A Fed-issued digital currency would be no more in our interests than the current dollar system.

By Jeremy R. Hammond

Source: Jeremy R. Hammond Blog

China’s ‘Social Credit’ System

“And he causeth all, both small and great, rich and poor, free and bond, to receive a mark in their right hand, or in their foreheads: And that no man might buy or sell, save he that had the mark, or the name of the beast, or the number of his name.” — Revelation 13:16-17

In China, as you have likely heard, the government has been experimenting with a “social credit” system aimed at giving politicians even greater control over people’s behavior. China was, of course, also the country whose authoritarian “lockdown” response to the outbreak of SARS‑CoV‑2—the coronavirus that causes COVID‑19 and was likely engineered in a Chinese lab with US government funding—was pointed to as a model for the rest of the world to follow by the World Health Organization (WHO).

The WHO has since been aiming to acquire even more centralized global authority to issue diktats in the event of another pandemic, such as implementation of “lockdown” measures that might include travel restrictions, prevention of employment, and vaccine mandates or passport systems.

As of December 2020, around the time of the initial outbreak of the virus in Wuhan, China, social credit laws and regulations had been implemented in an estimated 80 percent of the country.

Naturally, the system is characterized by its proponents as a benevolent means to reward socially responsible people while denying privileges to unsavory and untrustworthy characters and businesses. But you and I both recognize the grave threat posed by politicians wielding this type of power and control over the population. It is an obvious threat to privacy and liberty.

The people of China regrettably but unsurprisingly appear to have welcomed this system, although the perception of public approval might be largely an artifact of people being afraid to publicly criticize the system lest their names be placed on one of the government’s “blacklists”.

As with any law or government policy, we should view it through the lens of how such power could be used as opposed to how politicians say they intend to use it.

A glimpse of how it could be used is the city of Rongcheng’s prohibition on “spreading harmful information”, violations of which could result in subtraction of points off residents’ social credit scores.

Such prohibitions must be seen in light of how governments are in the habit of interpreting “harmful information” as any information that does not align with the adopted political agenda. In the US during the COVID‑19 pandemic, there has been no greater purveyor of misinformation than the US government itself.

According to MIT Technology Review, the central government actually pressed the city to scale back the threat to individual liberty posed by its social credit system, such as enabling residents to opt-out. “The Chinese government did emphasize that all social-credit-related punishment has to adhere to existing laws,” the Review states, “but laws themselves can be unjust in the first place.”

The takeaway from that article is that “the social credit system does not (yet) exemplify abuse of advanced technologies like artificial intelligence”. But that’s no reason for the citizenry to consent to the implementation of systems that are conducive to extreme governmental abuses of authority.

A July 2019 article in Wired magazine related the example of Liu Hu, a journalist who was arrested, fined, and blacklisted, reportedly for writing about censorship and government corruption. He found himself on a “List of Dishonest Persons Subject to Enforcement by the Supreme People’s Court as ‘not qualified’ to buy a plane ticket, and banned from travelling some train lines, buying property, or taking out a loan.”

A more recent Newsweek article appropriately describes the system this way:

On an individual level, the government seeks to instill in the public an increased sense of morality to discourage everything from fraud and plagiarism to counterfeit goods and petty crime. But a system to make individual actions more transparent would necessitate the creation of tools to monitor all aspects of life. Social control, if not the original aim, could be an inevitable consequence, researchers say.

. . . While China’s vision of the system has yet to emerge as a dystopian tool for control driven by big data, there are real concerns about the way personal information is to be collected and processed to create social credit profiles, which could have lasting implications for individuals.

An untrustworthy government has no place dictating to its citizens what types of behaviors should be regarded as creating or breaking trust.

Human Rights Watch provides the example of lawyer Li Xioaolin, who was denied a plane ticket home while away on a work trip inside China because his name was on a blacklist of “untrustworthy” people in relation to a years-old court-related issue that he thought he had resolved.

