cannot be held accountable, legally or otherwise. The only difference to what has happened historically is that now even the pretense of some form of equity, the rule of law and even the notion of democracy are being abandoned in the final rush to techno-totalitarianism and wealth concentration.

Beyond this, however, other components of the elite program are designed to play a part in destroying human society and the global economy. For a summary of these, see ‘Killing Off Humanity: How The Global Elite Is Using Eugenics And Transhumanism To Shape Our Future’.

Collapsing the Global Economy

Not content with these measures, however, the war in central Asia was precipitated by the Elite to advance key elements of their program. Superficially portrayed by most politicians and corporate media as a war between Russia and Ukraine, many thoughtful analysts perceive some of the deeper strands of what has occurred: Since the collapse of the Soviet Union and NATO commitments made at the end of the Cold War, NATO has consistently violated those commitments and there has been routine Ukrainian attacks on Donetsk and Luhansk over the past eight years. These and other events have ensured a long but steady ‘lead time’ in the final build up to the war, precipitating the military response of Russia, as intended. For just four thoughtful analyses, see ‘Understanding The Great Game in Ukraine’, ‘Ukraine, Russia, and the New World Order’, ‘Some of Us Don’t Think the Russian Invasion Was “Aggression.” Here’s Why.’ and ‘The U.S. Is Leading the World Into the Abyss’.

Obscured by the war, however, the leaderships of both Russia and Ukraine are heavily involved in the World Economic Forum and both have been heavily committed to imposing the elite agenda on their populations. In short, the Russia-Ukraine war serves elite purposes well with consequences including even greater disruption of food and fuel supply chains than the ‘Great Reset’ was able to achieve alone. See ‘The War in Ukraine: Understanding and Resisting the Global Elite’s Deeper Agenda’.

Similarly, the sabotage of the Nord Stream 1 & 2 gas pipelines – see ‘Ukraine War: New Developments’ – might be seen through various lenses but, again, it serves elite purposes well. As Tom Luongo noted: ‘The important thing I keep trying to point out [is] that thinking in terms of “country” is ultimately the wrong lens to view these people’s actions. Factions are the better lens. Factions cross political borders.’ See ‘The Curious Whodunit of Nordstreams 1 and 2’. Given that the sabotage of these two pipelines is seriously exacerbating the energy crisis in Europe, while displacing people’s anger onto one or other parties in the war, as always the elite forces driving destruction of the world economy escape scrutiny.

Beyond this, on 7 October 2022 the Biden Administration dealt a ‘nuclear’ strike to the hi-tech industry by imposing onerous new export rules that cut off supply of essential technology (advanced semiconductors, chip-making equipment and supercomputer components) to China, immediately and adversely impacting Chinese production. See ‘Implementation of Additional Export Controls: Certain Advanced Computing and Semiconductor Manufacturing Items’. But whatever pain this will inflict on the Chinese, it will inflict far more pain on ordinary people who will be required to deal with the outcomes of this latest supply-chain disruption: higher prices, more battered household budgets and fewer families able to scrape by on shrinking wages. See ‘Biden’s Tech-War Goes Nuclear’ and ‘US Economic War on China Threatens Global Microchip Industry’.

In any case, the ongoing destruction of the global economy will continue even while, apparently, considerable effort is being made to restructure key elements of it, such as those in relation to trade relations, trade routes, currencies and international banking being undertaken in various international fora. For one discussion of these ongoing efforts, see ‘Russia, India, China, Iran: the Quad that really matters’.

But, again, how serious are these efforts when all governments are collaborating closely on the fundamental Elite program? At one of these meetings, recently concluded, the G20 Summit in Bali – see ‘G20 Bali Leaders’ Declaration’ – Moscow, Beijing, Washington and all other governments present, agreed to ‘the creation of a global health-preserving Pandemic Fund sponsored by the WHO, the World Bank, Bill Gates, and the Rockefeller Foundation. The fund will ensure there is plenty of money for experimental genetic vaccines in the weeks, months, and decades ahead.’ Beyond this, however, the Declaration contains ‘purple prose’ about ‘digital transformation’, ‘interoperability of Central Bank Digital Currencies (CBDCs) for cross-border payments’, and other elements of the Elite’s technocratic program. As Riley Waggaman observed: ‘It’s truly heart-warming that even amidst ceaseless geopolitical squabbling, Moscow and the Collective West can sit down at the negotiating table, break bread, and agree to cattle-tag the entire world.’ See ‘World leaders agree to cattle-tag the planet’.

And while a recent World Economic Forum report, based on the views of 50 chief economists from around the world, sanitized economic prospects by simply referring to a likely forthcoming ‘recession’ either in 2022 or 2023, spokesperson Saadia Zahidi couldn’t avoid mentioning the heavy consensus that real wages will decline, poverty will increase and ‘social unrest is expected to continue to rise’ in response to rises in the cost of living, particularly due to production and supply chain disruptions in fuel and food supplies. See ‘Special Agenda Dialogue on the Future of the Global Economy’.

