By Brandon Smith

Source: Alt-Market.us

One of my favorite false narratives floating around corporate media platforms has been the argument that the American people “just don’t seem to understand how good the economy really is right now.” If only they would look at the stats, they would realize that we are in the middle of a financial renaissance, right? It must be that people have been brainwashed by negative press from conservative sources…

I have to laugh at this claim because it’s a very common one throughout history – It’s an assertion made by almost every single political regime right before a major collapse. These people always say the same things, and when you study economics as long as I have you can’t help but throw up your hands and marvel at their dedication to the propaganda.

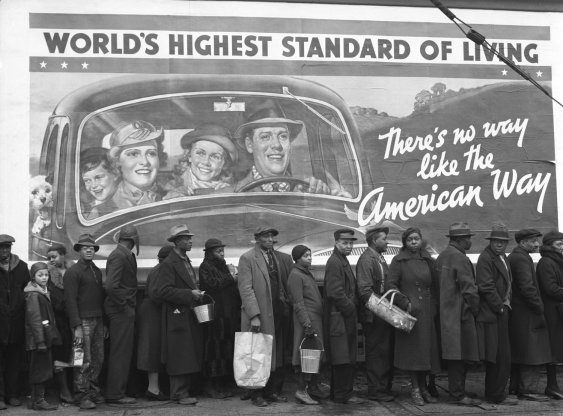

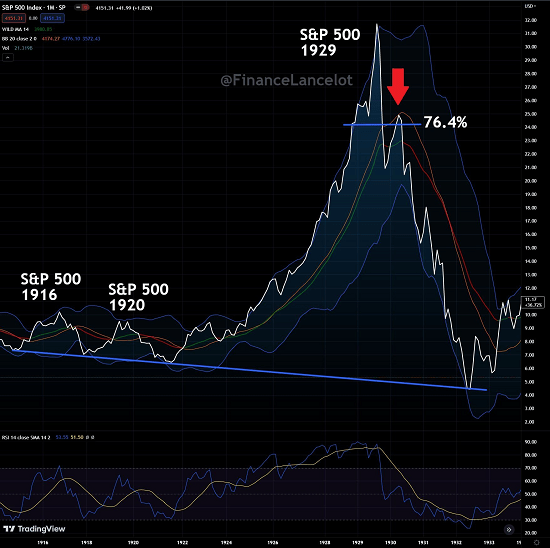

One example that comes to mind immediately is the delusional optimism of the “roaring” 1920s and the lead up to the Great Depression. At the time around 60% of the US population was living in poverty conditions (according to the metrics of the decade) earning less than $2000 a year. However, in the years after WWI ravaged Europe, America’s economic power was considered unrivaled.

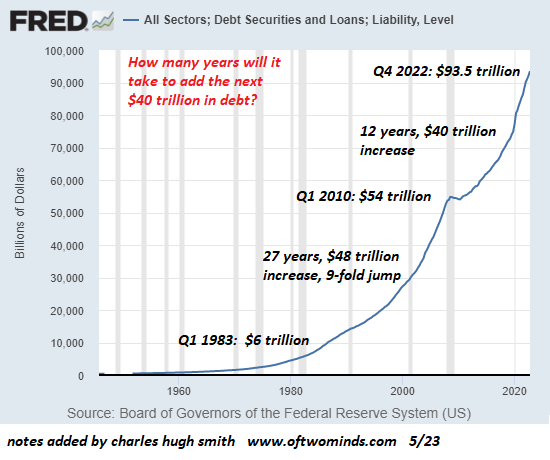

The 1920s was an era of mass production and rampant consumerism but it was all fueled by easy access to debt, a condition which had not really existed before in America. It was this illusion of prosperity created by the unchecked application of credit that eventually led to the massive stock market bubble and the crash of 1929. This implosion, along with the Federal Reserve’s policy of raising interest rates into economic weakness, created a black hole in the US financial system for over a decade.