According to Human Rights Watch, journalist Liu Hu was punished not for criticizing the government and exposing corruption but for having offered an apology that the government deemed “insincere” after losing a defamation case for publishing an article alleging that someone was an extortionist. Still, the organization notes, in both cases, “penalties were exacted in wildly arbitrary and unaccountable manners.” Additionally, “the courts failed to notify them, leaving them no chance to contest their treatment.”

According to the human rights organization, between 2013 and 2017, the Chinese government imposed more than seven million punishments to people for failing to carry out local court orders, which punishments have included publicly naming and shaming individuals and barring them from flights and trains.

After experiencing the totalitarianism of the disastrously harmful lockdown regimes and the accompanying efforts to coerce the population into accepting COVID‑19 vaccines and to censor truths countering the government’s incessant lies (I was permanently banned from LinkedIn, for example, for accurately reporting that the CDC’s claim that COVID‑19 vaccines provide greater protection against SARS‑CoV‑2 infection than natural immunity was a bald-faced lie), it should not be too difficult to imagine such a system being dangerously used to silence critics and punish dissenters so that whatever ruling regime can continue its crimes against humanity unobstructed.

The idea of a “social credit” score, of course, is inherently tied to the idea of central banking. In the US, the central bank is the Federal Reserve, a government-legislated private monopoly over the supply of currency. Increasingly, there is talk of a central bank digital currency, heightening concerns about the government having the means to exercise power over us and control our behavior.

“Project Hamilton”

As an example of how the Fed is exploring the idea of adopting a digital currency, the Massachusetts Institute of Technology (MIT) has teamed up with the Federal Reserve Bank of Boston under the appropriately named “Project Hamilton”.

Alexander Hamilton, of course, was instrumental in the adoption of central banking by the US government, famously at odds with Thomas Jefferson, who rightly opposed the idea and warned about the dangers inherent in such an institution. Jefferson appeared to hold the view that the means of exchange and interest rates ought to be determined by the market as opposed to being determined by fiat by a roomful of central planners.

Jefferson accurately foresaw how the government would use the central bank to pay for its spending as an alternative to raising taxes directly, and how the debt that would consequently be incurred by this uncontrolled spending would ultimately be borne by future generations.

In a letter to John Wayles Eppes in 1813, for example, Jefferson wrote:

I have said that the taxes should be continued by annual or biennial re-enactments; because a constant hold, by the nation, of the strings of the public purse, is a salutary restraint, from which an honest government ought not to wish, nor a corrupt one to be permitted, to be free. No tax should ever be yielded for longer than that of the Congress granting it, except when pledged for the reimbursement of a loan.

. . . Bank-paper must be suppressed, and the circulating medium must be restored to the nation to whom it belongs. . . . Treasury bills, bottomed on taxes, bearing, or not bearing interest, as may be found necessary, thrown into circulation, will take the place of so much gold & silver, which last, when crouded, will find an efflux into other countries, and thus keep the quantum of medium at its salutary level.

In a letter to John Taylor in 1816, Jefferson described central banking as rightly “reprobated” and as “a blot left in all our constitutions, which, if not covered, will end in their destruction”. He wrote, “And I sincerely believe with you, that banking establishments are more dangerous than standing armies; & that the principle of spending money to be paid by posterity, under the name of funding, is but swindling futurity on a large scale”.

Jefferson viewed the federal government as having no authority to institute a central banking system. As he wrote in 1791, “The incorporation of a bank, and the powers assumed by this bill, have not, in my opinion, been delegated to the United States, by the Constitution.”

The stated aim of Project Hamilton “is to investigate the technical feasibility of a general purpose central bank digital currency (CBDC) that could be used by an economy the size of the United States and to gain a hands-on understanding of a CBDC’s technical challenges, opportunities, risks, and tradeoffs.”

The project is part of MIT’s “Digital Currency Initiative”, which is aimed at bringing minds together “to conduct the research necessary to support the development of digital currency and blockchain technology.”

The aim of the collaboration with the Federal Reserve Bank of Boston has been “to develop a hypothetical CBDC.” MIT describes the possibility of a “central-bank-issued digital currency” as “a unique opportunity to address challenges in our existing payments system and design an economy that is more resilient, participatory, and open.”