Taking a similarly ‘moderate’ stance, in its recent ‘World Economic Outlook’, the International Monetary Fund warned that ‘More than a third of the global economy will contract this year or next, while the three largest economies – the United States, the European Union, and China – will continue to stall. In short, the worst is yet to come, and for many people 2023 will feel like a recession.’ See ‘World Economic Outlook – Countering the Cost-of-Living Crisis’. At the media briefing to launch the report, the Director of the IMF’s Research Department, Pierre-Olivier Gourinchas, noted that ‘the global economy is headed for stormy waters’ and ‘Too many low-income countries are close to or are already in debt distress. Progress toward orderly debt restructuring… is urgently needed to avert a wave of sovereign debt crises. Time may soon run out.’ See ‘WEO Press Briefing Annual Meetings 2022’.

But other reports suggest something far worse.

Summarizing his own extensive research on the subject over the past three years, in a recent interview Professor Michel Chossudovsky simply explains what triggered the economic collapse, referring to the origin of the crisis with decisions made in early 2020: ‘This is really Economics 101:… the announcement of the lockdown… implies the confinement of the labor force on the one hand and the freezing of the workplace on the other…. What happens? The answer is obvious: Collapse! Economic and social collapse on an unprecedented basis because it was implemented simultaneously in 190 countries.’ Watch ‘The Worldwide Corona Crisis, Global Coup d’Etat Against Humanity’.

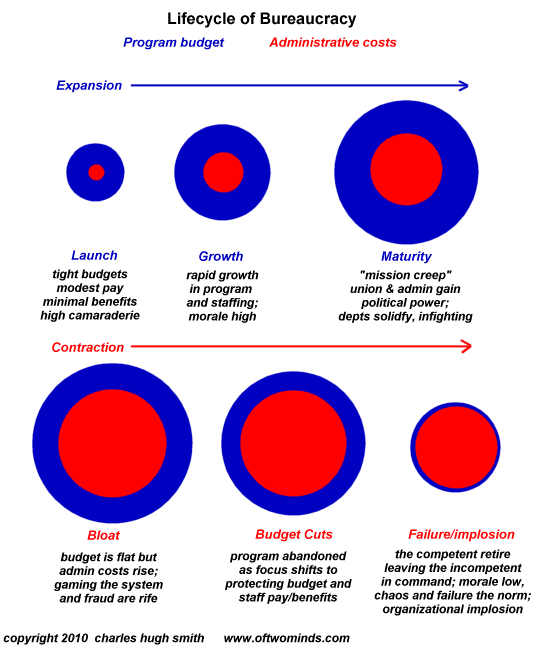

Noting the complete failure of authorities to hold even one corporate executive to account for the financial collapse they caused in 2008 – when banking institutions intentionally sold securities they knew were bad to defraud customers and increase their own profits, as carefully reported in a ‘Frontline’ documentary in 2013 – Dr Joseph Mercola argues that the ‘same criminal bankers are now intentionally destroying the global financial system in order to replace it with something even worse – social credit scores, digital identity and Central Banking Digital Currencies (CBDCs), which will give them the ability to control not only your individual finances but also everything else in your life’. Apparently unaware of the extensive lead time on what is happening, he goes on to observe that ‘We’re now at the point where banksters have self-selected themselves to rule the whole world, tossing notions of democracy, freedom and human dignity in the waste bin along the way.’ See ‘Who Is Behind the Economic Collapse?’

As explained above, these ‘banksters’ operate beyond the rule of law too.

According to the Irish economist Philip Pilkington: ‘The Western world today faces a serious risk of slipping into another Great Depression. This risk has arisen… due to global economic relations deteriorating to the point of all out warfare.’ Noting the critical importance of the sabotage of the Nord Stream pipelines, leaving Europe with ‘insufficient access to energy, the price of energy in Europe will remain extremely high for years to come. European industry, for which energy is a key input, will become uncompetitive.’ See ‘The next Great Depression? Economic warfare has severe implications’.

According to former BlackRock manager, Edward Dowd, the outcome of what has been happening, which is being accelerated by the corruption that has plagued Wall Street since the 1990s, is that the forthcoming financial collapse is a ‘mathematical certainty’ and will occur within the next six to 24 months. Watch ‘Ex-BlackRock Manager: Global Financial Collapse a “Mathematical Certainty”’.

Or, in the words of strategic risk consultant William Engdahl: What is coming in the months ahead, barring a dramatic policy reversal, ‘is the worst economic depression in history to date’. See ‘Global Planned Financial Tsunami Has Just Begun’.