There are two primary tools that various failing regimes will always use to distort the true conditions of the economy: Debt and inflation. In the case of America today, we are experiencing BOTH problems simultaneously and this has made certain economic indicators appear healthy when they are, in fact, highly unstable. The average American knows this is the case because they see the effects daily. They see the damage to their wallets, to their buying power, in the jobs market and in their quality of life. This is why public faith in the economy has been stuck in the dregs since 2021.

The establishment can shove out-of-context stats in people’s faces, but they can’t force the populace to see a recovery that simply does not exist. Let’s go through a short list of the most faulty indicators and the real reasons why the fiscal picture is not as rosy as the media would like us to believe…

The “Miracle” Labor Market Recovery

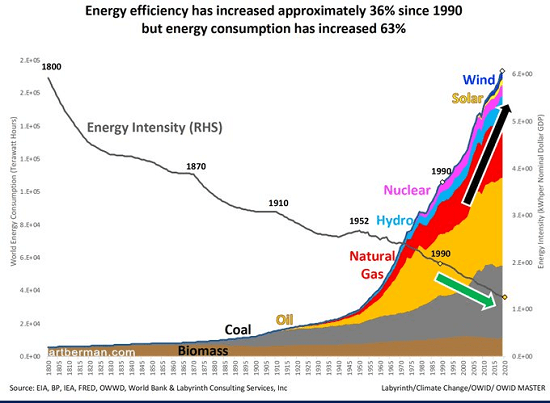

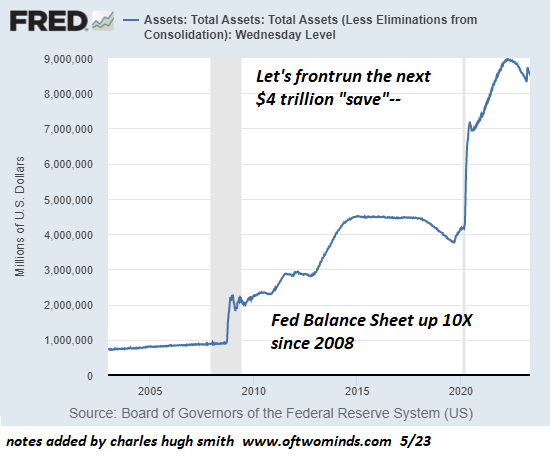

In the case of the US labor market, we have a clear example of distortion through inflation. The $8 trillion+ dropped on the economy in the first 18 months of the pandemic response sent the system over the edge into stagflation land. Helicopter money has a habit of doing two things very well: Blowing up a bubble in stock markets and blowing up a bubble in retail. Hence, the massive rush by Americans to go out and buy, followed by the sudden labor shortage and the race to hire (mostly for low wage part-time jobs).

The problem with this “miracle” is that inflation leads to price explosions, which we have already experienced. The average American is spending around 30% more for goods, services and housing compared to what they were spending in 2020. This is what happens when you have too much fiat money chasing too few goods and limited production.

The jobs market looks great on paper, but the majority of jobs generated in the past few years are jobs that returned after the covid lockdowns ended (the same lockdowns Democrats tried to keep in place perpetually). The rest are jobs created through monetary stimulus, and then there is the issue of “immigrant jobs” and data that is revised to the negative months later. I suspect we won’t ever hear the real stats unless Trump enters office in 2025. Then the media discussion will focus intently on how terrible the labor market really is.

Part time low wage service sector jobs are not going to keep the country rolling for very long in a stagflation environment. The question is, what happens now that the stimulus punch bowl has been removed?

Just as we witnessed in the 1920s, Americans have turned to debt to make up for higher prices and stagnant wages by maxing out their credit cards to historic levels. With the central bank keeping interest rates high, the credit safety net will soon falter. This condition also goes for businesses; businesses that will soon jump headlong into mass layoffs when they realize the party is over. It happened during the Great Depression and it will happen again today.

