The dollar is finally being dethroned

By John Michael Greer

Source: UnHerd

Let’s start with the basics. Roughly 5% of the human race currently live in the United States of America. That very small fraction of humanity, until quite recently, enjoyed about a third of the world’s energy resources and manufactured products and about a quarter of its raw materials. This didn’t happen because nobody else wanted these things, or because the US manufactured and sold something so enticing that the rest of the world eagerly handed over its wealth in exchange. It happened because, as the dominant nation, the US imposed unbalanced patterns of exchange on the rest of the world, and these funnelled a disproportionate share of the planet’s wealth to itself.

There’s nothing new about this sort of arrangement. In its day, the British Empire controlled an even larger share of the planet’s wealth, and the Spanish Empire played a comparable role further back. Before then, there were other empires, though limits to transport technologies meant that their reach wasn’t as large. Nor, by the way, was any of this an invention of people with light-coloured skin. Mighty empires flourished in Asia and Africa when the peoples of Europe lived in thatched-roofed mud huts. Empires rise whenever a nation becomes powerful enough to dominate other nations and drain them of wealth. They’ve thrived as far back as records go and they’ll doubtless thrive for as long as human civilisations exist.

America’s empire came into being in the wake of the collapse of the British Empire, during the fratricidal European wars of the early 20th century. Throughout those bitter years, the role of global hegemon was up for grabs, and by 1930 or so it was pretty clear that Germany, the Soviet Union or the US would end up taking the prize. In the usual way, two contenders joined forces to squeeze out the third, and then the victors went at each other, carving out competing spheres of influence until one collapsed. When the Soviet Union imploded in 1991, the US emerged as the last empire standing.

Francis Fukuyama insisted in a 1989 essay that having won the top slot, the US was destined to stay there forever. He was, of course, wrong, but then he was a Hegelian and couldn’t help it. (If a follower of Hegel tells you the sky is blue, go look.) The ascendancy of one empire guarantees that other aspirants for the same status will begin sharpening their knives. They’ll get to use them, too, because empires invariably wreck themselves: over time, the economic and social consequences of empire destroy the conditions that make empire possible. That can happen quickly or slowly, depending on the mechanism that each empire uses to extract wealth from its subject nations.

The mechanism the US used for this latter purpose was ingenious but even more short-term than most. In simple terms, the US imposed a series of arrangements on most other nations that guaranteed the lion’s share of international trade would use US dollars as the medium of exchange, and saw to it that an ever-expanding share of world economic activity required international trade. (That’s what all that gabble about “globalisation” meant in practice.) This allowed the US government to manufacture dollars out of thin air by way of gargantuan budget deficits, so that US interests could use those dollars to buy up vast amounts of the world’s wealth. Since the excess dollars got scooped up by overseas central banks and business firms, which needed them for their own foreign trade, inflation stayed under control while the wealthy classes in the US profited mightily.

The problem with this scheme is the same difficulty faced by all Ponzi schemes, which is that, sooner or later, you run out of suckers to draw in. This happened not long after the turn of the millennium, and along with other factors — notably the peaking of global conventional petroleum production — it led to the financial crisis of 2008-2010. Since 2010 the US has been lurching from one crisis to another. This is not accidental. The wealth pump that kept the US at the top of the global pyramid has been sputtering as a growing number of nations have found ways to keep a larger share of their own wealth by expanding their domestic markets and raising the kind of trade barriers the US used before 1945 to build its own economy. The one question left is how soon the pump will start to fail altogether.

When Russia launched its invasion of Ukraine in February 2022, the US and its allies responded not with military force but with punitive economic sanctions, which were expected to cripple the Russian economy and force Russia to its knees. Apparently, nobody in Washington considered the possibility that other nations with an interest in undercutting the US empire might have something to say about that. Of course, that’s what happened. China, which has the largest economy on Earth in purchasing-power terms, extended a middle finger in the direction of Washington and upped its imports of Russian oil, gas, grain and other products. So did India, currently the third-largest economy on Earth in the same terms; as did more than 100 other countries.

Then there’s Iran, which most Americans are impressively stupid about. Iran is the 17th largest nation in the world, more than twice the size of Texas and even more richly stocked with oil and natural gas. It’s also a booming industrial power. It has a thriving automobile industry, for example, and builds and launches its own orbital satellites. It’s been dealing with severe US sanctions since not long after the Shah fell in 1978, so it’s a safe bet that the Iranian government and industrial sector know every imaginable trick for getting around those sanctions.

Right after the start of the Ukraine war, Russia and Iran suddenly started inking trade deals to Iran’s great benefit. Clearly, one part of the quid pro quo was that the Iranians passed on their hard-earned knowledge about how to dodge sanctions to an attentive audience of Russian officials. With a little help from China, India and most of the rest of humanity, the total failure of the sanctions followed in short order. Today, the sanctions are hurting the US and Europe, not Russia, but the US leadership has wedged itself into a position from which it can’t back down. This may go a long way towards explaining why the Russian campaign in Ukraine has been so leisurely. The Russians have no reason to hurry. They know that time is not on the side of the US.

