By Brian Berletic

Source: New Eastern Outlook

As Russia’s special military operation (SMO) approaches two years of intense fighting, having parried Ukraine’s “spring counteroffensive” and with the initiative shifting to Russian forces, Western capitals are now admitting they are reaching the limits to remaining support for Kiev.

During the Ukrainian offensive alone, the Western media has admitted Ukrainian forces have suffered catastrophic losses in both manpower and material. The Ukrainian economy has all but been replaced by heavy subsidies from the United States, Europe, and the International Monetary Fund (IMF). Ukrainian infrastructure including its power grid and ports have suffered severe damage the collective West is unable to repair in a timely manner.

Ukraine’s territory has shrunk. Four oblasts, Lugansk, Donetsk, Zaporozhye, and Kherson are now considered by Moscow as part of the Russian Federation. Crimea had already joined the Russian Federation following a referendum conducted in 2014 after the US-backed overthrow of the elected Ukrainian government.

In fact, from 2014 onward, Ukraine’s sovereignty had been stripped away, with the resulting client regime installed into power by the US answering to Washington at the expense of Ukraine’s best interests. To say Ukraine’s status as a viable nation state hangs in the balance because of this arrangement would not be an understatement.

Ukraine, as a US proxy, has suffered irreversible losses economically, politically, socially, and militarily. In a wider sense, Europe is also politically captured, led by the European Union bureaucracy who, like the Ukrainian government, serves Washington’s interests entirely at the expense of Europe’s collective interests.

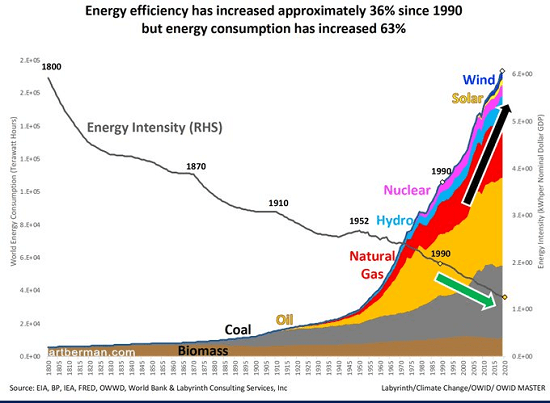

Germany stands out as a particularly poignant example, having ignored the destruction of the Nord Stream pipelines, imposing sanctions on Russia to restrict any remaining hydrocarbons required by Germany’s industry and public, beginning a process of recession and deindustrialization.

Europe’s wider economy is suffering from similar setbacks, setbacks that cannot be offset by alternatives such as US liquefied petroleum gas (LPG) moved by ship across the Atlantic Ocean which will always be more expensive than Russian hydrocarbons piped in directly to Europe.

The price of subordination to the United States is in reality the existential threat the US claims Russia poses to Europe in fiction.

It should be noted that the US had long-planned to use Ukraine as a proxy to overextend Russia. Laid out in a 2019 policy paper published by the US government and arms industry-funded think tank, RAND Corporation, titled, “Extending Russia: Competing from Advantageous Ground,” US policymakers would recommend providing lethal aid to Ukraine to draw Russia into the ongoing conflict between Kiev and militants in eastern Ukraine. The idea was to “increase the costs to Russia, in both blood and treasure,” as it dealt with the conflict between Kiev and eastern Ukraine along its borders.

The paper also noted, however, the strategy posed a high risk to Ukraine. Such a move, the paper warned, might:

…come at a significant cost to Ukraine and to U.S. prestige and credibility. This could produce disproportionately large Ukrainian casualties, territorial losses, and refugee flows. It might even lead Ukraine into a disadvantageous peace.

Despite these acknowledged risks, the United States pressed ahead with the plan anyway. Today, we see that fears expressed by US policymakers proposing this strategy have been fully realized, if not entirely surpassed.

Taiwan is Next…

As Ukraine is destroyed by a US-engineered proxy war against Russia, with members of the US Congress vowing to fight Russia to the “last Ukrainian,” a similar arrangement is being used to organize the Chinese island province of Taiwan as a heavily US-armed proxy against the rest of China.

Just as was the case with Ukraine, US policymakers acknowledge the existential threat Taiwan faces in its role as a US proxy.

The Center for Strategic and International Studies (CSIS), likewise funded by the US government and arms manufacturers, published a 2023 paper titled, “The First Battle of the Next War: Wargaming a Chinese Invasion of Taiwan.” In it, policymakers acknowledge that during any fighting between a US-backed Taiwan administration and the rest of China, heavy damage would be inflicted on the island.

