By Charles Hugh Smith

Source: Of Two Minds

The sole remaining reservoirs of trust in American life are personal networks, local enterprises and local institutions.

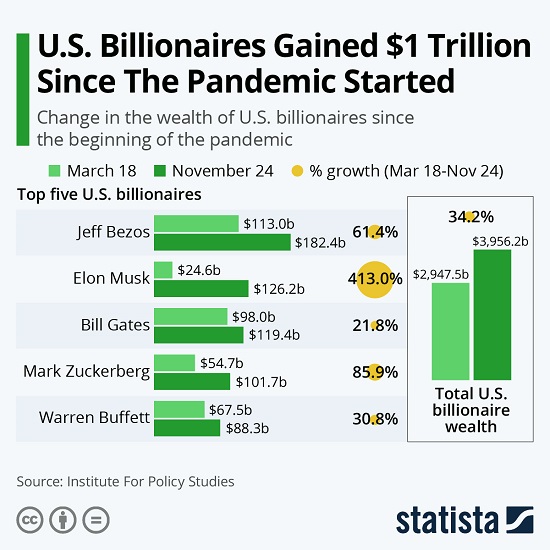

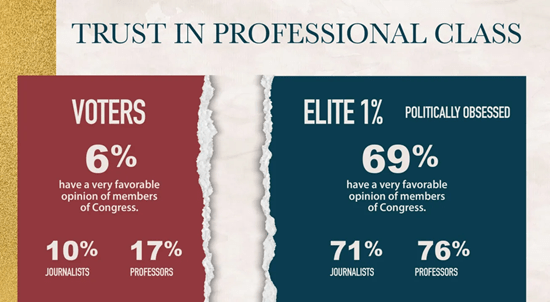

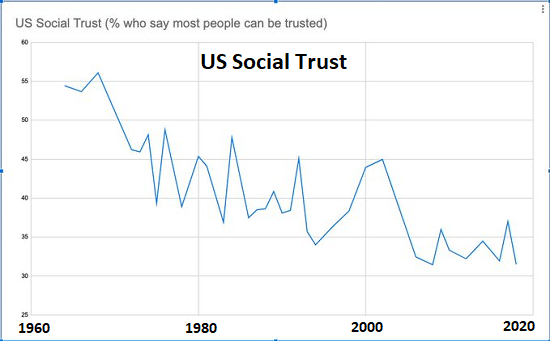

It’s not exactly news that social trust has declined significantly in the United States. Surveys find that public trust in institutions and the professional classes that dominate those institutions has cratered. (see chart below) Social trust–our confidence that other people are trustworthy–has also fallen to multi-decade lows.

This was not the case in decades past. Americans maintained high levels of trust in their institutions, government and fellow citizens. The decline in social trust is across the entire spectrum: our trust in institutions, professional elites and our fellow Americans has declined precipitously.

The causes of this decay of social trust can be debated endlessly, but several factors are obvious:

1. Institutions forfeited the trust of the citizenry by withholding / editing realities to serve the interests of hidden agendas and insiders’ careers. The Vietnam War was pursued on fabrications, as was the second Gulf War to topple Saddam. Watergate eroded trust on multiple levels, as did the Church Committee’s investigation of America’s security agencies’ domestic spying / over-reach.