After listing a sequence of industry shutdowns and other measures in Europe because of energy shortages, Michael Snyder simply observes that ‘This is what an economic collapse looks like’, notes the prospect (also predicted by NATO Secretary General Jens Stoltenberg and, as we saw above, the World Economic Forum) of ‘civil unrest’ and warns that ‘Europe is going to descend into “the new Dark Ages” this winter, and the entire world will experience extreme pain as a result.’ See ‘This Winter, Europe Plunges Into “The New Dark Ages”’.

According to Irina Slav, countries of the European Union have suffered a consistent decline in gas and electricity consumption this year amid record-breaking prices. Businesses are shutting down factories, downsizing or relocating, while production of such basic products as steel, zinc, aluminium, chemicals, plastics and ceramics has been cut substantially, if not slashed dramatically. Observing that the European Union is heading for a recession that is ‘quite clear to anyone watching the indicators’ she goes on to state that ‘Europe may well be on the way to deindustrialization’. See ‘Europe May See Forced De-Industrialization As Result Of Energy Crisis’.

Dr. Seshadri Kumar agrees. He has offered an intensively detailed critique of the economic fallout from the ongoing Russia-Ukraine war and events such as the sanctions against Russia and the sabotage of the Nord Stream 1 & 2 gas pipelines. Following his careful analysis, he notes a series of conclusions including that ‘The scarcity of oil and gas, combined with the scarcity of commodities, will lead to the De-Industrialization of Europe in short order.’

‘Europe needs what Russia has (and what China has). It cannot do without those things. But Russia (and China) can do without what Europe has. They are self-sufficient. The financial impact of European sanctions on Russia is minimal. Therefore, economic sanctions against Russia (or China) will never work. But, because of the overwhelming dependence of Europe on Russian (and Chinese) goods, sanctions on Russia (or China) will utterly destroy Europe. The only hope for Europe to prevent a total economic catastrophe is to achieve an agreement with Russia that ends the current destructive sanctions as soon as possible, and at whatever political cost, including the abandonment of Ukraine and cession of Ukrainian territory to Russia. The longer this is postponed, the more extensive the permanent economic damage to Europe will be….

‘A New World Order is taking birth before our eyes….

‘The sanctions on Russia will be seen in hindsight as Europe’s Stalingrad as well as its Waterloo.’ See ‘The Coming European Economic Apocalypse’.

Commenting on the banking system, precious metals businessman Stefan Gleason warns that ‘The global fractional-reserve banking system is teetering on the brink of failure. Financial strains are exposing major banks as under-capitalized and ill prepared to weather additional strains from high inflation, rising interest rates, and a weakening economy. Banks operating outside the United States are presently most vulnerable. A spike in interest rates concomitant with a spike in the exchange rate of the Federal Reserve note “dollar” is wreaking havoc in global debt markets and driving capital flight. Many analysts fear bank runs are coming. They are already hitting developing countries.’ See ‘Banks on the Brink: Is Your Money Safe?’

Noting that imposition of technologies associated with the fourth industrial revolution and the war in Ukraine are impacting the labor force, among a wide variety of other impacts on society as a whole, ‘Winter Oak’ observes that while anticipating future employment trends is not easy, ‘the combined threat of pandemics and wars means the labour force is on the brink of an unprecedented reshuffle with technology reshaping logistics, potentially threatening hundreds of millions of blue and white collar jobs, resulting in the greatest and fastest displacement of jobs in history and foreshadowing a labour market shift which was previously inconceivable.’

Furthermore: the nation state model is being upended ‘by a global technocracy, consisting of an unelected consortium of leaders of industry, central banking oligarchs and private financial institutions, most of which are predominantly non-state corporate actors attempting to restructure global governance and enlist themselves in the global decision-making process.’ See ‘The Great Reset Phase 2: War’.

James Corbett simply observes that ‘the financial order we have known our whole lives is slated for destruction’. The demolition of the economy provides cover to conceal implementation of other key elements of the elite plan in which all fit neatly together: ‘vaccine passports introduce the digital ID. The digital ID provides the infrastructure for the CBDCs. The CBDCs provide a mechanism for enforcement of a social credit system.’ As Corbett notes: ‘To see these events as separate events unfolding haphazardly and coincidentally is to miss the entire point.’ See ‘The Controlled Demolition of the Economy’.

And, according to a source cited by Anviksha Patel, executives at the giant hedge-fund firm Elliott Management Corp. recently sent a letter to investors advising that the world is ‘on the path to hyperinflation’ which could lead to ‘global societal collapse and civil or international strife’. See ‘Hedge-fund giant Elliott warns looming hyperinflation could lead to “global societal collapse”’.

Among many other commentaries offering insight into one or more aspects of what is happening, Oxfam documents the fact that ‘billionaires in the food and energy sectors are increasing their fortunes by $1 billion dollars every two days’ and that a new billionaire is being created every 30 hours while nearly a million people are being pushed into extreme poverty at nearly the same rate. See ‘Pandemic creates new billionaire every 30 hours – now a million people could fall into extreme poverty at same rate in 2022’.

