By Colin Todhunter

Source: Off-Guardian

The food transition, the energy transition, net-zero ideology, programmable central bank digital currencies, the censorship of free speech and clampdowns on protest. What’s it all about? To understand these processes, we need to first locate what is essentially a social and economic reset within the context of a collapsing financial system.

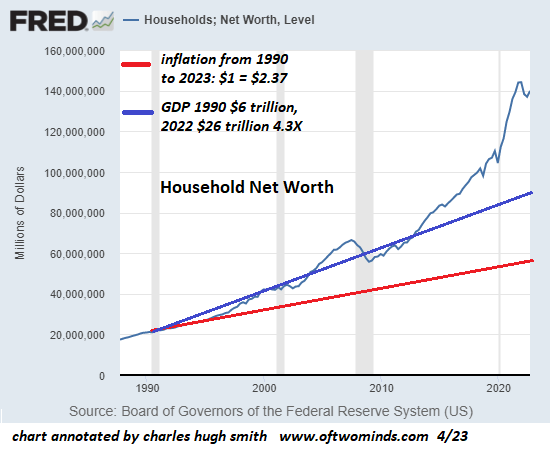

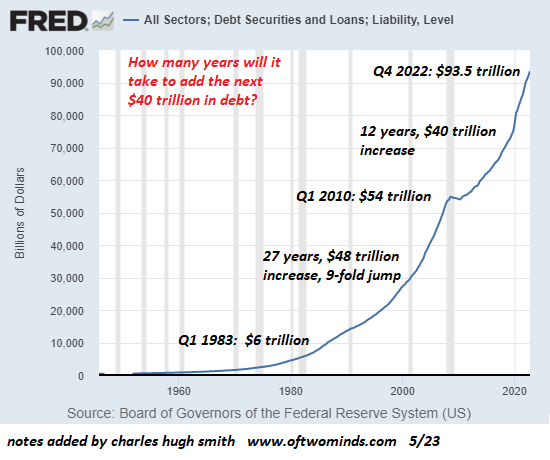

Writer Ted Reece notes that the general rate of profit has trended downwards from an estimated 43% in the 1870s to 17% in the 2000s. By late 2019, many companies could not generate enough profit. Falling turnover, squeezed margins, limited cashflows and highly leveraged balance sheets were prevalent.

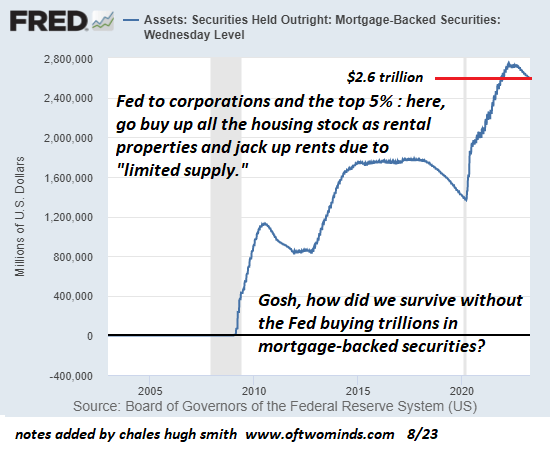

Professor Fabio Vighi of Cardiff University has described how closing down the global economy in early 2020 under the guise of fighting a supposedly new and novel pathogen allowed the US Federal Reserve to flood collapsing financial markets (COVID relief) with freshly printed money without causing hyperinflation. Lockdowns curtailed economic activity, thereby removing demand for the newly printed money (credit) in the physical economy and preventing ‘contagion’.

According to investigative journalist Michael Byrant, €1.5 trillion was needed to deal with the crisis in Europe alone. The financial collapse staring European central bankers in the face came to a head in 2019. The appearance of a ‘novel virus’ provided a convenient cover story.

The European Central Bank agreed to a €1.31 trillion bailout of banks followed by the EU agreeing to a €750 billion recovery fund for European states and corporations. This package of long-term, ultra-cheap credit to hundreds of banks was sold to the public as a necessary programme to cushion the impact of the pandemic on businesses and workers.

In response to a collapsing neoliberalism, we are now seeing the rollout of an authoritarian great reset — an agenda that intends to reshape the economy and change how we live.

SHIFT TO AUTHORITARIANISM

The new economy is to be dominated by a handful of tech giants, global conglomerates and e-commerce platforms, and new markets will also be created through the financialisation of nature, which is to be colonised, commodified and traded under the notion of protecting the environment.