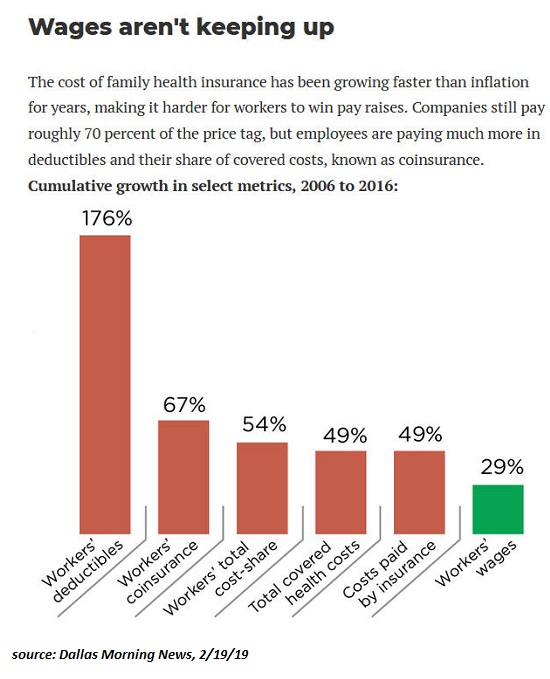

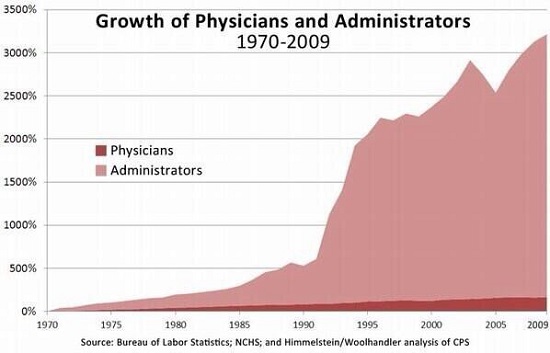

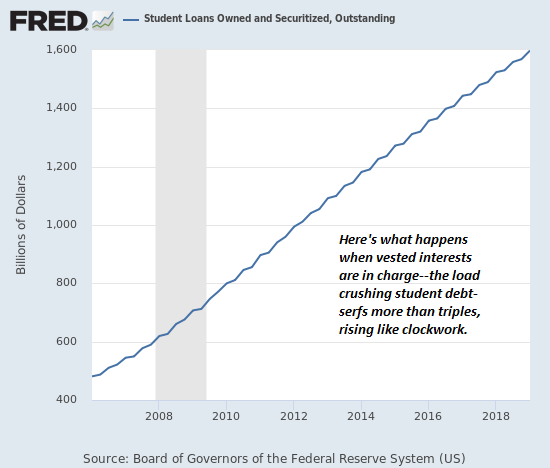

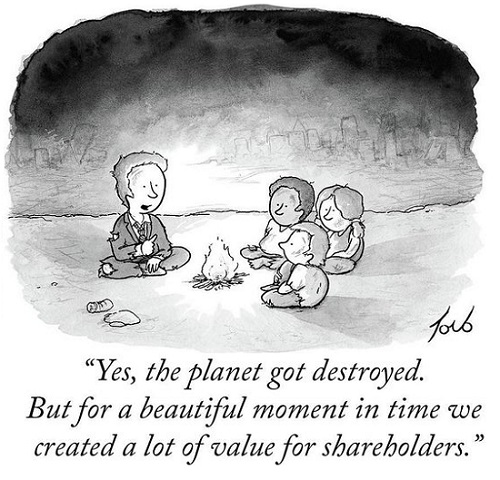

2. The managerial / professional elites at the top of the nation’s institutions no longer put the citizenry’s interests above their own. The public’s trust has eroded as institutions are primarily viewed as vehicles for self-enrichment and career advancement: healthcare CEOs pay themselves millions, higher education is bloated with layers of non-teaching administration, defense contractors and the Pentagon have greased the revolving door to the benefit of incumbents and insiders, and so on, in an endless parade of self-serving cloaked with smirking PR claims of “serving the public.”

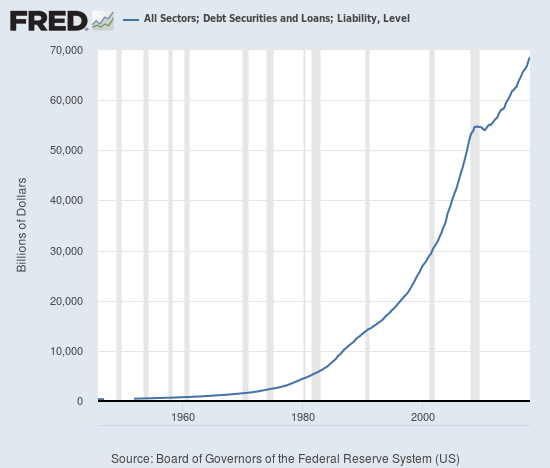

The shift from a high-trust society to a low-trust society is consequential economically, politically and socially. Low-trust societies have stagnant economies, as nobody trusts anyone they don’t know personally or through personally trusted networks, and nobody trust institutions to function effectively or fulfill their stated mission to serve the public good.