But perhaps the most evocative account of what is transpiring is offered by Egon von Greyerz, founder and managing partner of Matterhorn Asset Management in Switzerland, a company that has ‘always held a deep respect for analysing and managing risk’: By the end of the 1990s, it was clear ‘that global [financial] risk was growing increasingly apparent as debts and derivative levels rapidly rose’. See Matterhorn Asset Management: History.

Noting that laws governing the functioning of modern economies ensure that ‘No banker, no company management or business owner ever has to take the loss personally if he makes a mistake. Losses are socialised and profits are capitalised. Heads I win, Tails I don’t lose!’ Greyerz goes on to note that ‘there are honourable exceptions.’ Some Swiss banks still operate in accordance with the principle of unlimited personal liability for the partners/owners which clearly encourages a responsible, ethical approach to the conduct of business.

He observes: ‘If the global financial system and governments applied that principle, imagine how different the world would look not just financially but also ethically.’ If we had such a system, he contends, then human values would come before adoration of ‘the golden calf’. And evaluation of an investment proposal or a loan would be based on a judgment about its soundness economically and ethically, as well as a judgment that the risk of loss was minimal, rather than just the size of the personal profit it might return.

Instead, since 1971 (when President Nixon unilaterally terminated convertibility of the US dollar into gold, effectively ending the 1944 Bretton Woods system) ‘governments and central banks have contributed to the creation of almost $300 trillion of new money plus quasi money in the form of unfunded liabilities and derivatives [‘the most dangerous and aggressive financial instrument of destruction’] of $2.2 quadrillion making $2.5 [quadrillion] in total. As debt explodes, the world could easily face a debt burden of $3 quadrillion by 2025-2030.’ At the same time, ‘Central banks around the world hold $2 trillion [in gold reserves].’

The outcome is inevitable: ‘with over $2 quadrillion (2 and 15 zeros) of debt and liabilities resting on a foundation of $2 trillion of government-owned gold that makes a gold coverage of 0.1% or a leverage of 1000X!… an inverse pyramid with a very weak foundation.’ Noting that a sound financial system ‘needs a very solid foundation of real money’ it is simply the case that quadrillions of debt and liabilities ‘can not survive resting on this feeble amount of gold. So the $2 quadrillion financial weapon of mass destruction is now on the way to totally destroy the system. This is a global house of cards that will collapse at some point in the not too distant future…. No government and no central bank can solve the problem that they have created. More of the same just won’t work.’ See ‘$2 Quadrillion Debt Precariously Resting on $2 Trillion Gold’.

The most likely outcome, according to Greyerz: ‘The dollar will go to ZERO and the US will default. The same will happen to most countries.’ See ‘In the End the $ Goes to Zero and the US Defaults’.

The fundamental summary then, according to Greyerz, is this: ‘This system will start to implode.’… ‘The whole banking system is rotten. With the problems in Europe now it is actually a critical situation…. We have a two tier economy:… the rich are still rich but the poor are really poor. And you see that in every country in the world now… People haven’t got enough money to live…. This is going to be a human disaster of major proportions: it’s so sad and governments will not have any chance of doing anything about it.’ In the US outside the metropolitan areas, ‘the poverty is incredibly high and people live in boxes… poverty is everywhere and sadly, we are only seeing the beginning and there is no solution…. From a human point of view, we are looking at a major disaster.’ Watch ‘$2.5 Quadrillion Disaster Waiting to Happen’.

Will action be taken to halt the collapse? According to alternative economist Brandon Smith, it won’t. Consider this: ‘What if the goal of the Fed is the destruction of the middle class?… What if they are luring investors into markets with rumors of a pivot, tricking those investors into pumping money back into markets and then triggering losses yet again with more rate hikes and hawkish language? What if this is a wealth destruction steam valve? What if it’s a trap? I present this idea because we have seen this before in the US, from 1929 through the 1930s during the Great Depression. The Fed used very similar tactics to systematically destroy middle class wealth and consolidate power for the international banking elites.’

Smith’s conclusion? ‘This is an engineered crash, not an accidental crash.’ See ‘Markets Are Expecting The Federal Reserve To Save Them – It’s Not Going To Happen’.

And that, of course, is the point: the crash has been engineered. Why?

In summarizing the ongoing collapse of European infrastructure and industry, and energy shortages in the USA, Mike Adams notes that the ‘globalists are decimating the pillars of civilization in order to cause collapse and depopulation…. The overarching goal is to exterminate the vast majority of the human population, then enslave the survivors.’ See ‘Dark Times: Industry and infrastructure collapsing by the day across Europe and the USA’.