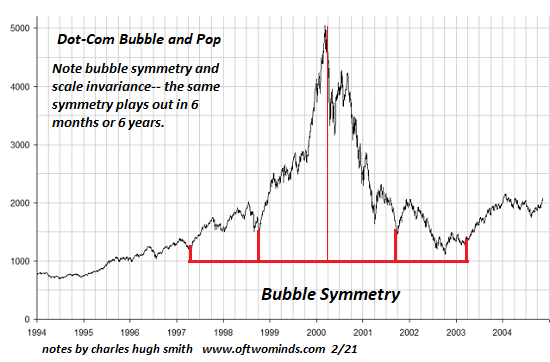

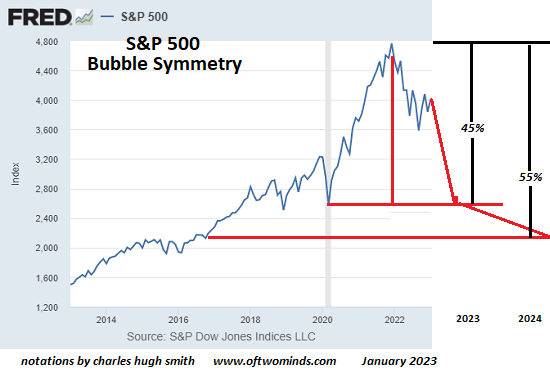

Stock Market Bonanza

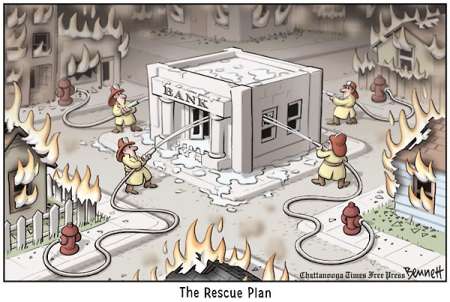

We saw cracks in in the armor of the financial structure in 2023 with the spring banking crisis, and without the abrupt Federal Reserve backstop many more small and medium banks would have dropped dead. The weakness of US banks is offset by the relative strength of the US dollar, which lures in foreign investors hoping to protect their wealth using dollar denominated assets.

But something is amiss. Gold and Bitcoin have rocketed higher along with stocks and the dollar. This is the opposite of what’s supposed to happen. Gold and BC are supposed to be hedges against a weak dollar and weak equities, right? If global faith in the dollar and in stocks is so high, why are investors diving into protective assets like gold?