Faced with incompetent, unaccountable, corrupt bureaucracies and a culture overflowing with scams, frauds, imposters and get-rich-quick schemes, people give up and drop out. Rather than start a business and accept all the risks just to get dumped on or ripped off, they don’t even try to start a business. Given the financial insecurity that is now the norm, they decide not to get married or have children.

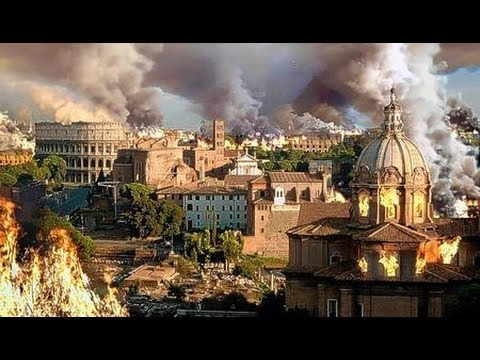

The vast trading networks of the Roman Empire were based on personal trusted networks and trust in Rome’s functionaries / institutions. The owners of trading ships dealt with trusted captains and merchants, who then paid duties to Roman functionaries in Alexandria and other major trading ports.

In other words, tightly bound personal trusted networks work well as long as the state institutions that bind the entire economy are trusted as fair and reliable–not perfect, of course, but efficient and “good enough.”

But when public institutions are viewed as unfair, unreliable, corrupt or incompetent, the entire economy decays. Even personal trusted networks cannot survive in an economy of unfair, unreliable, corrupt or incompetent state bureaucracies and private institutions.

The American economy is now dominated by enormous privately owned and managed monopolies and cartels that are the private-sector equivalent of self-serving state bureaucracies. Big Tech, Big Pharma, Big Healthcare, Big Ag, Big Finance, etc., are even worse than state bureaucracies because there are no legal requirements for transparency or recourse. Try getting a response from a Big Tech corporation when you’ve been shadow-banned or sent to Digital Siberia.

The sole remaining reservoirs of trust in American life are personal networks, local enterprises and local institutions. These are not guaranteed, of course; in many locales, even these reservoirs have been drained. But in other locales, enterprises and institutions such as the county water utility, the local newspaper, the local community college, etc. continue to earn the trust of the public by performing the services they exist to provide effectively and at a reasonable cost.

The larger the institution and the greater its wealth and power, the lower the social trust–for good reasons. The greater the influence of the managerial elites, the greater the disconnect from the everyday experiences of the citizenry and customers, and the more extreme the self-serving PR.

Sure, I trust Big Tech, Big Pharma, Big Healthcare, Big Finance–to rip me off, profiteer, send me obfuscating bills, jack up junk fees, make it impossible to contact them, and send me to Digital Siberia if I complain.

The divide between the elites and the commoners should prompt us to examine the low-trust path we’re sliding down:

In a society in which everything is phony, low quality or fraudulent, you’re taking a chance trusting anyone you don’t know personally–and even that can be risky now that self-aggrandizing flim-flam is the last remaining path to financial security for non-elites.

A low-trust society is an impoverished society, economically stagnant and socially threadbare. That’s where we are now, and the more fragmented, greedy, self-serving, desperate and deranged we become, the lower the odds that we’ll find the means to rebuild trust.

Sadly, we already know that anyone claiming to “rebuild trust” is spouting PR designed to mask self-enrichment. We also know that the vast army of well-paid flacks, factotums, enforcers, happy-story apologists, lackeys, toadies and sell-out minions are declaring “everything’s great!”

Just mumble, “Uh, sure” and continue to Tune in (to degrowth), drop out (of hyper-consumerism and debt-serfdom) and turn on (to self-reliance and relocalizing capital and agency).