By Charles Hugh Smith

Source: Of Two Minds

Long cycles operate at such a glacial pace they’re easily dismissed as either figments of fevered imagination or this time it’s different.

But since Nature and human nature remain stubbornly grounded by the same old dynamics, cycles eventually turn and the world changes dramatically. Nobody thinks the cyclical turn is possible until it’s already well underway.

Multiple long cycles are turning in unison:

1. The cycle of interest rates: down for 40+ years (last turn, 1981), now up for an unknown but consequential period of time.

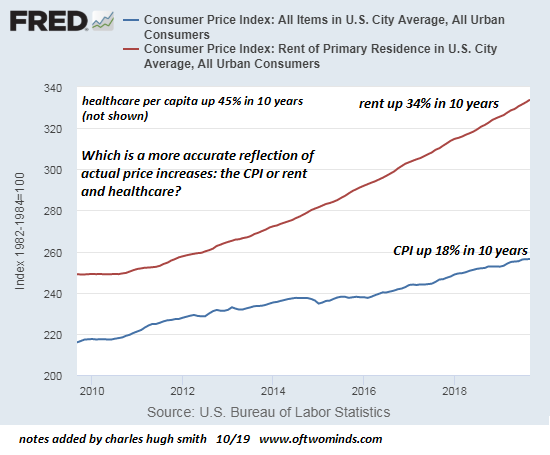

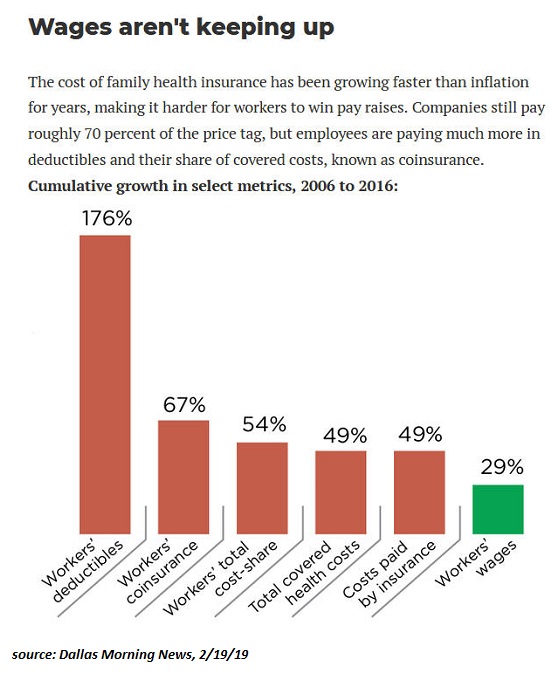

2. The cycle of inflation / deflation: the 40-year period of low real-world inflation and rip-roaring speculative debt-asset inflation has ended and now an era of scarcity, real-world inflation and speculative debt-asset deflation begins.

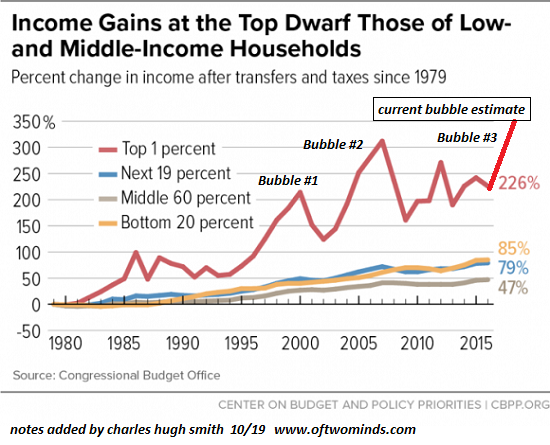

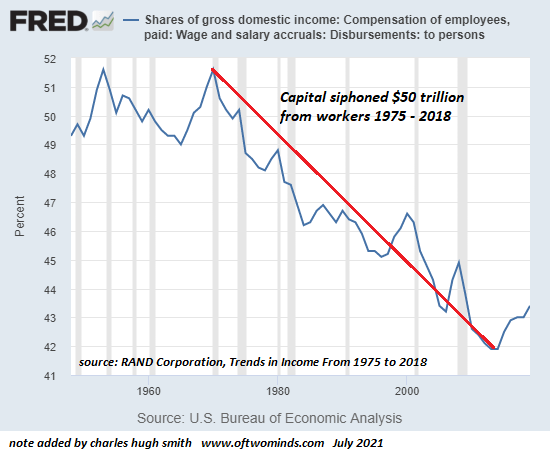

3. The cycle of capital-labor balance: capital has dominated labor for 40+ years, siphoning $50 trillion from labor. This cycle has now turned and the rebalancing is underway: it’s capital’s turn to surrender gains and power.

4. The cycle of social order-disorder: as documented by historian Peter Turchin and others, social order (in Turchin’s phrase, the integrative phase) holds sway for about 50 years and then it gives way to an era of social disorder (the disintegrative phase). This phase doesn’t end with mild reforms nobody even notices, it ends with a rebalancing of social, political and economic power.

5. The cycle of wealth/power inequality: wealth–and the political power it buys–becomes increasingly concentrated in the hands of the few at the expense of the many. This feeds economic and political dysfunction and exploitation that must be remedied by reducing extremes of wealth-power inequality.

6. The cycle of speculative excess: those in power protect their wealth and the wealth of their cronies by instituting moral hazard, the disconnect of risk and consequence: the central state and central bank backstop and bail out the most egregious big speculators, who keep all their gains and transfer their losses to the public.

The public concludes the only way to get ahead in such a rigged financial system is to belly up to the gaming tables and gamble that the next bubble will never pop because those in power won’t ever let it pop.

But alas, humans do not possess god-like powers, they only possess hubris, and so all bubbles pop: the more extreme the bubble, the more devastating the pop. The faint cries that fade to silence are: but this time it’s different! and the Fed will save us! That’s not how cycles work: all the god-like powers are revealed as hubris, which arouses the fatal ire of Nemesis.