For many decades now, the threat of being cut out of international trade by US sanctions was the big stick Washington used to threaten unruly nations that weren’t small enough for a US invasion or fragile enough for a CIA-backed regime-change operation. Over the last year, that big stick turned out to be made of balsa wood and snapped off in Joe Biden’s hand. As a result, all over the world, nations that thought they had no choice but to use dollars in their foreign trade are switching over to their own currencies, or to the currencies of rising powers. The US dollar’s day as the global medium of exchange is thus ending.

It’s been interesting to watch economic pundits reacting to this. As you might expect, quite a few of them simply deny that it’s happening — after all, economic statistics from previous years don’t show it yet, Some others have pointed out that no other currency is ready to take on the dollar’s role; this is true, but irrelevant. When the British pound lost a similar role in the early years of the Great Depression, no other currency was ready to take on its role either. It wasn’t until 1970 or so that the US dollar finished settling into place as the currency of global trade. In the interval, international trade lurched along awkwardly using whatever currencies or commodity swaps the trading partners could settle on: that is to say, the same situation that’s taking shape around us in the free-for-all of global trade that will define the post-dollar era.

One of the interesting consequences of the shift now under way is a reversion to the mean of global wealth distribution. Until the era of European global empire, the economic heart of the world was in east and south Asia. India and China were the richest countries on the planet, and a glittering necklace of other wealthy states from Iran to Japan filled in the picture. To this day, most of the human population is found in the same part of the world. The great age of European conquest temporarily diverted much of that wealth to Europe, impoverishing Asia in the process. That condition began to break down with the collapse of European colonial empires in the decade following the Second World War, but some of the same arrangements were propped up by the US thereafter. Now those are coming apart, and Asia is rising. By next year, four of the five largest economies on the planet in terms of purchasing power parity will be Asian. The fifth is the US, and it may not be in that list for much longer.

In short, America is bankrupt. Our governments from the federal level down, our big corporations and a very large number of our well-off citizens have run up gargantuan debts, which can only be serviced given direct or indirect access to the flows of unearned wealth the US extracted from the rest of the planet. Those debts cannot be paid off, and many of them can’t even be serviced for much longer. The only options are defaulting on them or inflating them out of existence, and in either case, arrangements based on familiar levels of expenditure will no longer be possible. Since the arrangements in question include most of what counts as an ordinary lifestyle in today’s US, the impact of their dissolution will be severe.

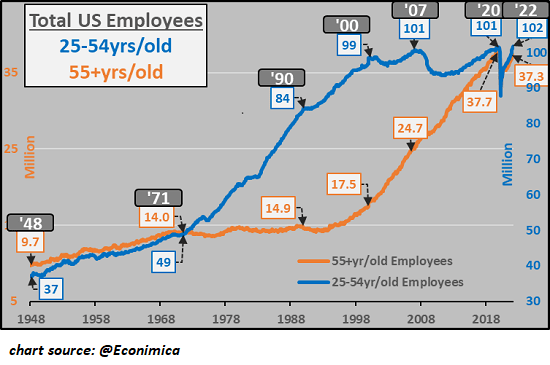

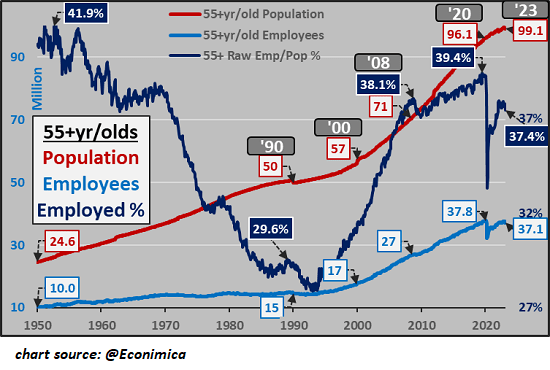

In effect, the 5% of us in this country are going to have to go back to living the way we did before 1945. If we still had the factories, the trained workforce, the abundant natural resources and the thrifty habits we had back then, that would have been a wrenching transition but not a debacle. The difficulty, of course, is that we don’t have those things anymore. The factories were shut down in the offshoring craze of the Seventies and Eighties, when the imperial economy slammed into overdrive, and the trained workforce was handed over to malign neglect.

We’ve still got some of the natural resources, but nothing like what we once had. The thrifty habits? Those went whistling down the wind a long time ago. In the late stages of an empire, exploiting flows of unearned wealth from abroad is far more profitable than trying to produce wealth at home, and most people direct their efforts accordingly. That’s how you end up with the typical late-imperial economy, with a governing class that flaunts fantastic levels of paper wealth, a parasite class of hangers-on that thrive by catering to the very rich or staffing the baroque bureaucratic systems that permeate public and private life, and the vast majority of the population impoverished, sullen, and unwilling to lift a finger to save their soi-disant betters from the consequences of their own actions.