But this is no surprise. All that any thoughtful observer needs to do is consider history, listen to what the Global Elite is telling us they are doing, observe them doing it, and then simply inform people what is at hand: The destruction of the global economy, as part of the fundamental reshaping of world order.

After all, the Elite has been crystal clear. It’s fundamental aim is to kill off a substantial proportion of the human population and reduce those humans and transhumans left alive to slavery while confined in their technocratic prison; even wealth concentration is anciliary to that, although a product of it. See ‘The Elite Coup to Kill or Enslave Us: Why Can’t Governments, Legal Actions and Protests Stop Them?’ And if you crash the global economy denying people regular food, energy to stay warm and the capacity to communicate effectively, most of those left alive will be inclined to submit to whatever conditions they are offered in order to survive. How bad does your technocratic prison sound now? Even if you are eating insects?

So, to reiterate a vital point, the Elite agenda in relation to the economy is intimately related to its wider agenda in relation to eugenics and technocracy.

In an interview about her recently published book – see One Nation Under Blackmail: The sordid union between Intelligence and Organized Crime that gave rise to Jeffrey Epstein – Whitney Webb simply observes that ‘we are being herded into a technofeudalism, slavery… there’s a lot of different names for it going around but it’s not good and it’s organized crime running the show’…. Elaborating, Webb explained that ‘They’re looking at feudalism and how do you create a class of slaves that cannot even cognitively rebel ever again.’ Watch ‘How Elites Will Create a New Class of Slaves’.

How will this happen? While it will obviously require several of the range of measures being introduced, particularly including the deployment of 5G, the digitization of your identity and the utilization of a range of other technologies such as artificial intelligence and geofencing, here is what Clive Thompson, retired Managing Director of Union Bancaire Privée in Switzerland, believes might happen:

‘I think its quite likely that the CBDC will arrive and it will also be the subject of the currency reset at the same time. At some point the world is going to go into a crisis or a country is going to go into a crisis…. When that happens I think they will close the banks, you will wake up on a Sunday morning and hear the news that they’ve shut the banks, they’re not going to open on Monday. Then by Monday evening or Tuesday you’ll get the announcement that we’re having a new currency – the CBDC – and don’t worry it will be one-to-one against the old currency but there will be some restrictions on your ability to convert your old money into the new money.

‘So if you’re poor and you have a small bank account it will be converted one-to-one straight away, and you’ll probably even find that you get a free gift from the government to kickstart the system, maybe three or five thousand pounds will be given to every citizen gratuitiously to kickstart the new system to the new CBDC. But if you have a hundred thousand or a million in the bank you’re going to be told ‘Yes, it’s one-to-one but you’re going to have to wait to convert it to the new currency.’ Now “wait” means “never”, we all know that. But they won’t tell you that. They’ll say it’s a temporary suspension because we’re in the middle of a crisis, the people are rioting in the street, we need to calm the system so ‘Here’s some free money everybody, go and enjoy yourselves.’…

‘So I think the CBDC will arrive as a consequence of a crisis and when that happens there will be a limitation on how much of your old currency you can convert, at one-to-one, with the new one…. But the advantage of this, from the government’s point of view, is it’s to all intents and purposes wiping the slate clean because all their liabilities will be denominated in a currency that nobody can use, nobody can spend.’ Watch ‘The Currency Reset Will Wipe Out Creditors and Usher in CBDCs. Part 1’.

In preparing to cope with the disruption this must inevitably cause, among other assets that would be critically useful while retaining value, such as open-pollinated (non-hybrid) seeds, Thompson suggests gold and silver (including gold and silver coins), land, property, equities, collectibles (such as art and rarer coins), machine and other tools, electricity generators, useful items, animals, firewood, washing powder, canned food and house extensions. See ‘The Currency Reset Will Wipe Out Creditors and Usher in CBDCs. Part 2.’

Of course, Thompson might be wrong in his prediction of precisely how the technocratic state will ultimately be imposed. But imposed it will be, one way or another, unless we are effectively resisting the foundational components of the Elite program.

Is cryptocurrency part of the answer?

Many people are suggesting cryptocurrencies as one way around some of the problems we face. However, the very basis of sound economy for any world that is unfolding is self-reliance, particularly in relation to essential needs around food, water, clothing, shelter and energy, within a local, sustainable community that is as self-sufficient as possible, and able to nonviolently defend itself.

Complemented by use of local markets and trading schemes – whether using local currencies or goods and services directly – this will maximise economic survival prospects for those participating (and no doubt some others besides).

Anything that is internet-based will become increasingly vulnerable, and there are definitely plans to shut down some/all of it, depending on the scenario. Cyber Polygon makes that crystal clear. See ‘Taking Control by Destroying Cash: Beware Cyber Polygon as Part of the Elite Coup’.

