By William Kaufman

Source: CounterPunch

What is the stock market?

1) It’s not real economic activity—it’s a form of mass hysteria or mass psychosis.

2) Stock prices reflect a mass-hysteria impression of the worth of a piece of paper you hold—a stock certificate. The worth of that piece of paper is sometimes tethered to some economic reality of some corporation—at least partially—but sometimes not. Often a stock price bears little relation to the economic health of a company, as illustrated in the wildly gyrating stock price-to-earnings ratios through the decades. Hence the stock price is often a matter of caprice, covert manipulation, and/or unfathomable crowd psychology, not necessarily real economic “health” or productivity.

If, say, you are fortunate enough to own a stock that has doubled or tripled in price, this does not mean that you have accrued new wealth—that stock valuation is meaningless as long as you still own the piece of paper (the stock certificate); you realize that wealth only by selling the stock. And if you do cash out—sell the piece of paper—to someone else, you are transferring to another person the hazard of seeing that valuation drop or evaporate—an opportune fobbing off of risk to someone else, a transfer of cash to you, but no real creation of wealth—just the passing on of a piece of paper in exchange for currency. Eventually, down the road, your gain will be someone else’s loss when the music stops playing and the last holder of the piece of paper finds there is no chair for him to land on—the stock market as Ponzi scheme.

If everyone or most people decide to sell their pieces of paper—to take their profits—all at once, then the stock prices tumble, so the idea that everyone can cash out and realize this imaginary wealth equally and universally is a mirage: if everyone tried to access it at once, it would evaporate. Hence the common notion that rising stock prices indicate a general increase in wealth or national prosperity is delusional. A stock crash does not erase billions or trillions in “wealth” overnight, as we are commonly told. There was never any “wealth” there to begin with, in the sense that a stock price rationally or measurably reflects the worth of tangible goods or services; that price is just a mass fever dream, a collective, chaotic, bidding war about the worth of pieces of paper.

3) The stock market is a swindle.

Much of the movement of these equities markets originates in the decisions of large funds or high-speed traders who have access to esoteric information, advanced algorithms, or trading networks from which Joe Trader, playing the market at home on his laptop, is excluded. Hence Joe Trader inevitably gets screwed. The author Michael Lewis draws the veil from this complicated high-tech rigging in a 2014 interview with CBS’s 60 Minutes:

Steve Kroft: What’s the headline here?

Michael Lewis: Stock market’s rigged. The United States stock market, the most iconic market in global capitalism is rigged.

Steve Kroft: By whom?

Michael Lewis: By a combination of these stock exchanges, the big Wall Street banks and high-frequency traders.

Steve Kroft: Who are the victims?

Michael Lewis: Everybody who has an investment in the stock market. . . .

Steve Kroft: And this is all being done by computers?

Michael Lewis: All being done by computers. It’s too fast to be done by humans. Humans have been completely removed from the marketplace. “Fast” is the operative word. Machines with secret programs are now trading stocks in tiny fractions of a second, way too fast to be seen or recorded on a stock ticker or computer screen. Faster than the market itself. High-frequency traders, big Wall Street firms and stock exchanges have spent billions to gain an advantage of a millisecond for themselves and their customers, just to get a peek at stock market prices and orders a flash before everyone else, along with the opportunity to act on it. . . . The insiders are able to move faster than you. They’re able to see your order and play it against other orders in ways that you don’t understand. They’re able to front run your order.

Steve Kroft: What do you mean front run?

Michael Lewis: Means they’re able to identify your desire to, to buy shares in Microsoft and buy ‘em in front of you and sell ‘em back to you at a higher price. It all happens in infinitesimally small periods of time. There’s speed advantage that the faster traders have is milliseconds, some of it is fractions of milliseconds. But it’s enough for them to identify what you’re gonna do and do it before you do it at your expense.

4) The MSM commentators on the markets are all industry touts.

Their unvarying counsel, under all circumstances, is this: Get into the market. Get in if you’re not in already. Stay in if you’re already in. A plunge is a buying opportunity. A surge is a buying opportunity. A buying opportunity is that which puts a commission in their pockets. A mass exit from the stock market is the end of their livelihood. I don’t know the Latin term for the logical fallacy at work here, but I think the English translation is something like this: bullshit being slung by greedy con artists. These are people with no more conscience or expertise than the barking guy with the Australian accent on the three a.m. informercial raving about a miracle degreaser or stain remover.

5) This market, more than most, is a big fat bubble, ready to pop.

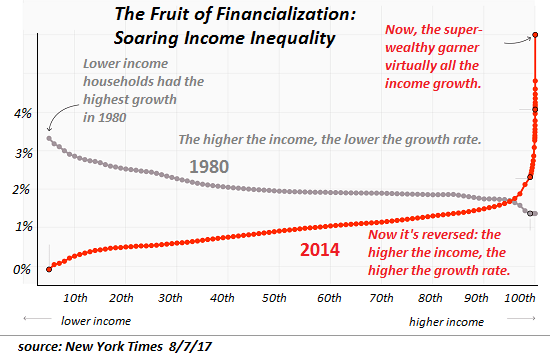

This bubble is a cloistered biosphere of Teslas and beach houses, of con artists, kleptocrats, and financial sorcerers. It is rigorously insulated from the dolorous real economy inhabited by the 99 percent: declining living standards; stagnant real hourly wages; lousy service-industry jobs; debilitating consumer and student debt peonage; soaring medical insurance premiums and deductibles that render many people’s swiss-cheese policies unusable; crumbling cities and infrastructure; climate disasters of biblical proportions; and toxic food, water, and air. This stock-market bubble has been artificially inflated by historically low interest rates (so the suckers have to go into the market to get a return on their money) and Fed “quantitative easing,” a technocratic euphemism for a novel form of welfare for the one percent that has left untold trillions of “liquidity” sloshing around among the financial elites with which to play Monopoly with one another and pad their net worth by buying back shares of their own companies to inflate stock prices. Moreover, this bubble is even more perilous and tenuous than previous ones because the “air” inside is being pumped by unprecedented levels of consumer and institutional debt that will cause a deafening “pop” when some of the key players start to lose their shirts, and suddenly all the Peters start calling in the debts of all the Pauls who can’t pay.

6) The end game is near. We can console ourselves that these latest innovations in financial prestidigitation and fraud are stretched about as far as they can go. The financial elites are out of three-card monte scams to suck the wealth out of the economy. The heroic productivist heyday of capitalism, celebrated by Marx himself, is over in this country—no more driven visionary builders of railroads, factories, skyscrapers, and highways to a better tomorrow: just endless financial skullduggery and hoarding at the top, and for the rest of us the cold comforts of cell phones, smart televisions, and the endless streams of plastic consumer junk circulating through Amazon and Walmart. What Baudrillard called “the mirror of production” is a prison for the planet earth and every species on it. All that is left for the bipartisan predator class of the United States is scavenging: massive tax breaks for the rich today and tomorrow, perhaps, no more Medicare, no more Social Security, no more public schools—if they have their way, and they probably will. Pop goes the stock market, the illusion of prosperity, the whole unsustainable carbon-poison “economy,” and pop goes the planet and the human race. But look at it this way: it’s a buying opportunity.