By John W. Whitehead

Source: The Rutherford Institute

“When plunder becomes a way of life for a group of men in a society, over the course of time they create for themselves a legal system that authorizes it and a moral code that glorifies it.” ― Frédéric Bastiat, French economist

Americans can no longer afford to get sick and there’s a reason why.

That’s because a growing number of Americans are struggling to stretch their dollars far enough to pay their bills, get out of debt and ensure that if and when an illness arises, it doesn’t bankrupt them.

This is a reality that no amount of partisan political bickering can deny.

Many Americans can no longer afford health insurance, drug costs or hospital bills. They can’t afford to pay rising healthcare premiums, out-of-pocket deductibles and prescription drug bills.

They can’t afford to live, and now they can’t afford to get sick or die, either.

To be clear, my definition of “affordable healthcare” is different from the government’s. To the government, you can “afford” to pay for healthcare if your income falls above the poverty line. That takes no account of rising taxes, the cost of living, the cost to clothe and feed a household, the cost of transportation and communication and education, or any of the other line items that add up to a life worth living.

As Helaine Olen points out in The Atlantic:

“Just because a person is insured, it doesn’t mean he or she can actually afford their doctor, hospital, pharmaceutical, and other medical bills. The point of insurance is to protect patients’ finances from the costs of everything from hospitalizations to prescription drugs, but out-of-pocket spending for people even with employer-provided health insurance has increased by more than 50 percent since 2010.”

For too many Americans, achieving any kind of quality of life has become a choice between putting food on the table and paying one’s bills or health care coverage.

It’s a gamble any way you look at it, and the medical community is not helping.

Healthcare costs are rising, driven by a medical, insurance and pharmaceutical industry that are getting rich off the sick and dying.

Indeed, Americans currently pay $3.4 trillion a year for medical care. We spent more than $10,000 per person on health care in 2016. Those attempting to shop for health insurance coverage right now are understandably experiencing sticker shock with premiums set to rise 34% in 2018. It’s estimated that costs may rise as high as $15,000 by 2023.

As Bloomberg reports, “Rising health-care costs are eating up the wage gains won by American workers, who are being asked by their employers to pick up more of the heftier tab… The cost of buying health coverage at work has increased faster than wages and inflation for years, pressuring household budgets.”

Appallingly, Americans spend more than any developed country on healthcare and have less to show for it. We don’t live as long, we have higher infant mortality rates, we have fewer hospital and physician visits, and the quality of our healthcare is generally worse. We also pay astronomical amounts for prescription drugs, compared to other countries.

Whether or not you’re insured through an employer, the healthcare marketplace, a government-subsidized program such as Medicare or Medicaid, or have no health coverage whatsoever, it’s still “we the consumers” who have to pay to subsidize the bill whenever anyone gets sick in this country. And that bill is a whopper.

While Obamacare (a.k.a. the Affordable Care Act) may have made health insurance more accessible to greater numbers of individuals, it has failed to make healthcare any more affordable.

Why?

As journalist Laurie Meisler concludes, “One big reason U.S. health care costs are so high: pharmaceutical spending. The U.S. spends more per capita on prescription medicines and over-the-counter products than any other country.”

One investigative journalist spent seven months analyzing hundreds of bills from hospitals, doctors, drug companies, and medical equipment manufacturers. His findings confirmed what we’ve known all along: health care in America is just another way of making corporations rich at consumer expense.

An examination of an itemized hospital bill (only available upon request) revealed an amazing amount of price gouging. Tylenol, which you can buy for less than $10 for a bottle, was charged to the patient at a rate of $15 per pill, for a total of $345 for a hospital stay. $8 for a plastic bag to hold the patient’s personal items and another $8 for a box of Kleenex. $23 for a single alcohol swab. $53 per pair for non-sterile gloves (adding up to $5,141 for the entire hospital stay). $10 for plastic cup in which to take one’s medicine. $93 for the use of an overhead light during a surgical procedure. $39 each time you want to hold your newborn baby. And $800 for a sterile water IV bag that costs about a dollar to make.