And unless a currency is backed by something with genuine value – as currencies were backed by gold or other metals in earlier eras – or there is widespread confidence in a currency for another reason (as currencies around the world have been backed by their governments until now), it can become valueless very quickly.

Moreover, the big banks are heavily invested in cryptocurrencies: Another reason to be wary. See ‘3 Banks That Have Big Plans for Blockchain and Cryptocurrency’.

But for an extremely succinct warning against crypto, check out this brief statement from Catherine Austin Fitts: ‘If you move to crypto, and I just want to really underscore this, crypto is not a currency, it is a control system.’ See ‘The Dangers Of Cryptocurrencies’.

And, perhaps, the recent bankruptcy of the FTX Group is worth considering. See ‘“This Is Unprecedented”: Enron Liquidator Overseeing FTX Bankruptcy Speechless: “I Have Never Seen Anything Like This”’.

For another of the many critiques of crypto, see retired corporate accountant Lawrence A. Stellato’s ‘The Dangers of Cryptocurrencies’.

Crypto has a high environmental cost too, given the technology it uses and the energy it needs to run.

In essence: Just not part of the future we must work together to build.

The Rothschilds and Transhumanism

Before concluding this investigation, it is worth returning to consideration of the Rothschild family in relation to one final issue: Transhumanism.

Why is this important?

Throughout this investigation, I have endeavoured to document a few basic facts: The Global Elite is intent on reshaping world order by killing off a substantial proportion of the human population and enslaving those left alive as transhuman slaves imprisoned in ‘smart’ cities. As part of achieving this outcome, the global economy is being ransacked and destroyed: This is intended to deprive people of the sustenance necessary to resist the entire Elite program that, among other outcomes, will concentrate virtually all remaining wealth in Elite hands.

This program has been planned in detail by elite agents in organizations like the World Economic Forum and the World Health Organization and is being implemented by relevant international organizations and multinational corporations (particularly those in the pharmaceutical and biotechnology industries, and the corporate media), as well as national governments and medical organizations.

But, as I have pointed out, every organization, corporation and government is composed of individual human beings who make decisions (consciously or unconsciously) about what they do in any given circumstance. And while structural power is not something that can be ignored, individuals do have agency.

To illustrate this point, I have used the House of Rothschild as one example of a family of individuals who make decisions about how to act in the world and how the decisions of this family exercise enormous influence over world events. Consider another brief example of the decisions made by Rothschild family members and what has transpired as a result.

The Rothschild influence over world banking and the global economy, and thus political systems, is heavily documented and illustrated above. So, given the current Elite push to substantially reduce the human population and introduce a technocratic state populated by transhuman slaves, one question that inevitably suggests itself as worthy of further investigation concerns the possible involvement of the Rothschilds in the research and development of the technologies and biotechnologies that make this all possible.

An investigation soon reveals that Nathaniel Mayer Victor Rothschild, the 3rd Baron Rothschild, was born in 1910 and attended Trinity College, Cambridge, where he read physiology, later gaining a PhD. After working for MI5 during World War II, ‘he joined the zoology department at Cambridge University from 1950 to 1970. He served as chairman of the Agricultural Research Council from 1948 to 1958 and as worldwide head of research at Royal Dutch/Shell [as noted above, a family business] from 1963 to 1970.’ See ‘Victor Rothschild, 3rd Baron Rothschild’.

Beyond this, however, articles in ‘The Financial Times’ in 1982-1983 reveal that N.M. Rothschild, of which the biologist Lord Rothschild was head, had established a venture capital fund called Biotechnology Investments in 1981 to attract £25m investments for biotechnology research. However, the fund, registered in the tax haven of Guernsey, had such exacting scientific and financial standards that it was having trouble identifying companies that could meet those standards despite the rapidly growing field. According to one news report in 1982: ‘City [of London] estimates put the number of new technology companies established in the last five years at about 150, mostly in North America. At least 70 are practising genetic engineering.’ See ‘Newsclippings re. Biotechnology Investments Limited (BIL) owned by N.M. Rothschild Asset Management’.

But lest you are concerned that the Rothschilds failed to establish a firm foothold in this fledgling industry, you might be reassured, but no wiser, to read the entry on the CHSL Archives Repository (that focuses on ‘Preserving and promoting the history of molecular biology’) titled ‘Rothschild Asset Management – Rothschild, Lord Victor’.

You will be no wiser because the archive is marked ‘Closed until Jan 2045 – Suppress all images for 60 years’.

As it turns out, however, the Rothschilds, whose business acumen is never questioned, are still raising funds and investing heavily in biotechnology. See ‘Edmond de Rothschild private equity unit to invest in biotech’. It’s just that, as usual, while you are hearing from elite agents (such as Klaus Schwab, Yuval Noah Harari and Elon Musk) who publicly promote transhumanist endeavours, you are hearing very little from those, like the Rothschilds, who prefer control and profit to publicity.