We can reasonably assume that Thomas Jefferson, were he alive today, would disagree and view the idea as anathema to both a sound economy and a free society.

Noting that it was Alexander Hamilton “who laid the foundation for a U.S. central bank”, a project white paper published in February 2022 concluded that it is “critical” for research to continue for “achieving goals for a CBDC.” That is, it is not a question of whether the Fed should adopt a digital currency but how and when.

Biden’s Executive Order and Project Lithium

In January 2022, the Federal Reserve Board of Governors similarly published a paper titled “Money and Payments: The U.S. Dollar in the Age of Digital Transformation”, the aim of which was “to foster a broad and transparent public dialogue about CBDCs in general, and about the potential benefits and risks of a U.S. CBDC.”

Then in March 2022 President Joe Biden signed an “Executive Order on Ensuring Responsible Development of Digital Assets”, which declares the supposed need for the US government to “regulate” digital assets, including for the purpose of preventing circumvention of its sanctions regimes—in which context we might remember the US government’s criminal sanctions regime against Iraq in the 1990s and how Secretary of State Madeleine Albright insisted that the “price” of half-a-million dead Iraqi children was “worth it”.

The executive order, number 14067, describes how the government has an interest in maintaining the US dollar’s “central role” in “the global financial system”, which refers to the use of the dollar as a reserve currency. To that end, the order states, the Biden administration “places the highest urgency on research and development efforts into the potential design and deployment options of a United States CBDC.”

The White House is intent on determining what actions would be required to launch such a currency “if doing so is deemed to be in the national interest”. Of course, as the example of half a million excess childhood deaths in Iraq due to sanctions once again illustrates, determining just what is in the “national interest” is not a task that government policymakers seem particularly good at.

The lockdown measures, which utterly failed to project those at highest risk from COVID-19 while causing devastating harms globally, are another useful example of the ineptitude of policymakers when it comes to making decision that are in our best interests.

Following Biden’s executive order, in April 2022, the Depository Trust & Clearing Corporation (DTCC) announced “the development of the first prototype to explore how a CBDC might operate”. This endeavor was given the name “Project Lithium”, on which the DTCC is collaborating with The Digital Dollar Project (DDP), an organization that advocates US leadership “in advancing a CBDC” and encourages the executive branch of government “to support appropriate legislation” to authorize further research and development of such a currency.

The DDP published a white paper in May 2020 concluding that the US government “should, and must, take a leadership role in this new wave of digital innovation” and preserve the dollar’s role as “the world’s primary reserve currency” by working toward “the launch of a tokenized digital dollar”.

End the Fed!

Naturally, advocates of a central bank digital currency describe the aims of such a development as benign, just as the Federal Reserve system was originally established on the pretext that having a more centrally controlled economy would benefit all.

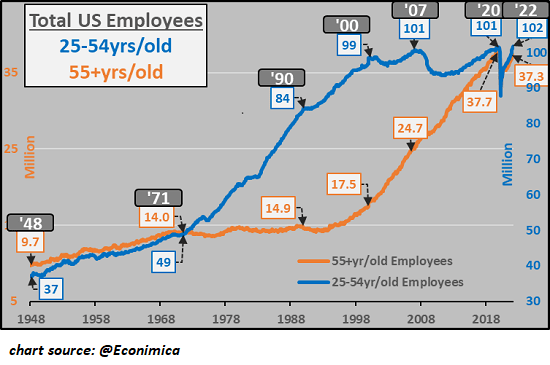

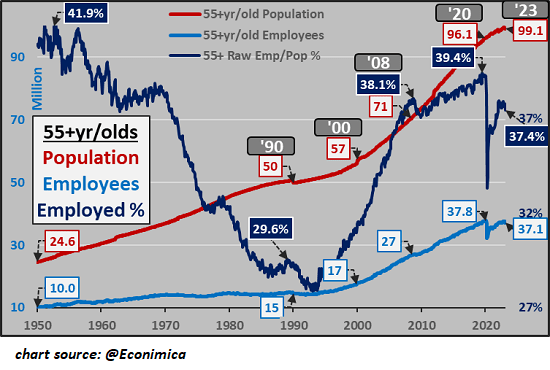

In truth, the Federal Reserve system serves the interests of the financially and political elite at the expense of the rest of us. Central banking itself, whatever the form of currency issued, is harmful to the economy because central banks essentially exist to effect a transfer of wealth upward. Schools of economic thought like Keynesianism and Modern Monetary Theory (MMT), which I like to refer to as “Keynesianism 2.0”, exist to justify the existence of central banks.