This is clearly not a problem that can be remedied by partisan politics.

The so-called Affordable Care Act pushed through by the Obama administration is proving to be anything but affordable for anyone over the poverty line. And the Trump administration’s “fixes” promise to be no better. Indeed, for too many Americans who live paycheck to paycheck and struggle just to get by, the tax penalty for not having health insurance will actually be cheaper than trying to find affordable coverage that actually pays for care.

This is how the middle classes, who fuel the nation’s economy and fund the government’s programs, get screwed repeatedly.

When almost 60% of Americans are so financially strapped that they don’t have even $500 in savings and nothing whatsoever put away for retirement, and yet they are being forced to pay for government programs that do little to enhance their lives, we’re not living the American dream.

We’re living a financial nightmare.

We have no real say in how the government runs, or how our taxpayer funds are used, but that doesn’t prevent the government from fleecing us at every turn and forcing us to pay for endless wars that do more to fund the military industrial complex than protect us, pork barrel projects that produce little to nothing, and a police state that serves only to imprison us within its walls.

We have no real say, but we’re being forced to pay through the nose, anyhow.

George Harrison, who died 16 years ago this month, summed up this outrageous state of affairs in his song Taxman:

If you drive a car, I’ll tax the street,

If you try to sit, I’ll tax your seat.

If you get too cold I’ll tax the heat,

If you take a walk, I’ll tax your feet.

Don’t ask me what I want it for

If you don’t want to pay some more

‘Cause I’m the taxman, yeah, I’m the taxman

Now my advice for those who die

Declare the pennies on your eyes

‘Cause I’m the taxman, yeah, I’m the taxman

And you’re working for no one but me.

In other words, in the eyes of the government, “we the people, the voters, the consumers, and the taxpayers” are little more than indentured servants and sources of revenue.

If you have no choice, no voice, and no real options when it comes to the government’s claims on your property and your money, you’re not free.

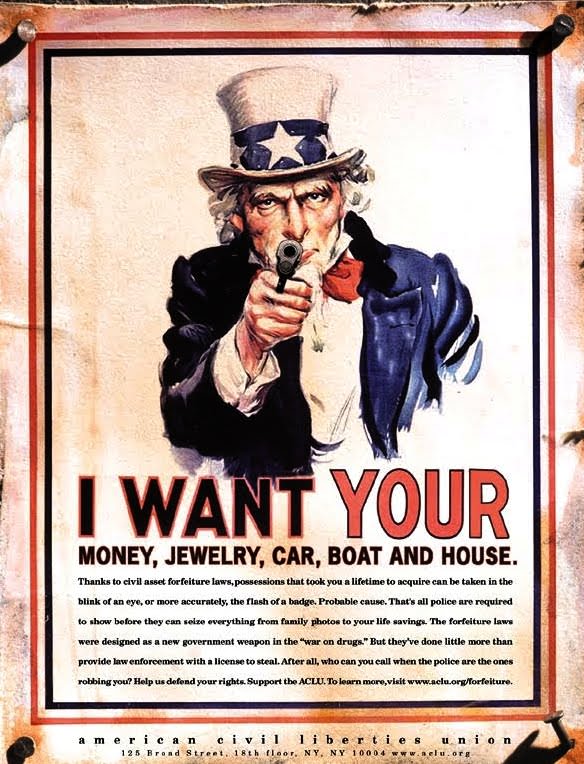

Consider: The government can seize your home and your car (which you’ve bought and paid for) over nonpayment of taxes. Government agents can freeze and seize your bank accounts and other valuables if they merely “suspect” wrongdoing. And the IRS insists on getting the first cut of your salary to pay for government programs over which you have no say.

It wasn’t always this way, of course.

Early Americans went to war over the inalienable rights described by philosopher John Locke as the natural rights of life, liberty and property.

