By Charles Hugh Smith

Source: Of Two Minds

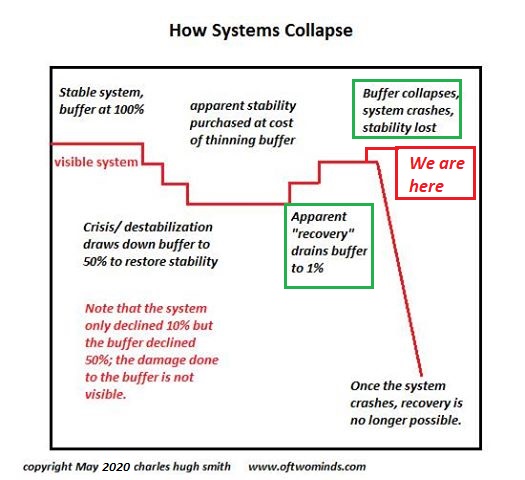

We live in a peculiar juncture of history in which truth has been banished as a threat to the maximization of private gain, i.e. the hyper-pursuit of self-interest. Evidence that supports a causal chain has been replaced by cherry-picked data that supports a self-serving narrative: both the evidence and narrative are manufactured to serve the interests of the few at the expense of the many.

In this juncture of history, evidence is easily disputed because the process of manufacturing self-serving evidence has been perfected. Indeed, self-serving evidence is now a commodity which can be purchased wholesale: rig the sample size, massage the data statistically, conjure up a context that serves to frame the evidence in a slippery self-interested fashion, omit disinterested evidence and contexts, top with arcane math and voila, evidence and narrative are presented as “facts” rather than what they really are, an elaborate, well-staged con designed to maximize the private gains of the few by exploiting the many.

Organizing the entire system to serve the pathological greed of the few is best served by devaluing truth to mere opinion and causal chains to mere narratives. In this juncture of history, truth has been revealed as a chimera; there is only opinion, and all opinions are equal. Opinions are beliefs, and all beliefs are equal. All narratives are equal. All questions boil down to values: values are all equally detached, free-floating and of the same value: zero.

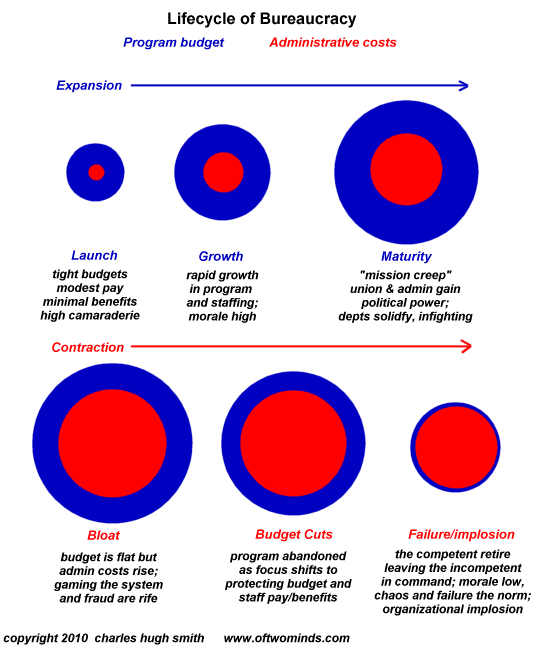

This con has reached perfection in our financial system, which is now optimized for exploitation and sociopaths. As Nassim Taleb has explained (referencing Adam Smith), markets only function if there are rules which are imposed equally on all participants. In our financial system, there are two sets of rules: one which we can summarize as anything goes for the super-wealthy and the well-connected, and another set for everyone else.

Shear the sheep of billions, pay a modest fine–and if all your bets go bad, get bailed out because you’re too important to fail. Sneak a few thousand out of the credit union, go to prison. Sell a financial product that’s designed to go bust as low-risk, oh well, buyer beware, haha, that’s just the free market at work. Sell a nickel bag of drugs, get a tenner in the Gulag.

Two sets of rules: one simulacrum of rules for the rich–just another con, really–and punitive rules for everyone else.

Since evidence, causal chains and values have all been devalued, there is no longer any recognition that the desire for gain–greed–can be either exploitive or beneficial to the many. If your greed drives you to make a product that is faster, better, cheaper, more durable and efficient than what’s currently available, your gain is the result of an advance that serves the interests of the many.

If your desire for gain leads you to misrepresent a shoddy product designed to fail (subprime mortgages, Landfill Economy products) or you raise the price because you can, your greed serves your interests at the expense of the many. This is the acme of exploitation. Kleptocrats and sociopaths, rejoice!

This system is optimized for exploitation, as the exploiters can exploit the many without the many even recognizing they’ve been stripmined. We no longer have the means to differentiate fraud from fact or exploitation from rules-based markets.

This landscape of wide-open exploitation and debauchery is Heaven on Earth for sociopaths who not only do not see any difference between gains skimmed at others’ expense and gains earned by providing a superior product / service, they revel in exploiting the system and every participant: employees, partners, suppliers, depositors, borrowers and customers.

But in this desert of exploitation and the supremacy of self-interest, some things remain true and others remain false. Some truths remain self-evident. As I have shown here many times, we can look at the hourly wages and cost of essentials in 1980, 1990, 2000, 2010 and the present and calculate how many hours of labor it took to pay for essentials such as rent, property taxes, healthcare, childcare, taxes, education, etc. These calculations reveal that the purchasing power of wages has declined for decades. This evidence cannot be made to vanish by declaring it opinion, belief or a “different set of values”–it is fact.

If we measure prosperity by how much labor can buy, all but the top few wage earners are less prosperous today. The evidence and causal chain are self-evident. The self-interested few who have reaped the vast majority of the economy’s gains can hire shills to argue that since TVs now require fewer hours of labor to buy, we’re all better off, but these obfuscations are nothing more than distractions designed to divert our attention from the mechanisms of exploitation that are operating 24/7 beneath the ceaseless churn of “news” and “market action.”

Let’s call this financial system what it really is: the MetaPerverse, a conjured world of self-serving cons that is optimized for exploitation, the perversion of justice, infinite inequality and the stripmining of the many to the benefit of the few, all securely protected by a cloud of confusion in which everything is equally valueless and truth no longer exists. All that remains is a babble of competing cons.