Consequently, the Rothschilds are playing a key role both in the ongoing ransacking of the global economy and in profiting from the control they are helping to make possible through introduction of transhumanist technologies. It goes without saying that the family has heavy investments in many other technologies too, including those that will be critical to the success of the imminent technocratic world order, such as the Internet of Things. See, for example, Rothschild Technology Limited.

Of course, the Rothschilds and other Elite families with whom they are interconnected in various ways are also heavily involved through investments in major asset management corporations such as Vanguard and BlackRock. But again, it is not just about wealth concentration; it is about control and depopulation too. So, for example, the Rockefellers, another family closely connected to the Rothschilds, are also well-known for their longstanding involvement in social engineering and eugenics. See ‘Where Did this “New World Order” Coup Come From? The Rockefeller’s “Social Engineering Project”’ and ‘Killing Off Humanity: How the Global Elite is using Eugenics and Transhumanism to Shape Our Future’.

So What Can We Do about This?

Because it controls the political, economic, financial, technological, medical, educational, media and other important levers of society, the Elite profits hugely from daily human activity. But it can also precipitate an ‘extreme event’ (or the delusion of one) – a war, financial crisis (including depression), revolution, ‘natural disaster’, ‘pandemic’ (if you think that the Covid-19 scam was the last of its kind, see ‘Who’s Driving the Pandemic Express?’ and watch the plan for the next one, already available: ‘Catastrophic Contagion’) – and use its control of the political, economic, technological and other levers mentioned to manage how events unfold while simultaneously managing the narrative about what is taking place so that the truth is concealed.

This means that the Elite’s killing and exploitation of the human population at large is hidden behind whatever ‘enemy’ (human or otherwise) that Elite agents in government and the media direct the attention of the public towards at any given time.

It doesn’t matter whether we all end up blaming Hitler, Saddam or ‘the Russians’, ‘the capitalists’ or ‘Wall Street’, ‘the government’, ‘the climate’ or ‘the virus’, we never blame the Elite. So we never take action that is focused on stopping those individuals and their corporations and institutions that are fundamentally responsible for inflicting unending harm on us all, as well as the Earth and all of its other creatures too.

Fortunately, while the Elite is adept at devising an ever-expanding range of tools that can be used to manipulate events while simultaneously concealing this behind a barrage of propaganda, there is still just enough time to finally recognize what is happening and to end it. Otherwise, just as in the board game ‘Monopoly’, where one player finally owns everything and the other players have been forced out of the game, the Elite will win the ‘final battle’ against humanity, capture all wealth and reduce those humans and transhumans left alive to the status of slaves. See ‘The Final Battle for Humanity: It is “Now or Never” in the Long War Against Homo Sapiens’.

Does this sound insane to you? Of course it is. Do you think the Elite is insane? Of course it is. See ‘The Global Elite is Insane Revisited’ with further detail in ‘Why Violence?’ and ‘Fearless Psychology and Fearful Psychology: Principles and Practice’.

But just because someone is insane and their plan is insane, it doesn’t mean they cannot succeed. Remember Adolf Hitler? Idi Amin in Uganda? Pol Pot in Cambodia? Insane violence of unspeakable magnitude can succeed if too many people either cannot perceive the insanity, are afraid of it or simply believe it is too preposterous – ‘It can’t be true.’ – and do nothing about it. Or, in the cases just mentioned, not until it was too late to prevent vast killing.

So here is the summary: Humanity faces the gravest threat in our history. But because our opponent – the Global Elite – is insane, we cannot rely on reason or thoughtfulness alone to get us out of this mess: You cannot reason with insanity. And because the Global Elite controls international and national political processes, the global economy and legal systems, efforts to seek redress through those channels must fail. See ‘The Elite Coup to Kill or Enslave Us: Why Can’t Governments, Legal Actions and Protests Stop Them?’

Hence, if we are going to defeat this long-planned, complex and multifaceted threat, we must defeat its foundational components, not delude ourselves that we can defeat it one threat at a time or even by choosing those threats we think are the worst and addressing those first.

This is because the elite program, whatever its flaws and inconsistencies, as well as its potential for technological failure at times, is deeply integrated so we must direct our efforts at preventing or halting those foundational components of it that make everything else possible. This is why random acts of resistance will achieve nothing. Effective resistance requires the focused exercise of our power. In simple terms, we must be ‘strategic’.

If you are interested in being strategic in your resistance to the ‘Great Reset’ and its related agendas, you are welcome to participate in the ‘We Are Human, We Are Free’ campaign which identifies a list of 30 strategic goals for doing so.