It didn’t take long, however—a hundred years, in fact—before the American government was laying claim to the citizenry’s property by levying taxes to pay for the Civil War. As the New York Times reports, “Widespread resistance led to its repeal in 1872.”

Determined to claim some of the citizenry’s wealth for its own uses, the government reinstituted the income tax in 1894. Charles Pollock challenged the tax as unconstitutional, and the U.S. Supreme Court ruled in his favor. Pollock’s victory was relatively short-lived. Members of Congress—united in their determination to tax the American people’s income—worked together to adopt a constitutional amendment to overrule the Pollock decision.

On the eve of World War I, in 1913, Congress instituted a permanent income tax by way of the 16th Amendment to the Constitution and the Revenue Act of 1913. Under the Revenue Act, individuals with income exceeding $3,000 could be taxed starting at 1% up to 7% for incomes exceeding $500,000.

It’s all gone downhill from there.

Unsurprisingly, the government has used its tax powers to advance its own imperialistic agendas and the courts have repeatedly upheld the government’s power to penalize or jail those who refused to pay their taxes.

Irwin A. Schiff was one of the nation’s most vocal tax protesters. He spent a good portion of his life arguing that the income tax was unconstitutional. He paid the price for his resistance, too: Schiff served three separate prison terms (more than 10 years in all) over his refusal to pay taxes. He died at the age of 87 serving a 14-year prison term. As constitutional activist Robert L. Schulz noted in Schiff’s obituary, “In a society where there is so much fear of government, and in particular of the I.R.S., [Schiff] was probably the most influential educator regarding the illegal and unconstitutional operation and enforcement of the Internal Revenue Code. It’s very hard to speak to power, but he did, and he paid a very heavy price.”

It’s still hard to speak to power, and those who do are still paying a very heavy price.

All the while the government continues to do whatever it likes—levy taxes, rack up debt, spend outrageously and irresponsibly—with little thought for the plight of its citizens.

The national debt is $20 trillion and growing. The amount this country owes is now greater than its gross national product (all the products and services produced in one year by labor and property supplied by the citizens). We’re paying more than $270 billion just in interest on that debt annually. And the top two foreign countries who “own” our debt are China and Japan.

To top it all off, all of those wars the U.S. is so eager to fight abroad are being waged with borrowed funds. As The Atlantic reports, “For 15 years now, the United States has been putting these wars on a credit card… U.S. leaders are essentially bankrolling the wars with debt, in the form of purchases of U.S. Treasury bonds by U.S.-based entities like pension funds and state and local governments, and by countries like China and Japan.”

If Americans managed their personal finances the way the government mismanages the nation’s finances, we’d all be in debtors’ prison by now.

Still, the government remains unrepentant, unfazed and undeterred in its money grabs.

While we’re struggling to get by, and making tough decisions about how to spend what little money actually makes it into our pockets after the federal, state and local governments take their share (this doesn’t include the stealth taxes imposed through tolls, fines and other fiscal penalties), the police state is spending our hard-earned tax dollars to further entrench its powers and entrap its citizens.

For instance, American taxpayers have been forced to shell out $5.6 trillion since 9/11 for the military industrial complex’s costly, endless so-called “war on terrorism.” That translates to roughly $23,000 per taxpayer to wage wars abroad, occupy foreign countries, provide financial aid to foreign allies, and fill the pockets of defense contractors and grease the hands of corrupt foreign dignitaries.

Mind you, that staggering $6 trillion is only a portion of what the Pentagon spends on America’s military empire.

That price tag keeps growing, too.

The 16-year war in Afghanistan, which now stands as the longest and one of the most expensive wars in U.S. history, is about to get even longer and more costly, thanks to President Trump’s promise to send more troops over.

In this way, the military industrial complex will get even richer, and the American taxpayer will be forced to shell out even more funds for programs that do little to enhance our lives, ensure our happiness and well-being, or secure our freedoms.