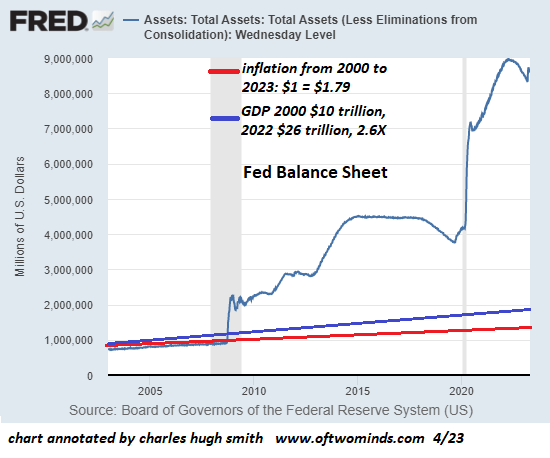

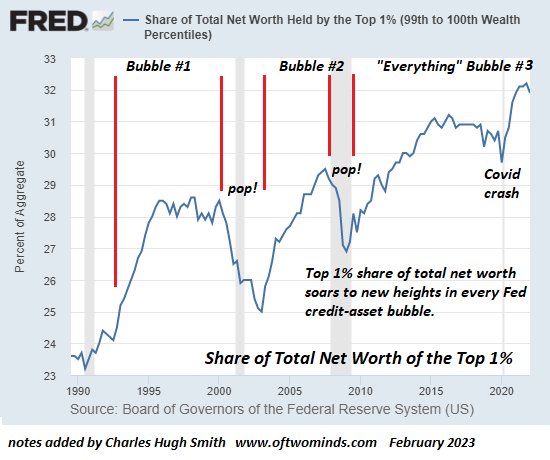

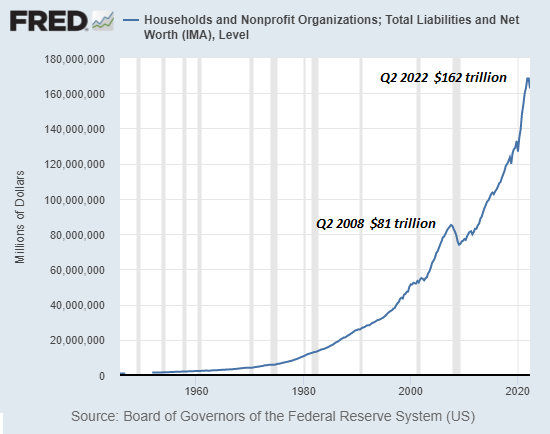

Again, as noted above, inflation distorts everything. Tens of trillions of extra dollars printed by the Fed are floating around and it’s no surprise that much of that cash is flooding into the stock market which simply pushes higher right along with prices on the shelf. But, gold and BC are telling us a more nuanced story about what’s really happening.

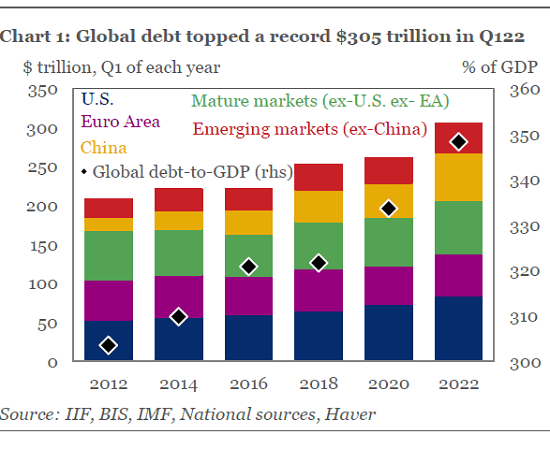

Right now, the US government is adding around $1 Trillion every 100 days to the national debt as the Fed holds rates higher to fight inflation. Higher interest means exponential debt conditions, and this debt is going to crush America’s financial standing for global investors who will eventually ask HOW the US is going to handle that growing millstone? As I predicted years ago, the Fed has created a perfect Catch-22 scenario in which the US must either return to rampant inflation, or, face a debt breakdown. In either case, US dollar denominated assets will lose their appeal and stock markets will ultimately plummet.

Beyond this reality, stocks are not a leading indicator of anything, let alone the stability of the financial system. Stocks are a trailing indicator; they crash well after all the other warning signals have made it obvious that something is wrong. Average Americans, for good reason, do not care what stock markets have to say.

Healthy GDP Is A Complete Farce

Beyond the stock market, GDP is the most common out-of-context stat used by governments to convince the citizenry that all is well. It is yet another stat that is entirely manipulated by inflation. It is also manipulated by the way in which modern governments define “production and market value.”

GDP is primarily driven by spending. Meaning, the higher inflation goes, the higher prices go, and the higher GDP climbs (to a point). Eventually prices go too high, credit cards tap out and spending ceases. But, for a short time inflation makes GDP (as well as retail) look good.

Another factor that creates a bubble is the reality that government spending is actually included in the calculation of GDP. That’s right, every dollar of your tax money that the government wastes helps the establishment by propping up GDP numbers. This is why government spending increases will never stop – It’s too valuable for them to spend as a way to make the economy appear healthier than it is.

The Real Economy Is Eclipsing The Fake Economy

The bottom line is that Americans used to be able to ignore the warning signs because their bank accounts were not being directly affected. This is over. Now, every person in the country is dealing with a massive decline in buying power and higher prices across the board in all assets. Even the wealthy are seeing a compression to their profits and many are struggling to keep their businesses in the black.

The unfortunate truth is that the elections of 2024 will probably be the turning point at which the whole edifice comes tumbling down. Even if the public votes for change, the system is already broken and cannot be repaired without a complete overhaul. We have consistently avoided taking our medicine and our weaknesses have only accumulated.

People have lost faith in the economy because they have not faced this kind of uncertainty since the 1930s. Even the stagflation crisis of the 1970s will likely pale in comparison to what is about to happen. On the bright side, at least a large number of Americans are aware of the threat, as opposed to the 1920s when the vast majority of people were utterly conned by the government, the banks and the media into thinking all was well. Knowing is the first step to preparing.