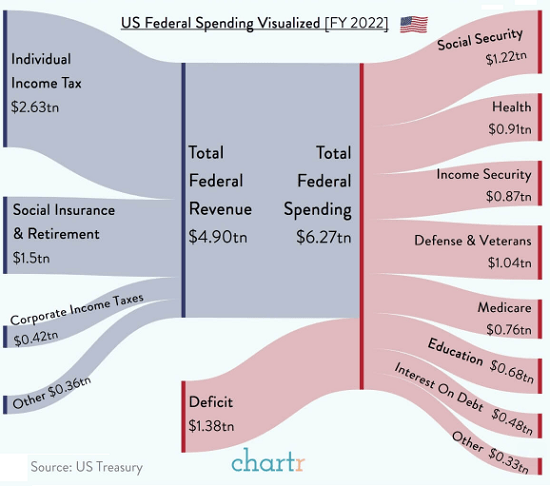

The Fed, a government-legislated private monopoly over the currency supply, enables the government to spend on whatever, including endless wars (euphemistically called “defense” spending), but the means of paying for it all, the creation of “money” out of thin air, results in upward wealth transfer. The elite classes who receive the newly created dollars first are able to spend it for purchasing assets prior to the resulting devaluation that manifests in the form of higher prices for goods and services.

Monetary inflation robs us of our purchasing power and so serves as a hidden tax. It also causes widespread malinvestment and major economic distortions like the housing bubble that burst in 2007 and precipitated the 2008 financial crisis, not to mention the current housing bubble and general asset inflation. (For more on that, see my book Ron Paul vs. Paul Krugman: Austrian vs. Keynesian Economics in the Financial Crisis.)

We are meant to believe we need centralized control over the currency supply for economic growth, but central banks instead serve to impede real economic growth in favor of enabling the government’s endlessly wasteful and harmful spending.

The chief appeal of a cryptocurrency like Bitcoin is that it is a decentralized medium of exchange that serves to compete with central-bank-issued currency and potentially enables people to opt-out of the exploitative dollar system. The idea of a “legal tender” digital currency in the hands of the bankers and politicians is anathema to the whole concept of a peer-to-peer electronic cash system.

One might argue that the replacement of print dollars with a centrally controlled cryptocurrency is just a natural evolution from the current system, in which exchange of actual cash is becoming less frequent and most transactions occur digitally anyway. We should keep up with the times and adapt to advancements in technology, the argument goes.

However, this overlooks the more fundamental issue that we should not have central banks in the first place. The way I see it, the movement towards replacing the US dollar with a Fed-issued cryptocurrency is far from benign. We have seen in the past few years just how far government policymakers are willing to go to exercise authoritarian control over us.

To illustrate, remember how businesses deemed “non-essential” were shut down by clueless bureaucrats under threat of punishment, and how coercive measures including mandates and travel restrictions were used to get people to accept COVID‑19 vaccinations?

With the World Economic Forum (WEF) having announced its “Great Reset” agenda, which ties directly into the global mass vaccination agenda, the advocates of greater centralized control over society do not deserve the benefit of our doubt about their intentions. It would be naïve to think that if the authoritarians in government had even greater means to penalize citizens for disobedience to the regime that they would not attempt to use it. It is safer to assume that if they can utilize a digital currency to control our behavior, they will.

It seems therefore imperative to oppose a centralized digital currency, but we also need to go further than that and oppose the existence of the Federal Reserve altogether. Whatever the form of currency, centralized economic planning is an abomination and anathema to the principle of a free market.

“And I heard another voice from heaven, saying, Come out of her, my people, that ye be not partakers of her sins, and that ye receive not of her plagues.” — Revelation 18:4