The paper notes that any infrastructure the People’s Liberation Army (PLA) does not destroy in the fighting, because of its possible use to the PLA, the US itself would target and destroy it:

Ports and airfields enable the use of more varied ships and aircraft to accelerate the transport of troops ashore. The United States may attack these facilities to deny their use after Chinese capture.

Beyond infrastructure useful to Chinese military forces, US policymakers have also explored the possibility of destroying economically useful infrastructure on Taiwan. An October 2022 Bloomberg article titled, “Taiwan Tensions Spark New Round of US War-Gaming on Risk to TSMC,” would report:

Contingency planning for a potential assault on Taiwan has been stepped up after Russia’s invasion of Ukraine, according to people familiar with the Biden administration’s deliberations. The scenarios attach heightened strategic significance to the island’s cutting-edge chip industry, led by Taiwan Semiconductor Manufacturing Co. In the worst case, they say, the US would consider evacuating Taiwan’s highly skilled chip engineers.

The article also stated:

At the extreme end of the spectrum, some advocate the US make clear to China that it would destroy TSMC facilities if the island was occupied, in an attempt to deter military action or, ultimately, deprive Beijing of the production plants. Such a “scorched-earth strategy” scenario was raised in a paper by two academics that appeared in the November 2021 issue of the US Army War College Quarterly.

CSIS’ paper would analyze the possible outcome of a conflict between China and the US-backed administration on Taiwan, surmising:

In most scenarios, the United States/Taiwan/Japan defeated a conventional amphibious invasion by China and maintained an autonomous Taiwan. However, this defense came at high cost. The United States and its allies lost dozens of ships, hundreds of aircraft, and tens of thousands of servicemembers. Taiwan saw its economy devastated. Further, the high losses damaged the U.S. global position for many years.

In other words, even under the best-case scenario, following a US-backed defeat of any Chinese military operation aimed at reunification, the US would nonetheless have suffered heavy losses in terms of its military while Taiwan would have suffered catastrophic losses both militarily and economically.

Like Ukraine, Taiwan, in its capacity as a US proxy, would be destroyed.

Israel Will Not Be Spared Either

US policy papers are also abounding with strategies employing Israel as an eager military proxy in the Middle East. Israel is elected to strike at nations across the region with impunity, freeing Washington of the political, military, economic, and diplomatic baggage of carrying out such military operations itself.

Of course, such military operations expose Israel to the same dangers that have threatened Ukraine’s self-preservation and threaten to undermine Taiwan’s.

With the US having demonstrated a fundamental inability to sponsor and win proxy wars against peer and near-peer adversaries in both Ukraine and Taiwan, there is little reason to believe that an already overstretched US military industrial base could somehow give Israel the ability to wage and win protracted proxy war in the Middle East.

Such a proxy war has already unfolded from 2011 onward both in Syria and Yemen with little success. Israel has already played a role in Syria, carrying out missile strikes across the country in an attempt to provoke Syria into a wider conflict.

Syria and its allies Iran and Russia have only strengthened their positions in the region and are driving a fundamental transformation across the Middle East. Even long-time US allies like Saudi Arabia and Turkey find themselves gradually divesting from a US-led regional order to one that better fits with the wider trend toward global multipolarism.

This has left the US and its remaining proxies in the region more isolated and vulnerable than ever. The US itself finds its own troops illegally occupying eastern Syria in an increasingly precarious position.

Israel, in many ways, finds itself likewise isolated. Should it lend itself to a major US proxy war more directly, it may find itself in a similar position as Ukraine – locked in intense, protracted combat with its US allies unable to provide the arms and ammunition necessary to win.

Unlike either Ukraine or Taiwan, Israel is believed to be in possession of between scores to hundreds of nuclear weapons. While Israel will thus never face the same sort of defeat Ukraine faces, a protracted military conflict will leave Israel exhausted economically and isolated diplomatically. Its Arab neighbors will move on with the multipolar world while Israel exhausts itself fighting to reassert US-led unipolarism.

Because of the deliberate, premeditated manner in which the US uses and then disposes of its proxies around the globe, there is little reason to believe it will spare Israel. While Israel has several advantages over other US proxies in terms of its economy, military capabilities, and diplomatic connections, these advantages will only prevent Israel’s use and disposal by US foreign policy if there is a conscious decision to pivot with the rest of the region away from US subordination and toward regional and global multipolarism.