These six men own as much wealth as half the world’s population

By Alec Anderson

Source: WSWS.org

On Wednesday, the US finance magazine Forbes released its annual “Forbes 400” list of wealthiest Americans, revealing an immense increase in wealth among the top social stratum in the United States.

The total net worth of the 400 people included on the list hit a record $2.9 trillion this year, up from $2.7 trillion last year. The most heavily represented sector was finance, from which 88 people on the list, including bank executives, hedge fund managers and investors, drew their wealth.

The next highest proportion comes from technology giants such as Google and Facebook. The CEO of Twitter and payments firm Square, Jack Dorsey, registered the greatest percentage growth in wealth from the previous year, an increase of 186 percent to $6.3 billion. This was due in large part to a jump in Square’s stock price.

The threshold necessary for inclusion on the list rose to $2.2 billion in 2018, up $100 billion from last year’s threshold. Fully one-third of billionaires in the United States, a record 204 individuals, failed to make this year’s Forbes 400 list.

The average net worth of billionaires on the list rose to $7.2 billion, an increase of a half-billion over last year’s average of $6.7 billion.

As Forbes notes, the vast increase in wealth among the very richest Americans is largely thanks to a continuing surge in US stock indexes. They have reached new record highs in part due to unprecedented levels of stock buybacks and dividend increases, which are parasitic diversions of wealth away from productive investment in areas that produce decent-paying jobs and to the detriment of pursuits such as research and development. The billionaires on the Forbes 400 list have also benefited immensely from the Trump tax cuts for corporations and the wealthy signed into law in December 2017.

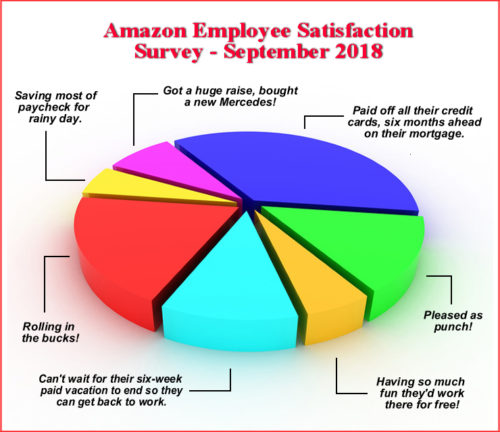

Topping the list is Amazon CEO and world’s richest person Jeff Bezos, whose $160 billion is $63 billion more than the second-wealthiest person on the list, Bill Gates, and a full $78.5 billion more than last year. Bezos has made his fortune through the super-exploitation of warehouse workers around the world, enabling Amazon to move its products faster and at cheaper prices than its retail competitors.

The staggering increase in Bezos’s wealth over the past year has been due to the more than 100 percent increase in Amazon’s stock price. The $2,950 Jeff Bezos has earned per second in 2018 is more than the $2,796 a fulfillment center worker in India makes in an entire year.

Ironically, the Forbes report was published the same day that the press was full of praise for Bezos’s supposed generosity and humanitarian concern for his workers, occasioned by the announcement that he was raising the minimum wage of his US-based employees to the poverty-level wage of $15 an hour.

If the $160 billion fortune Bezos holds were divided among Amazon’s global workforce of 500,000, each worker would receive $320,000.

Coming in second on the list with a net worth of $97 billion is Microsoft co-founder and former CEO Bill Gates, who had topped the Forbes list since 1994. The top 10 wealthiest people on the list alone have a total net worth of $730 billion, up from $610 billion in 2018.

However, just the top 45 individuals out of the 400 on the list accounted for fully half of the total wealth, or $1.45 trillion. That amounts to an average fortune of more than $32 billion each, which is more than the estimated $30 billion required to end world hunger, according to a United Nations estimate.

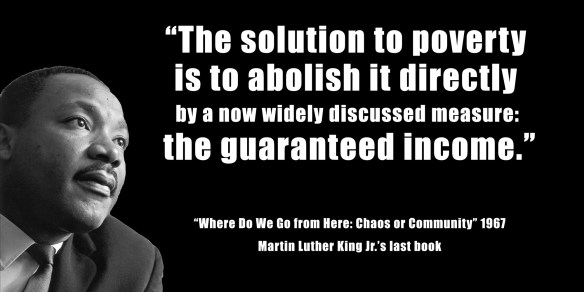

The Forbes report illustrates that the barrier to resolving societal ills, such as poverty, hunger and disease, is the siphoning off and hoarding of a growing proportion of society’s resources by the wealthiest segment of society.

The $2.9 trillion in the hands of these 400 richest people in the United States is roughly three-quarters of the total federal budget. It represents nearly three times the 2018 budget for the Department of Health and Human Services, which was slashed from over $1.126 trillion in 2017 to $1.112 trillion this year, and 176 times the $16.4 billion budget for the Department of Education in 2018.

Rather than addressing these issues, the Democratic Party’s midterm election campaign has instead been centered on a right-wing effort to channel opposition to Supreme Court nominee Brett Kavanaugh and Donald Trump behind a #MeToo-style hysteria over alleged sexual abuse. This is accompanied by the ongoing campaign to demonize Russia and Vladimir Putin and brand Trump as a stooge of the Kremlin.

The timing of the release of the Forbes list is significant, coming as it does on the 10-year anniversary of the passage of the Troubled Asset Relief Program (TARP)—the $700 billion bank bailout that set the stage for the trillions that were essentially stolen from the working class to rescue the financial oligarchy and make it richer than ever. The result of the decade-long plundering of society since the crash, carried out by both Republican and Democratic administrations, is the ever-increasing concentration of wealth at the very top reflected in the new Forbes 400 list.