The good news is that there’s a solution to all this. The bad news is that it’s going to take a couple of decades of serious turmoil to get there. The solution is that the US economy will retool itself to produce earned wealth in the form of real goods and non-financial services. That’ll happen inevitably as the flows of unearned wealth falter, foreign goods become unaffordable to most Americans, and it becomes profitable to produce things here in the US again. The difficulty, of course, is that most of a century of economic and political choices meant to support our former imperial project are going to have to be undone.

The most obvious example? The metastatic bloat of government, corporate and non-profit managerial jobs in American life. That’s a sensible move in an age of empire, as it funnels money into the consumer economy, which provides what jobs exist for the impoverished classes. Public and private offices alike teem with legions of office workers whose labour contributes nothing to national prosperity but whose pay cheques prop up the consumer sector. That bubble is already losing air. It’s indicative that Elon Musk, after his takeover of Twitter, fired some 80% of that company’s staff; other huge internet combines are pruning their workforce in the same way, though not yet to the same degree.

The recent hullaballoo about artificial intelligence is helping to amplify the same trend. Behind the chatbots are programs called large language models (LLMs), which are very good at imitating the more predictable uses of human language. A very large number of office jobs these days spend most of their time producing texts that fall into that category: contracts, legal briefs, press releases, media stories and so on. Those jobs are going away. Computer coding is even more amenable to LLM production, so you can kiss a great many software jobs goodbye as well. Any other form of economic activity that involves assembling predictable sequences of symbols is facing the same crunch. A recent paper by Goldman Sachs estimates that something like 300 million jobs across the industrial world will be wholly or partly replaced by LLMs in the years immediately ahead.

Another technology with similar results is CGI image creation. Levi’s announced not long ago that all its future catalogues and advertising will use CGI images instead of highly-paid models and photographers. Expect the same thing to spread generally. Oh, and Hollywood’s next. We’re not too far from the point at which a program can harvest all the footage of Marilyn Monroe from her films, and use that to generate new Marilyn Monroe movies for a tiny fraction of what it costs to hire living actors, camera crews and the rest. The result will be a drastic decrease in high-paying jobs across a broad swathe of the economy.

The outcome of all this? Well, one lot of pundits will insist at the top of their lungs that nothing will change in any way that matters, and another lot will start shrieking that the apocalypse is upon us. Those are the only two options our collective imagination can process these days. Of course, neither of those things will actually happen.

What will happen instead is that the middle and upper-middle classes in the US, and in many other countries, will face the same kind of slow demolition that swept over the working classes of those same countries in the late 20th century. Layoffs, corporate bankruptcies, declining salaries and benefits, and the latest high-tech version of NO HELP WANTED signs will follow one another at irregular intervals. All the businesses that make money catering to these same classes will lose their incomes as well, a piece at a time. Communities will hollow out the way the factory towns of America’s Rust Belt and the English Midlands did half a century ago, but this time it will be the turn of upscale suburbs and fashionable urban neighbourhoods to collapse as the income streams that supported them disappear.

This is not going to be a fast process. The US dollar is losing its place as the universal medium of foreign trade, but it will still be used by some countries for years to come. The unravelling of the arrangements that direct unearned wealth to the US will go a little faster, but that will still take time. The collapse of the cubicle class and the gutting of the suburbs will unfold over decades. That’s the way changes of this kind play out.

As for what people can do in response this late in the game, I refer to a post I made on The Archdruid Report in 2012 titled “Collapse Now and Avoid the Rush”. In that post I pointed out that the unravelling of the American economy, and the broader project of industrial civilisation, was picking up speed around us, and those who wanted to get ready for it needed to start preparing soon by cutting their expenses, getting out of debt, and picking up the skills needed to produce goods and services for people rather than the corporate machine. I’m glad to say that some people did these things, but a great many others rolled their eyes, or made earnest resolutions to do something as soon as things were more convenient, which they never were.

Over the years that followed I repeated that warning and then moved on to other themes, since there really wasn’t much point to harping on about the approaching mess when the time to act had slipped away. Those who made preparations in time will weather the approaching mess as well as anyone can. Those who didn’t? The rush is here. I’m sorry to say that whatever you try, it’s likely that there’ll be plenty of other frantic people trying to do the same thing. You might still get lucky, but it’s going to be a hard row to hoe.

Mind you, I expect some people to take a different tack. In the months before a prediction of mine comes true, I reliably field a flurry of comments insisting that I’m too rigid and dogmatic in my views about the future, that I need to be more open-minded about alternative possibilities, that wonderful futures are still in reach, and so on. I got that in 2008 just before the real estate bubble started to go bust, as I’d predicted, and I also got it in 2010 just before the price of oil peaked and started to slide, as I’d also predicted, taking the peak oil movement with it. I’ve started to field the same sort of criticism once again.

We are dancing on the brink of a long slippery slope into an unwelcome new reality. I’d encourage readers in America and its close allies to brace themselves for a couple of decades of wrenching economic, social, and political turmoil. Those elsewhere will have an easier time of it, but it’s still going to be a wild ride before the rubble stops bouncing, and new social, economic, and political arrangements get patched together out of the wreckage.