By Charles Hugh Smith

Source: Of Two Minds

Those households, enterprises and organizations that have no debt, a very low cost basis and a highly flexible, adaptable structure will survive and even prosper.

The coming recession will be unevenly distributed, meaning that it will devastate many while leaving others relatively untouched. A few will actually do better in the recession than they did in the so-called “recovery.”

I realize many of the concepts floated here are cryptic and need a fuller explanation: the impact of owning differing kinds of capital, fragmentation, asymmetry, opacity, etc. ( 2019: Fragmented, Unevenly Distributed, Asymmetric, Opaque).

These dynamics guarantee a highly uneven distribution of recessionary consequences and whatever rewards are generated will be reaped by a few.

One aspect of the uneven distribution is that sectors that were relatively protected in recent recessions will finally feel the impact of this one. Large swaths of the tech sector (which is composed of dozens of different industries and services) that were devastated in the dot-com recession of 2000-02 came through the 2008-09 recession relatively unscathed.

This time it will be different. The build-out of mobile telephony merging with the web has been completed, social media has reached the stagnation phase of the S-Curve and many technologies that are widely promoted as around the corner are far from profitability.

Then there’s slumping global demand for mobile phones and other consumer items that require silicon (processors) and other tech components: autos, to name just one major end-user of electronics.

The net result will be mass layoffs globally across much of the tech sector.Research is nice but it doesn’t pay the bills today or quiet the restive shareholders as profits tank.

The public sector is also ripe for uneven distribution of recessionary impacts.Local government and its agencies in boomtowns such as the SF Bay Area, Seattle, Los Angeles, NYC, etc. have feasted on soaring tax revenues and multi-billion dollar municipal bonds.

The Powers That Be in these boomtowns are confident that the good times will never end, and so the modest rainy-day funds they’ve set aside are widely viewed as immense bulwarks against recession when in reality they are mere sand castles that will melt away in the first wave.

A $1 billion reserve looks impressive in good times but not when annual deficits soar to $10 billion. Local governments depend on various revenue streams, and most rely on a mix of property, sales and income taxes, both wages (earned) and capital gains (unearned). All of these will be negatively impacted in the next recession.

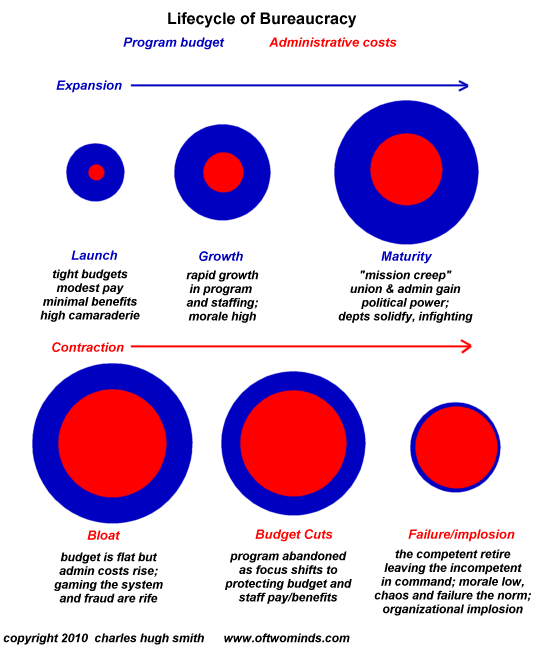

Local governments are especially prone to The Ratchet Effect, the dynamic in which expenses move higher as revenues climb but the organization is incapable of shrinking, i.e. it only knows how to expand. This defines government as an organizational type.

Inefficiencies (including low-level corruption and fraud) pile up and are offset with higher revenues. When revenue crashes, the system is incapable of eliminating the inefficiencies or reducing benefits and headcount.

I call the endgame of The Ratchet Effect the Rising Wedge Model of Breakdown:

The Ratchet Effect is visible in organizations of all scales, from households to sprawling bureaucracies. The core of the Ratchet Effect is the ease with which the cost basis of an organization rises and the extreme resistance to any reduction in funding.

The psychology of this resistance is easy to understand: everyone hired in the expansion will fight to keep their job, regardless of the needs of the organization or the larger society. Every individual, department and division will fight with the fierceness of a cornered animal to retain their share of the budget, for their self-interest trumps the interests of the organization or society.

Since each “ratchet” will fight with desperate energy to resist being cut while those attempting to do the cutting are simply following directives, the group that has pulled out all the stops to resist cuts will typically win bureaucratic battles.

Broad-based cuts trigger Internecine Warfare Between Protected Fiefdoms as entrenched vested interests battle to shift the cuts to some politically less favored fiefdom. Bureaucracies facing cuts quickly shift resources to protecting their budget, leaving their mission on auto-control. (The Lifecycle of Bureaucracy December 2, 2010)

These dynamics create a rising wedge in which “minimum” costs continue to rise over time even if modest cuts are imposed from time to time. The eventual consequence is a cost basis that is so high that even a modest reduction collapses the organization.

In other words, incremental reductions and reforms have zero impact on the endgame. The organization has become so brittle that any structural reform triggers a breakdown.

Those households, enterprises and organizations that have no debt, a very low cost basis and a highly flexible, adaptable structure will survive and even prosper. Those with high debt loads, high fixed expenses and inflexible responses will find incremental reductions and reforms will have little impact on the endgame of breakdown and collapse.

This is one of the core topics of my latest book, Pathfinding our Destiny: Preventing the Final Fall of Our Democratic Republic.

Here’s a household example of the type of organization that won’t just survive but thrive in the recession: a household with $100,000 in revenues from multiple income sources and fixed expenses of $35,000, no debt and a management team (the spouses/adults) that’s willing to implement radical changes in lifestyle, expenses and work at the first disruption of revenues. The household that doesn’t just survive but thrives sees crisis / disruption as an opportunity, not a disaster to be mitigated with denial and wishful thinking.