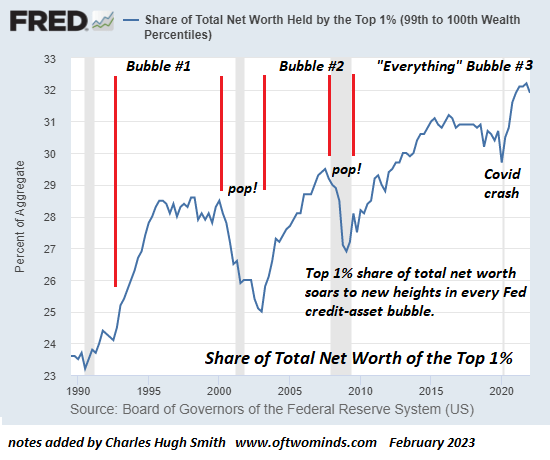

In recent years, we have witnessed an overaccumulation of capital, and the creation of such markets will provide fresh investment opportunities (including dodgy carbon offsetting Ponzi schemes) for the super-rich to park their wealth and prosper.

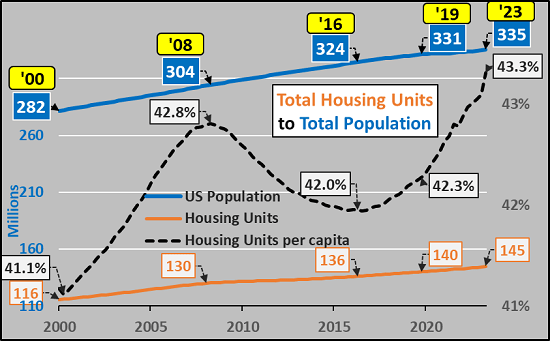

This great reset envisages a transformation of Western societies, resulting in permanent restrictions on fundamental liberties and mass surveillance. Being rolled out under the benign term of a ‘Fourth Industrial Revolution’, the World Economic Forum (WEF) says the public will eventually ‘rent’ everything they require (remember the WEF video ‘you will own nothing and be happy’?): stripping the right of ownership under the guise of a ‘green economy’ and underpinned by the rhetoric of ‘sustainable consumption’ and ‘climate emergency’.

Climate alarmism and the mantra of sustainability are about promoting money-making schemes. But they also serve another purpose: social control.

Neoliberalism has run its course, resulting in the impoverishment of large sections of the population. But to dampen dissent and lower expectations, the levels of personal freedom we have been used to will not be tolerated. This means that the wider population will be subjected to the discipline of an emerging surveillance state.

To push back against any dissent, ordinary people are being told that they must sacrifice personal liberty in order to protect public health, societal security (those terrible Russians, Islamic extremists or that Sunak-designated bogeyman George Galloway) or the climate. Unlike in the old normal of neoliberalism, an ideological shift is occurring whereby personal freedoms are increasingly depicted as being dangerous because they run counter to the collective good.

The real reason for this ideological shift is to ensure that the masses get used to lower living standards and accept them. Consider, for instance, the Bank of England’s chief economist Huw Pill saying that people should ‘accept’ being poorer. And then there is Rob Kapito of the world’s biggest asset management firm BlackRock, who says that a “very entitled” generation must deal with scarcity for the first time in their lives.

At the same time, to muddy the waters, the message is that lower living standards are the result of the conflict in Ukraine and supply shocks that both the war and ‘the virus’ have caused.

The net-zero carbon emissions agenda will help legitimise lower living standards (reducing your carbon footprint) while reinforcing the notion that our rights must be sacrificed for the greater good. You will own nothing, not because the rich and their neoliberal agenda made you poor but because you will be instructed to stop being irresponsible and must act to protect the planet.

NET-ZERO AGENDA

But what of this shift towards net-zero greenhouse gas emissions and the plan to slash our carbon footprints? Is it even feasible or necessary?

Gordon Hughes, a former World Bank economist and current professor of economics at the University of Edinburgh, says in a new report that current UK and European net-zero policies will likely lead to further economic ruin.

Apparently, the only viable way to raise the cash for sufficient new capital expenditure (on wind and solar infrastructure) would be a two decades-long reduction in private consumption of up to 10 per cent. Such a shock has never occurred in the last century outside war; even then, never for more than a decade.