As Dwight D. Eisenhower warned in a 1953 speech:

Every gun that is made, every warship launched, every rocket fired signifies, in the final sense, a theft from those who hunger and are not fed, those who are cold and are not clothed. This world in arms is not spending money alone. It is spending the sweat of its laborers, the genius of its scientists, the hopes of its children. The cost of one modern heavy bomber is this: a modern brick school in more than 30 cities. It is two electric power plants, each serving a town of 60,000 population. It is two fine, fully equipped hospitals. It is some fifty miles of concrete pavement. We pay for a single fighter plane with a half million bushels of wheat. We pay for a single destroyer with new homes that could have housed more than 8,000 people. This is, I repeat, the best way of life to be found on the road the world has been taking. This is not a way of life at all, in any true sense. Under the cloud of threatening war, it is humanity hanging from a cross of iron. […] Is there no other way the world may live?

This is still no way of life.

Yet it’s not just the government’s endless wars that are bleeding us dry.

We’re also being forced to shell out money for surveillance systems to track our movements, money to further militarize our already militarized police, money to allow the government to raid our homes and bank accounts, money to fund schools where our kids learn nothing about freedom and everything about how to comply, and on and on.

Are you getting the picture yet?

The government isn’t taking our money to make our lives better. Just take a look at the nation’s failing infrastructure, and you’ll see how little is being spent on programs that advance the common good.

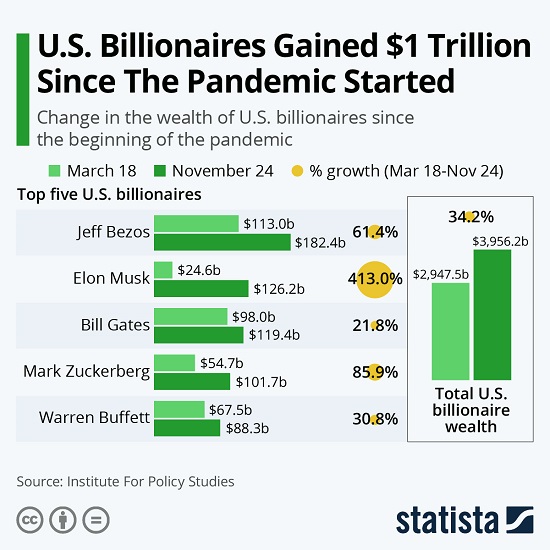

We’re being robbed blind so the governmental elite can get richer.

This is nothing less than financial tyranny.

“We the people” have become the new, permanent underclass in America.

It’s tempting to say that there’s little we can do about it, except that’s not quite accurate.

There are a few things we can do (demand transparency, reject cronyism and graft, insist on fair pricing and honest accounting methods, call a halt to incentive-driven government programs that prioritize profits over people), but it will require that “we the people” stop playing politics and stand united against the politicians and corporate interests who have turned our government and economy into a pay-to-play exercise in fascism.

We’ve become so invested in identity politics that label us based on our political leanings that we’ve lost sight of the one label that unites us: we’re all Americans.

As I make clear in my book Battlefield America: The War on the American People, the powers-that-be want to pit us against one another. They want us to adopt an “us versus them” mindset that keeps us powerless and divided. Trust me, the only “us versus them” that matters anymore is “we the people” against the police state.

We’re all in the same boat, folks, and there’s only one real life preserver: that’s the Constitution and the Bill of Rights.

The Constitution starts with those three powerful words: “We the people.”

The message is this: there is power in our numbers.

That remains our greatest strength in the face of a governmental elite that continues to ride roughshod over the populace. It remains our greatest defense against a government that has claimed for itself unlimited power over the purse (taxpayer funds) and the sword (military might). As Patrick Henry declared in the last speech before his death, “United we stand, divided we fall. Let us not split into factions … or … exhaust [our strength] in civil commotions and intestine wars.”

This holds true whether you’re talking about health care, war spending, or the American police state.