In addition and more simply, you can download the one-page flyer that identifies a short series of crucial nonviolent actions that anyone can take. This flyer, recently updated and now available in 23 languages (Chinese, Croatian, Czech, Danish, Dutch, English, Finnish, French, German, Greek, Hebrew, Hungarian, Italian, Japanese, Malay, Polish, Portuguese, Romanian, Russian, Serbian, Spanish, Slovak and Turkish) with several more languages in the pipeline, can be downloaded from here: ‘One-page Flyer’.

If this strategic resistance to the ‘Great Reset’ (and related agendas) appeals to you, consider joining the ‘We Are Human, We Are Free’ Telegram group (with a link accessible from the website).

And if you want to organize a mass mobilization, such as a rally, at least make sure that one or more of any team of organizers and/or speakers is responsible for inviting people to participate in this campaign and that some people at the event are designated to hand out the one-page flyer about the campaign.

If you like, you can also watch, share and/or organize to show, a short video about the campaign here: ‘We Are Human, We Are Free’ video.

In parallel with our resistance, we must create the political, economic and social structures that serve our needs, not those of the Elite. That is why long-standing efforts to encourage and support people to grow their own food, participate in local trading schemes (involving the exchange of knowledge, skills, services and products with or without a local medium of exchange) and develop structures for cooperation, governance, nonviolent defence and networking with other communities are so important. Of course, indigenous peoples still have many of these capacities – lost to vast numbers of humans as civilization has expanded over the past five millennia – but many people are now engaged in renewed efforts to create local communities, such as ecovillages, and local trading schemes, such as Community Exchange Systems. Obviously, we must initiate/expand these forms of individual and community engagement in city neighbourhoods too.

Moreover, as Catherine Austin Fitts reminds us, if we choose that option, there is nothing to stop us having our own decentralised money system, starting with our own local community central bank and our own local community currency. Watch ‘We Need to Talk about Mr Global – Part Two’.

Finally, as noted by Professor Carroll Quigley in the very last words of his nearly-1,000 page epic Tragedy & Hope:

‘Some things we clearly do not yet know, including the most important of all, which is how to bring up children to form them into mature, responsible adults.’ See Tragedy & Hope: A History of the World in Our Time, p. 947.

Fortunately, the passage of time since Quigley wrote these words has revealed an answer to this challenge. So, if you want to raise children who are powerfully able to investigate, analyze and act, you are welcome to make ‘My Promise to Children’.

Conclusion

Since the dawn of human civilization 5,000 years ago, in one context after another, some people who are more terrified than others in their immediate vicinity have sought what they perceived to be increased personal ‘security’ by gaining and exercising greater control over the people and resources around them.

Progressively, over time, this serious psychological dysfunctionality has been compounding until, today, the degree of ‘security’ and control that some people require includes all of us and all of the world’s resources. For want of a better term, we might call them the ‘Global Elite’ but it is important to understand that they are insane, criminal and ruthlessly violent.

This takeover of all of us and everything on Planet Earth is currently being attempted by this Elite through the ‘Great Reset’ and its related fourth industrial revolution, eugenicist and transhumanist agendas.

In essence, the intention is to kill off a substantial proportion of us, as is now happening, enclose the commons forever (and force those who live in regional areas off the land) while imprisoning those left alive as transhuman slaves in their technocratic ‘smart cities’ where we will ‘own nothing’ but provide the compliant workforce necessary to serve Elite ends.

Whether wars or financial crises (including depressions), ‘natural disasters’, revolutions or ‘pandemics’, great events are contrived by the Elite to distract attention from and facilitate profound changes in world order and obscure vast transfers of wealth from ordinary people to this Elite.

And this is done with the active complicity of Elite agents – including international organizations such as the United Nations, national governments and legal systems – which is why redress cannot be found through mainstream political or legal channels.

However, distracted by an endless stream of irrelevant ‘news’, superficial debates such as capitalism vs. socialism, monarchy vs. democracy, this political party vs. that political party, or even which football team is better, virtually all people are oblivious to how the world really works and who is orchestrating how history will be written by elite agents.

Is there conflict between individuals, families and groups within the Elite? Of course! But unlike the conflicts they endlessly throw in our faces to distract and manipulate us, the unifying agenda to which they all subscribe is to perpetually restructure world order to expand Elite control and extract more wealth for Elites. 5,000 years of human history categorically demonstrates that point.

Hence, if humanity is to defeat this Elite program, we must do it ourselves.

And if you want your resistance to this carefully-planned Elite technocratic takeover to be effective, then it must be strategic. Otherwise, your death or technocratic enslavement is now imminent.

I thank Anita McKone for thoughtful suggestions to improve the original draft of this investigation.

Robert J. Burrowes has a lifetime commitment to understanding and ending human violence. He has done extensive research since 1966 in an effort to understand why human beings are violent and has been a nonviolent activist since 1981. He is the author of ‘Why Violence?’ His email address is flametree@riseup.net and his website is here. He is a regular contributor to Global Research.