But this agenda will also cause serious environmental degradation. So says Andrew Nikiforuk in the article The Rising Chorus of Renewable Energy Skeptics, which outlines how the green techno-dream is vastly destructive.

He lists the devastating environmental impacts of an even more mineral-intensive system based on renewables and warns:

“The whole process of replacing a declining system with a more complex mining-based enterprise is now supposed to take place with a fragile banking system, dysfunctional democracies, broken supply chains, critical mineral shortages and hostile geopolitics.”

All of this assumes that global warming is real and anthropogenic. Not everyone agrees. In the article Global warming and the confrontation between the West and the rest of the world, journalist Thierry Meyssan argues that net zero is based on political ideology rather than science. But to state such things has become heresy in the Western countries and shouted down with accusations of ‘climate science denial’.

Regardless of such concerns, the march towards net zero continues, and key to this is the United Nations Agenda 2030 for Sustainable Development Goals.

Today, almost every business or corporate report, website or brochure includes a multitude of references to ‘carbon footprints’, ‘sustainability’, ‘net zero’ or ‘climate neutrality’ and how a company or organisation intends to achieve its sustainability targets. Green profiling, green bonds and green investments go hand in hand with displaying ‘green’ credentials and ambitions wherever and whenever possible.

It seems anyone and everyone in business is planting their corporate flag on the summit of sustainability. Take Sainsbury’s, for instance. It is one of the ‘big six’ food retail supermarkets in the UK and has a vision for the future of food that it published in 2019.

Here’s a quote from it:

“Personalised Optimisation is a trend that could see people chipped and connected like never before. A significant step on from wearable tech used today, the advent of personal microchips and neural laces has the potential to see all of our genetic, health and situational data recorded, stored and analysed by algorithms which could work out exactly what we need to support us at a particular time in our life. Retailers, such as Sainsbury’s could play a critical role to support this, arranging delivery of the needed food within thirty minutes — perhaps by drone.”

Tracked, traced and chipped — for your own benefit. Corporations accessing all of our personal data, right down to our DNA. The report is littered with references to sustainability and the climate or environment, and it is difficult not to get the impression that it is written so as to leave the reader awestruck by the technological possibilities.

However, the promotion of a brave new world of technological innovation that has nothing to say about power — who determines policies that have led to massive inequalities, poverty, malnutrition, food insecurity and hunger and who is responsible for the degradation of the environment in the first place — is nothing new.

The essence of power is conveniently glossed over, not least because those behind the prevailing food regime are also shaping the techno-utopian fairytale where everyone lives happily ever after eating bugs and synthetic food while living in a digital panopticon.

FAKE GREEN

The type of ‘green’ agenda being pushed is a multi-trillion market opportunity for lining the pockets of rich investors and subsidy-sucking green infrastructure firms and also part of a strategy required to secure compliance required for the ‘new normal’.

It is, furthermore, a type of green that plans to cover much of the countryside with wind farms and solar panels with most farmers no longer farming. A recipe for food insecurity.

Those investing in the ‘green’ agenda care first and foremost about profit. The supremely influential BlackRock invests in the current food system that is responsible for polluted waterways, degraded soils, the displacement of smallholder farmers, a spiralling public health crisis, malnutrition and much more.

It also invests in healthcare — an industry that thrives on the illnesses and conditions created by eating the substandard food that the current system produces. Did Larry Fink, the top man at BlackRock, suddenly develop a conscience and become an environmentalist who cares about the planet and ordinary people? Of course not.

Any serious deliberations on the future of food would surely consider issues like food sovereignty, the role of agroecology and the strengthening of family farms — the backbone of current global food production.

The aforementioned article by Andrew Nikiforuk concludes that, if we are really serious about our impacts on the environment, we must scale back our needs and simplify society.

In terms of food, the solution rests on a low-input approach that strengthens rural communities and local markets and prioritises smallholder farms and small independent enterprises and retailers, localised democratic food systems and a concept of food sovereignty based on self-sufficiency, agroecological principles and regenerative agriculture.

It would involve facilitating the right to culturally appropriate food that is nutritionally dense due to diverse cropping patterns and free from toxic chemicals while ensuring local ownership and stewardship of common resources like land, water, soil and seeds.

That’s where genuine environmentalism and the future of food begins.