By Charles Hugh Smith

Source: Of Two Minds

Economists focus on what can be easily measured: sales, profits, prices, tax revenues, etc. Since the decay and failure of institutions isn’t easily quantified, this decay doesn’t register in the realm of economics. Since it isn’t measured, it doesn’t exist.

But institutional decay and failure is all too real, and it begs the question: how can a society and economy thrive if its core institutions fail? The short answer is they cannot thrive, as institutions are the foundations of the social and economic orders.

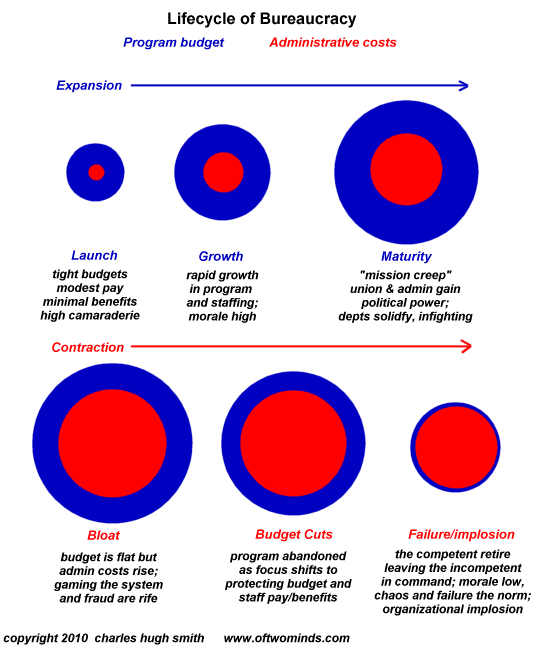

As I explain in my new book, Global Crisis, National Renewal, the conventional view has a naive faith that “great leaders” can reverse institutional rot. This faith overlooks the systemic sources of institutional decay and failure which are outlined in the graphic below, The Lifecycle of Bureaucracy, a.k.a. institutions.

Leaders are constrained by the nature of centralized organizations and the incentive structure that slowly shifts from rewarding efforts to further the institution’s core mission to self-service and protecting an ossified, failing institution from outside scrutiny and reform.

As Samo Burja explains in his insightful essay, Why Civilizations Collapse, those inside institutions are by design so compartmentalized that few (if any) even recognize the institution is failing. As long as everything is glued together in each little compartment, no one grasps the entire institution has lost its way. And since no one recognizes it, no one attempts to save it.

Institutions end up advancing caretaker managers who excel at the political game of rising to the top of a sprawling institution. When the decay (or budget cuts) finally trigger a crisis, the institution has been stripped of visionaries with a bold grasp of what’s needed to restore the focus on the core mission and institute new incentives. The bold leaders quit in disgust or were sent to bureaucratic Siberia as potential threats to the status quo.

The problem is institutions fail by the very nature of their centralized design. The organization is centralized so directives flow down the chain of command, and every branch is compartmentalized to limit the power of each department and employee to disrupt the orderly flow of top-down directives.

Within this compartmentalized, top-down structure, the incentives are to follow procedures rather than get results. The rewards go to those who dutifully follow procedures rather than to those who raise the alarm about the loss of transparency, effectiveness and focus on fulfilling the mission.

The path of least resistance is to protect the existing structure and add more compartments, i.e. “mission creep.” Rather than focus on the dissipation of resources and the decline of the core mission, leaders add “feel good” missions and PR promotions of phony reforms and initiatives that bleed more resources from the core mission.

Consider the institution of democracy, which has been corrupted into an invitation-only auction of state favors and rentier skims. Democracies have another fatal flaw: politicians win re-election by promising virtually everyone something for nothing: more benefits and entitlements and lower taxes. The gap between higher costs and declining revenues will be filled by government borrowing.

All this additional borrowing will supposedly be paid by the magic of “growth”, which will expand tax revenues at a rate that exceeds the cost of borrowing.

But demographics, resource depletion and the diminishing returns of a consumer economy fueled by rapidly expanding public and private debt have sapped “growth” in fundamental ways. Ironically, borrowing and spending more to spur “growth” only hastens the diminishing returns of increasing debt to fund consumption today.

Democracies are thus optimized for rapid “growth” and are ill-suited to transition to DeGrowth, i.e. less of everything for the vast majority of the citizenry as resources become scarce and debt eats the economy alive. (DeGrowth could work to everyone’s benefit, which is the point of Global Crisis, National Renewal.)

Central banking is another failing institution. When faced with fiscal crises, central states/banks inevitably succumb to the temptation to print/borrow currency in whatever sums are needed to fill the shortfall of the moment, i.e. political expediency. This profligate creation of currency seems to be magic at first; everyone accepts the “new money” at the current value. But eventually gravity takes hold and the currency’s purchasing power declines, as the real economy (the production of goods and services) grows at rates far below the expansion of credit and currency.

Even the greatest empires in human history have been unable to resist the “easy” solution of devaluing currency as the means of fulfilling all the promises that were made in more prosperous times.

The progression of centralized power slowly but surely replaces the self-organizing, resilient, decentralized structures of civil society with tightly bound hierarchical centralized structures that are increasingly ineffective, increasingly costly and increasingly fragile, i.e. increasingly prone to failure or collapse.

The irony of institutional decay and failure is everyone inside is so busy following procedures that nobody notices the decay until the whole worm-eaten structure collapses. Look no farther than financialized asset bubbles, healthcare and education for examples of institutions in run-to-failure decline.

We are in effect so busy arranging the beach umbrellas per our instructions that we don’t notice the approaching tsunami. Can a nation prosper as its institutions decay and collapse? Only in the fantasies and magical thinking of the delusional.